Intro

Discover 5 essential Michigan payroll tips, including tax compliance, wage laws, and employee benefits, to streamline your payroll process and avoid costly errors in the Great Lakes States unique regulatory landscape.

Michigan payroll processing can be complex and time-consuming, especially for small business owners or those new to managing employee compensation. Understanding the nuances of payroll in Michigan is crucial to avoid penalties, ensure compliance with state and federal regulations, and maintain a positive working relationship with employees. The importance of accurate and timely payroll processing cannot be overstated, as it directly affects the livelihood of employees and the overall financial health of a business.

In Michigan, as in other states, employers must navigate a myriad of laws and regulations governing payroll, including minimum wage, overtime, and tax withholding. The state also has its own set of specific requirements, such as the Michigan Income Tax Act, which mandates the withholding of state income taxes from employee wages. Furthermore, employers must be aware of the federal laws that intersect with state regulations, such as the Fair Labor Standards Act (FLSA), which dictates minimum wage, overtime pay, and record-keeping requirements.

The consequences of non-compliance with payroll regulations can be severe, ranging from fines and penalties to legal action and damage to a company's reputation. Therefore, it is essential for employers in Michigan to stay informed about the latest payroll laws and best practices. This includes understanding how to properly classify employees, calculate wages and deductions, and submit tax payments and reports to the appropriate authorities. By prioritizing payroll compliance, businesses can minimize risks, optimize their payroll processes, and focus on growth and development.

Understanding Michigan Payroll Laws

Minimum Wage and Overtime Requirements

Michigan's minimum wage law applies to most employees, with a few exceptions, such as certain minors, students, and individuals with disabilities. Employers must also comply with the overtime provisions, which mandate paying eligible employees one and a half times their regular rate for hours worked over 40 in a single workweek. Understanding who is exempt from overtime and ensuring accurate tracking of work hours are crucial to avoiding violations of these regulations.Payroll Tax Compliance in Michigan

Federal and State Tax Withholding

Proper tax withholding is essential to avoid penalties and interest. Employers must obtain a completed Form W-4 from each employee to determine the correct amount of federal income tax to withhold. For state income tax withholding, Michigan employers use the Michigan Withholding Certificate (Form MI-W4). Accurate and timely submission of these forms, along with the payment of withheld taxes, is critical for maintaining compliance with both federal and state tax authorities.Best Practices for Michigan Payroll Processing

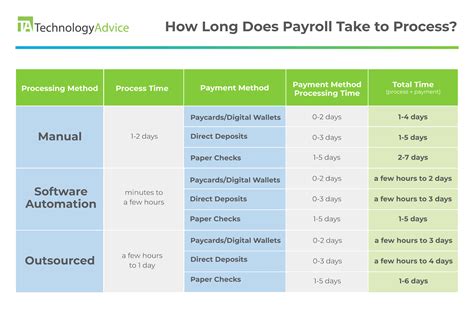

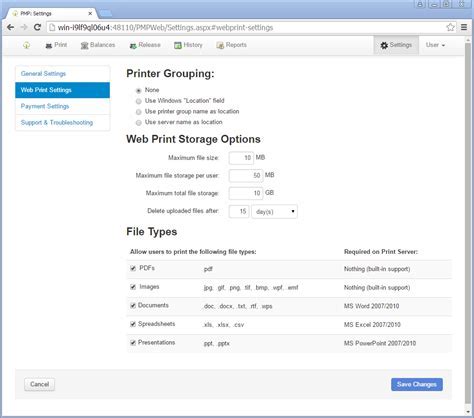

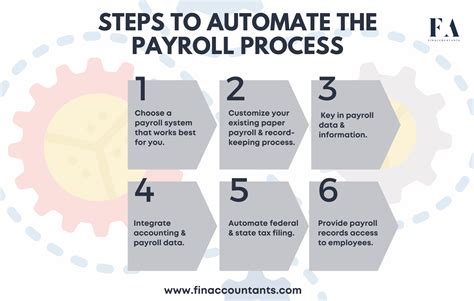

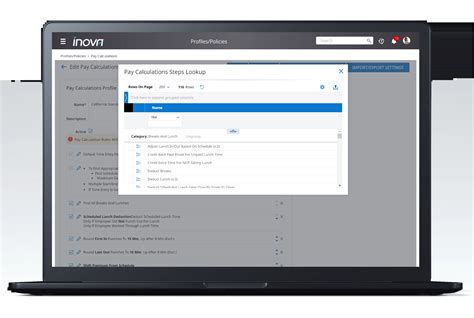

Automating Payroll Processes

Automating payroll processes can streamline operations, reduce manual errors, and ensure compliance with ever-changing payroll laws. When selecting a payroll software, employers should consider factors such as ease of use, scalability, integration with existing HR systems, and customer support. Additionally, ensuring that all payroll staff are trained on the software and understand Michigan's specific payroll regulations is vital for successful implementation.Michigan Payroll Tips for Employers

Importance of Compliance

Compliance with Michigan payroll laws is not only a legal requirement but also essential for maintaining a positive and trustworthy relationship with employees. Non-compliance can lead to severe penalties, legal action, and damage to a company's reputation. By prioritizing payroll compliance and following best practices, employers can minimize risks, optimize their payroll processes, and focus on the growth and success of their business.Gallery of Michigan Payroll Images

Michigan Payroll Image Gallery

In conclusion, managing payroll in Michigan requires a deep understanding of the state's unique laws and regulations, as well as federal requirements. By following the tips and best practices outlined above, employers can ensure compliance, reduce the risk of errors, and focus on building a successful and sustainable business. Whether you're a small startup or an established corporation, prioritizing payroll compliance and investing in the right tools and expertise can make all the difference in your business's long-term success. We invite you to share your thoughts on Michigan payroll processing, ask questions, or explore more topics related to payroll management and compliance. Your engagement and feedback are invaluable in helping us provide the most relevant and useful information for businesses operating in Michigan.