Intro

Estimate NJ taxes with the Nj Paycheck Estimator Tool, calculating gross income, deductions, and net pay, utilizing tax withholding, salary, and benefits to forecast take-home pay accurately.

The NJ Paycheck Estimator Tool is a valuable resource for individuals living and working in New Jersey. This tool allows users to estimate their take-home pay, taking into account various factors such as gross income, deductions, and taxes. With the ever-changing tax landscape, it's essential to have a reliable tool to help individuals plan their finances and make informed decisions about their careers and personal lives. In this article, we will delve into the importance of the NJ Paycheck Estimator Tool, its benefits, and how to use it effectively.

The NJ Paycheck Estimator Tool is particularly useful for individuals who are considering a new job or a change in career. By using the tool, they can estimate their potential take-home pay and make a more informed decision about whether the new opportunity is right for them. Additionally, the tool can help individuals who are trying to budget and plan their finances, as it provides a clear picture of their net income and the amount of taxes they will owe. This can be especially helpful for those who are trying to save for a big purchase, such as a house or a car, or for those who are trying to pay off debt.

The tool is also beneficial for businesses and employers, as it allows them to provide more accurate information to their employees about their take-home pay. This can be especially helpful during the hiring process, as it can give employers a competitive edge in attracting top talent. Furthermore, the tool can help businesses to better understand their employees' financial situations, which can lead to more effective compensation and benefits packages.

How the NJ Paycheck Estimator Tool Works

The NJ Paycheck Estimator Tool is a user-friendly online calculator that takes into account various factors to estimate an individual's take-home pay. The tool asks for information such as gross income, filing status, number of dependents, and deductions, and then uses this information to calculate the estimated take-home pay. The tool also takes into account New Jersey state taxes, as well as federal taxes, to provide a comprehensive picture of an individual's net income.

To use the tool, individuals simply need to visit the website and enter their information into the calculator. The tool will then provide an estimate of their take-home pay, broken down into monthly, bi-weekly, and weekly amounts. The tool also provides a detailed breakdown of the calculations, including the amount of taxes owed and the amount of deductions taken.

Benefits of the NJ Paycheck Estimator Tool

The NJ Paycheck Estimator Tool offers several benefits to individuals and businesses. Some of the key benefits include:

- Accurate estimates: The tool provides accurate estimates of take-home pay, taking into account various factors such as taxes and deductions.

- Easy to use: The tool is user-friendly and easy to use, making it accessible to individuals with varying levels of financial knowledge.

- Comprehensive: The tool provides a comprehensive picture of an individual's net income, including the amount of taxes owed and the amount of deductions taken.

- Time-saving: The tool saves time and effort, as individuals do not need to manually calculate their take-home pay or consult with a financial advisor.

- Free: The tool is free to use, making it a valuable resource for individuals and businesses.

How to Use the NJ Paycheck Estimator Tool Effectively

To use the NJ Paycheck Estimator Tool effectively, individuals should follow these steps:

- Gather all necessary information: Before using the tool, individuals should gather all necessary information, including their gross income, filing status, number of dependents, and deductions.

- Enter information accurately: Individuals should enter their information accurately and completely, to ensure that the tool provides an accurate estimate of their take-home pay.

- Review and adjust: Individuals should review the estimate provided by the tool and adjust as necessary. For example, if the individual has other sources of income or deductions that are not accounted for in the tool, they should adjust the estimate accordingly.

- Use the tool regularly: Individuals should use the tool regularly, to ensure that their estimates are up-to-date and accurate.

Common Mistakes to Avoid When Using the NJ Paycheck Estimator Tool

When using the NJ Paycheck Estimator Tool, individuals should avoid the following common mistakes:

- Entering incorrect information: Individuals should ensure that they enter their information accurately and completely, to avoid errors in the estimate.

- Not accounting for all income: Individuals should account for all sources of income, including side hustles and investments, to ensure that the estimate is accurate.

- Not accounting for all deductions: Individuals should account for all deductions, including charitable donations and mortgage interest, to ensure that the estimate is accurate.

- Not reviewing and adjusting: Individuals should review the estimate provided by the tool and adjust as necessary, to ensure that the estimate is accurate and up-to-date.

FAQs About the NJ Paycheck Estimator Tool

Here are some frequently asked questions about the NJ Paycheck Estimator Tool:

- Q: Is the NJ Paycheck Estimator Tool free to use? A: Yes, the tool is free to use.

- Q: How accurate is the NJ Paycheck Estimator Tool? A: The tool is highly accurate, but individuals should review and adjust the estimate as necessary to ensure accuracy.

- Q: Can I use the NJ Paycheck Estimator Tool for multiple income sources? A: Yes, individuals can use the tool for multiple income sources, including side hustles and investments.

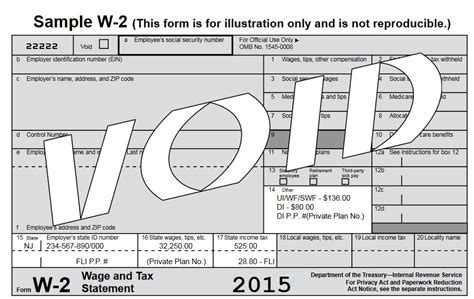

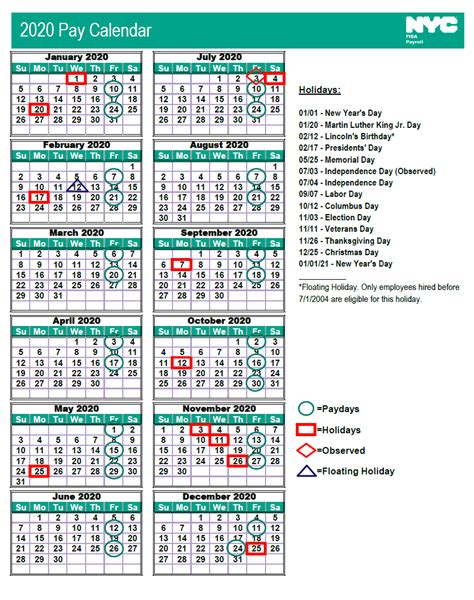

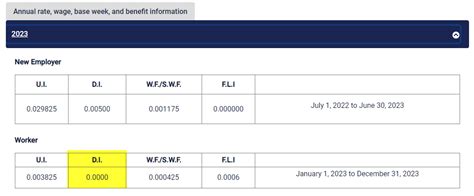

NJ Paycheck Estimator Tool Image Gallery

In conclusion, the NJ Paycheck Estimator Tool is a valuable resource for individuals and businesses in New Jersey. The tool provides accurate estimates of take-home pay, taking into account various factors such as taxes and deductions. By using the tool effectively, individuals can make informed decisions about their careers and personal finances, and businesses can provide more accurate information to their employees about their take-home pay. We encourage readers to try out the NJ Paycheck Estimator Tool and share their experiences with us in the comments below. Additionally, we invite readers to share this article with others who may benefit from the tool, and to explore other resources and tools related to personal finance and career development.