Unlock rewards with Old Navy Credit Card tips, including payment hacks, rewards redemption, and exclusive discounts, to maximize your shopping experience and earn Navyist rewards.

The world of credit cards can be overwhelming, with numerous options available to consumers. One popular choice is the Old Navy Credit Card, which offers a range of benefits and rewards to its users. However, to get the most out of this card, it's essential to understand how it works and how to use it effectively. In this article, we'll delve into the world of Old Navy Credit Cards, exploring their features, benefits, and providing valuable tips on how to make the most of them.

For those who frequently shop at Old Navy, the Old Navy Credit Card can be a great way to earn rewards and save money. The card offers 5 points for every $1 spent at Old Navy, as well as other Gap Inc. brands, including Gap, Banana Republic, and Athleta. Additionally, cardholders can enjoy exclusive discounts, early access to sales, and a $5 reward for every 500 points earned. With these benefits in mind, it's no wonder why many shoppers choose to apply for the Old Navy Credit Card.

However, like any credit card, there are some potential pitfalls to be aware of. For example, the card has a relatively high interest rate, which can lead to significant charges if balances are not paid in full each month. Furthermore, the rewards program can be complex, with various restrictions and limitations on redemption. To avoid these common mistakes and get the most out of the Old Navy Credit Card, it's crucial to understand the terms and conditions and use the card responsibly.

Understanding the Old Navy Credit Card Benefits

One of the primary benefits of the Old Navy Credit Card is its rewards program. Cardholders can earn 5 points for every $1 spent at Old Navy, as well as other Gap Inc. brands. These points can be redeemed for rewards, such as discounts, free merchandise, and exclusive experiences. Additionally, cardholders can enjoy exclusive discounts, early access to sales, and a $5 reward for every 500 points earned. To maximize these benefits, it's essential to understand how the rewards program works and how to earn and redeem points effectively.

How to Earn Points with the Old Navy Credit Card

Earning points with the Old Navy Credit Card is relatively straightforward. Cardholders can earn 5 points for every $1 spent at Old Navy, as well as other Gap Inc. brands. This means that for every $100 spent, cardholders can earn 500 points, which can be redeemed for a $5 reward. Additionally, cardholders can earn points on other purchases, although at a lower rate. To maximize points earnings, it's essential to use the card for all Old Navy purchases and take advantage of exclusive promotions and offers.Managing Your Old Navy Credit Card Account

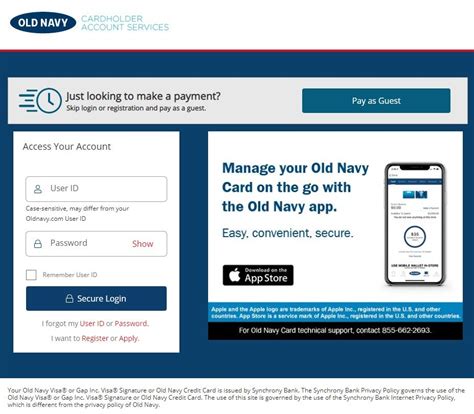

To get the most out of the Old Navy Credit Card, it's essential to manage the account effectively. This includes making on-time payments, keeping track of balances, and monitoring credit scores. Cardholders can access their account information online or through the Old Navy Credit Card mobile app, making it easy to stay on top of account activity. Additionally, cardholders can set up account alerts and notifications to ensure they never miss a payment or exceed their credit limit.

Old Navy Credit Card Payment Options

The Old Navy Credit Card offers various payment options, making it easy for cardholders to manage their account. Cardholders can make payments online, by phone, or by mail, and can also set up automatic payments to ensure they never miss a payment. Additionally, cardholders can choose from various payment plans, including monthly payments or lump sum payments. To avoid late fees and interest charges, it's essential to make on-time payments and keep track of account balances.Old Navy Credit Card Tips and Tricks

To get the most out of the Old Navy Credit Card, it's essential to use it effectively. Here are some valuable tips and tricks to keep in mind:

- Always make on-time payments to avoid late fees and interest charges

- Keep track of account balances and credit scores to ensure responsible credit use

- Take advantage of exclusive promotions and offers to maximize rewards earnings

- Use the card for all Old Navy purchases to earn points and rewards

- Consider paying off balances in full each month to avoid interest charges

By following these tips and tricks, cardholders can get the most out of the Old Navy Credit Card and enjoy the benefits of rewards, discounts, and exclusive experiences.

Common Mistakes to Avoid with the Old Navy Credit Card

While the Old Navy Credit Card can be a great way to earn rewards and save money, there are some common mistakes to avoid. These include: * Missing payments or making late payments, which can result in late fees and interest charges * Exceeding credit limits, which can negatively impact credit scores * Not monitoring account activity, which can lead to unauthorized charges or identity theft * Not understanding the terms and conditions, which can result in unexpected fees or chargesBy avoiding these common mistakes, cardholders can use the Old Navy Credit Card responsibly and get the most out of its benefits.

Old Navy Credit Card Rewards and Redemption

One of the primary benefits of the Old Navy Credit Card is its rewards program. Cardholders can earn points on every purchase, which can be redeemed for rewards, such as discounts, free merchandise, and exclusive experiences. To maximize rewards earnings, it's essential to understand how the rewards program works and how to redeem points effectively.

How to Redeem Old Navy Credit Card Rewards

Redeeming Old Navy Credit Card rewards is relatively straightforward. Cardholders can log in to their account online or through the mobile app and browse available rewards. Rewards can be redeemed for discounts, free merchandise, and exclusive experiences, and can be used online or in-store. To maximize rewards redemption, it's essential to understand the terms and conditions and plan ahead.Old Navy Credit Card Customer Service

The Old Navy Credit Card offers various customer service options, making it easy for cardholders to get help when they need it. Cardholders can contact customer service by phone, email, or mail, and can also access account information online or through the mobile app. Additionally, cardholders can visit the Old Navy website for FAQs, tutorials, and other resources.

Old Navy Credit Card FAQs

Here are some frequently asked questions about the Old Navy Credit Card: * How do I apply for the Old Navy Credit Card? * How do I earn points with the Old Navy Credit Card? * How do I redeem Old Navy Credit Card rewards? * What are the interest rates and fees associated with the Old Navy Credit Card? * How do I contact Old Navy Credit Card customer service?By understanding the answers to these questions, cardholders can get the most out of the Old Navy Credit Card and enjoy the benefits of rewards, discounts, and exclusive experiences.

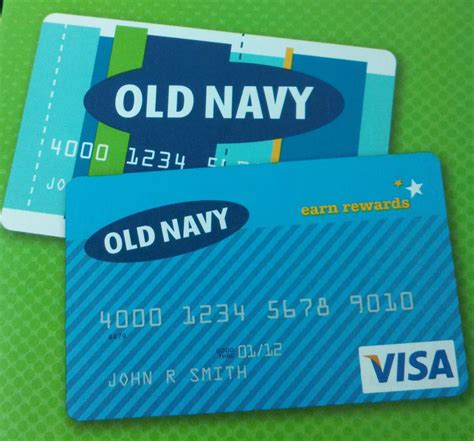

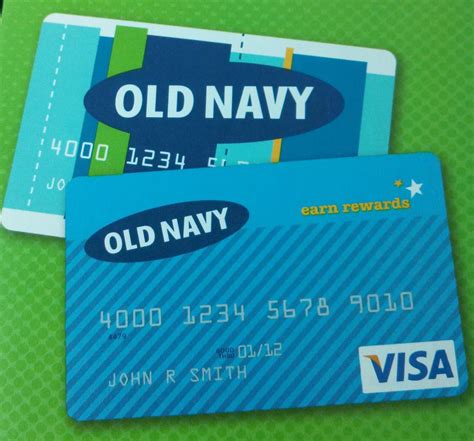

Old Navy Credit Card Image Gallery

In conclusion, the Old Navy Credit Card can be a great way to earn rewards and save money for frequent Old Navy shoppers. By understanding the benefits, terms, and conditions, and using the card responsibly, cardholders can get the most out of its rewards program and enjoy exclusive experiences. Whether you're a longtime Old Navy fan or just looking for a new credit card, the Old Navy Credit Card is definitely worth considering. So why not apply today and start earning rewards on your Old Navy purchases? Share your thoughts on the Old Navy Credit Card in the comments below, and don't forget to share this article with your friends and family who might be interested in learning more about this great credit card option.