Calculating the payback period is a crucial step in evaluating the feasibility of a project or investment. It represents the amount of time it takes for the initial investment to be recovered through cash inflows or savings. In this article, we will explore how to calculate the payback period in Excel, making it easy for you to analyze and make informed decisions about your investments.

The payback period is a widely used metric in finance and accounting, as it provides a clear indication of the time required for an investment to break even. It is particularly useful for comparing different investment opportunities and determining which one is likely to generate returns faster. However, calculating the payback period manually can be time-consuming and prone to errors. This is where Excel comes in, offering a convenient and accurate way to perform the calculation.

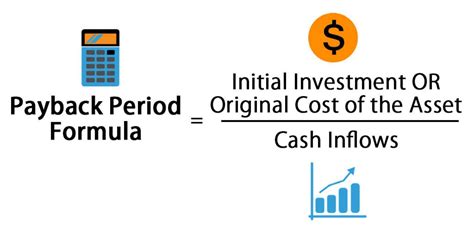

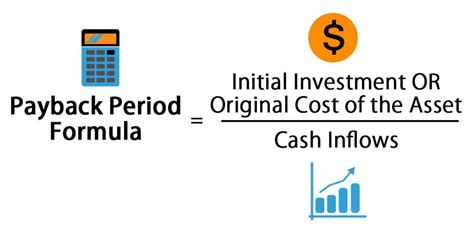

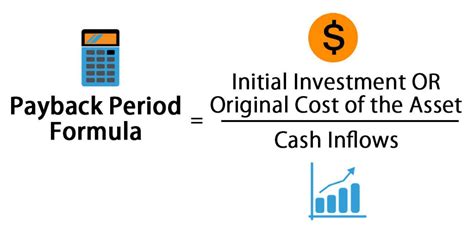

Understanding the Payback Period Formula

The payback period formula is straightforward: it is the initial investment divided by the annual cash inflows or savings. However, when the cash inflows are uneven or vary over time, the calculation becomes more complex. This is where Excel's built-in functions and formulas come into play.

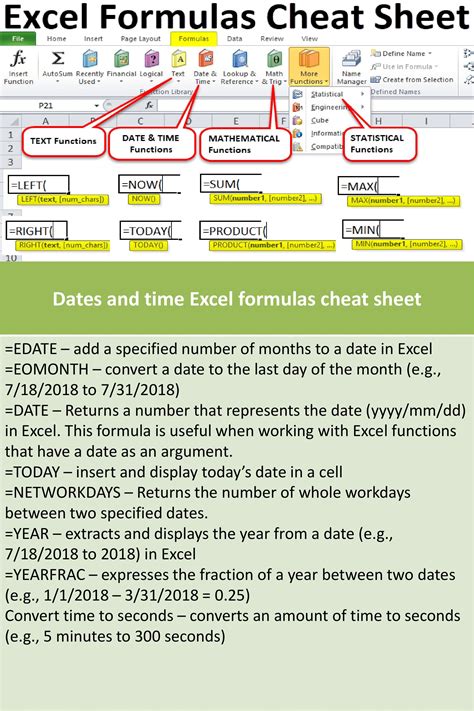

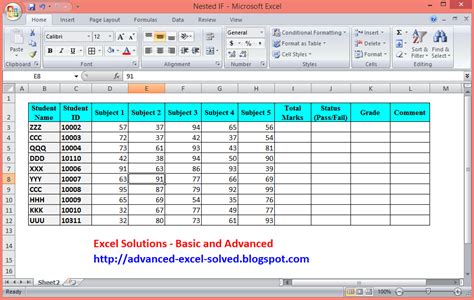

Using Excel Formulas to Calculate Payback Period

To calculate the payback period in Excel, you can use a combination of formulas and functions. Here's a step-by-step guide:

- Enter the initial investment: Enter the initial investment amount in a cell, for example, cell A1.

- Enter the annual cash inflows: Enter the annual cash inflows or savings in a separate column, for example, cells B1:B5.

- Calculate the cumulative cash inflows: Use the

=SUM(B$1:B1)formula to calculate the cumulative cash inflows for each year. This formula will add up the cash inflows from the beginning of the project to the current year. - Calculate the payback period: Use the

=A1/SUM(B$1:B1)formula to calculate the payback period for each year. This formula will divide the initial investment by the cumulative cash inflows.

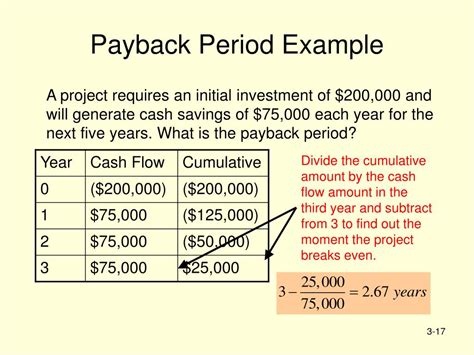

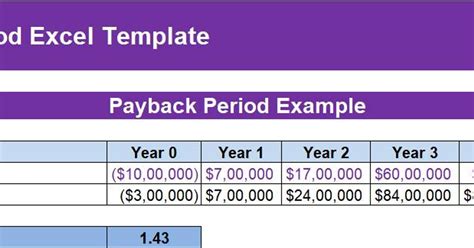

Example: Calculating Payback Period in Excel

Suppose we want to calculate the payback period for a project with an initial investment of $100,000 and annual cash inflows of $20,000, $30,000, $40,000, and $50,000.

| Year | Cash Inflows | Cumulative Cash Inflows | Payback Period |

|---|---|---|---|

| 1 | $20,000 | $20,000 | 5 years |

| 2 | $30,000 | $50,000 | 3.33 years |

| 3 | $40,000 | $90,000 | 2.22 years |

| 4 | $50,000 | $140,000 | 1.67 years |

Using the formulas and functions in Excel, we can easily calculate the payback period for each year.

Using Excel Functions to Calculate Payback Period

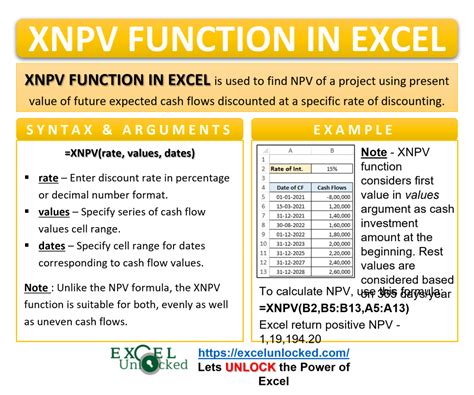

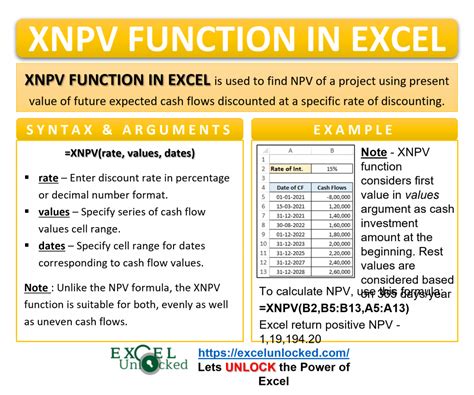

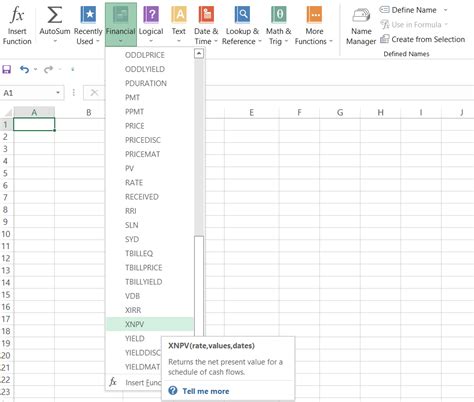

Alternatively, you can use Excel's built-in functions, such as the XNPV function, to calculate the payback period. The XNPV function calculates the present value of a series of cash flows and can be used to calculate the payback period.

Example: Using XNPV Function to Calculate Payback Period

Suppose we want to calculate the payback period for the same project using the XNPV function.

=XNPV(0, A1, B1:B4)

Where:

A1is the initial investmentB1:B4is the range of annual cash inflows

Using the XNPV function, we can easily calculate the payback period.

Gallery of Payback Period Calculations

Payback Period Calculation Gallery

Frequently Asked Questions

Q: What is the payback period formula? A: The payback period formula is the initial investment divided by the annual cash inflows or savings.

Q: How do I calculate the payback period in Excel?

A: You can calculate the payback period in Excel using formulas and functions, such as the SUM and XNPV functions.

Q: What is the XNPV function in Excel? A: The XNPV function in Excel calculates the present value of a series of cash flows and can be used to calculate the payback period.

Q: Can I use the payback period to compare different investment opportunities? A: Yes, the payback period is a useful metric for comparing different investment opportunities and determining which one is likely to generate returns faster.

Get Started with Calculating Payback Period in Excel

Calculating the payback period in Excel is a straightforward process that can help you make informed decisions about your investments. By using formulas and functions, such as the SUM and XNPV functions, you can easily calculate the payback period and compare different investment opportunities. Try it out today and start making data-driven decisions!