Intro

Simplify payroll reconciliation with an Excel template. Learn 5 efficient ways to streamline your payroll process, reducing errors and saving time. Discover how to automate payroll data, reconcile discrepancies, and ensure compliance with our expert guide. Boost your accounting efficiency with these easy-to-implement Excel solutions.

The payroll reconciliation process can be a daunting and time-consuming task for many businesses. It involves verifying the accuracy of payroll transactions, ensuring compliance with tax laws, and identifying any discrepancies or errors. However, with the help of an Excel template, simplifying payroll reconciliation is achievable. In this article, we will explore five ways to simplify payroll reconciliation using an Excel template.

What is Payroll Reconciliation?

Payroll reconciliation is the process of verifying the accuracy of payroll transactions, including salary payments, tax deductions, and benefit contributions. It involves comparing the payroll data with the company's financial records to ensure that the payroll transactions are accurate and complete.

Benefits of Using an Excel Template for Payroll Reconciliation

Using an Excel template for payroll reconciliation offers several benefits, including:

- Improved accuracy and reduced errors

- Increased efficiency and reduced processing time

- Enhanced transparency and visibility

- Simplified compliance with tax laws and regulations

- Better decision-making with real-time data and analytics

5 Ways to Simplify Payroll Reconciliation with Excel Template

1. Automate Payroll Data Import

One of the most significant advantages of using an Excel template for payroll reconciliation is the ability to automate payroll data import. By setting up a connection between the payroll system and the Excel template, you can automatically import payroll data, reducing manual errors and saving time.

2. Use Pre-Configured Formulas and Functions

An Excel template for payroll reconciliation can be set up with pre-configured formulas and functions to simplify the reconciliation process. For example, you can use formulas to calculate tax deductions, benefit contributions, and other payroll-related calculations.

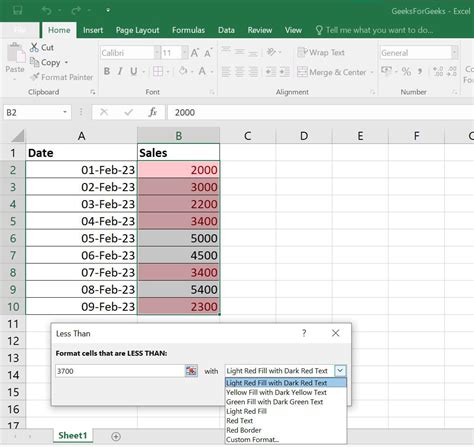

3. Implement Conditional Formatting

Conditional formatting is a powerful feature in Excel that allows you to highlight errors, discrepancies, and anomalies in payroll data. By implementing conditional formatting in your Excel template, you can quickly identify issues and take corrective action.

4. Create a Reconciliation Dashboard

A reconciliation dashboard is a centralized platform that provides a snapshot of payroll reconciliation data. By creating a reconciliation dashboard in your Excel template, you can easily track and monitor payroll reconciliation metrics, such as accuracy rates, error rates, and processing times.

5. Use Data Validation and Error Handling

Data validation and error handling are essential features in Excel that can help simplify payroll reconciliation. By setting up data validation rules and error handling mechanisms in your Excel template, you can prevent errors, detect discrepancies, and ensure data integrity.

Best Practices for Using an Excel Template for Payroll Reconciliation

To get the most out of an Excel template for payroll reconciliation, follow these best practices:

- Regularly update and maintain the template to ensure accuracy and compliance

- Use clear and concise labeling and formatting to improve readability

- Implement data validation and error handling mechanisms to prevent errors

- Use conditional formatting to highlight errors and discrepancies

- Regularly review and analyze payroll reconciliation data to identify trends and areas for improvement

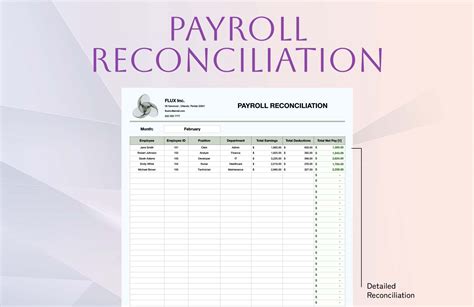

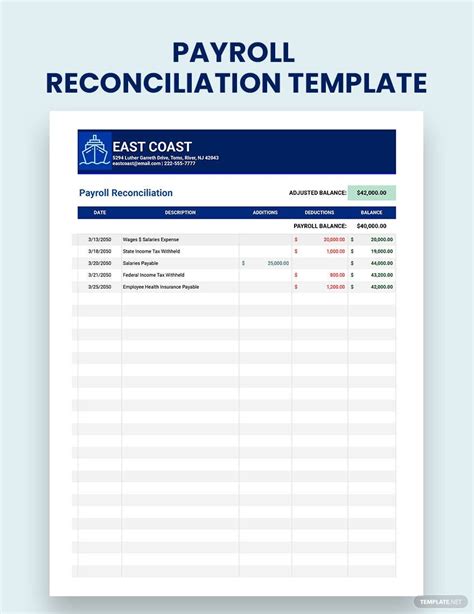

Payroll Reconciliation Template Example

Here's an example of a payroll reconciliation template in Excel:

| Employee ID | Employee Name | Gross Pay | Tax Deductions | Benefit Contributions | Net Pay |

|---|---|---|---|---|---|

| 1234 | John Doe | 5000 | 1000 | 500 | 3500 |

| 5678 | Jane Smith | 6000 | 1200 | 600 | 4200 |

| 9012 | Bob Johnson | 7000 | 1400 | 700 | 4900 |

This template includes columns for employee ID, employee name, gross pay, tax deductions, benefit contributions, and net pay. You can customize the template to fit your specific payroll reconciliation needs.

Payroll Reconciliation Template Gallery

Payroll Reconciliation Template Gallery

In conclusion, simplifying payroll reconciliation with an Excel template can save time, reduce errors, and improve accuracy. By following the five ways outlined in this article, you can create a payroll reconciliation template that meets your specific needs and improves your overall payroll reconciliation process.