Intro

Calculate the payback period of an investment with ease using Excel. Learn the simple payback period formula and how to apply it to determine the time it takes to recover your initial investment. Discover the benefits of using Excel for payback period calculation and understand key concepts like cash flow, return on investment, and break-even analysis.

Understanding the Payback Period Formula in Excel is a crucial skill for any business professional or investor. It helps you calculate the amount of time it takes for an investment to generate returns, allowing you to make informed decisions about your finances.

Investing in a new project or business venture can be a daunting task, especially when it comes to determining whether the investment will pay off in the long run. One of the most effective ways to gauge the potential success of an investment is by calculating its payback period. In this article, we will delve into the world of payback period calculation in Excel, exploring the simple and easy formula to help you make informed investment decisions.

What is Payback Period?

The payback period is the amount of time it takes for an investment to generate returns equal to the initial investment. It's a key metric used to evaluate the feasibility of a project or investment, helping you determine whether the investment will pay off in the long run.

Why is Payback Period Important?

Calculating the payback period is essential for several reasons:

- Risk Assessment: The payback period helps you assess the risk associated with an investment. A shorter payback period indicates lower risk, while a longer payback period suggests higher risk.

- Cash Flow Management: Understanding the payback period enables you to manage your cash flow more effectively. You can allocate funds to investments with shorter payback periods, ensuring a steady stream of returns.

- Investment Comparison: The payback period allows you to compare different investment opportunities. By calculating the payback period for each investment, you can determine which one is more likely to generate returns.

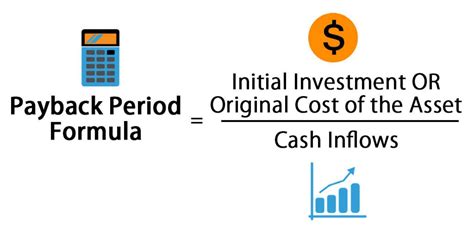

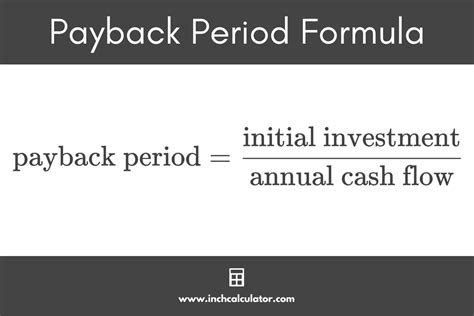

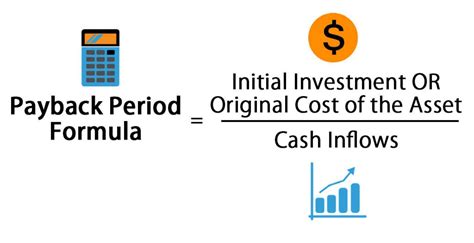

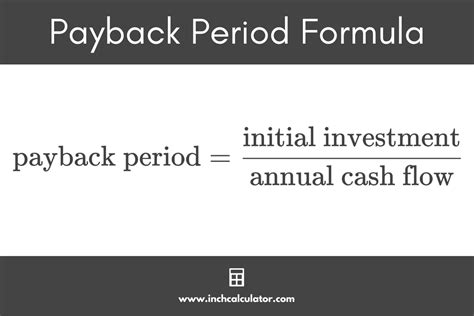

Payback Period Formula in Excel

Calculating the payback period in Excel is a straightforward process. The formula is:

Payback Period = Total Investment / Annual Cash Flow

Where:

- Total Investment is the initial investment amount

- Annual Cash Flow is the annual returns generated by the investment

For example, let's say you invested $10,000 in a project with an expected annual return of $2,000.

Payback Period = $10,000 / $2,000 = 5 years

This means that the investment will take 5 years to generate returns equal to the initial investment.

How to Calculate Payback Period in Excel

To calculate the payback period in Excel, follow these steps:

- Enter the total investment amount in a cell (e.g., A1).

- Enter the annual cash flow amount in another cell (e.g., B1).

- Use the formula: =A1/B1

- Press Enter to calculate the payback period.

The result will be displayed in years.

Tips and Variations

Here are some additional tips and variations to help you get the most out of the payback period formula:

- Monthly Cash Flow: If you want to calculate the payback period based on monthly cash flow, simply divide the annual cash flow by 12.

- Multiple Investments: If you have multiple investments with different cash flows, you can use the same formula to calculate the payback period for each investment.

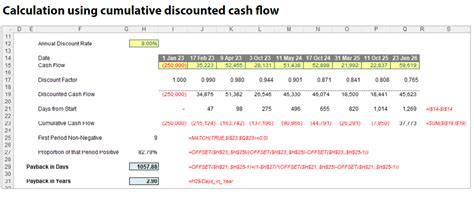

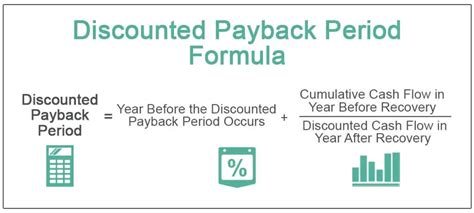

- Discounted Cash Flow: To calculate the payback period using discounted cash flow, you can use the XNPV function in Excel.

Common Mistakes to Avoid

When calculating the payback period, make sure to avoid the following common mistakes:

- Incorrect Cash Flow: Ensure that you use the correct cash flow amount. If you're using annual cash flow, make sure it's the correct amount for the entire year.

- Ignoring Time Value of Money: The payback period calculation assumes that the cash flows occur at the end of each year. If you're using monthly or quarterly cash flows, make sure to adjust the calculation accordingly.

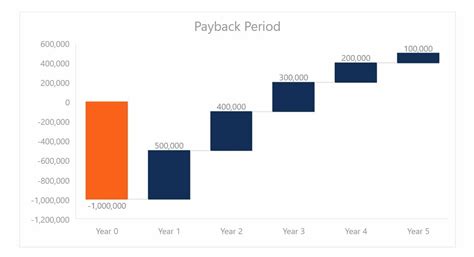

Payback Period Example

Let's say you're considering investing in a new project with an initial investment of $50,000. The project is expected to generate annual returns of $10,000. Using the payback period formula, you can calculate the payback period as follows:

Payback Period = $50,000 / $10,000 = 5 years

This means that the project will take 5 years to generate returns equal to the initial investment.

Payback Period Calculator

To make it easier to calculate the payback period, you can create a simple calculator in Excel. Here's an example:

| A | B | |

|---|---|---|

| 1 | Total Investment | |

| 2 | Annual Cash Flow | |

| 3 | Payback Period | =A1/B1 |

Simply enter the total investment and annual cash flow amounts, and the calculator will display the payback period.

Gallery of Payback Period Images

Payback Period Images

Conclusion

Calculating the payback period is a crucial step in evaluating the feasibility of an investment. By using the simple and easy formula in Excel, you can determine the amount of time it takes for an investment to generate returns equal to the initial investment. Remember to avoid common mistakes and use the correct cash flow amounts to get accurate results. With the payback period formula, you'll be able to make informed investment decisions and achieve your financial goals.

We hope this article has been helpful in explaining the payback period formula in Excel. If you have any questions or need further clarification, please don't hesitate to ask. Share your thoughts and experiences with payback period calculations in the comments section below.