Intro

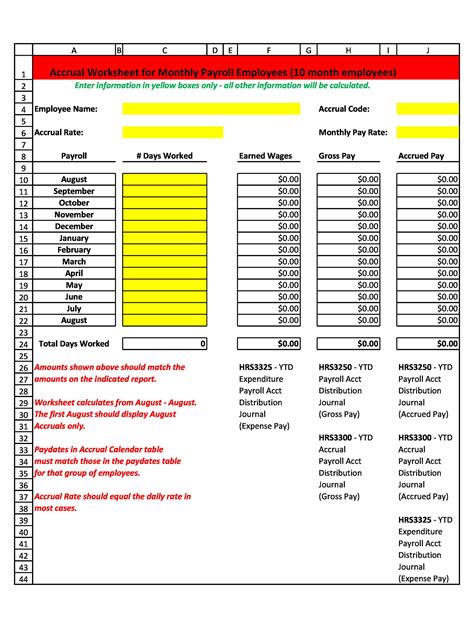

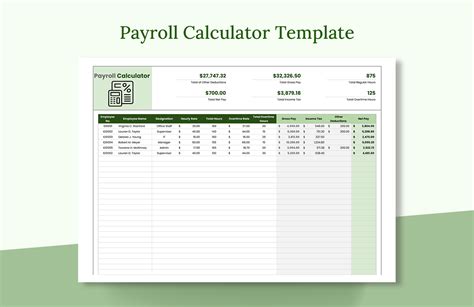

Streamline payroll processing with a paycheck calculator Excel template. Learn 5 effective ways to utilize this tool for accurate salary calculations, tax deductions, and benefits adjustments. Discover how to simplify paycheck processing, reduce errors, and increase productivity using this essential HR template, perfect for small businesses and payroll professionals.

Are you tired of manually calculating your take-home pay or struggling to create a budget that accurately reflects your income? A paycheck calculator Excel template can be a game-changer for individuals looking to simplify their financial planning. In this article, we'll explore five ways to use a paycheck calculator Excel template to streamline your financial management.

Managing your finances effectively is crucial for achieving financial stability and security. One of the most critical aspects of personal finance is understanding your take-home pay and creating a budget that works for you. However, calculating your take-home pay can be a daunting task, especially when dealing with complex tax laws and deductions. This is where a paycheck calculator Excel template comes in – a powerful tool designed to simplify the process and provide you with accurate calculations.

A paycheck calculator Excel template is a pre-designed spreadsheet that allows you to input your income, deductions, and taxes to calculate your take-home pay. With this template, you can easily create a budget, track your expenses, and make informed financial decisions. In this article, we'll delve into five ways to use a paycheck calculator Excel template to take control of your finances.

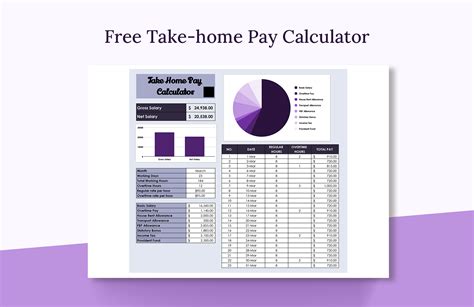

1. Calculate Take-Home Pay

One of the primary functions of a paycheck calculator Excel template is to calculate your take-home pay. By inputting your gross income, deductions, and taxes, the template will provide you with an accurate calculation of your take-home pay. This feature is particularly useful for individuals who receive irregular paychecks or have variable income.

To use the template for calculating take-home pay, simply follow these steps:

- Input your gross income

- Enter your deductions, such as health insurance, 401(k), and other benefits

- Enter your tax information, including federal, state, and local taxes

- The template will calculate your take-home pay based on the input data

Benefits of Using a Paycheck Calculator for Take-Home Pay

Using a paycheck calculator Excel template to calculate your take-home pay offers several benefits, including:

- Accuracy: The template ensures accurate calculations, eliminating the risk of human error.

- Convenience: The template is easy to use and saves time, allowing you to focus on other financial tasks.

- Flexibility: The template can be customized to accommodate different income scenarios and deductions.

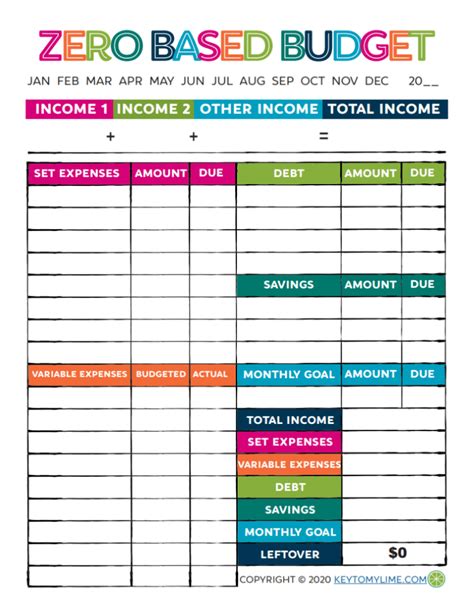

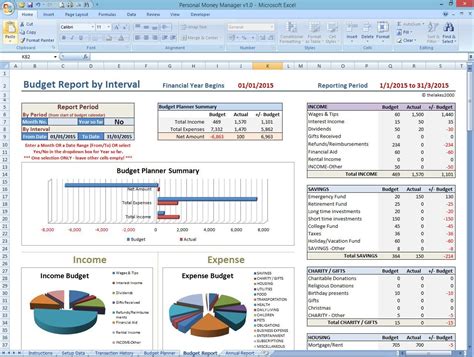

2. Create a Budget

A paycheck calculator Excel template can also be used to create a budget that accurately reflects your income. By inputting your take-home pay and expenses, the template will help you allocate your income effectively and make informed financial decisions.

To use the template for creating a budget, follow these steps:

- Input your take-home pay

- Enter your fixed expenses, such as rent, utilities, and car payments

- Enter your variable expenses, such as groceries, entertainment, and travel

- The template will help you allocate your income and create a budget that works for you

Benefits of Using a Paycheck Calculator for Budgeting

Using a paycheck calculator Excel template for budgeting offers several benefits, including:

- Accurate income allocation: The template ensures that your income is allocated effectively, eliminating the risk of overspending.

- Customization: The template can be customized to accommodate different income scenarios and expenses.

- Financial clarity: The template provides a clear picture of your financial situation, allowing you to make informed decisions.

3. Track Expenses

A paycheck calculator Excel template can also be used to track your expenses and ensure that you're staying within your budget. By inputting your income and expenses, the template will provide you with a clear picture of your financial situation.

To use the template for tracking expenses, follow these steps:

- Input your income

- Enter your expenses, including fixed and variable expenses

- The template will track your expenses and provide you with a clear picture of your financial situation

Benefits of Using a Paycheck Calculator for Expense Tracking

Using a paycheck calculator Excel template for expense tracking offers several benefits, including:

- Financial clarity: The template provides a clear picture of your financial situation, allowing you to make informed decisions.

- Budgeting accuracy: The template ensures that your expenses are accurately tracked, eliminating the risk of overspending.

- Customization: The template can be customized to accommodate different income scenarios and expenses.

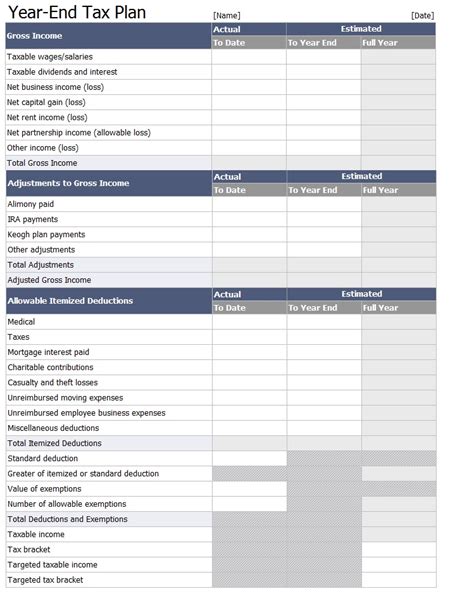

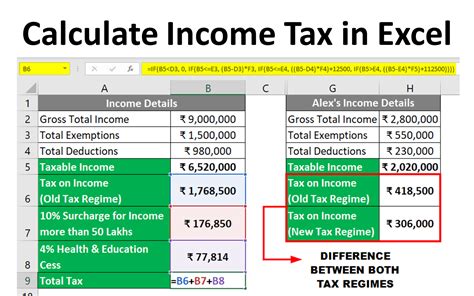

4. Plan for Taxes

A paycheck calculator Excel template can also be used to plan for taxes and ensure that you're taking advantage of available tax deductions and credits. By inputting your income and tax information, the template will provide you with a clear picture of your tax situation.

To use the template for tax planning, follow these steps:

- Input your income

- Enter your tax information, including deductions and credits

- The template will provide you with a clear picture of your tax situation and help you plan for taxes

Benefits of Using a Paycheck Calculator for Tax Planning

Using a paycheck calculator Excel template for tax planning offers several benefits, including:

- Tax savings: The template helps you identify available tax deductions and credits, allowing you to save money on your taxes.

- Financial clarity: The template provides a clear picture of your tax situation, allowing you to make informed decisions.

- Customization: The template can be customized to accommodate different income scenarios and tax situations.

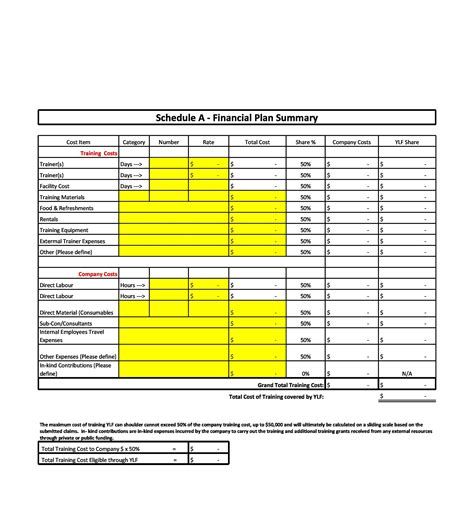

5. Create a Financial Plan

A paycheck calculator Excel template can also be used to create a comprehensive financial plan that takes into account your income, expenses, taxes, and long-term financial goals. By inputting your financial data, the template will provide you with a clear picture of your financial situation and help you create a plan that works for you.

To use the template for financial planning, follow these steps:

- Input your income

- Enter your expenses, including fixed and variable expenses

- Enter your tax information, including deductions and credits

- Enter your long-term financial goals, such as saving for retirement or a down payment on a house

- The template will provide you with a clear picture of your financial situation and help you create a plan that works for you

Benefits of Using a Paycheck Calculator for Financial Planning

Using a paycheck calculator Excel template for financial planning offers several benefits, including:

- Comprehensive financial picture: The template provides a clear picture of your financial situation, allowing you to make informed decisions.

- Customization: The template can be customized to accommodate different income scenarios and financial goals.

- Long-term planning: The template helps you create a plan that takes into account your long-term financial goals, ensuring that you're on track to achieve financial stability and security.

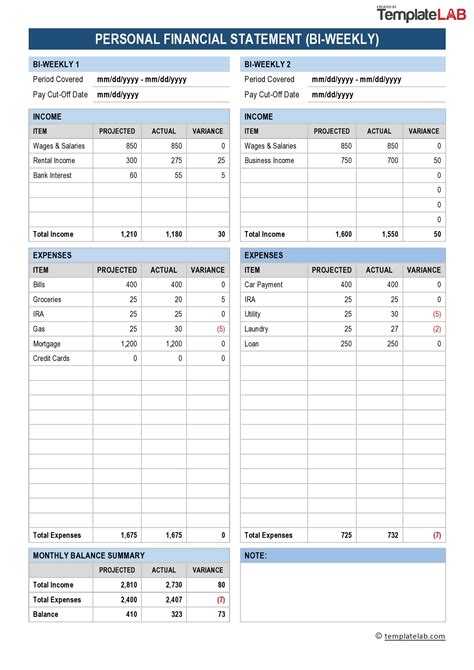

Paycheck Calculator Excel Template Image Gallery

In conclusion, a paycheck calculator Excel template is a powerful tool that can help you streamline your financial management and achieve financial stability and security. By using the template to calculate your take-home pay, create a budget, track your expenses, plan for taxes, and create a comprehensive financial plan, you can take control of your finances and make informed decisions.