Explore Old Navy credit card payment options, including online, phone, and in-store methods, with benefits like rewards and discounts, managing accounts, and bill pay flexibility.

The Old Navy credit card is a popular choice among shoppers who frequent Old Navy, Gap, Banana Republic, and Athleta stores. As a cardholder, it's essential to stay on top of your payments to avoid late fees and interest charges. Fortunately, Old Navy offers several payment options to make managing your account convenient and hassle-free. In this article, we'll explore the various payment options available to Old Navy credit cardholders, including online payments, phone payments, mail payments, and in-store payments.

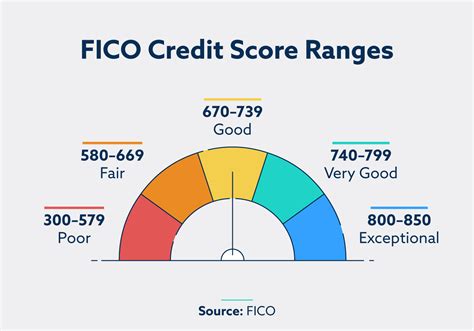

Paying your Old Navy credit card bill on time is crucial to maintaining a healthy credit score and avoiding unnecessary charges. With the rise of digital payments, it's easier than ever to make payments from the comfort of your own home. Whether you prefer to pay online, by phone, or in person, Old Navy has a payment option that suits your needs. In the following sections, we'll delve into the details of each payment option, including the benefits and any associated fees.

As a responsible credit cardholder, it's essential to understand the payment options available to you. By doing so, you can avoid missed payments, late fees, and interest charges, which can add up quickly. Old Navy's payment options are designed to be flexible and convenient, allowing you to choose the method that works best for you. Whether you're a tech-savvy individual who prefers online payments or someone who likes to pay in person, Old Navy has a payment option that's right for you.

Online Payment Options

One of the benefits of online payments is the ability to set up automatic payments. By doing so, you can ensure that your payments are made on time, every time, without having to worry about missing a payment. Additionally, online payments are free, and you can avoid the hassle of mailing a check or visiting a store.

Benefits of Online Payments

Some of the benefits of online payments include: * Convenience: Online payments can be made 24/7 from the comfort of your own home. * Speed: Online payments are processed immediately, and you'll receive a confirmation email once the payment has been successfully processed. * Automatic payments: You can set up automatic payments to ensure that your payments are made on time, every time. * No fees: Online payments are free, and you can avoid the hassle of mailing a check or visiting a store.Phone Payment Options

Phone payments are a convenient option for those who prefer to speak with a customer service representative. However, be aware that phone payments may incur a fee, which can range from $10 to $15, depending on the payment amount.

Benefits of Phone Payments

Some of the benefits of phone payments include: * Convenience: Phone payments can be made from anywhere, at any time. * Personalized service: You'll have the opportunity to speak with a customer service representative who can answer any questions you may have. * Flexibility: Phone payments can be made using a bank account or debit card.Mail Payment Options

Mail payments can take several days to process, so be sure to plan ahead and send your payment early to avoid late fees. Additionally, be aware that mail payments may incur a fee, which can range from $10 to $15, depending on the payment amount.

Benefits of Mail Payments

Some of the benefits of mail payments include: * No need for technology: Mail payments can be made without the need for a computer or phone. * Paper trail: You'll have a paper record of your payment, which can be useful for record-keeping purposes. * Flexibility: Mail payments can be made using a check or money order.In-Store Payment Options

In-store payments are a convenient option for those who prefer to pay in person. Additionally, in-store payments are free, and you can avoid the hassle of mailing a check or making a phone payment.

Benefits of In-Store Payments

Some of the benefits of in-store payments include: * Convenience: In-store payments can be made at any Old Navy store. * No fees: In-store payments are free, and you can avoid the hassle of mailing a check or making a phone payment. * Personalized service: You'll have the opportunity to speak with a cashier who can answer any questions you may have.Payment Fees and Interest Charges

To avoid payment fees and interest charges, it's essential to make your payments on time, every time. By doing so, you can avoid unnecessary charges and keep your credit score healthy.

Tips for Avoiding Payment Fees and Interest Charges

Some tips for avoiding payment fees and interest charges include: * Make your payments on time, every time. * Set up automatic payments to ensure that your payments are made on time. * Pay more than the minimum payment to avoid interest charges. * Avoid late payments, which can incur a fee of up to $38.Gallery of Old Navy Credit Card Payment Options

Old Navy Credit Card Payment Options Image Gallery

Final Thoughts

We encourage you to share your thoughts and experiences with the Old Navy credit card payment options in the comments section below. Have you had a positive experience with online payments or do you prefer to make payments in person? Let us know, and we'll do our best to address any questions or concerns you may have. Additionally, if you found this article helpful, please share it with your friends and family who may be interested in learning more about the Old Navy credit card payment options.