Intro

Calculate take-home pay with the Nashville Paycheck Calculator, considering Tennessee taxes, deductions, and exemptions for accurate salary estimates and budget planning.

The city of Nashville, Tennessee, is known for its vibrant music scene, delicious Southern cuisine, and a thriving economy. As the capital of Tennessee, Nashville is home to a diverse range of industries, including healthcare, technology, and tourism. With a growing population and a strong job market, many individuals are relocating to Nashville for work or starting their own businesses. When it comes to managing finances, having a reliable paycheck calculator is essential for anyone living or working in Nashville. In this article, we will delve into the world of paycheck calculators, exploring their importance, benefits, and how they can be used to navigate the complexities of Nashville's tax landscape.

Nashville's economy is characterized by a mix of small businesses, startups, and large corporations, which can make it challenging for individuals to understand their take-home pay. With a paycheck calculator, employees can easily determine their net income, taking into account factors such as federal and state income taxes, deductions, and benefits. This information is crucial for creating a budget, saving for the future, and making informed financial decisions. Whether you are a freelancer, entrepreneur, or employee, a paycheck calculator can help you stay on top of your finances and make the most of your hard-earned money.

The importance of using a paycheck calculator in Nashville cannot be overstated. With the city's thriving music and entertainment industry, many individuals work on a freelance or contract basis, which can lead to unpredictable income and complex tax situations. A paycheck calculator can help these individuals estimate their taxes and plan accordingly, avoiding any potential surprises when tax season arrives. Additionally, for employees working in traditional 9-to-5 jobs, a paycheck calculator can provide a clear understanding of their take-home pay, allowing them to budget and plan for the future with confidence.

Nashville Paycheck Calculator Benefits

Using a Nashville paycheck calculator offers numerous benefits, including accuracy, convenience, and flexibility. With a calculator, individuals can quickly and easily determine their net income, taking into account various factors such as income taxes, deductions, and benefits. This information is essential for creating a budget, saving for the future, and making informed financial decisions. Some of the key benefits of using a Nashville paycheck calculator include:

- Accuracy: A paycheck calculator provides accurate calculations, reducing the risk of errors and surprises when tax season arrives.

- Convenience: With a calculator, individuals can quickly and easily determine their take-home pay, without having to manually calculate taxes and deductions.

- Flexibility: A paycheck calculator can be used for a variety of purposes, including estimating taxes, planning for retirement, and creating a budget.

How to Use a Nashville Paycheck Calculator

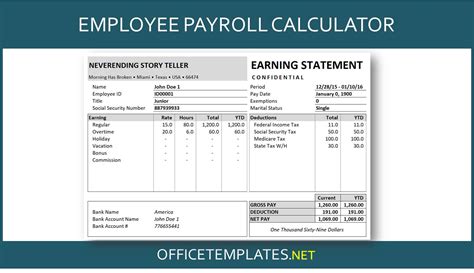

Using a Nashville paycheck calculator is relatively straightforward. To get started, individuals will need to gather some basic information, including their gross income, tax filing status, and any relevant deductions or benefits. From there, the calculator will do the rest, providing an accurate estimate of take-home pay and taxes owed. Some of the key steps involved in using a Nashville paycheck calculator include: * Gathering information: Individuals will need to gather their gross income, tax filing status, and any relevant deductions or benefits. * Entering data: The information gathered will need to be entered into the calculator, which will then provide an estimate of take-home pay and taxes owed. * Reviewing results: Once the calculation is complete, individuals can review the results, making any necessary adjustments to their budget or financial plan.Nashville Tax Landscape

Nashville's tax landscape is characterized by a mix of federal, state, and local taxes. As the capital of Tennessee, Nashville is subject to state income taxes, which range from 1% to 3.75% depending on income level. Additionally, the city has a local sales tax rate of 2.25%, which applies to most goods and services. When it comes to payroll taxes, Nashville employers are required to withhold federal income taxes, as well as Social Security and Medicare taxes. Some of the key taxes and deductions that individuals living or working in Nashville should be aware of include:

- Federal income taxes: Nashville employers are required to withhold federal income taxes, which range from 10% to 37% depending on income level.

- State income taxes: Tennessee state income taxes range from 1% to 3.75% depending on income level.

- Local sales tax: Nashville has a local sales tax rate of 2.25%, which applies to most goods and services.

- Payroll taxes: Employers are required to withhold Social Security and Medicare taxes, which are used to fund these programs.

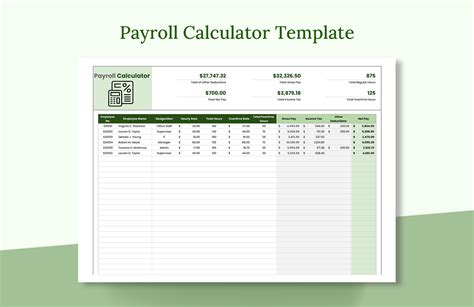

Nashville Paycheck Calculator for Employers

For employers in Nashville, a paycheck calculator can be a valuable tool for managing payroll and ensuring compliance with tax laws. With a calculator, employers can quickly and easily determine the correct amount of taxes to withhold, reducing the risk of errors and penalties. Some of the key benefits of using a Nashville paycheck calculator for employers include: * Accuracy: A paycheck calculator provides accurate calculations, reducing the risk of errors and penalties. * Convenience: With a calculator, employers can quickly and easily determine the correct amount of taxes to withhold. * Compliance: A paycheck calculator can help employers ensure compliance with tax laws, reducing the risk of penalties and fines.Nashville Paycheck Calculator for Employees

For employees living or working in Nashville, a paycheck calculator can be a valuable tool for managing finances and planning for the future. With a calculator, employees can quickly and easily determine their take-home pay, taking into account factors such as income taxes, deductions, and benefits. Some of the key benefits of using a Nashville paycheck calculator for employees include:

- Accuracy: A paycheck calculator provides accurate calculations, reducing the risk of errors and surprises when tax season arrives.

- Convenience: With a calculator, employees can quickly and easily determine their take-home pay, without having to manually calculate taxes and deductions.

- Flexibility: A paycheck calculator can be used for a variety of purposes, including estimating taxes, planning for retirement, and creating a budget.

Nashville Paycheck Calculator FAQs

Some frequently asked questions about Nashville paycheck calculators include: * What is a paycheck calculator? * How do I use a paycheck calculator? * What are the benefits of using a paycheck calculator? * Can I use a paycheck calculator for both federal and state taxes? * How accurate are paycheck calculators?Nashville Paycheck Calculator Tools

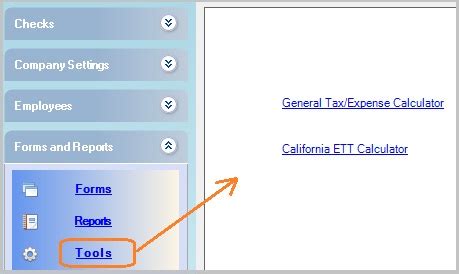

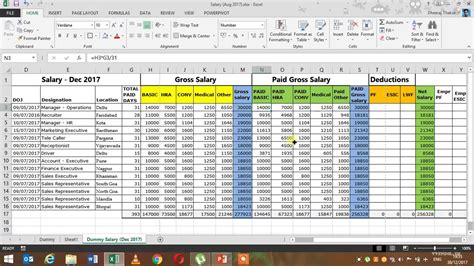

There are a variety of tools and resources available for individuals looking to use a Nashville paycheck calculator. Some of the most popular tools include:

- Online calculators: There are many online calculators available, which can be used to estimate taxes and determine take-home pay.

- Spreadsheets: Spreadsheets can be used to create a customized paycheck calculator, taking into account individual circumstances and tax laws.

- Tax software: Tax software can be used to prepare and file taxes, as well as estimate taxes and determine take-home pay.

Nashville Paycheck Calculator Best Practices

Some best practices for using a Nashville paycheck calculator include: * Gathering accurate information: Individuals should gather accurate information about their income, tax filing status, and any relevant deductions or benefits. * Using a reliable calculator: Individuals should use a reliable calculator, which takes into account the latest tax laws and regulations. * Reviewing results: Individuals should review the results of the calculator, making any necessary adjustments to their budget or financial plan.Nashville Paycheck Calculator Gallery

Nashville Paycheck Calculator Image Gallery

In conclusion, a Nashville paycheck calculator is a valuable tool for anyone living or working in Nashville. With its ability to accurately estimate taxes and determine take-home pay, a paycheck calculator can help individuals manage their finances, plan for the future, and make informed decisions about their money. Whether you are an employee, employer, or freelancer, a Nashville paycheck calculator is an essential resource that can help you navigate the complexities of the city's tax landscape. We invite you to share your thoughts and experiences with paycheck calculators in the comments below, and to explore the various tools and resources available for managing your finances in Nashville.