Intro

Master your finances with our expert guide on creating a personal financial statement in Excel. Learn 7 essential tips to effectively track income, expenses, and savings. Discover how to build a budget, manage debt, and make informed financial decisions with our comprehensive tutorial and downloadable templates.

Creating a personal financial statement is an essential step in managing your finances effectively. It provides a clear picture of your financial situation, helping you make informed decisions about your money. One of the most efficient ways to create a personal financial statement is by using Excel. Here are 7 essential tips to help you create a comprehensive and accurate personal financial statement in Excel.

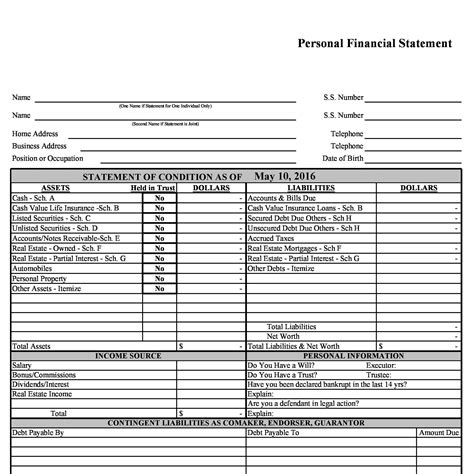

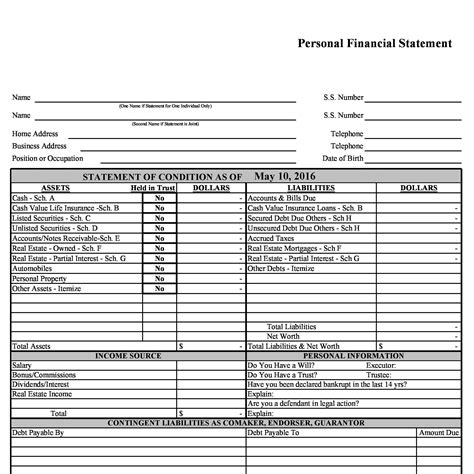

Why You Need a Personal Financial Statement A personal financial statement is a document that outlines your financial position at a specific point in time. It includes your assets, liabilities, income, and expenses, providing a comprehensive view of your financial situation. Having a personal financial statement helps you track your financial progress, identify areas for improvement, and make informed decisions about your money.

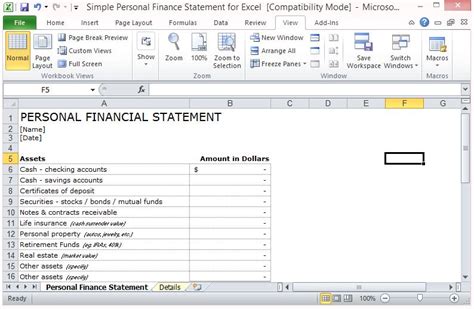

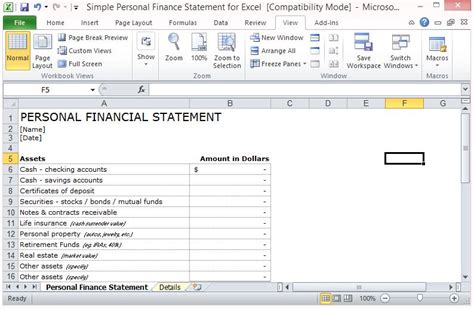

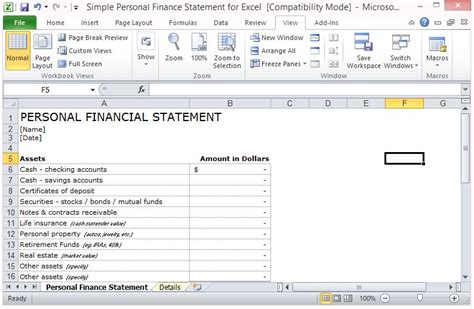

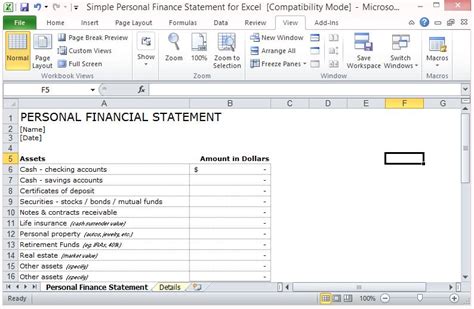

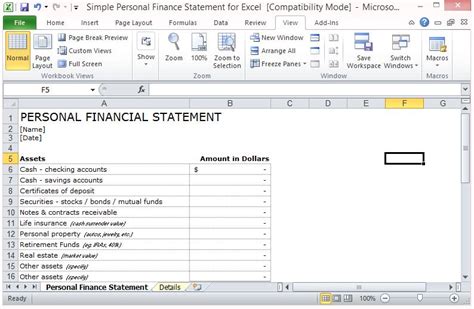

Tip 1: Set Up Your Excel Spreadsheet To create a personal financial statement in Excel, start by setting up a new spreadsheet. Create separate sheets for your assets, liabilities, income, and expenses. This will help you organize your data and make it easier to review your financial statement.

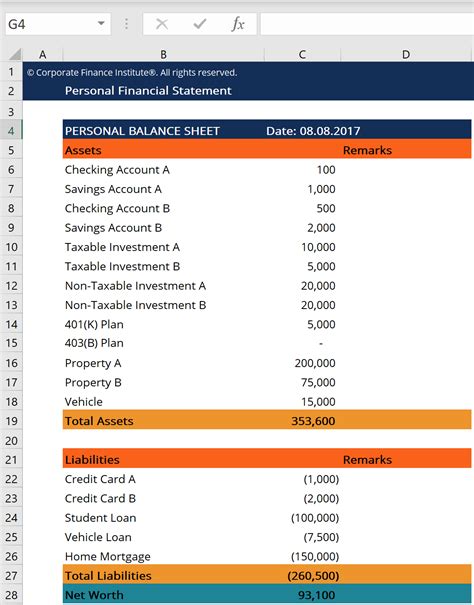

Tip 2: List Your Assets Your assets include everything you own that has value, such as cash, investments, real estate, and personal property. Make a list of all your assets, including their current value. Be sure to include:

- Cash and savings accounts

- Investments, such as stocks and bonds

- Retirement accounts, such as 401(k) and IRA

- Real estate, including your primary residence and any investment properties

- Personal property, such as vehicles and jewelry

Tip 3: List Your Liabilities Your liabilities include everything you owe to others, such as debts and loans. Make a list of all your liabilities, including their current balance and interest rate. Be sure to include:

- Credit card debt

- Student loans

- Personal loans

- Mortgage debt

- Car loans

Tip 4: Calculate Your Net Worth Your net worth is the difference between your assets and liabilities. To calculate your net worth, subtract your total liabilities from your total assets. This will give you a clear picture of your financial position.

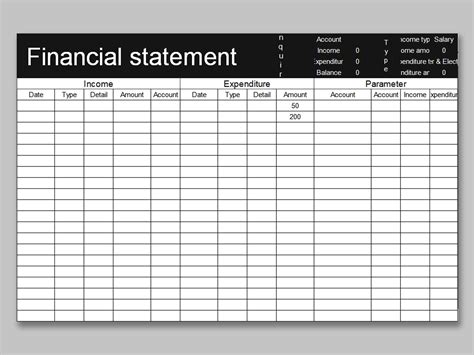

Tip 5: Track Your Income Your income includes all the money you receive on a regular basis, such as your salary, investments, and any side hustles. Make a list of all your income sources, including their monthly and annual amounts.

Tip 6: Track Your Expenses Your expenses include all the money you spend on a regular basis, such as rent, utilities, groceries, and entertainment. Make a list of all your expenses, including their monthly and annual amounts. Be sure to include:

- Housing expenses, such as rent and utilities

- Transportation expenses, such as car loans and gas

- Food expenses, such as groceries and dining out

- Insurance expenses, such as health and life insurance

- Entertainment expenses, such as movies and concerts

Tip 7: Review and Update Your Statement Regularly Your personal financial statement is not a one-time task. It's essential to review and update your statement regularly to track your financial progress and make informed decisions about your money. Set a reminder to review your statement every few months to ensure you're on track with your financial goals.

By following these 7 essential tips, you can create a comprehensive and accurate personal financial statement in Excel. Remember to review and update your statement regularly to ensure you're making the most of your money.

Gallery of Personal Financial Statement Excel Templates

Personal Financial Statement Excel Template Gallery

We hope this article has helped you create a comprehensive and accurate personal financial statement in Excel. Remember to review and update your statement regularly to ensure you're making the most of your money. If you have any questions or need further assistance, please don't hesitate to ask.