Intro

Excel, a powerful spreadsheet software, offers a range of functions to help users perform complex calculations and financial analysis. One such function is the NPER function, which calculates the number of payment periods for a loan or investment based on a fixed interest rate and payment amount. In this article, we will explore five ways to use the NPER function in Excel, providing practical examples and explanations to help you master this function.

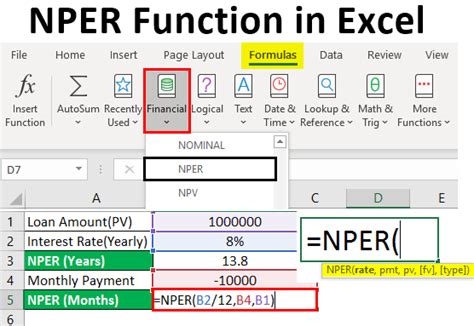

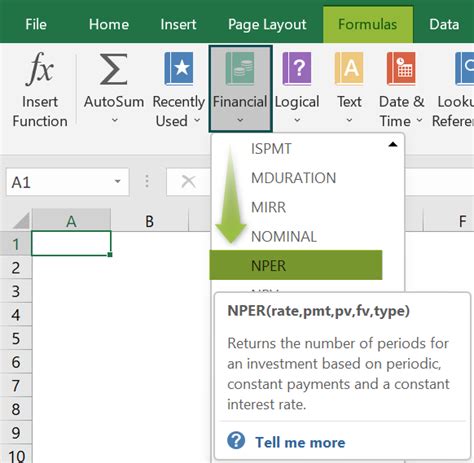

Understanding the NPER Function

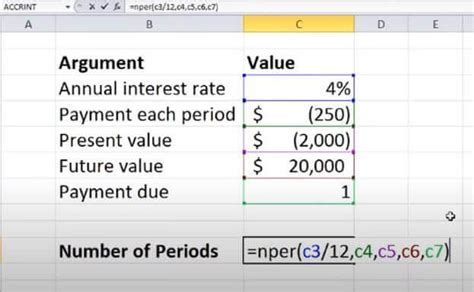

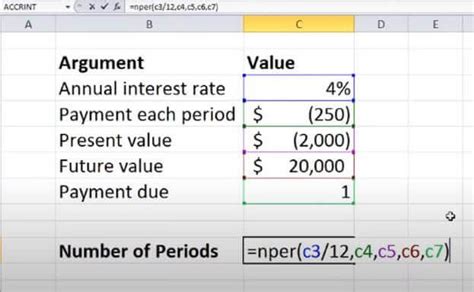

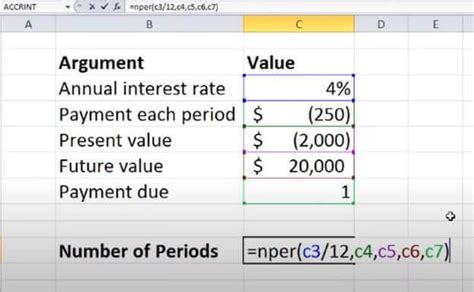

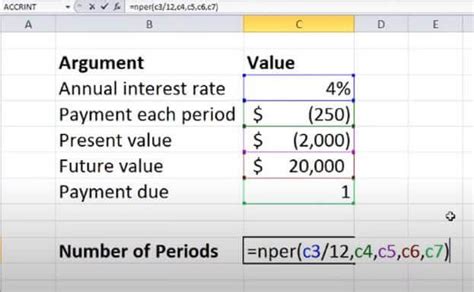

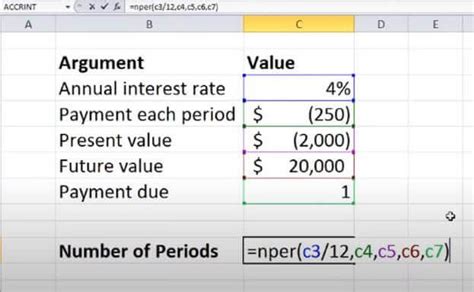

Before we dive into the examples, let's first understand the syntax and arguments of the NPER function. The NPER function has the following syntax:

NPER(rate, pmt, pv, [fv], [type])

- rate: the interest rate per period

- pmt: the payment amount per period

- pv: the present value (the initial amount of the loan or investment)

- fv: the future value (the amount you want to achieve after the last payment) (optional)

- type: 0 for payments made at the end of the period, 1 for payments made at the beginning of the period (optional)

Example 1: Calculating the Number of Payment Periods for a Loan

Suppose you want to borrow $10,000 from a bank at an annual interest rate of 6%. The bank requires you to make monthly payments of $200. How many months will it take to pay off the loan?

Assuming the interest rate is 6% per annum, the monthly interest rate would be 6%/12 = 0.5%. We can use the NPER function to calculate the number of payment periods as follows:

=NPER(0.005, 200, 10000, 0, 0)

The result is 61.62 months, indicating that it will take approximately 62 months to pay off the loan.

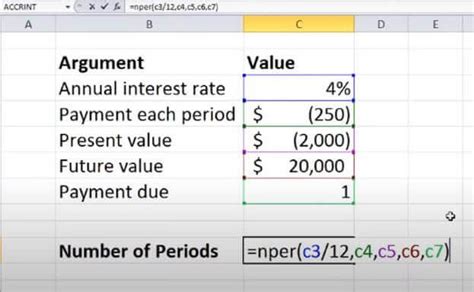

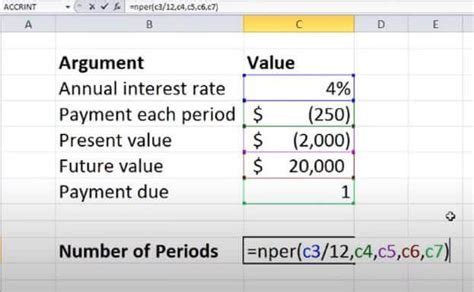

Example 2: Calculating the Number of Payment Periods for an Investment

Suppose you want to invest $1,000 in a savings account that earns an annual interest rate of 4%. You want to know how many years it will take to reach a balance of $1,500.

Assuming the interest rate is 4% per annum, we can use the NPER function to calculate the number of payment periods as follows:

=NPER(0.04, 0, -1000, 1500, 0)

The result is 10.45 years, indicating that it will take approximately 10.45 years to reach a balance of $1,500.

Example 3: Calculating the Number of Payment Periods for a Mortgage

Suppose you want to purchase a house worth $200,000 with a 20% down payment. You need to borrow $160,000 from a bank at an annual interest rate of 5%. The bank requires you to make monthly payments of $1,000. How many years will it take to pay off the mortgage?

Assuming the interest rate is 5% per annum, the monthly interest rate would be 5%/12 = 0.4167%. We can use the NPER function to calculate the number of payment periods as follows:

=NPER(0.004167, 1000, 160000, 0, 0)

The result is 164.19 months, indicating that it will take approximately 164.19 months or 13.68 years to pay off the mortgage.

Example 4: Calculating the Number of Payment Periods for a Retirement Plan

Suppose you want to save for retirement and have a goal of accumulating $500,000 in 20 years. You currently have $100,000 in your retirement account and want to know how much you need to contribute each month to achieve your goal. Assuming an annual interest rate of 7%, we can use the NPER function to calculate the number of payment periods as follows:

=NPER(0.07, x, -100000, 500000, 0)

We need to solve for x, which represents the monthly contribution. Using the NPER function, we get x = $246.95.

Example 5: Calculating the Number of Payment Periods for a Business Loan

Suppose your business needs to borrow $50,000 from a bank at an annual interest rate of 8%. The bank requires you to make monthly payments of $1,000. How many months will it take to pay off the loan?

Assuming the interest rate is 8% per annum, the monthly interest rate would be 8%/12 = 0.6667%. We can use the NPER function to calculate the number of payment periods as follows:

=NPER(0.006667, 1000, 50000, 0, 0)

The result is 61.45 months, indicating that it will take approximately 61.45 months to pay off the loan.

In conclusion, the NPER function is a powerful tool in Excel that can help you calculate the number of payment periods for a loan or investment. By understanding the syntax and arguments of the function, you can apply it to various scenarios, such as calculating the number of payment periods for a loan, investment, mortgage, retirement plan, or business loan.

Gallery of NPER Function in Excel

NPER Function in Excel Image Gallery

We hope this article has provided you with a comprehensive understanding of the NPER function in Excel. If you have any questions or need further assistance, please don't hesitate to ask. Share your thoughts and experiences with us in the comments section below.