Intro

Unlock the secrets to crafting a winning Offering Memorandum with our expert guide. Discover the 10 essential components of a Real Estate Template, including executive summary, investment highlights, property overview, and financial projections. Elevate your commercial real estate game with this comprehensive resource, perfect for investors, brokers, and developers.

In the world of real estate investing, an Offering Memorandum (OM) is a crucial document that outlines the terms and conditions of a proposed investment opportunity. A well-structured OM template can help attract potential investors, facilitate due diligence, and ultimately secure funding for a project. Here, we'll delve into the 10 essential components of an Offering Memorandum Real Estate Template.

Understanding the Importance of an Offering Memorandum

An Offering Memorandum is a comprehensive document that provides a detailed overview of a real estate investment opportunity. It serves as a marketing tool, a disclosure document, and a roadmap for potential investors. A well-crafted OM can help establish credibility, build trust, and showcase the potential for returns on investment.

Essential Components of an Offering Memorandum Real Estate Template

1. Executive Summary

Executive Summary

The Executive Summary provides a concise overview of the investment opportunity, highlighting key points such as the project's objectives, target returns, and investment requirements. This section should entice readers to delve deeper into the document.

2. Investment Overview

Investment Overview

The Investment Overview section provides a detailed description of the project, including its location, property type, and proposed use. This section should also outline the investment structure, including the type of investment (e.g., equity, debt), investment amount, and expected returns.

3. Market Analysis

Market Analysis

The Market Analysis section provides an in-depth examination of the local market conditions, including demographic trends, supply and demand, and competitor analysis. This section should demonstrate a thorough understanding of the market and the project's potential for success.

4. Property Description

Property Description

The Property Description section provides a detailed description of the property, including its location, size, age, and condition. This section should also outline any notable features, such as amenities, parking, and accessibility.

5. Investment Strategy

Investment Strategy

The Investment Strategy section outlines the investment approach, including the target returns, investment horizon, and risk management strategies. This section should demonstrate a clear understanding of the investment goals and objectives.

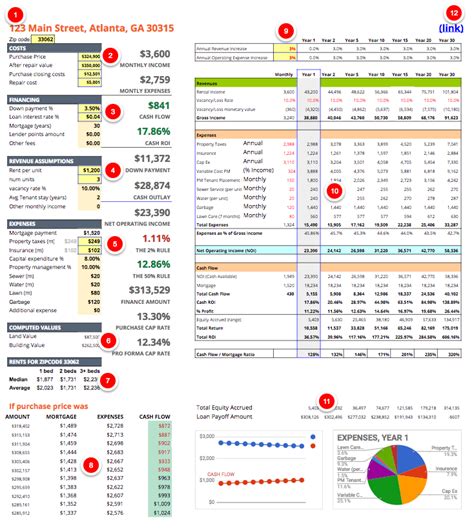

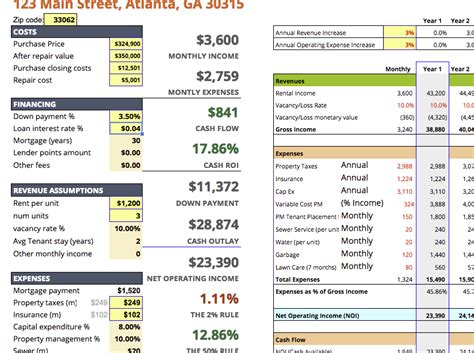

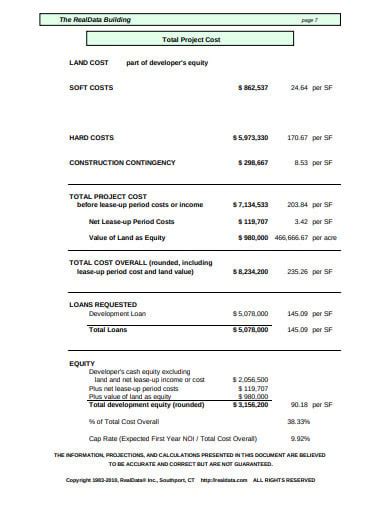

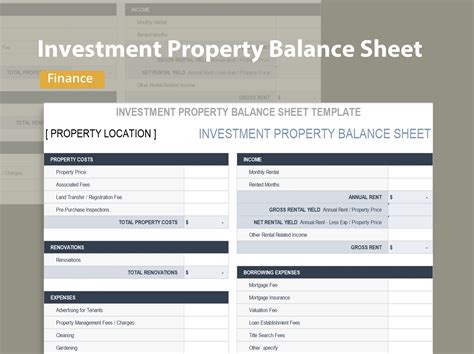

6. Financial Projections

Financial Projections

The Financial Projections section provides detailed financial projections, including income statements, balance sheets, and cash flow statements. This section should demonstrate a thorough understanding of the project's financial performance and potential for returns.

7. Management and Organization

Management and Organization

The Management and Organization section provides an overview of the project's management structure, including the key personnel, their roles, and responsibilities. This section should demonstrate a clear understanding of the project's leadership and operational capabilities.

8. Risk Factors

Risk Factors

The Risk Factors section outlines the potential risks associated with the investment, including market risks, regulatory risks, and operational risks. This section should demonstrate a thorough understanding of the potential risks and mitigants.

9. Terms and Conditions

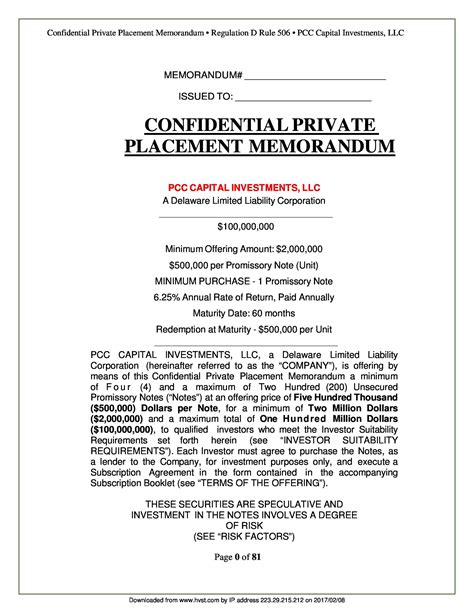

Terms and Conditions

The Terms and Conditions section outlines the terms and conditions of the investment, including the investment amount, investment period, and exit strategies. This section should demonstrate a clear understanding of the investment terms and conditions.

10. Appendices

Appendices

The Appendices section provides additional supporting documentation, including market research reports, financial statements, and legal documents. This section should demonstrate a thorough understanding of the project's underlying documentation and due diligence.

Offering Memorandum Real Estate Template Gallery

Call to Action

In conclusion, a well-structured Offering Memorandum Real Estate Template is essential for attracting potential investors and securing funding for a real estate project. By including the 10 essential components outlined above, you can create a comprehensive and persuasive document that showcases the potential for returns on investment. Take the first step today and start building your Offering Memorandum template.

We invite you to share your thoughts and feedback on this article. Have you used an Offering Memorandum template in the past? What were some of the challenges you faced? Share your experiences and insights in the comments section below.