In the world of finance and investment, understanding the payback period is crucial for making informed decisions. The payback period is the amount of time it takes for an investment to generate returns equal to its initial cost. In this article, we will explore the payback period formula in Excel and provide a step-by-step guide on how to calculate it.

The payback period is an essential metric for investors, businesses, and individuals to evaluate the feasibility of a project or investment. It helps to determine whether an investment is worthwhile and how long it will take to recover the initial cost.

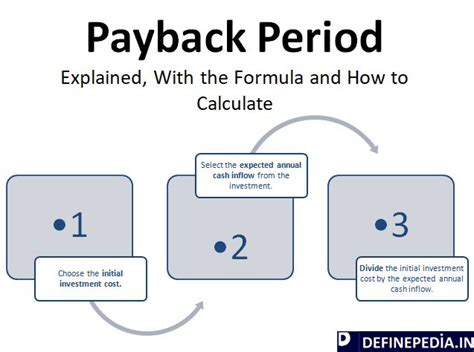

What is the Payback Period Formula?

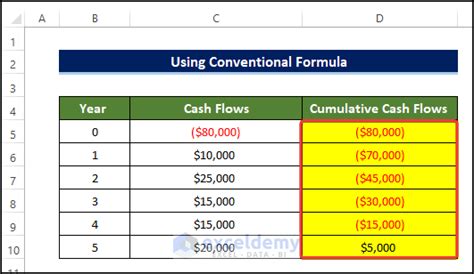

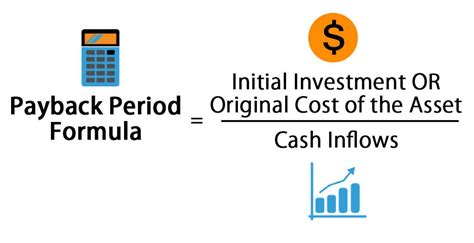

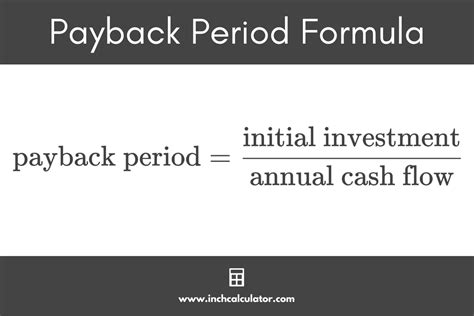

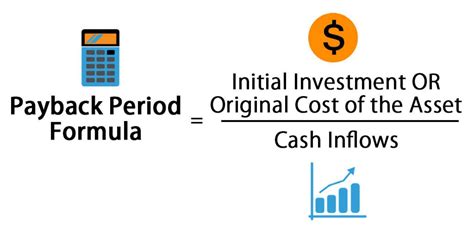

The payback period formula is a simple and straightforward calculation. The formula is:

Payback Period = Total Investment / Annual Cash Flow

Where:

- Total Investment is the initial cost of the investment

- Annual Cash Flow is the annual return on investment

For example, if the total investment is $10,000 and the annual cash flow is $2,000, the payback period would be:

Payback Period = $10,000 / $2,000 = 5 years

This means that it will take 5 years for the investment to generate returns equal to its initial cost.

How to Calculate Payback Period in Excel

Calculating the payback period in Excel is a straightforward process. Here are the steps:

- Open a new Excel spreadsheet and enter the total investment and annual cash flow values.

- Create a formula to calculate the payback period using the formula:

=Total Investment / Annual Cash Flow - Press Enter to calculate the payback period.

For example:

| A | B | |

|---|---|---|

| 1 | Total Investment | $10,000 |

| 2 | Annual Cash Flow | $2,000 |

| 3 | Payback Period | =A1/B1 |

When you press Enter, the payback period will be calculated and displayed in cell B3.

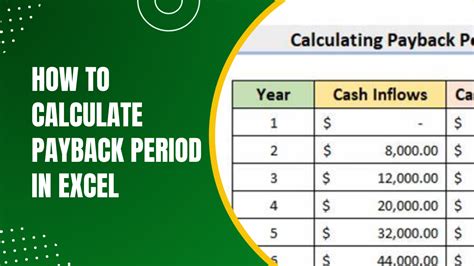

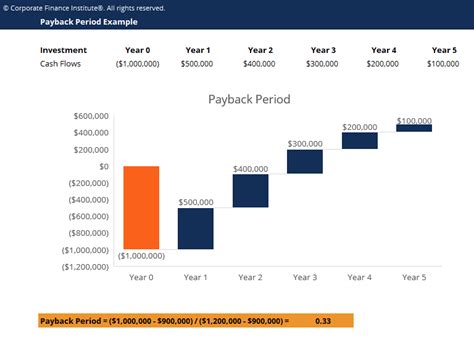

Payback Period Formula with Multiple Cash Flows

In some cases, you may have multiple cash flows per year. To calculate the payback period in this scenario, you can use the following formula:

Payback Period = Total Investment / (Annual Cash Flow 1 + Annual Cash Flow 2 +...)

Where:

- Annual Cash Flow 1, Annual Cash Flow 2, etc. are the annual cash flows from each source

For example, if the total investment is $10,000 and there are two annual cash flows of $1,500 and $500, the payback period would be:

Payback Period = $10,000 / ($1,500 + $500) = 5 years

This means that it will take 5 years for the investment to generate returns equal to its initial cost.

How to Calculate Payback Period with Multiple Cash Flows in Excel

Calculating the payback period with multiple cash flows in Excel is a straightforward process. Here are the steps:

- Open a new Excel spreadsheet and enter the total investment and annual cash flow values.

- Create a formula to calculate the payback period using the formula:

=Total Investment / (Annual Cash Flow 1 + Annual Cash Flow 2 +...) - Press Enter to calculate the payback period.

For example:

| A | B | C | |

|---|---|---|---|

| 1 | Total Investment | $10,000 | |

| 2 | Annual Cash Flow 1 | $1,500 | |

| 3 | Annual Cash Flow 2 | $500 | |

| 4 | Payback Period | =A1/(B1+C1) |

When you press Enter, the payback period will be calculated and displayed in cell D4.

Benefits of Using the Payback Period Formula

The payback period formula is a useful tool for evaluating investments and projects. Here are some benefits of using the payback period formula:

- Easy to calculate: The payback period formula is a simple and straightforward calculation.

- Quick evaluation: The payback period formula provides a quick and easy way to evaluate the feasibility of an investment or project.

- Comparing investments: The payback period formula can be used to compare different investments and projects.

- Decision-making: The payback period formula can be used to make informed decisions about investments and projects.

Limitations of the Payback Period Formula

While the payback period formula is a useful tool, it has some limitations. Here are some limitations of the payback period formula:

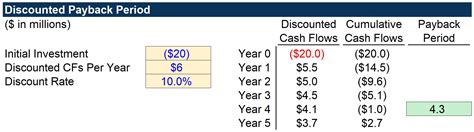

- Ignores time value of money: The payback period formula ignores the time value of money, which means that it does not take into account the fact that a dollar today is worth more than a dollar in the future.

- Does not consider risk: The payback period formula does not consider the risk associated with an investment or project.

- Does not consider other factors: The payback period formula does not consider other factors that may affect the investment or project, such as inflation, interest rates, and taxes.

Gallery of Payback Period Formula

Payback Period Formula Image Gallery

In conclusion, the payback period formula is a useful tool for evaluating investments and projects. While it has some limitations, it provides a quick and easy way to calculate the payback period of an investment or project. By using the payback period formula, you can make informed decisions about investments and projects.