Intro

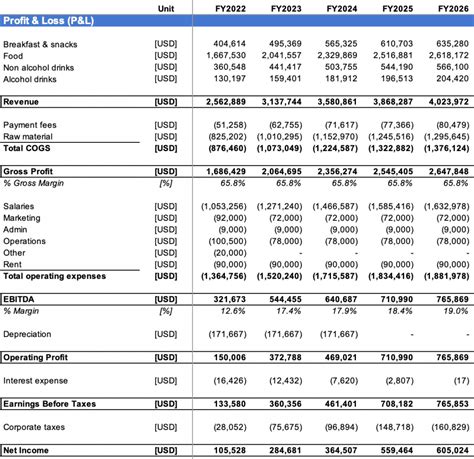

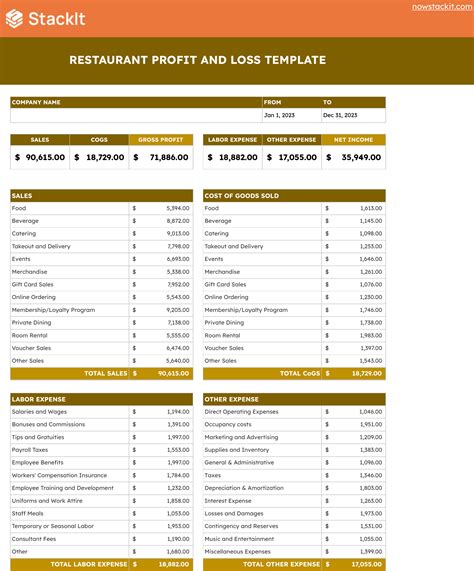

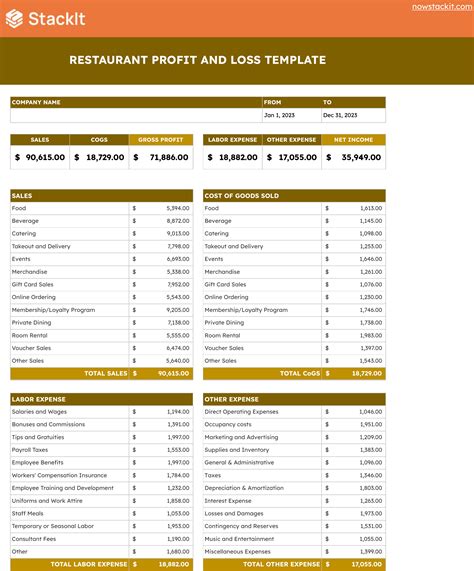

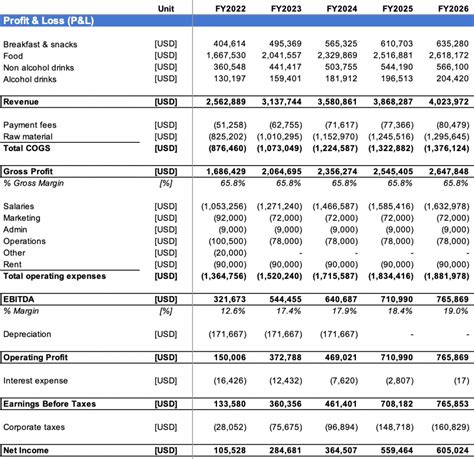

Optimize your restaurants financial performance with a well-structured P&L template. Discover the 7 essential elements to include, such as revenue streams, cost of goods sold, labor costs, and more. Learn how to create a comprehensive profit and loss statement that drives business growth and informed decision-making.

A Profit and Loss (P&L) restaurant template is a crucial tool for any restaurant owner or manager. It helps track and analyze the financial performance of the business, making it easier to identify areas of strength and weakness. A well-designed P&L template can help restaurants make informed decisions, optimize operations, and ultimately increase profitability.

Here are the 7 essential elements of a P&L restaurant template that you should include:

1. Revenue Streams

A P&L restaurant template should start by identifying all the revenue streams of the business. This includes:

- Sales: This is the total revenue generated from food and beverage sales.

- Other income: This includes revenue from catering, events, and other non-food sales.

It's essential to break down sales into different categories, such as:

- Food sales

- Beverage sales

- Catering sales

- Event sales

This will help you understand which revenue streams are performing well and which ones need improvement.

Example of Revenue Streams

| Revenue Stream | Amount |

|---|---|

| Food Sales | $100,000 |

| Beverage Sales | $50,000 |

| Catering Sales | $20,000 |

| Event Sales | $10,000 |

| Other Income | $5,000 |

2. Cost of Goods Sold (COGS)

COGS includes the direct costs associated with producing and selling your menu items. This includes:

- Food costs: The cost of ingredients, supplies, and labor used to prepare menu items.

- Beverage costs: The cost of beverages, including coffee, tea, and soft drinks.

- Labor costs: The cost of labor used to prepare and serve menu items.

It's essential to calculate COGS as a percentage of sales to understand the profitability of your menu items.

Example of COGS

| COGS Category | Amount | Percentage of Sales |

|---|---|---|

| Food Costs | $30,000 | 30% |

| Beverage Costs | $10,000 | 10% |

| Labor Costs | $20,000 | 20% |

3. Labor Costs

Labor costs include the cost of employee salaries, benefits, and payroll taxes. This includes:

- Front-of-house labor: The cost of labor used to serve customers, including servers, bartenders, and hosts.

- Back-of-house labor: The cost of labor used to prepare menu items, including chefs, cooks, and dishwashers.

It's essential to calculate labor costs as a percentage of sales to understand the efficiency of your labor operations.

Example of Labor Costs

| Labor Cost Category | Amount | Percentage of Sales |

|---|---|---|

| Front-of-House Labor | $15,000 | 15% |

| Back-of-House Labor | $10,000 | 10% |

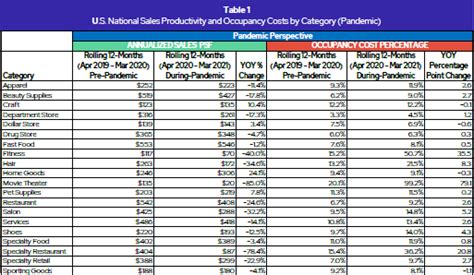

4. Occupancy Costs

Occupancy costs include the cost of renting or owning a physical location. This includes:

- Rent: The cost of renting a physical location.

- Utilities: The cost of electricity, gas, water, and other utilities used to operate the restaurant.

- Maintenance: The cost of maintaining the physical location, including repairs and maintenance.

It's essential to calculate occupancy costs as a percentage of sales to understand the efficiency of your operations.

Example of Occupancy Costs

| Occupancy Cost Category | Amount | Percentage of Sales |

|---|---|---|

| Rent | $10,000 | 10% |

| Utilities | $2,000 | 2% |

| Maintenance | $1,000 | 1% |

5. Marketing and Advertising Expenses

Marketing and advertising expenses include the cost of promoting your restaurant to attract new customers. This includes:

- Online marketing: The cost of online marketing, including social media advertising and email marketing.

- Offline marketing: The cost of offline marketing, including print advertising and event marketing.

It's essential to calculate marketing and advertising expenses as a percentage of sales to understand the efficiency of your marketing operations.

Example of Marketing and Advertising Expenses

| Marketing and Advertising Expense Category | Amount | Percentage of Sales |

|---|---|---|

| Online Marketing | $5,000 | 5% |

| Offline Marketing | $2,000 | 2% |

6. General and Administrative Expenses

General and administrative expenses include the cost of operating the restaurant, including:

- Insurance: The cost of insurance, including liability insurance and property insurance.

- Office expenses: The cost of office expenses, including supplies and equipment.

- Professional fees: The cost of professional fees, including accounting and legal fees.

It's essential to calculate general and administrative expenses as a percentage of sales to understand the efficiency of your operations.

Example of General and Administrative Expenses

| General and Administrative Expense Category | Amount | Percentage of Sales |

|---|---|---|

| Insurance | $2,000 | 2% |

| Office Expenses | $1,000 | 1% |

| Professional Fees | $1,500 | 1.5% |

7. Net Profit

Net profit is the amount of money left over after all expenses have been subtracted from revenue. It's essential to calculate net profit as a percentage of sales to understand the profitability of your restaurant.

Example of Net Profit

| Net Profit Category | Amount | Percentage of Sales |

|---|---|---|

| Net Profit | $20,000 | 20% |

By including these 7 essential elements in your P&L restaurant template, you'll be able to track and analyze your financial performance, make informed decisions, and optimize your operations to increase profitability.

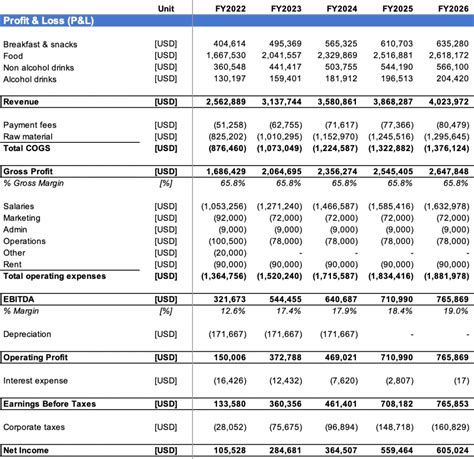

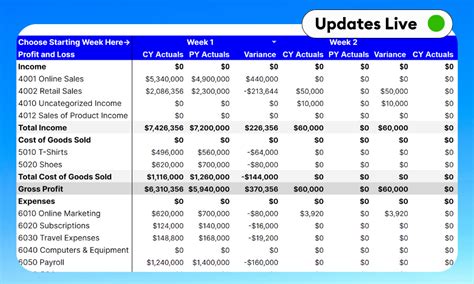

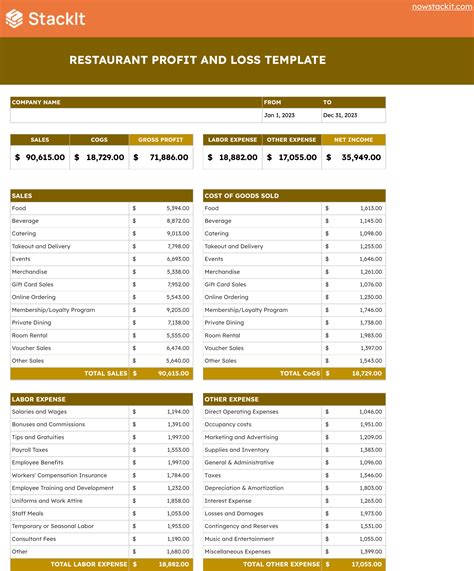

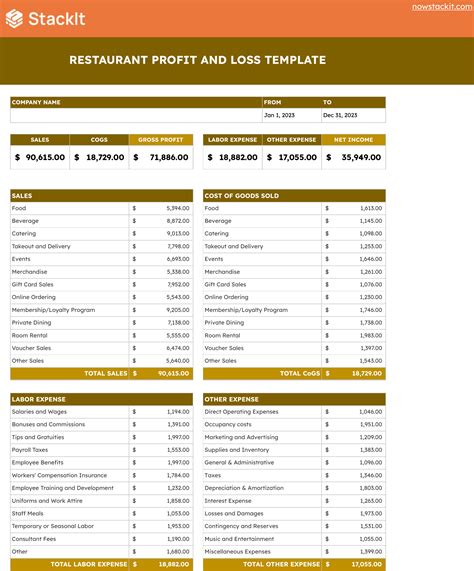

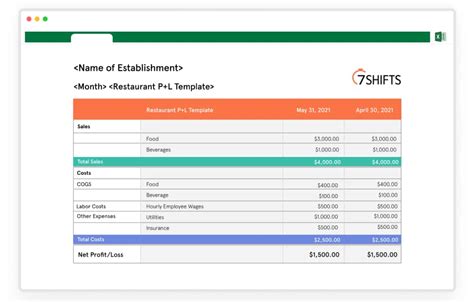

Restaurant P&L Template Image Gallery

We hope this article has helped you understand the importance of a P&L restaurant template and how to create one that meets your needs. Remember to regularly review and update your template to ensure it remains accurate and effective.

What do you think about this article? Share your thoughts and comments below.