Boost financial stability with 5 Navy Federal Loan Tips, covering loan options, interest rates, and repayment terms, to help you make informed decisions on personal loans, credit scores, and debt management.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. For those who are part of the military community, Navy Federal is often the go-to institution for banking, loans, and other financial needs. Loans, in particular, are a crucial aspect of personal finance, and Navy Federal offers various loan options to cater to different requirements. Understanding how to navigate these loan options effectively can make a significant difference in managing your finances efficiently.

The importance of choosing the right loan cannot be overstated. Whether you're looking to purchase a home, finance a car, or cover unexpected expenses, the terms and conditions of your loan can affect your financial stability for years to come. Navy Federal, with its member-centric approach, provides competitive rates and flexible terms, but it's essential to approach loan applications with a clear understanding of what you're getting into. This includes knowing your credit score, understanding the different types of loans available, and being aware of the repayment terms.

For members of Navy Federal, the process of applying for a loan is streamlined and user-friendly, thanks to the credit union's robust online platform and mobile app. However, before diving into the application process, it's crucial to have a solid grasp of the loan options at your disposal. From personal loans and auto loans to mortgages and home equity loans, each type of loan is designed to meet specific financial needs. By understanding the characteristics of each loan type, you can make informed decisions that align with your financial goals and current situation.

Understanding Navy Federal Loan Options

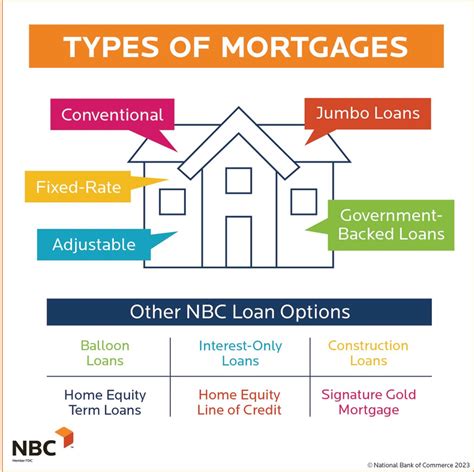

Navy Federal offers a diverse range of loan products, each tailored to address different financial requirements. Personal loans, for instance, can be used for anything from consolidating debt to financing a wedding. Auto loans are designed for vehicle purchases, with competitive rates for both new and used cars. For those looking to purchase or refinance a home, Navy Federal's mortgage options include fixed-rate and adjustable-rate loans, as well as VA loans for eligible veterans and active-duty personnel. Home equity loans and lines of credit allow homeowners to tap into their home's equity for major expenses or home improvements.

Benefits of Navy Federal Loans

The benefits of choosing Navy Federal for your loan needs are numerous. One of the most significant advantages is the competitive interest rates offered across various loan products. Members can also enjoy flexible repayment terms, which can be tailored to fit individual financial situations. Additionally, the application process is relatively straightforward, with the option to apply online or through the Navy Federal mobile app. For those who prefer a more personal touch, visits to local branches are also an option.Applying for a Navy Federal Loan

The process of applying for a Navy Federal loan is designed to be as hassle-free as possible. Potential borrowers can start by checking their eligibility and reviewing the different loan options available. It's also a good idea to check your credit score, as this can impact the interest rate you're offered. Once you've decided on a loan type, you can proceed with the application, either online, through the mobile app, or by visiting a branch. You'll need to provide some personal and financial information, including income verification and details about the loan's purpose.

Loan Application Tips

To increase your chances of a successful loan application and to ensure you get the best possible deal, there are several tips to keep in mind. First, make sure your credit score is in good shape. A higher credit score can qualify you for lower interest rates, saving you money over the life of the loan. It's also important to have a clear understanding of your financial situation, including your income, expenses, and any existing debt. This will help you determine how much you can afford to borrow and what repayment terms are feasible for you.Navy Federal Loan Repayment

Repaying your Navy Federal loan is straightforward, with several options available to make payments convenient. Members can set up automatic payments from their Navy Federal checking account or from an external bank account. Payments can also be made online, through the mobile app, by phone, or by mail. It's essential to make timely payments to avoid late fees and to maintain a healthy credit score. Navy Federal also offers assistance programs for members who are experiencing financial difficulties, which can provide temporary relief or modify loan terms to make payments more manageable.

Managing Your Loan

Effective loan management is key to avoiding financial stress and ensuring that your loan works for you, rather than against you. This involves keeping track of your payments, monitoring your balance, and being mindful of your credit utilization ratio. Navy Federal provides tools and resources to help members manage their loans, including online account access and mobile banking. By staying on top of your loan and communicating with Navy Federal if you encounter any issues, you can navigate the repayment process with confidence.Navy Federal Loan Customer Service

Navy Federal prides itself on its commitment to customer service, offering support to members through various channels. Whether you have questions about the loan application process, need assistance with loan repayment, or are looking for advice on managing your finances, Navy Federal's customer service team is available to help. Members can reach out via phone, email, or by visiting a local branch. The credit union also has an extensive online resource center, featuring FAQs, financial guides, and educational materials to empower members in their financial journey.

Additional Resources

For those looking to deepen their understanding of personal finance and loan management, Navy Federal provides a wealth of resources. From webinars and workshops to financial counseling services, members have access to a range of tools designed to promote financial literacy and stability. By leveraging these resources, individuals can make more informed financial decisions, navigate the complexities of loan management with ease, and work towards achieving their long-term financial goals.Conclusion and Next Steps

In conclusion, navigating the world of Navy Federal loans requires a combination of understanding the available loan options, being mindful of your financial situation, and leveraging the resources and support provided by the credit union. By following the tips and guidelines outlined above, members can make the most of their loan experience, whether they're financing a significant purchase, consolidating debt, or simply looking for a financial safety net. As you move forward with your loan application or repayment, remember to stay informed, plan carefully, and don't hesitate to reach out for assistance when needed.

Final Thoughts

The journey to financial stability and success is unique to each individual, and loans can play a significant role in this journey. Navy Federal, with its member-focused approach and comprehensive range of loan products, is well-positioned to support its members in achieving their financial goals. Whether you're just starting out or are well on your way to financial independence, the right loan can make all the difference. Take the time to explore your options, ask questions, and seek advice when necessary. With the right mindset and support, you can harness the power of loans to build a stronger financial future.Navy Federal Loan Image Gallery

We invite you to share your thoughts and experiences with Navy Federal loans in the comments below. Your insights can help others make informed decisions about their financial futures. If you found this article helpful, consider sharing it with friends or family who might benefit from learning more about Navy Federal's loan options and how to navigate them effectively. By working together and supporting one another, we can all strive towards achieving greater financial stability and success.