In today's digital age, creating a pay stub calculator in Excel is an essential skill for anyone who wants to streamline their payroll processing. A pay stub calculator can help you accurately calculate employee salaries, deductions, and benefits, making it easier to manage your company's finances. In this article, we will explore five ways to create a pay stub calculator in Excel, along with practical examples and step-by-step instructions.

Understanding the Basics of a Pay Stub Calculator

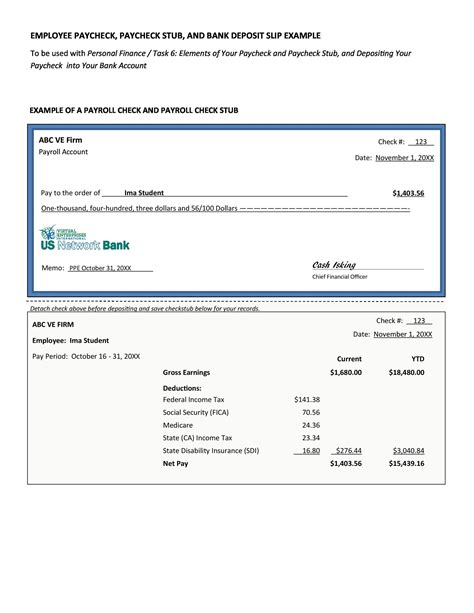

Before we dive into the different methods of creating a pay stub calculator, let's first understand what a pay stub calculator is and what it does. A pay stub calculator is a tool that helps you calculate an employee's net pay based on their gross income, deductions, and benefits. It typically includes information such as:

- Gross income

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

- Other deductions (e.g., health insurance, 401(k))

- Net pay

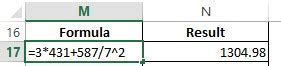

Method 1: Using Excel Formulas

One way to create a pay stub calculator in Excel is by using formulas. This method requires you to set up a table with the relevant columns and then use formulas to calculate the net pay.

For example, let's say you want to create a pay stub calculator that calculates an employee's net pay based on their gross income and federal income tax. You can use the following formula:

Net Pay = Gross Income - Federal Income Tax

You can enter this formula in a cell and then copy it down to other cells to calculate the net pay for multiple employees.

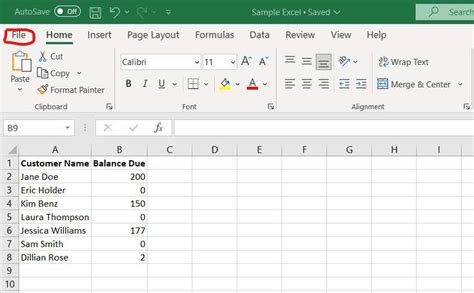

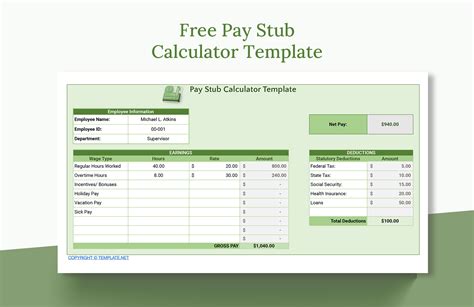

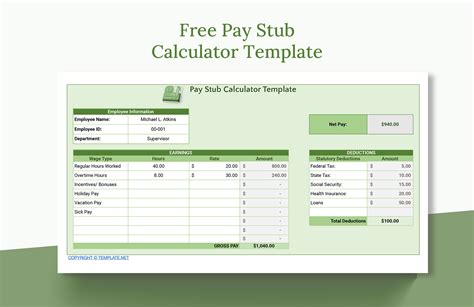

Method 2: Using Excel Templates

Another way to create a pay stub calculator in Excel is by using pre-built templates. Excel offers a range of templates that you can use to create a pay stub calculator, including templates for payroll, employee information, and benefits.

To use an Excel template, follow these steps:

- Open Excel and click on the "File" tab.

- Click on "New" and then select "Template".

- Search for "pay stub calculator" or "payroll template" and select a template that suits your needs.

- Customize the template by entering your company's information and employee data.

Method 3: Using Excel Macros

If you want to create a more advanced pay stub calculator, you can use Excel macros. Macros are a series of commands that can be executed with a single click, making it easier to automate repetitive tasks.

To create a pay stub calculator using Excel macros, follow these steps:

- Open the Visual Basic Editor by pressing "Alt + F11" or by navigating to "Developer" > "Visual Basic".

- Create a new module by clicking "Insert" > "Module".

- Write a macro that calculates the net pay based on the gross income and deductions.

- Assign the macro to a button or a shortcut key.

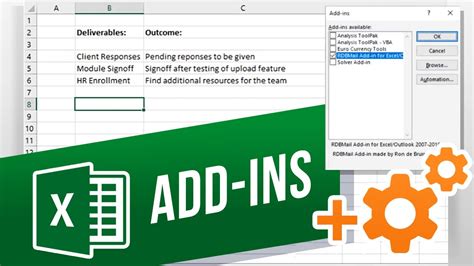

Method 4: Using Excel Add-ins

Another way to create a pay stub calculator in Excel is by using add-ins. Add-ins are software programs that can be installed in Excel to provide additional functionality.

There are several add-ins available that can help you create a pay stub calculator, including payroll software and accounting add-ins.

To use an Excel add-in, follow these steps:

- Search for "pay stub calculator add-in" or "payroll add-in" online.

- Download and install the add-in.

- Follow the instructions provided by the add-in to set up the pay stub calculator.

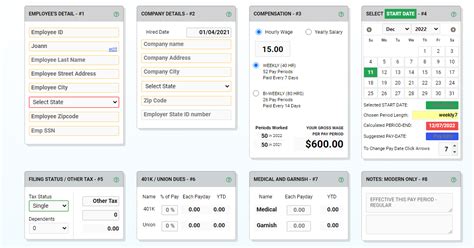

Method 5: Using Online Pay Stub Calculators

Finally, if you don't want to create a pay stub calculator in Excel, you can use online pay stub calculators. There are several websites that offer free pay stub calculators that you can use to calculate employee net pay.

To use an online pay stub calculator, follow these steps:

- Search for "pay stub calculator" or "online payroll calculator" online.

- Select a website that offers a free pay stub calculator.

- Enter the relevant information, such as gross income and deductions.

- Click "Calculate" to get the net pay.

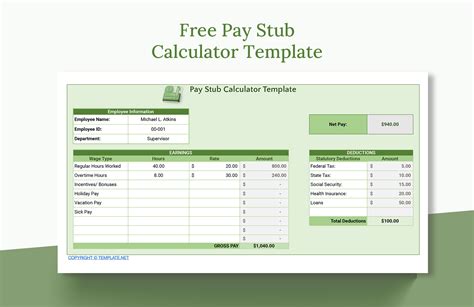

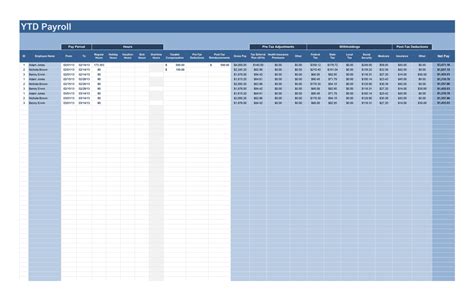

Gallery of Pay Stub Calculator Examples

Pay Stub Calculator Examples

Conclusion

Creating a pay stub calculator in Excel can be a simple and efficient way to manage your company's payroll. By using one of the five methods outlined in this article, you can create a pay stub calculator that accurately calculates employee net pay based on their gross income and deductions. Whether you use Excel formulas, templates, macros, add-ins, or online pay stub calculators, the key is to find a method that works for you and your business.

We hope this article has been helpful in providing you with the information and resources you need to create a pay stub calculator in Excel. If you have any questions or need further assistance, please don't hesitate to comment below.

Share this article with your friends and colleagues who may be interested in creating a pay stub calculator in Excel. And don't forget to subscribe to our blog for more articles on Excel, payroll, and business management.