Boost savings with 5 Old Navy Credit Tips, including rewards, discounts, and payment hacks, to maximize Navyist benefits and Super Cash rewards.

When it comes to managing finances and making the most out of shopping experiences, understanding how to effectively utilize credit options is crucial. Old Navy, a popular retail chain, offers its customers a credit card that can be highly beneficial when used wisely. The Old Navy credit card, issued by Synchrony Bank, provides cardholders with exclusive rewards, discounts, and perks that can enhance their shopping experience. Here, we'll delve into five key tips on how to make the most out of your Old Navy credit card, ensuring you maximize its benefits while maintaining a healthy financial stance.

The importance of credit cards in modern retail cannot be overstated. They offer consumers a convenient method of payment, the ability to build credit, and access to rewards programs that can save them money or provide other benefits. For frequent Old Navy shoppers, the Old Navy credit card can be a valuable tool in their financial arsenal, offering 5% rewards on Old Navy purchases, among other benefits. However, like any credit card, it requires responsible management to avoid interest charges and late fees, which can negate the benefits of the rewards.

Effective management of the Old Navy credit card begins with understanding its terms and conditions. This includes the annual percentage rate (APR), any annual fees, and the rewards program structure. By grasping these fundamentals, cardholders can make informed decisions about their purchases and payments, ensuring they reap the rewards without succumbing to potential pitfalls like high interest rates. Furthermore, setting up automatic payments can help avoid late fees and negative impacts on credit scores, which are essential for long-term financial health.

Understanding the Old Navy Credit Card Rewards

Benefits of the Old Navy Credit Card

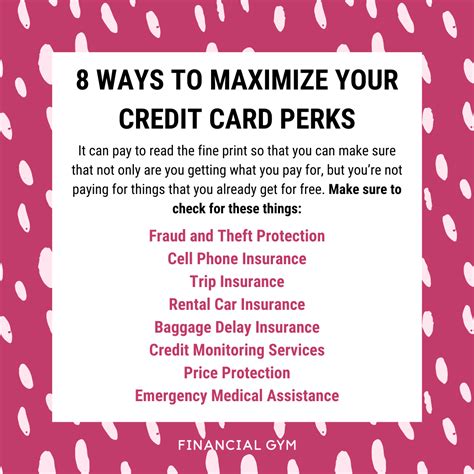

The benefits of the Old Navy credit card extend beyond the rewards program. Cardholders may also receive exclusive discounts, early access to sales, and special financing options on larger purchases. These perks can make the shopping experience more enjoyable and potentially save cardholders money. However, it's essential to weigh these benefits against the potential costs, such as interest charges if the balance is not paid in full each month. By doing so, cardholders can ensure they are using the credit card in a way that is financially beneficial.Managing Payments and Avoiding Interest

Building Credit with the Old Navy Credit Card

For individuals looking to build or rebuild their credit, the Old Navy credit card can be a useful tool. By making regular purchases and paying the balance in full and on time, cardholders can demonstrate responsible credit behavior. This can lead to an improvement in their credit score over time, making it easier to obtain credit in the future. It's also worth noting that Synchrony Bank, the issuer of the Old Navy credit card, reports payment history to the major credit bureaus, which can help in establishing or improving credit.Combining Rewards with Other Offers

Special Financing Options

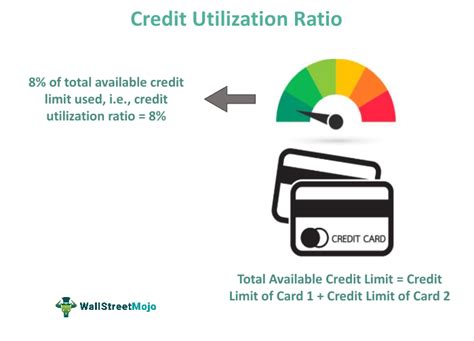

The Old Navy credit card may offer special financing options for larger purchases, allowing cardholders to pay for items over time without incurring interest charges, provided the balance is paid in full within the promotional period. These options can be particularly useful for big-ticket items or during significant sales events. However, it's crucial to understand the terms of these financing options, including the length of the promotional period and the consequences of not paying the balance in full by the end of this period.Maintaining a Healthy Credit Utilization Ratio

Monitoring Credit Score

Monitoring credit scores regularly is essential for anyone using credit, including the Old Navy credit card. By keeping track of their credit score, cardholders can identify any potential issues early on, such as errors on their credit report or signs of identity theft. Many credit card issuers, including Synchrony Bank, offer free access to credit scores, making it easier for cardholders to stay on top of their credit health.Customer Service and Support

Security and Fraud Protection

Security and fraud protection are also critical considerations for credit card holders. The Old Navy credit card, like other Synchrony Bank credit cards, comes with built-in security features designed to protect cardholders from fraud and identity theft. These features may include zero liability for unauthorized purchases, alerts for suspicious activity, and secure online account management. By understanding and utilizing these security features, cardholders can help safeguard their personal and financial information.Gallery of Old Navy Credit Card Benefits

Old Navy Credit Card Benefits Gallery

In conclusion, the Old Navy credit card can be a valuable financial tool for those who shop frequently at Old Navy and its affiliated brands. By understanding the rewards program, managing payments effectively, combining rewards with other offers, and maintaining a healthy credit utilization ratio, cardholders can maximize the benefits of the credit card while avoiding potential pitfalls. As with any credit card, responsible management is key to ensuring a positive experience. We invite our readers to share their experiences with the Old Navy credit card, ask questions about its benefits and management, or discuss strategies for maximizing rewards in the comments below. Your engagement and insights are invaluable in helping others make informed decisions about their financial tools and shopping experiences.