Effective financial tracking is crucial for both employers and employees to ensure seamless payroll processing and maintain a record of earnings and deductions. A pay stub template with a built-in calculator can simplify this process, making it easier to manage finances and stay organized.

The importance of accurate financial tracking cannot be overstated. For employers, it helps in maintaining transparency and compliance with labor laws, while for employees, it enables them to keep track of their earnings, deductions, and taxes. A well-designed pay stub template with a calculator can streamline this process, reducing errors and saving time.

What is a Pay Stub Template with Calculator?

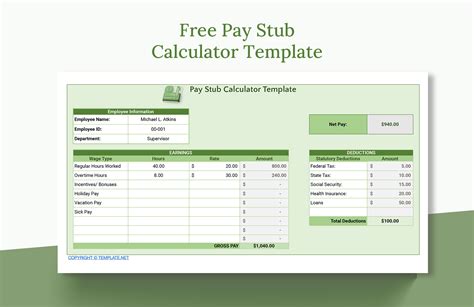

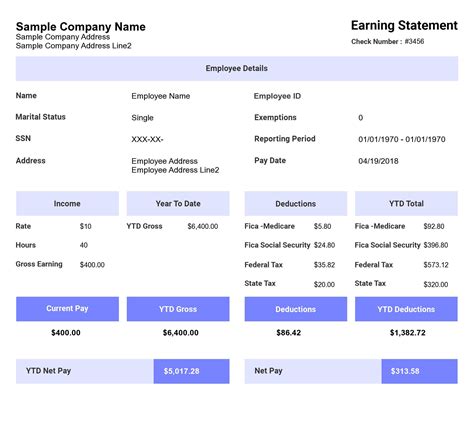

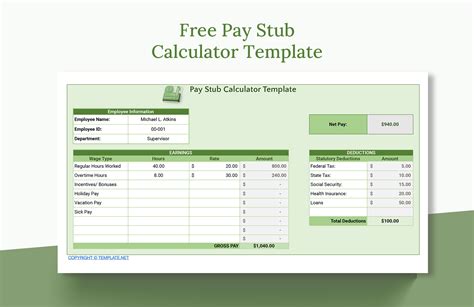

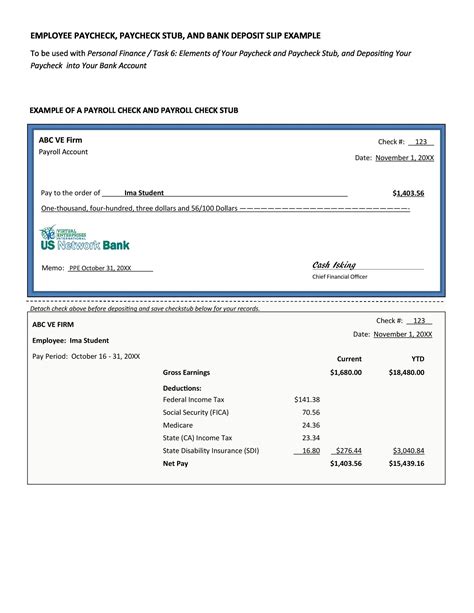

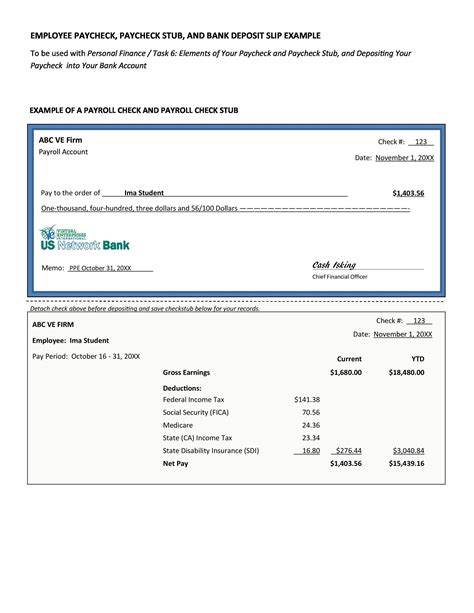

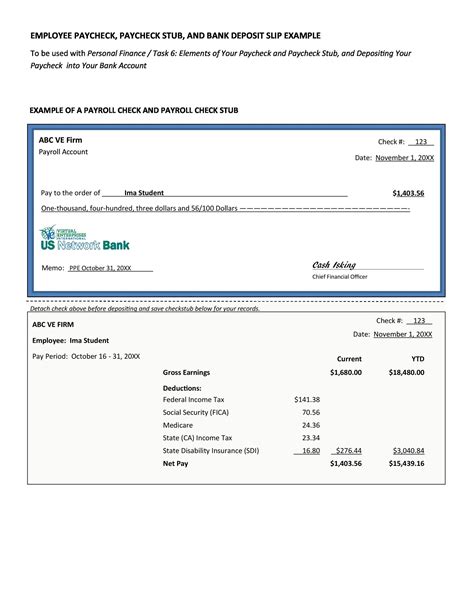

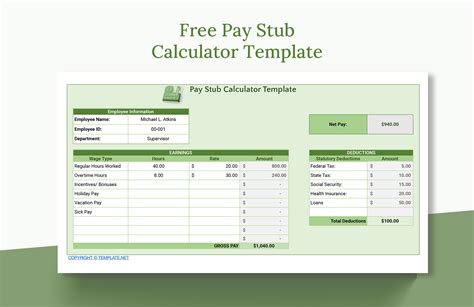

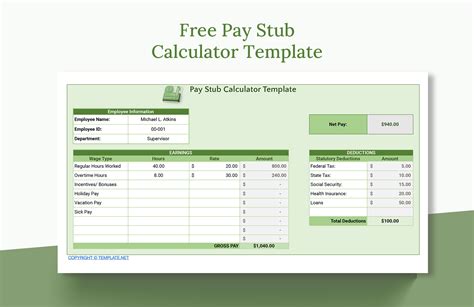

A pay stub template with a calculator is a digital or printable document that outlines an employee's earnings, deductions, and taxes for a specific pay period. The calculator feature allows users to easily compute gross pay, taxes, deductions, and net pay, ensuring accuracy and efficiency in payroll processing.

Benefits of Using a Pay Stub Template with Calculator

Using a pay stub template with a calculator offers numerous benefits for both employers and employees. Some of the key advantages include:

- Accurate calculations: The calculator feature ensures that all calculations are accurate, reducing errors and discrepancies in payroll processing.

- Time-saving: The template simplifies the process of creating pay stubs, saving time and effort for employers and payroll administrators.

- Transparency: The template provides a clear and transparent breakdown of earnings, deductions, and taxes, ensuring that employees understand their pay.

- Compliance: The template helps employers comply with labor laws and regulations, reducing the risk of non-compliance and associated penalties.

Key Components of a Pay Stub Template with Calculator

A pay stub template with a calculator typically includes the following key components:

- Employee information: The template includes fields for employee name, address, social security number, and other relevant details.

- Pay period information: The template includes fields for pay period dates, pay frequency, and pay rate.

- Earnings: The template includes fields for gross pay, overtime pay, and other earnings.

- Deductions: The template includes fields for taxes, benefits, and other deductions.

- Calculator: The template includes a calculator feature that computes net pay, taxes, and deductions.

How to Use a Pay Stub Template with Calculator

Using a pay stub template with a calculator is straightforward. Here's a step-by-step guide:

- Download or create a template: Download a pay stub template with a calculator or create one using a spreadsheet or word processing software.

- Enter employee information: Enter the employee's name, address, social security number, and other relevant details.

- Enter pay period information: Enter the pay period dates, pay frequency, and pay rate.

- Enter earnings: Enter the employee's gross pay, overtime pay, and other earnings.

- Enter deductions: Enter the employee's taxes, benefits, and other deductions.

- Use the calculator: Use the calculator feature to compute net pay, taxes, and deductions.

- Review and print: Review the pay stub for accuracy and print or email it to the employee.

Best Practices for Using a Pay Stub Template with Calculator

To get the most out of a pay stub template with a calculator, follow these best practices:

- Use a secure and reliable template: Use a template from a reputable source or create one using a secure and reliable software.

- Keep records up-to-date: Keep employee records and pay stubs up-to-date to ensure accuracy and compliance.

- Use the calculator feature: Use the calculator feature to ensure accurate calculations and reduce errors.

- Review and verify: Review and verify pay stubs for accuracy before printing or emailing them to employees.

Common Mistakes to Avoid When Using a Pay Stub Template with Calculator

When using a pay stub template with a calculator, avoid the following common mistakes:

- Inaccurate employee information: Ensure that employee information is accurate and up-to-date to avoid errors and discrepancies.

- Incorrect pay period information: Ensure that pay period information is accurate to avoid errors and discrepancies.

- Incorrect earnings and deductions: Ensure that earnings and deductions are accurate to avoid errors and discrepancies.

- Failure to use the calculator feature: Use the calculator feature to ensure accurate calculations and reduce errors.

Pay Stub Template with Calculator Image Gallery

In conclusion, a pay stub template with a calculator is a valuable tool for employers and employees to simplify payroll processing and maintain accurate financial records. By following best practices and avoiding common mistakes, users can get the most out of this template and ensure compliance with labor laws and regulations.