Investing in a new project or business venture can be a thrilling experience, but it's essential to ensure that your investment yields a good return. One crucial metric to evaluate the viability of a project is the payback period. In this article, we'll delve into the world of payback period calculation in Excel, making it easy for you to understand and apply this valuable tool.

The payback period is the time it takes for an investment to generate returns equal to its initial cost. It's a simple yet effective way to assess the feasibility of a project. A shorter payback period generally indicates a more attractive investment opportunity. However, calculating the payback period manually can be tedious and prone to errors. That's where Excel comes in – a powerful tool that can simplify the process and provide accurate results.

Understanding Payback Period Formula

Before we dive into the Excel calculation, let's understand the payback period formula:

Payback Period = Total Investment / Annual Cash Flow

This formula calculates the number of years it takes for the investment to pay for itself. However, this formula assumes a constant annual cash flow, which might not always be the case. To account for varying cash flows, we'll use a more advanced formula in Excel.

Calculating Payback Period in Excel

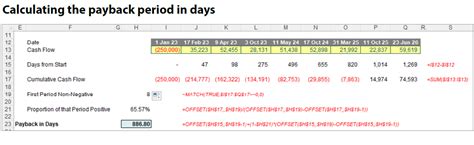

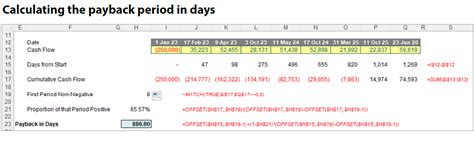

To calculate the payback period in Excel, we'll use the following steps:

- Set up a table with the following columns: Year, Investment, Cash Flow, and Cumulative Cash Flow.

- Enter the initial investment amount in the first row of the Investment column.

- Enter the annual cash flows for each year in the Cash Flow column.

- Calculate the cumulative cash flow by adding the current year's cash flow to the previous year's cumulative cash flow.

- Use the formula

=XLOOKUP(0, Cumulative Cash Flow, Year)to find the year when the cumulative cash flow equals the initial investment.

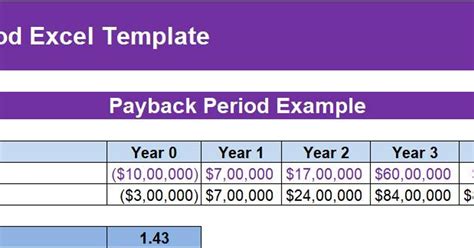

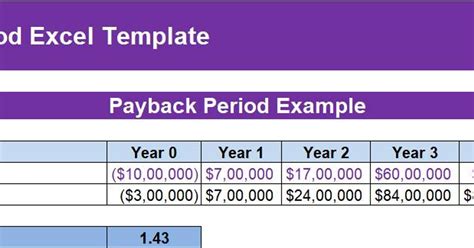

Let's break down the steps with an example:

| Year | Investment | Cash Flow | Cumulative Cash Flow |

|---|---|---|---|

| 0 | 100,000 | 0 | 0 |

| 1 | 0 | 20,000 | 20,000 |

| 2 | 0 | 30,000 | 50,000 |

| 3 | 0 | 40,000 | 90,000 |

| 4 | 0 | 50,000 | 140,000 |

Using the formula =XLOOKUP(0, Cumulative Cash Flow, Year), we get:

Payback Period = 3.57 years

This means that the investment will pay for itself in approximately 3.57 years.

Using Excel Functions for Payback Period Calculation

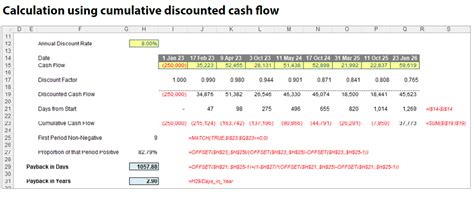

While the previous method works well for simple calculations, Excel provides several built-in functions to simplify the process. We can use the XNPV function to calculate the payback period:

=XNPV(rate, dates, cash flows)

Where:

rateis the discount rate (optional)datesis the range of dates for the cash flowscash flowsis the range of cash flows

Using the same example as before:

=XNPV(0, A2:A6, B2:B6)

Where:

A2:A6is the range of datesB2:B6is the range of cash flows

This formula returns the payback period in years.

Tips and Variations

When calculating the payback period, keep the following tips in mind:

- Use a discount rate if you want to account for the time value of money.

- Consider using a more advanced formula, such as the modified internal rate of return (MIRR), for more complex projects.

- Use Excel's built-in functions, such as

XNPVorIPMT, to simplify the calculation. - Experiment with different scenarios to see how changes in cash flows or investment amounts affect the payback period.

Payback Period Calculation in Excel: Best Practices

To ensure accurate and reliable results, follow these best practices when calculating the payback period in Excel:

- Use a clear and consistent format for your data.

- Double-check your formulas and calculations.

- Consider using a template or Excel add-in to simplify the process.

- Document your assumptions and methods used in the calculation.

By following these best practices and using the formulas and functions outlined in this article, you'll be well on your way to calculating payback periods with ease and confidence.

Payback Period Calculation in Excel Image Gallery

Conclusion

Calculating the payback period in Excel is a straightforward process that can help you make informed investment decisions. By following the steps and formulas outlined in this article, you'll be able to calculate the payback period with ease and confidence. Remember to use best practices, such as clear formatting and double-checking formulas, to ensure accurate results. With practice and experience, you'll become proficient in calculating payback periods and making better investment decisions.

We hope this article has helped you understand the payback period calculation in Excel. If you have any questions or need further clarification, please don't hesitate to ask. Share your thoughts and experiences in the comments below, and don't forget to share this article with your friends and colleagues who might find it useful.