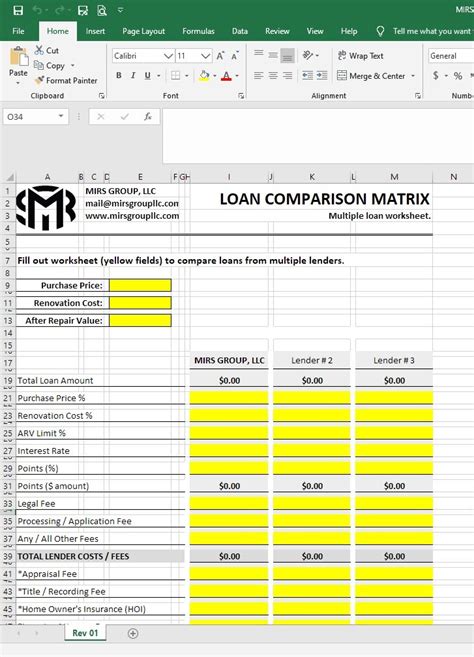

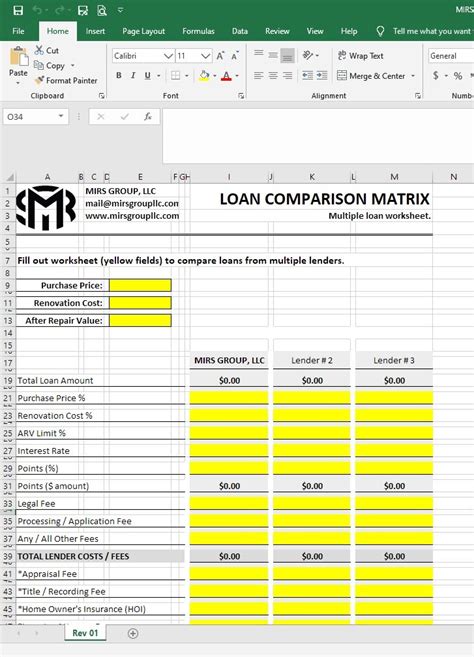

Using Cell C9 on the Loan Worksheet can be an effective way to streamline your financial calculations and make informed decisions about your loan. In this article, we will explore five ways to utilize Cell C9 on the Loan Worksheet, along with practical examples and step-by-step instructions.

Cell C9 is a crucial component of the Loan Worksheet, as it allows you to calculate the total interest paid over the life of the loan. By leveraging this cell, you can gain valuable insights into your loan's financial implications and make data-driven decisions. In the following sections, we will delve into the different ways to use Cell C9 on the Loan Worksheet.

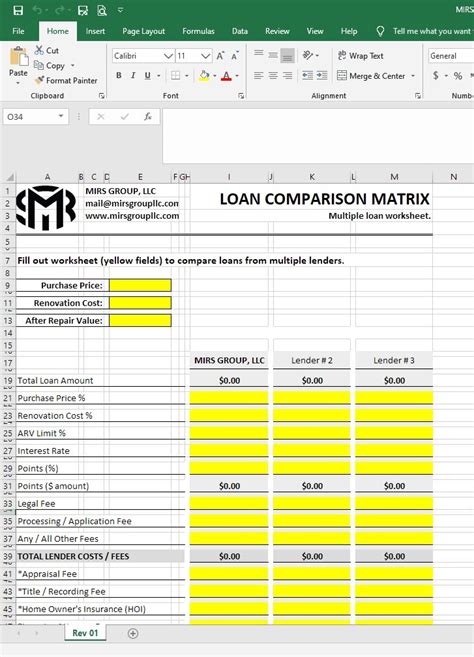

Understanding the Loan Worksheet

Before we dive into the five ways to use Cell C9, let's take a brief look at the Loan Worksheet and its components. The Loan Worksheet is a spreadsheet that helps you calculate the key parameters of a loan, including the monthly payment, total interest paid, and payoff period.

The Loan Worksheet typically consists of several cells, including:

- Cell A1: Loan amount

- Cell A2: Interest rate

- Cell A3: Loan term (in years)

- Cell C9: Total interest paid

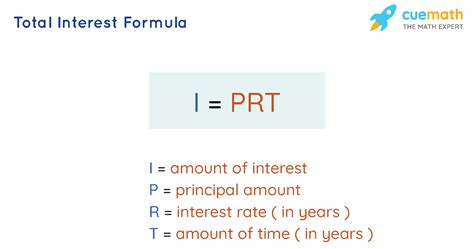

1. Calculating Total Interest Paid

One of the primary uses of Cell C9 is to calculate the total interest paid over the life of the loan. To do this, you can use the following formula:

=CUMIPMT(A2, A3, A1, 0, A3, 0)

Assuming your loan amount is $10,000, interest rate is 6%, and loan term is 5 years, the formula would calculate the total interest paid as follows:

=CUMIPMT(0.06, 5, 10000, 0, 5, 0) = $3,199.91

Example: How to Calculate Total Interest Paid

Let's say you want to calculate the total interest paid on a $20,000 loan with an interest rate of 8% and a loan term of 7 years. To do this, you would:

- Enter the loan amount in Cell A1: $20,000

- Enter the interest rate in Cell A2: 8%

- Enter the loan term in Cell A3: 7 years

- Use the formula =CUMIPMT(A2, A3, A1, 0, A3, 0) in Cell C9

The result would be the total interest paid over the life of the loan: $14,491.19

2. Comparing Loan Options

Cell C9 can also be used to compare different loan options and determine which one is the most cost-effective. By calculating the total interest paid for each loan option, you can make an informed decision about which loan to choose.

Example: Comparing Loan Options

Let's say you are considering two loan options:

- Loan A: $15,000 loan with an interest rate of 7% and a loan term of 6 years

- Loan B: $15,000 loan with an interest rate of 8% and a loan term of 5 years

To compare these loan options, you would:

- Enter the loan amount in Cell A1: $15,000

- Enter the interest rate in Cell A2: 7% (for Loan A) and 8% (for Loan B)

- Enter the loan term in Cell A3: 6 years (for Loan A) and 5 years (for Loan B)

- Use the formula =CUMIPMT(A2, A3, A1, 0, A3, 0) in Cell C9 for each loan option

The results would show the total interest paid for each loan option, allowing you to make an informed decision about which loan to choose.

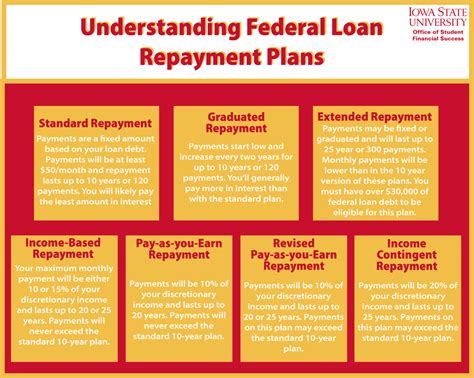

3. Creating a Loan Repayment Plan

Cell C9 can also be used to create a loan repayment plan by calculating the monthly payment and total interest paid over the life of the loan.

Example: Creating a Loan Repayment Plan

Let's say you want to create a loan repayment plan for a $10,000 loan with an interest rate of 6% and a loan term of 5 years. To do this, you would:

- Enter the loan amount in Cell A1: $10,000

- Enter the interest rate in Cell A2: 6%

- Enter the loan term in Cell A3: 5 years

- Use the formula =PMT(A2, A3, A1, 0) in Cell B2 to calculate the monthly payment

- Use the formula =CUMIPMT(A2, A3, A1, 0, A3, 0) in Cell C9 to calculate the total interest paid

The results would show the monthly payment and total interest paid over the life of the loan, allowing you to create a loan repayment plan.

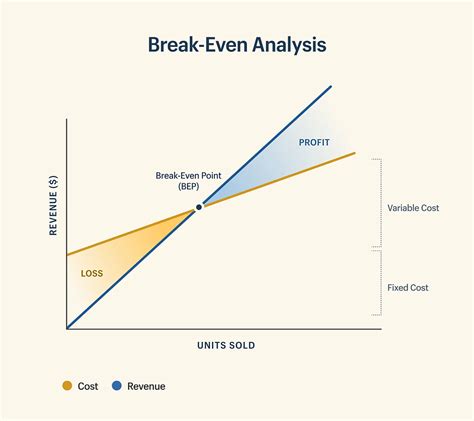

4. Determining the Break-Even Point

Cell C9 can also be used to determine the break-even point of a loan, which is the point at which the total interest paid equals the loan amount.

Example: Determining the Break-Even Point

Let's say you want to determine the break-even point for a $15,000 loan with an interest rate of 8% and a loan term of 7 years. To do this, you would:

- Enter the loan amount in Cell A1: $15,000

- Enter the interest rate in Cell A2: 8%

- Enter the loan term in Cell A3: 7 years

- Use the formula =CUMIPMT(A2, A3, A1, 0, A3, 0) in Cell C9 to calculate the total interest paid

The results would show the total interest paid over the life of the loan, allowing you to determine the break-even point.

5. Analyzing the Impact of Interest Rate Changes

Cell C9 can also be used to analyze the impact of interest rate changes on the total interest paid over the life of the loan.

Example: Analyzing the Impact of Interest Rate Changes

Let's say you want to analyze the impact of a 1% interest rate increase on a $10,000 loan with an interest rate of 6% and a loan term of 5 years. To do this, you would:

- Enter the loan amount in Cell A1: $10,000

- Enter the interest rate in Cell A2: 6%

- Enter the loan term in Cell A3: 5 years

- Use the formula =CUMIPMT(A2, A3, A1, 0, A3, 0) in Cell C9 to calculate the total interest paid

- Increase the interest rate by 1% and recalculate the total interest paid

The results would show the impact of the interest rate increase on the total interest paid over the life of the loan.

Cell C9 on the Loan Worksheet Image Gallery

In conclusion, Cell C9 on the Loan Worksheet is a powerful tool that can help you make informed decisions about your loan. By using the five methods outlined above, you can calculate the total interest paid, compare loan options, create a loan repayment plan, determine the break-even point, and analyze the impact of interest rate changes.