Intro

Unlock the secrets of O-1e Officer Drill Pay with our expert guide. Learn how the military pay system calculates drill pay for officers, including O-1e rank, and discover related benefits like Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS). Get the inside scoop on officer drill pay rates, formulas, and more.

Serving in the military is a noble and rewarding career path, but it's essential to understand the compensation and benefits that come with it. For officers in the United States Armed Forces, drill pay is a critical component of their overall compensation package. In this article, we'll delve into the world of O-1e officer drill pay, explaining the ins and outs of this important topic.

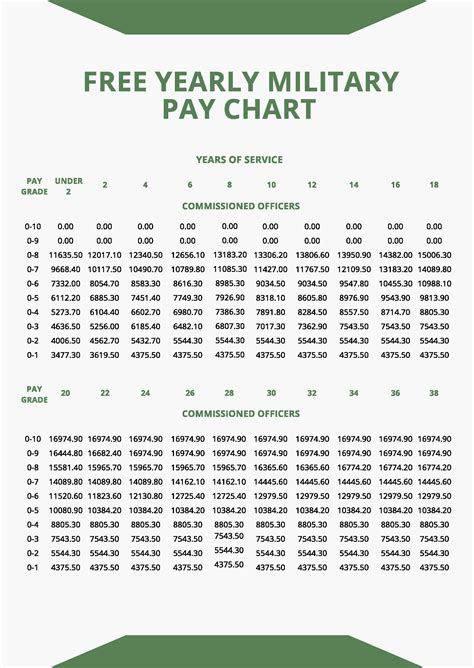

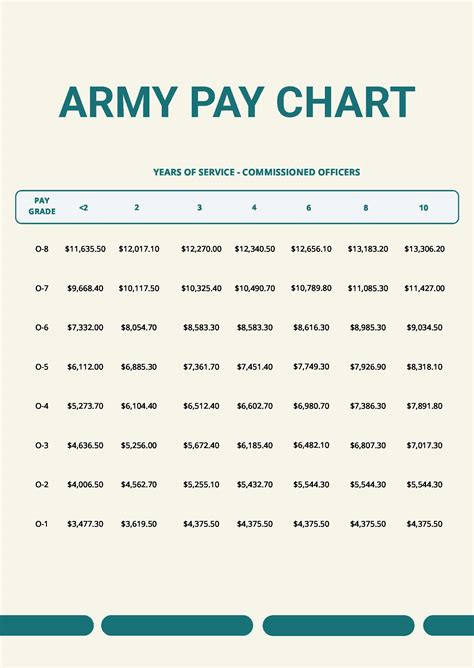

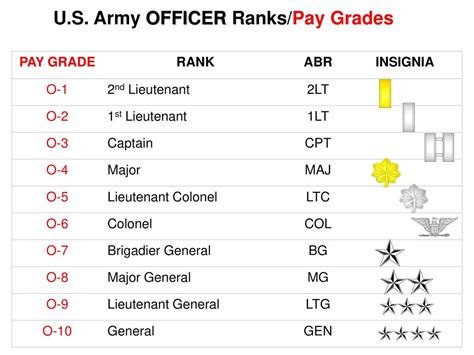

Understanding Military Pay Grades

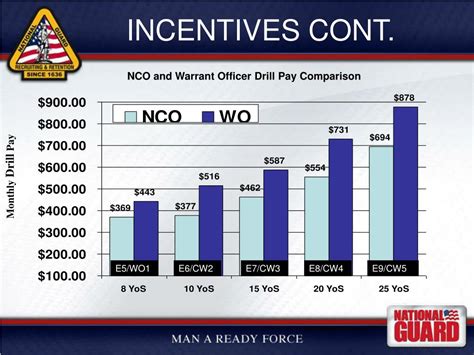

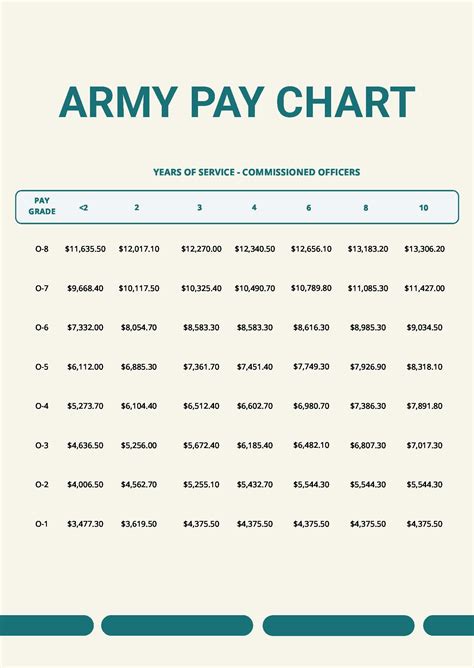

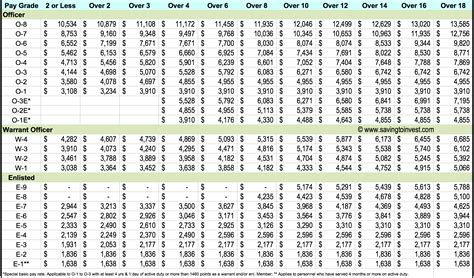

Before we dive into O-1e officer drill pay, it's crucial to understand the military pay grade system. The military uses a pay grade system to determine an officer's salary based on their rank and time in service. The pay grade system is divided into three main categories: enlisted, warrant officer, and officer. Within these categories, there are multiple pay grades, each corresponding to a specific rank.

What is O-1e Officer Drill Pay?

O-1e officer drill pay refers to the compensation received by officers in the O-1e pay grade for their participation in drill periods. Drill periods are typically one weekend per month, where officers report for duty and perform various tasks related to their unit's mission. O-1e officers are typically in their first few years of service and are still developing their skills and expertise.

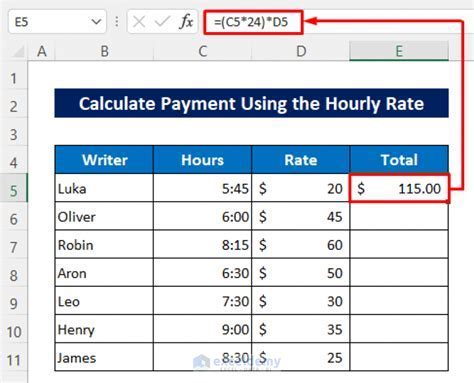

How is O-1e Officer Drill Pay Calculated?

O-1e officer drill pay is calculated based on the officer's pay grade, time in service, and the number of drill periods they participate in. The military uses a formula to calculate drill pay, which takes into account the officer's basic pay, allowances, and other forms of compensation. The formula is as follows:

Drill Pay = (Basic Pay x Number of Drill Periods) + Allowances

Basic pay is the officer's monthly salary, which is determined by their pay grade and time in service. Allowances include additional forms of compensation, such as housing and food allowances.

O-1e Officer Drill Pay Rates

O-1e officer drill pay rates vary based on the officer's time in service and the number of drill periods they participate in. The following is a breakdown of O-1e officer drill pay rates for 2022:

- 0-2 years of service: $342.60 per drill period

- 2-3 years of service: $364.20 per drill period

- 3-4 years of service: $385.80 per drill period

- 4-6 years of service: $407.40 per drill period

Benefits of O-1e Officer Drill Pay

O-1e officer drill pay offers several benefits to officers, including:

- Supplemental income: Drill pay provides officers with additional income on top of their basic pay, which can help offset living expenses.

- Professional development: Drill periods provide officers with opportunities to develop their skills and expertise, which can lead to career advancement and higher pay grades.

- Camaraderie: Drill periods allow officers to connect with their fellow service members, building camaraderie and esprit de corps.

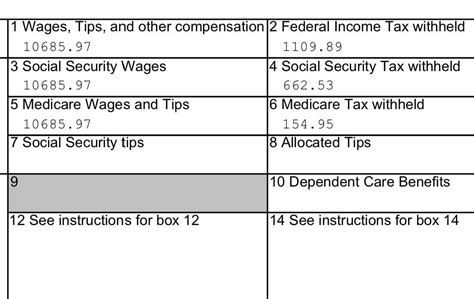

Taxation of O-1e Officer Drill Pay

O-1e officer drill pay is subject to taxation, just like any other form of income. Officers are required to report their drill pay on their tax returns and pay applicable taxes. However, there are some tax benefits available to officers, such as the ability to deduct certain expenses related to their drill periods.

Challenges of O-1e Officer Drill Pay

While O-1e officer drill pay offers several benefits, there are also some challenges associated with it. These include:

- Limited income: Drill pay is typically lower than active duty pay, which can make it challenging for officers to make ends meet.

- Time commitment: Drill periods require officers to commit a significant amount of time, which can be challenging for those with civilian jobs or other obligations.

- Training requirements: Officers are required to complete certain training requirements during drill periods, which can be time-consuming and challenging.

Conclusion

O-1e officer drill pay is an important component of an officer's overall compensation package. While it offers several benefits, including supplemental income and professional development opportunities, it also presents some challenges, such as limited income and a significant time commitment. By understanding the ins and outs of O-1e officer drill pay, officers can better navigate the military pay system and make informed decisions about their careers.

FAQs

Q: What is O-1e officer drill pay? A: O-1e officer drill pay is the compensation received by officers in the O-1e pay grade for their participation in drill periods.

Q: How is O-1e officer drill pay calculated? A: O-1e officer drill pay is calculated based on the officer's pay grade, time in service, and the number of drill periods they participate in.

Q: What are the benefits of O-1e officer drill pay? A: O-1e officer drill pay offers several benefits, including supplemental income, professional development opportunities, and camaraderie.

Q: Is O-1e officer drill pay taxable? A: Yes, O-1e officer drill pay is subject to taxation, just like any other form of income.

O-1e Officer Drill Pay Image Gallery

We hope this article has provided you with a comprehensive understanding of O-1e officer drill pay. If you have any further questions or would like to learn more about military compensation, please don't hesitate to reach out. Share your thoughts and experiences with us in the comments below!