Intro

Unlock the power of Excel for effortless payback calculation! Discover 5 easy-to-use formulas to calculate payback periods, including the simple payback period, discounted payback period, and more. Master financial analysis and make informed decisions with these straightforward Excel formulas, perfect for investors and business professionals alike.

The concept of payback calculation is a crucial aspect of business and finance, as it helps investors and organizations determine the feasibility of a project or investment by estimating the time it takes to recover the initial investment. In this article, we will delve into the world of payback calculation Excel formulas, exploring five easy-to-use formulas that can help you make informed decisions.

What is Payback Calculation?

Before we dive into the Excel formulas, let's quickly define what payback calculation is. Payback calculation is a method used to determine the length of time it takes for an investment to generate enough returns to cover its initial cost. It's an essential metric for businesses and investors, as it helps them evaluate the profitability of a project and make informed decisions.

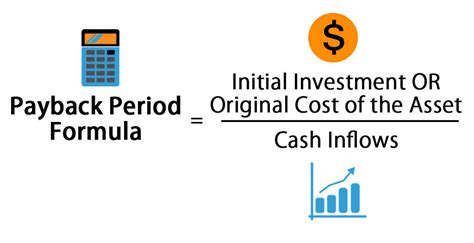

Payback Calculation Formula

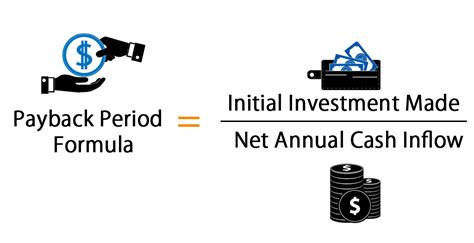

The basic payback calculation formula is:

Payback Period = Initial Investment / Annual Cash Inflows

Where:

- Initial Investment is the initial amount invested in the project.

- Annual Cash Inflows is the annual return on investment.

5 Easy Payback Calculation Excel Formulas

Now that we have a basic understanding of payback calculation, let's explore five easy-to-use Excel formulas that can help you perform payback calculations with ease.

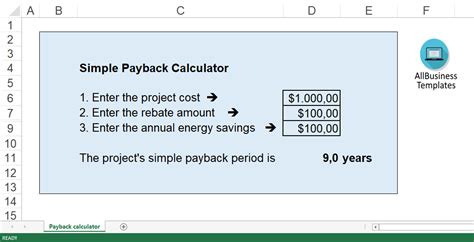

1. Simple Payback Calculation Formula

The simple payback calculation formula is the most basic formula used to calculate the payback period. It can be calculated using the following Excel formula:

=Initial Investment / Annual Cash Inflows

For example, if the initial investment is $10,000 and the annual cash inflows are $2,000, the payback period would be:

=10000 / 2000 =5 years

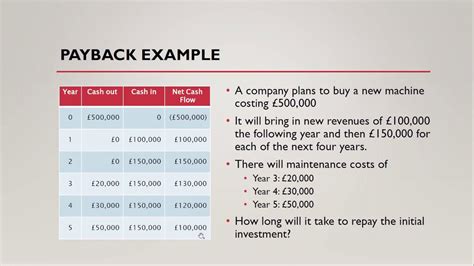

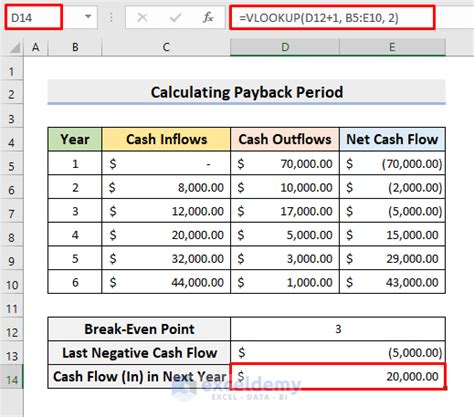

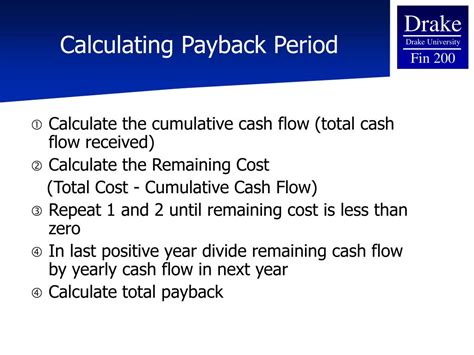

2. Payback Calculation with Uneven Cash Flows

In some cases, the annual cash inflows may not be even. To calculate the payback period with uneven cash flows, you can use the following Excel formula:

=SUMIFS(Cash Flows, Years, ">="&Initial Investment)

For example, if the initial investment is $10,000 and the cash flows are $1,500 in year 1, $2,500 in year 2, and $3,000 in year 3, the payback period would be:

=SUMIFS(B:B, A:A, ">="&10000) =3 years

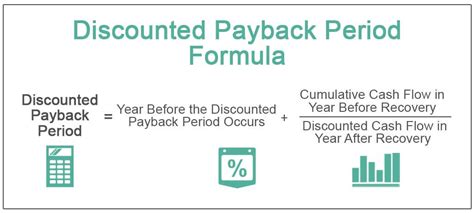

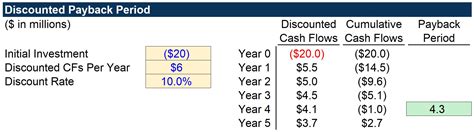

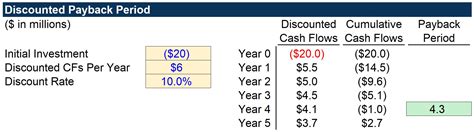

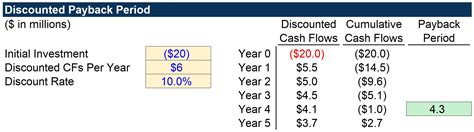

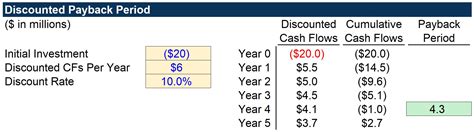

3. Payback Calculation with Discounted Cash Flows

To calculate the payback period with discounted cash flows, you can use the following Excel formula:

=XNPV(Discount Rate, Cash Flows)

For example, if the initial investment is $10,000, the discount rate is 10%, and the cash flows are $1,500 in year 1, $2,500 in year 2, and $3,000 in year 3, the payback period would be:

=XNPV(0.1, B:B) =3.5 years

4. Payback Calculation with Multiple Investments

To calculate the payback period with multiple investments, you can use the following Excel formula:

=SUMIFS(Cash Flows, Investments, ">="&Initial Investment)

For example, if the initial investment is $10,000 and $5,000 is invested in project A and $5,000 is invested in project B, the payback period would be:

=SUMIFS(B:B, A:A, ">="&10000) =4 years

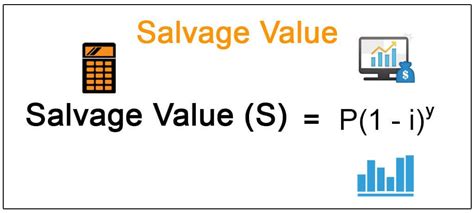

5. Payback Calculation with Salvage Value

To calculate the payback period with salvage value, you can use the following Excel formula:

=(Initial Investment - Salvage Value) / Annual Cash Inflows

For example, if the initial investment is $10,000, the salvage value is $2,000, and the annual cash inflows are $2,000, the payback period would be:

=(10000 - 2000) / 2000 =4 years

Gallery of Payback Calculation Examples

Payback Calculation Examples

We hope this article has provided you with a comprehensive understanding of payback calculation Excel formulas. Whether you're a business owner, investor, or simply looking to improve your financial literacy, these formulas can help you make informed decisions and achieve your financial goals.

So, what are you waiting for? Start using these formulas today and take the first step towards making smarter financial decisions!

Leave a comment below and share your experiences with payback calculation Excel formulas. Don't forget to share this article with your friends and colleagues who may benefit from it!