Understanding Payback Period and Its Importance in Business

When it comes to investing in a new project or business venture, one of the key factors to consider is the payback period. The payback period is the amount of time it takes for an investment to generate cash flows that equal the initial investment. In other words, it's the time it takes for an investment to "pay for itself." Understanding the payback period is crucial for businesses, as it helps them make informed decisions about investments and resource allocation.

Why is Payback Period Important?

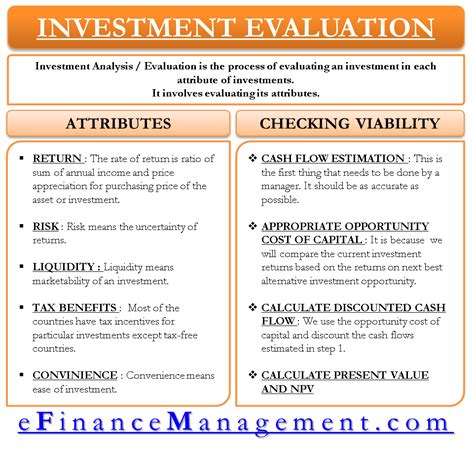

The payback period is an important metric for businesses because it helps them evaluate the viability of an investment. A shorter payback period indicates that an investment will generate returns quickly, which can be beneficial for businesses that need to manage cash flow or have limited resources. On the other hand, a longer payback period may indicate that an investment is riskier or less viable.

In addition to evaluating investment viability, the payback period can also help businesses compare different investment opportunities. By calculating the payback period for different investments, businesses can determine which investments are likely to generate returns more quickly and make more informed decisions about how to allocate resources.

Calculating Payback Period in Excel

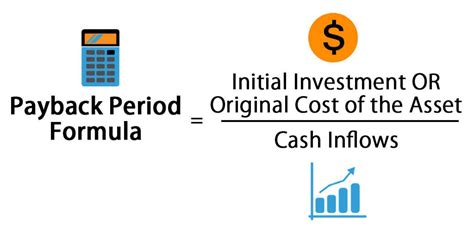

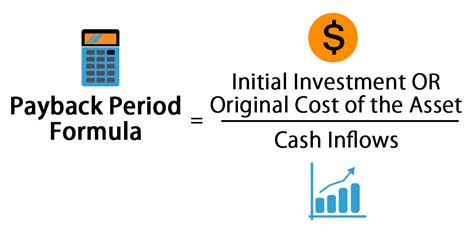

Calculating the payback period in Excel is relatively straightforward. The formula for payback period is:

Payback Period = Total Investment / Annual Cash Flow

Where:

- Total Investment is the initial investment amount

- Annual Cash Flow is the amount of cash generated by the investment each year

For example, let's say you invested $100,000 in a new project that generates $20,000 in cash flow each year. The payback period would be:

Payback Period = $100,000 / $20,000 = 5 years

In Excel, you can use the following formula to calculate the payback period:

=A1/B1

Where:

- A1 is the cell containing the total investment amount

- B1 is the cell containing the annual cash flow amount

Using the Payback Period Formula in Excel

To use the payback period formula in Excel, follow these steps:

- Enter the total investment amount in a cell (e.g. A1)

- Enter the annual cash flow amount in a cell (e.g. B1)

- Enter the formula

=A1/B1in a new cell (e.g. C1) - Press Enter to calculate the payback period

You can also use the formula to calculate the payback period for multiple investments by entering the investment amounts and cash flows in separate columns and using the formula to calculate the payback period for each investment.

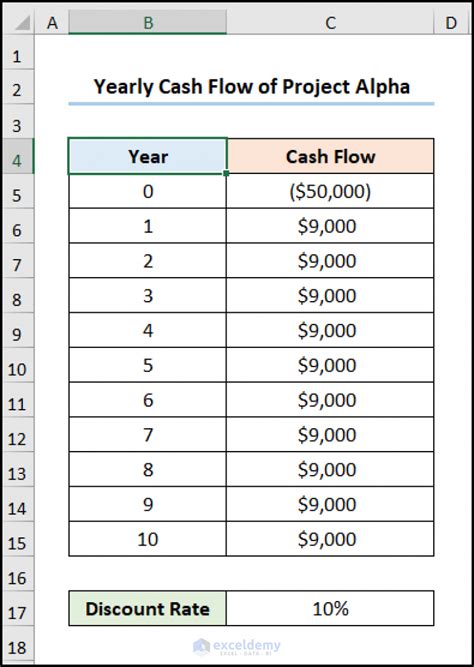

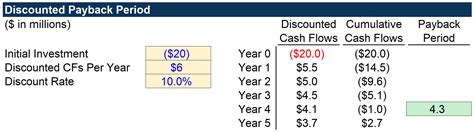

Example of Payback Period Calculation in Excel

Here's an example of how to calculate the payback period for multiple investments in Excel:

| Investment | Annual Cash Flow | Payback Period |

|---|---|---|

| $100,000 | $20,000 | =A2/B2 |

| $50,000 | $10,000 | =A3/B3 |

| $200,000 | $30,000 | =A4/B4 |

In this example, the payback period for each investment is calculated using the formula =A2/B2, =A3/B3, and =A4/B4, respectively.

Conclusion

In conclusion, calculating the payback period in Excel is a straightforward process that can help businesses evaluate the viability of investments and make more informed decisions about resource allocation. By using the payback period formula, businesses can quickly and easily determine how long it will take for an investment to generate returns and make more informed decisions about investments.

Payback Period Image Gallery

We hope this article has helped you understand the payback period formula and how to use it in Excel. If you have any questions or comments, please leave them below.