Intro

Simplify payroll calculations with our Paycheck Calculator for Excel template. Easily compute net salary, deductions, and benefits for employees. Get instant results with automated calculations, making payroll processing a breeze. Download our free template and streamline your salary calculations today, ensuring accuracy and efficiency.

Calculating salaries can be a tedious and time-consuming task, especially when dealing with multiple employees, pay rates, and deductions. However, with the help of a paycheck calculator for Excel, you can streamline the process and ensure accuracy in your salary calculations.

In today's fast-paced business environment, it's essential to have efficient tools to manage your payroll. A paycheck calculator for Excel can help you save time, reduce errors, and increase productivity. Whether you're a small business owner, HR manager, or accountant, this tool can be a valuable asset in your payroll management arsenal.

Using a paycheck calculator for Excel can also help you stay compliant with labor laws and regulations. By accurately calculating salaries, taxes, and deductions, you can ensure that your employees are paid correctly and on time.

How to Create a Paycheck Calculator in Excel

Creating a paycheck calculator in Excel is relatively straightforward. Here's a step-by-step guide to help you get started:

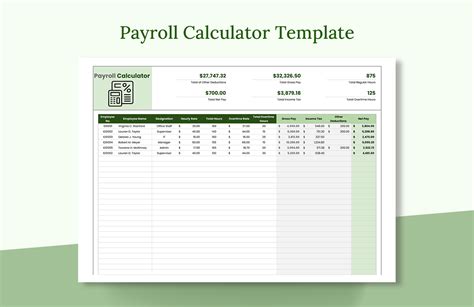

- Set up a new Excel spreadsheet: Create a new Excel spreadsheet and give it a title, such as "Paycheck Calculator."

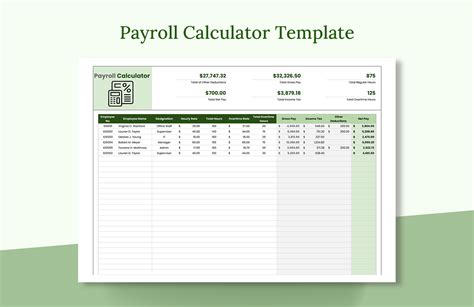

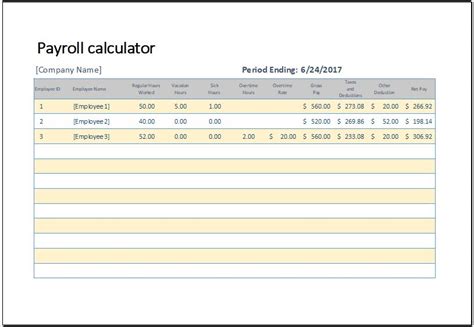

- Create a table: Create a table with the following columns: Employee Name, Pay Rate, Hours Worked, Gross Pay, Taxes, Deductions, and Net Pay.

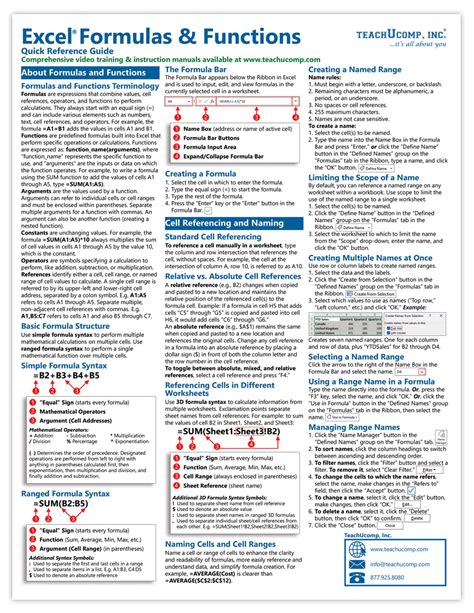

- Enter formulas: Enter formulas to calculate the gross pay, taxes, deductions, and net pay. You can use Excel's built-in formulas, such as =SUM and =PRODUCT, to perform calculations.

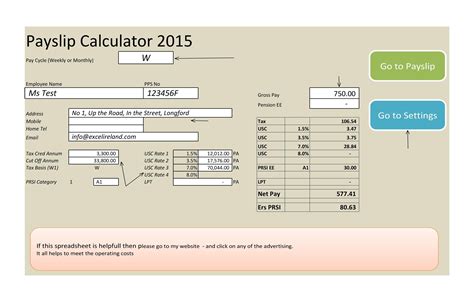

- Add formulas for taxes and deductions: Add formulas to calculate taxes and deductions, such as Social Security tax, Medicare tax, and health insurance premiums.

- Test the calculator: Test the calculator by entering sample data to ensure that it's working correctly.

Paycheck Calculator Formulas

Here are some common formulas used in a paycheck calculator:

- Gross Pay: =Pay Rate x Hours Worked

- Social Security Tax: =Gross Pay x 0.062 (6.2%)

- Medicare Tax: =Gross Pay x 0.0145 (1.45%)

- Federal Income Tax: =Gross Pay x 0.25 (25%)

- State Income Tax: =Gross Pay x 0.05 (5%)

- Net Pay: =Gross Pay - Taxes - Deductions

Benefits of Using a Paycheck Calculator in Excel

Using a paycheck calculator in Excel offers numerous benefits, including:

- Accuracy: A paycheck calculator ensures accuracy in salary calculations, reducing errors and discrepancies.

- Time-saving: A paycheck calculator saves time by automating calculations, allowing you to focus on other tasks.

- Compliance: A paycheck calculator helps you stay compliant with labor laws and regulations, reducing the risk of fines and penalties.

- Flexibility: A paycheck calculator can be customized to meet your specific payroll needs, including different pay rates, taxes, and deductions.

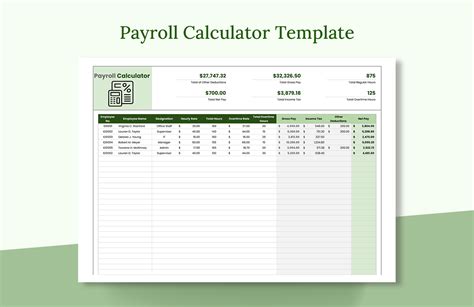

Common Paycheck Calculator Templates

Here are some common paycheck calculator templates:

- Basic Paycheck Calculator: A basic paycheck calculator template that calculates gross pay, taxes, and net pay.

- Advanced Paycheck Calculator: An advanced paycheck calculator template that includes additional features, such as overtime pay and benefits.

- Payroll Calculator with Taxes: A payroll calculator template that includes taxes, such as Social Security tax, Medicare tax, and federal income tax.

Conclusion

A paycheck calculator for Excel is a valuable tool for managing payroll. By following the steps outlined in this article, you can create a paycheck calculator that streamlines salary calculations and ensures accuracy. Whether you're a small business owner or HR manager, a paycheck calculator can help you save time, reduce errors, and increase productivity.

Gallery of Paycheck Calculator Images

Paycheck Calculator Image Gallery

Frequently Asked Questions

- What is a paycheck calculator?: A paycheck calculator is a tool used to calculate salaries, taxes, and deductions.

- How do I create a paycheck calculator in Excel?: To create a paycheck calculator in Excel, set up a new spreadsheet, create a table, enter formulas, and add formulas for taxes and deductions.

- What are the benefits of using a paycheck calculator?: The benefits of using a paycheck calculator include accuracy, time-saving, compliance, and flexibility.

I hope this article has provided you with valuable information on using a paycheck calculator for Excel. If you have any questions or comments, please feel free to leave them below.