Calculate take-home pay with the Tennessee Paycheck Calculator, considering taxes, deductions, and exemptions, for accurate payroll processing and salary planning, including gross income, net pay, and benefits.

The Volunteer State, known for its rich music scene, beautiful mountains, and vibrant cities, is also a great place to live and work. If you're one of the many individuals who call Tennessee home, you're likely interested in understanding how your paycheck is calculated. A Tennessee paycheck calculator can be a valuable tool in helping you determine your take-home pay, as well as the various taxes and deductions that are withheld from your salary.

Tennessee is one of the states with no state income tax, which means that you won't have to worry about paying state taxes on your earnings. However, you'll still need to pay federal income taxes, as well as other taxes and deductions that are required by law. A paycheck calculator can help you navigate the complex world of payroll taxes and deductions, ensuring that you're aware of how much money you'll take home each month.

Whether you're a resident of Nashville, Memphis, or Knoxville, a Tennessee paycheck calculator can be a useful resource in managing your finances. By understanding how your paycheck is calculated, you can better plan for the future, make informed decisions about your budget, and avoid any unexpected surprises when it comes to your take-home pay. In this article, we'll delve into the world of payroll taxes and deductions, exploring how a Tennessee paycheck calculator can help you make the most of your hard-earned money.

Tennessee Paycheck Calculator: How it Works

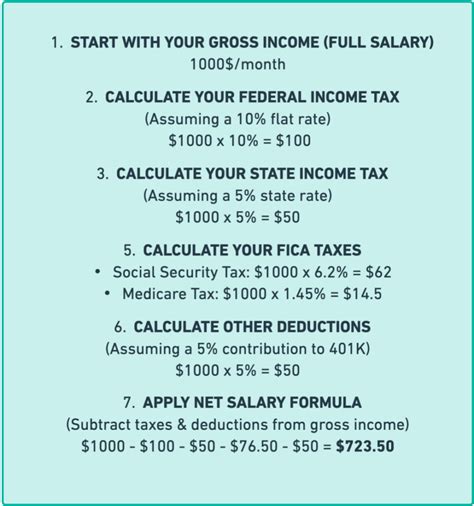

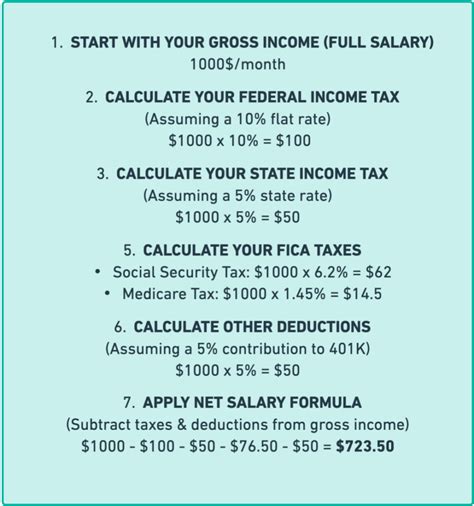

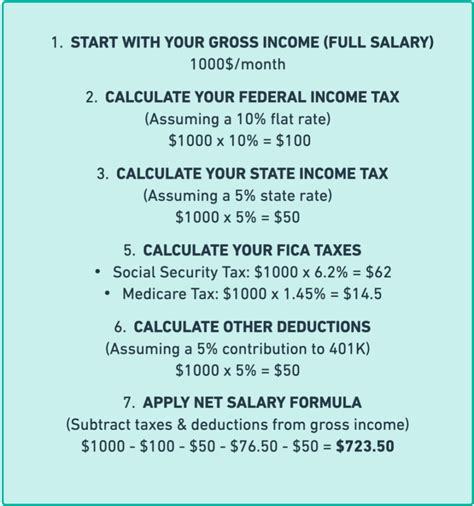

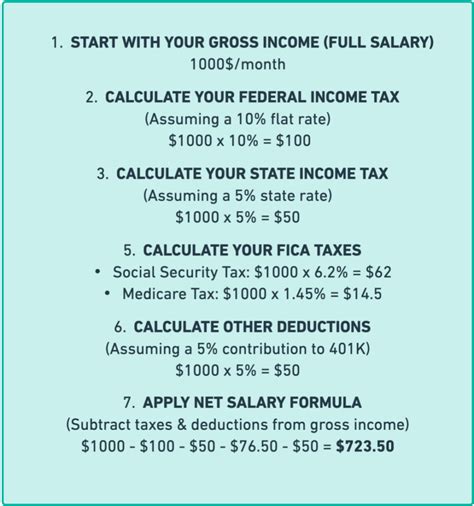

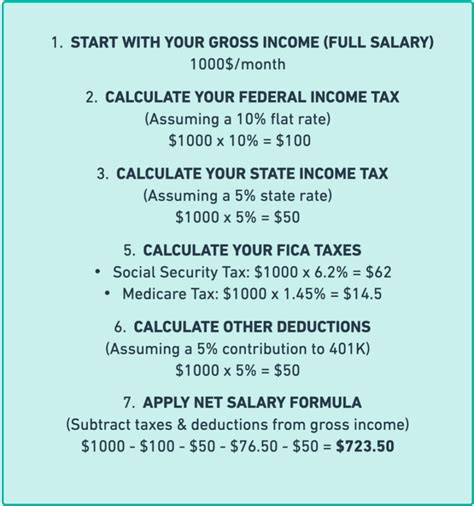

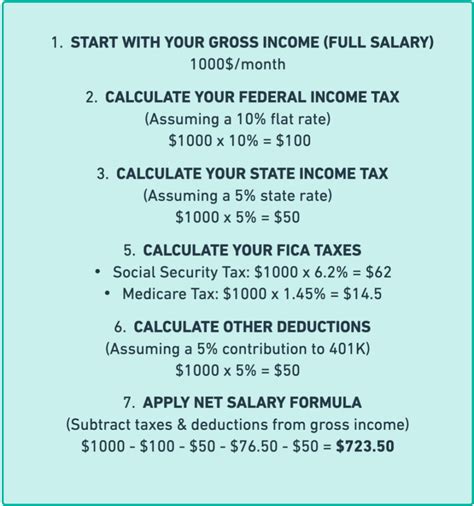

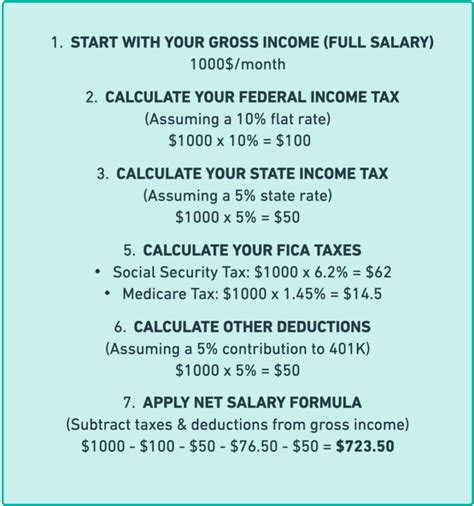

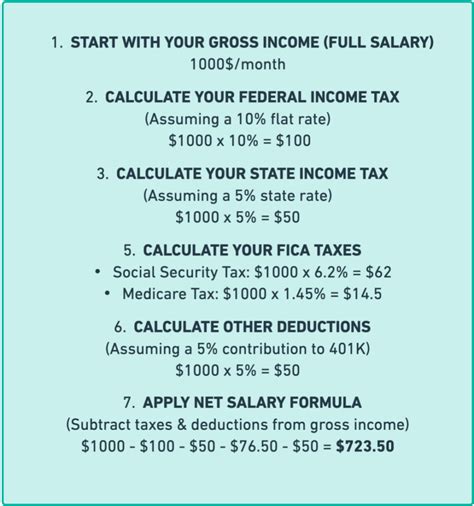

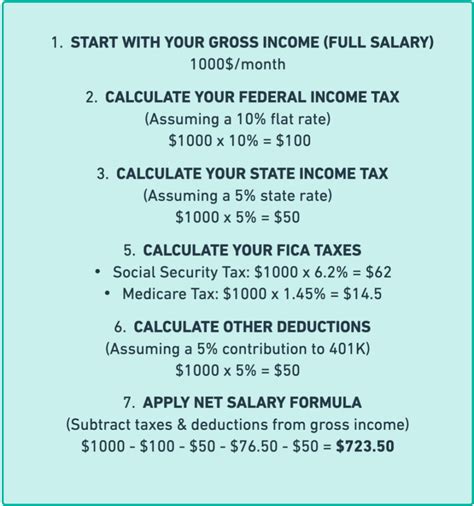

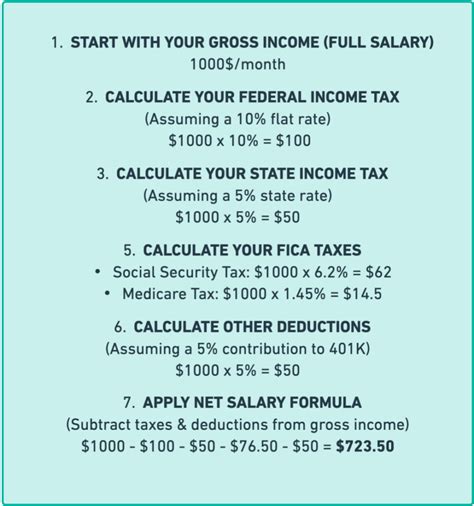

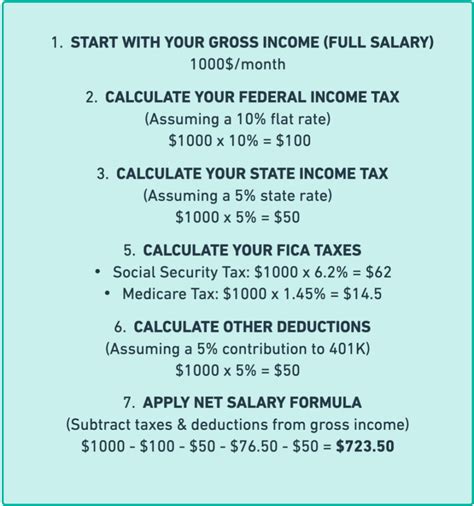

A Tennessee paycheck calculator is a simple and easy-to-use tool that helps you determine your take-home pay, based on your gross income and other factors. To use a paycheck calculator, you'll typically need to enter your hourly wage or annual salary, as well as the number of hours you work per week or the number of pay periods per year. You may also need to enter other information, such as your filing status, number of dependents, and any deductions or exemptions you're eligible for.

Once you've entered this information, the calculator will use a complex algorithm to determine your take-home pay, taking into account federal income taxes, Social Security taxes, Medicare taxes, and other deductions. The result will be a detailed breakdown of your paycheck, including your gross income, taxes withheld, and net pay.

Benefits of Using a Tennessee Paycheck Calculator

There are several benefits to using a Tennessee paycheck calculator, including:- Accurate calculations: A paycheck calculator can help you ensure that your paycheck is accurate, taking into account all the various taxes and deductions that are required by law.

- Financial planning: By understanding how your paycheck is calculated, you can better plan for the future, making informed decisions about your budget and finances.

- Tax planning: A paycheck calculator can help you optimize your tax strategy, ensuring that you're taking advantage of all the deductions and exemptions you're eligible for.

- Peace of mind: Using a paycheck calculator can give you peace of mind, knowing that your paycheck is accurate and that you're not missing out on any important deductions or exemptions.

Tennessee Payroll Taxes and Deductions

As an employee in Tennessee, you'll be subject to a variety of payroll taxes and deductions, including:

- Federal income taxes: These taxes are withheld from your paycheck and paid to the federal government.

- Social Security taxes: These taxes are withheld from your paycheck and paid to the Social Security Administration.

- Medicare taxes: These taxes are withheld from your paycheck and paid to the Medicare program.

- State and local taxes: While Tennessee does not have a state income tax, you may still be subject to local taxes, such as city or county taxes.

In addition to these taxes, you may also be subject to other deductions, such as:

- Health insurance premiums: If you're enrolled in a health insurance plan through your employer, you may have premiums deducted from your paycheck.

- 401(k) or retirement plan contributions: If you're enrolled in a 401(k) or other retirement plan, you may have contributions deducted from your paycheck.

- Life insurance premiums: If you're enrolled in a life insurance plan through your employer, you may have premiums deducted from your paycheck.

How to Use a Tennessee Paycheck Calculator

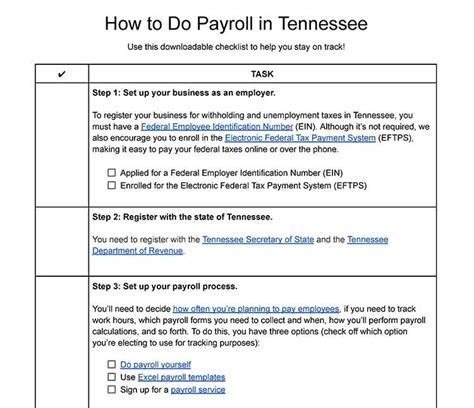

Using a Tennessee paycheck calculator is simple and easy. Here are the steps to follow:- Choose a reputable online paycheck calculator, such as a calculator provided by a financial institution or a payroll processing company.

- Enter your hourly wage or annual salary, as well as the number of hours you work per week or the number of pay periods per year.

- Enter your filing status, number of dependents, and any deductions or exemptions you're eligible for.

- Click the "calculate" button to see a detailed breakdown of your paycheck, including your gross income, taxes withheld, and net pay.

- Review the results to ensure that your paycheck is accurate and that you're taking advantage of all the deductions and exemptions you're eligible for.

Tennessee Paycheck Calculator Example

Let's say you're an employee in Tennessee, earning an annual salary of $50,000. You're single, with no dependents, and you're eligible for a standard deduction of $6,000. You work 40 hours per week, and you're paid biweekly.

Using a Tennessee paycheck calculator, you enter the following information:

- Hourly wage: $25.00 per hour

- Annual salary: $50,000 per year

- Number of hours worked per week: 40 hours

- Number of pay periods per year: 26 pay periods

- Filing status: Single

- Number of dependents: 0

- Deductions: $6,000 standard deduction

The calculator returns the following results:

- Gross income: $1,923.08 per pay period

- Federal income taxes: $341.54 per pay period

- Social Security taxes: $119.23 per pay period

- Medicare taxes: $27.85 per pay period

- Net pay: $1,434.46 per pay period

As you can see, using a Tennessee paycheck calculator can help you understand how your paycheck is calculated, taking into account all the various taxes and deductions that are required by law.

Tennessee Paycheck Calculator Tips and Tricks

Here are some tips and tricks to keep in mind when using a Tennessee paycheck calculator:- Make sure to enter accurate information, including your hourly wage or annual salary, number of hours worked per week, and number of pay periods per year.

- Take advantage of all the deductions and exemptions you're eligible for, including the standard deduction, mortgage interest deduction, and charitable contributions deduction.

- Consider contributing to a 401(k) or other retirement plan, which can help reduce your taxable income and lower your tax bill.

- Review your paycheck regularly to ensure that it's accurate and that you're not missing out on any important deductions or exemptions.

Gallery of Tennessee Paycheck Calculator Images

Tennessee Paycheck Calculator Image Gallery

We hope this article has provided you with a comprehensive understanding of how a Tennessee paycheck calculator works, as well as the various taxes and deductions that are withheld from your paycheck. By using a paycheck calculator, you can ensure that your paycheck is accurate, take advantage of all the deductions and exemptions you're eligible for, and make informed decisions about your budget and finances. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family, and help them understand the importance of using a Tennessee paycheck calculator.