Maximize Pentagon FCU credit benefits with expert tips on credit scores, reports, and management, including credit card optimization and loan strategies.

In today's financial landscape, managing credit effectively is crucial for achieving long-term stability and security. For members of the Pentagon Federal Credit Union (PenFed), understanding how to maximize their credit benefits can lead to significant financial advantages. PenFed, as one of the largest and most reputable credit unions, offers a wide range of financial products and services designed to help its members achieve their financial goals. Whether you're looking to build credit, manage debt, or simply understand how credit works, having the right strategies can make all the difference.

Navigating the world of credit can be complex, especially with the myriad of options and advice available. However, by focusing on a few key principles and strategies, individuals can significantly improve their financial health. From understanding credit scores and reports to leveraging credit cards and loans wisely, the path to financial wellness is paved with informed decisions. For PenFed members, the credit union's resources and tools can be particularly valuable in this journey, offering personalized support and competitive financial products.

The importance of credit management cannot be overstated. Good credit can open doors to better loan rates, higher credit limits, and even affect aspects of personal and professional life, such as apartment rentals and job applications. Conversely, poor credit management can lead to higher interest rates, lower credit limits, and significant financial strain. By adopting smart credit habits and utilizing the resources available through PenFed, members can work towards securing a brighter financial future. This includes taking advantage of educational resources, financial counseling, and the credit union's array of financial products tailored to meet various needs and goals.

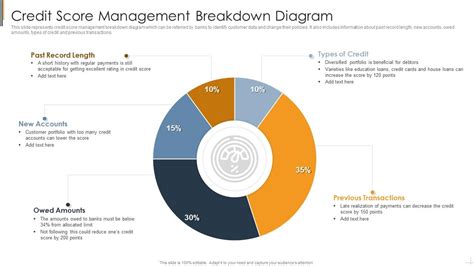

Understanding Credit Scores

Building Credit with PenFed

Managing Debt Effectively

Leveraging Credit Cards Wisely

Utilizing PenFed's Financial Resources

Benefits of PenFed Membership

The benefits of being a PenFed member extend beyond access to competitive financial products. Members also enjoy a range of services and perks, including: - Competitive rates on loans and credit cards - Higher yields on savings accounts and certificates - Access to financial education and counseling - Convenience through online and mobile banking - A community of members with shared interests and goalsConclusion and Next Steps

Pentagon Fcu Credit Tips Image Gallery

We invite you to share your thoughts and experiences with managing credit and achieving financial stability. Whether you're a PenFed member or simply looking for advice on how to improve your financial health, your insights can help others on their financial journey. Consider sharing this article with friends and family who might benefit from the strategies and resources discussed. Together, we can work towards a future where financial wellness is accessible to everyone.