Intro

Establish a solid foundation for your Maryland LLC with a comprehensive operating agreement. Learn how to create a customized agreement in 5 easy steps, covering vital aspects such as ownership structure, management roles, capital contributions, and dispute resolution. Ensure compliance with Maryland state laws and safeguard your business interests.

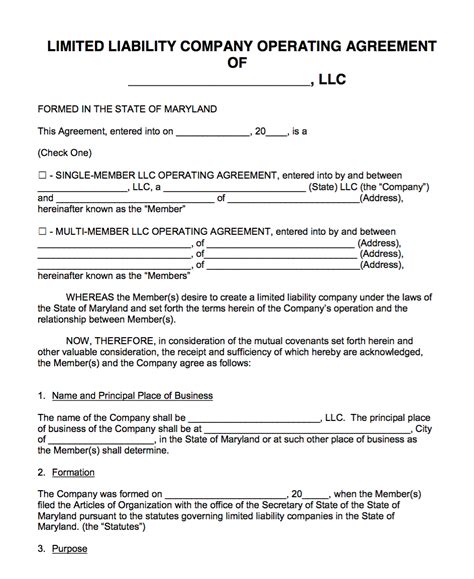

Creating a Maryland LLC Operating Agreement in 5 Steps

Forming a Limited Liability Company (LLC) in Maryland requires careful planning and documentation. One of the essential documents for an LLC is the Operating Agreement, which outlines the ownership, management, and operational structure of the company. In this article, we will guide you through the process of creating a Maryland LLC Operating Agreement in 5 steps.

Step 1: Determine the Type of LLC

Before creating an Operating Agreement, you need to determine the type of LLC you are forming. Maryland allows several types of LLCs, including:

- Single-member LLC (owned by one person)

- Multi-member LLC (owned by two or more people)

- Professional LLC (for licensed professionals, such as doctors or lawyers)

- Series LLC (a type of LLC that allows multiple separate series or cells)

The type of LLC you choose will affect the structure and content of your Operating Agreement.

Step 2: Identify the Members and Their Roles

The next step is to identify the members of the LLC and their respective roles. This includes:

- Their names and addresses

- Their ownership percentages

- Their roles and responsibilities within the company

- Their voting rights and powers

You should also determine how new members can join the LLC and how existing members can leave.

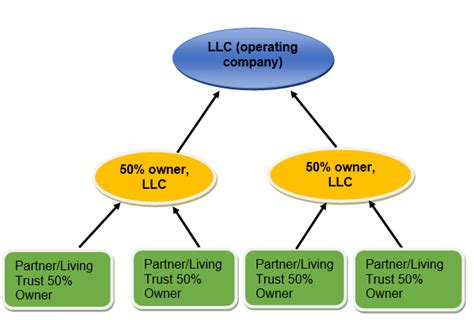

Step 3: Define the Management Structure

Maryland LLCs can be managed by their members (member-managed) or by appointed managers (manager-managed). You need to decide which management structure is best for your LLC and define it in the Operating Agreement.

- Member-managed LLC: All members participate in decision-making and management.

- Manager-managed LLC: Appointed managers make decisions and manage the LLC.

You should also outline the powers and duties of the managers or members, including their authority to bind the LLC.

Step 4: Outline the Financial and Operational Provisions

The Operating Agreement should also cover the financial and operational aspects of the LLC, including:

- Capital contributions: How much each member contributes to the LLC and when.

- Distributions: How profits and losses will be distributed among members.

- Accounting and record-keeping: How financial records will be maintained and reported.

- Meetings and voting: How meetings will be held and decisions made.

You should also outline the procedures for amending the Operating Agreement and resolving disputes.

Step 5: Review and Sign the Operating Agreement

Once you have drafted the Operating Agreement, review it carefully to ensure it accurately reflects the terms and conditions of your LLC. All members should sign the agreement, and it's a good idea to have a lawyer review it as well.

Additional Considerations

- Maryland law requires that an LLC have an Operating Agreement, but it does not need to be filed with the state.

- The Operating Agreement should be kept with the LLC's other important documents, such as the Articles of Organization and business licenses.

- Review and update the Operating Agreement regularly to ensure it remains accurate and effective.

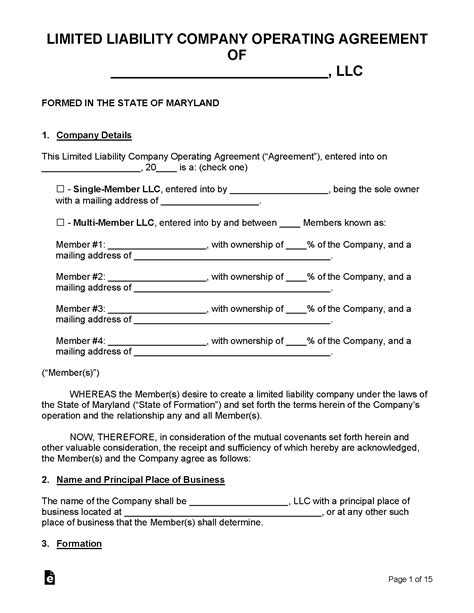

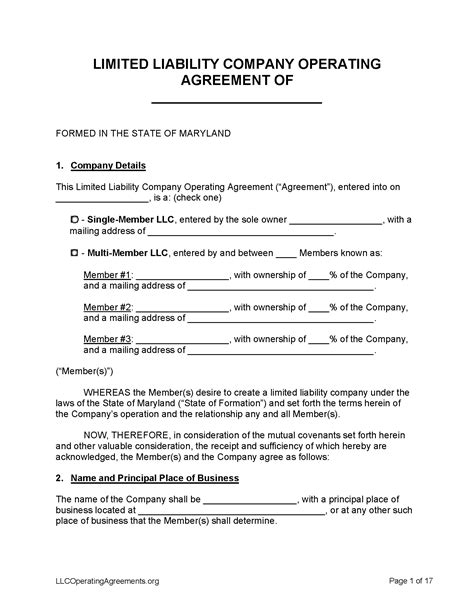

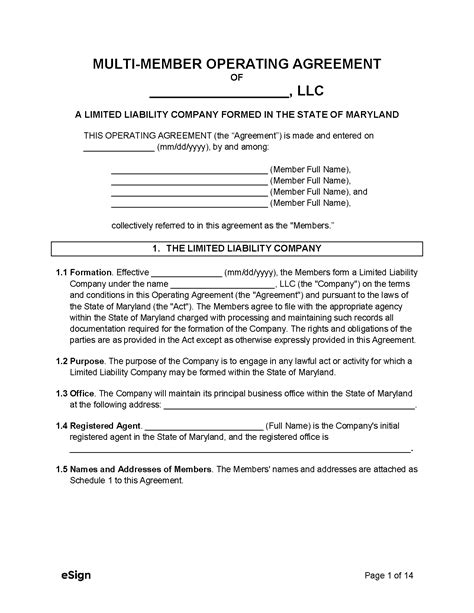

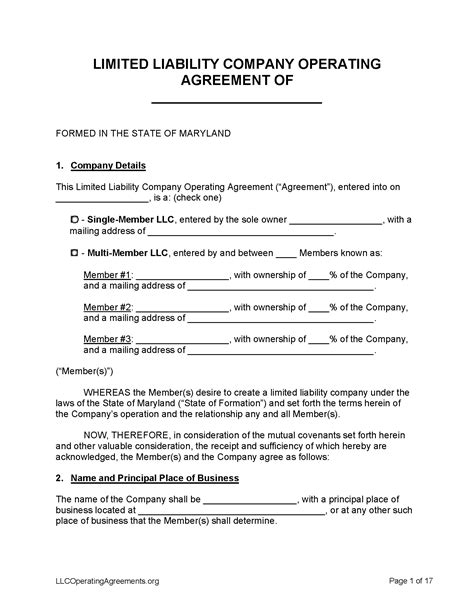

Gallery of Maryland LLC Operating Agreement Templates

Maryland LLC Operating Agreement Templates

FAQs

Q: Is an Operating Agreement required for a Maryland LLC? A: Yes, Maryland law requires that an LLC have an Operating Agreement.

Q: What should be included in a Maryland LLC Operating Agreement? A: The Operating Agreement should outline the ownership, management, and operational structure of the LLC, including the roles and responsibilities of members and managers.

Q: Can I use a template to create a Maryland LLC Operating Agreement? A: Yes, you can use a template to create a Maryland LLC Operating Agreement, but it's recommended to have a lawyer review it to ensure it accurately reflects the terms and conditions of your LLC.

Q: How often should I review and update my Maryland LLC Operating Agreement? A: You should review and update your Maryland LLC Operating Agreement regularly to ensure it remains accurate and effective.

By following these 5 steps and considering the additional factors outlined above, you can create a comprehensive and effective Maryland LLC Operating Agreement that will help your business succeed.