Intro

Unlock the secrets to crafting a compelling one-page investment teaser template. Discover the essential elements and best practices to create a persuasive pitch that grabs investors attention. Learn how to effectively communicate your value proposition, highlight key benefits, and drive success. Boost your fundraising efforts with a winning template.

Investing in the stock market can be a daunting task, especially for those who are new to the world of finance. With so many options available, it can be difficult to know where to start or how to make informed decisions. However, with the right guidance and strategy, investing can be a powerful tool for building wealth and achieving long-term financial goals.

In today's fast-paced and increasingly complex financial landscape, it's more important than ever to have a solid understanding of the investment process. From setting clear financial objectives to selecting the right investment vehicles, there are many factors to consider when building a successful investment portfolio. By taking the time to educate yourself and develop a well-thought-out investment strategy, you can set yourself up for success and achieve the financial freedom you've always wanted.

Whether you're a seasoned investor or just starting out, having a clear and concise investment plan is essential for achieving your financial goals. By focusing on key investment principles and strategies, you can make informed decisions and navigate the often-turbulent waters of the stock market with confidence.

Understanding Your Investment Objectives

Before you can start building a successful investment portfolio, it's essential to have a clear understanding of your investment objectives. What are your financial goals? Are you saving for retirement, a down payment on a house, or a big purchase? Do you want to generate income or grow your wealth over time? By understanding your investment objectives, you can develop a strategy that aligns with your needs and helps you achieve your goals.

Here are some key questions to consider when defining your investment objectives:

- What is your investment time horizon? Are you looking to invest for the short-term or long-term?

- What is your risk tolerance? Are you comfortable with the possibility of losing some or all of your investment in pursuit of higher returns?

- What are your income needs? Do you need to generate regular income from your investments or can you afford to focus on growth?

By answering these questions, you can develop a clear understanding of your investment objectives and create a strategy that helps you achieve your goals.

Assessing Your Risk Tolerance

Assessing your risk tolerance is a critical component of the investment process. Your risk tolerance will help determine the types of investments that are right for you and how you allocate your assets. By understanding your risk tolerance, you can avoid taking on too much risk and potentially losing money.

Here are some key factors to consider when assessing your risk tolerance:

- Your investment time horizon: If you have a long-term investment horizon, you may be able to take on more risk in pursuit of higher returns.

- Your financial situation: If you have a stable income and a solid emergency fund, you may be able to take on more risk.

- Your personal comfort level: If you're uncomfortable with the possibility of losing money, you may want to take on less risk.

By considering these factors, you can develop a clear understanding of your risk tolerance and create a strategy that aligns with your needs.

Building a Diversified Investment Portfolio

Building a diversified investment portfolio is essential for managing risk and achieving your long-term financial goals. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce your exposure to any one particular investment and increase your potential for long-term success.

Here are some key strategies for building a diversified investment portfolio:

- Asset allocation: Allocate your investments across different asset classes, such as stocks, bonds, and real estate.

- Sector diversification: Spread your investments across different sectors, such as technology, healthcare, and finance.

- Geographic diversification: Invest in different geographic regions, such as the United States, Europe, and Asia.

By diversifying your investment portfolio, you can reduce your risk and increase your potential for long-term success.

Investment Vehicles

Investment vehicles are the tools you use to invest in the stock market. There are many different types of investment vehicles available, each with its own unique characteristics and benefits. Here are some of the most common types of investment vehicles:

- Stocks: Represent ownership in a company and offer the potential for long-term growth.

- Bonds: Represent debt obligations and offer regular income and relatively low risk.

- Mutual funds: Pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Exchange-traded funds (ETFs): Similar to mutual funds but trade on an exchange like stocks.

- Real estate investment trusts (REITs): Allow individuals to invest in real estate without directly owning physical properties.

By understanding the different types of investment vehicles available, you can make informed decisions and select the vehicles that align with your investment objectives and risk tolerance.

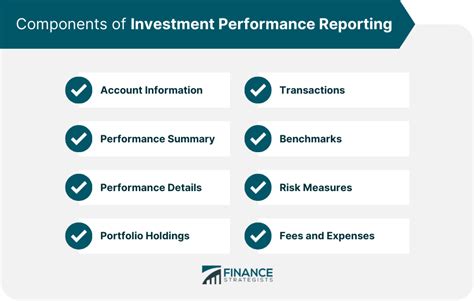

Managing Your Investment Portfolio

Managing your investment portfolio is an ongoing process that requires regular monitoring and adjustments. Here are some key strategies for managing your investment portfolio:

- Regular portfolio rebalancing: Periodically review your portfolio and rebalance it to ensure that it remains aligned with your investment objectives and risk tolerance.

- Tax-efficient investing: Consider the tax implications of your investments and strive to minimize tax liabilities.

- Risk management: Continuously monitor your portfolio for potential risks and take steps to mitigate them.

By following these strategies, you can help ensure that your investment portfolio remains on track to meet your long-term financial goals.

Seeking Professional Advice

While it's possible to manage your investment portfolio on your own, seeking professional advice can be beneficial, especially if you're new to investing. A financial advisor can help you develop a personalized investment plan, provide ongoing portfolio management, and offer valuable guidance and support.

Here are some key benefits of working with a financial advisor:

- Personalized investment plan: A financial advisor can help you develop a customized investment plan that aligns with your unique needs and goals.

- Ongoing portfolio management: A financial advisor can continuously monitor your portfolio and make adjustments as needed.

- Valuable guidance and support: A financial advisor can provide guidance and support to help you navigate the often-complex world of investing.

By working with a financial advisor, you can gain confidence and peace of mind, knowing that your investment portfolio is in good hands.

Conclusion

Investing in the stock market can be a powerful tool for building wealth and achieving long-term financial goals. By understanding your investment objectives, assessing your risk tolerance, building a diversified investment portfolio, and managing your investments effectively, you can set yourself up for success and achieve the financial freedom you've always wanted.

Remember, investing is a journey, and it's essential to be patient, disciplined, and informed. By following the strategies outlined in this article, you can make informed decisions and navigate the often-turbulent waters of the stock market with confidence.

We hope this article has provided you with valuable insights and information to help you on your investment journey. If you have any questions or would like to learn more, please don't hesitate to reach out.

Investment Image Gallery