Intro

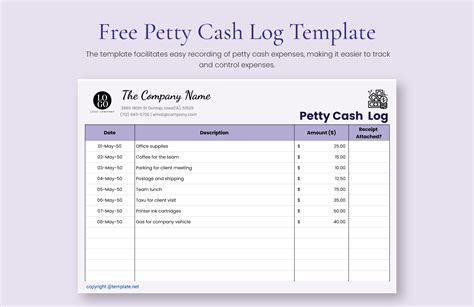

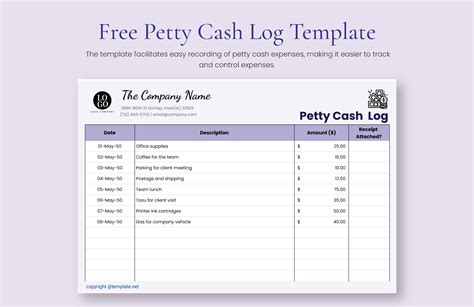

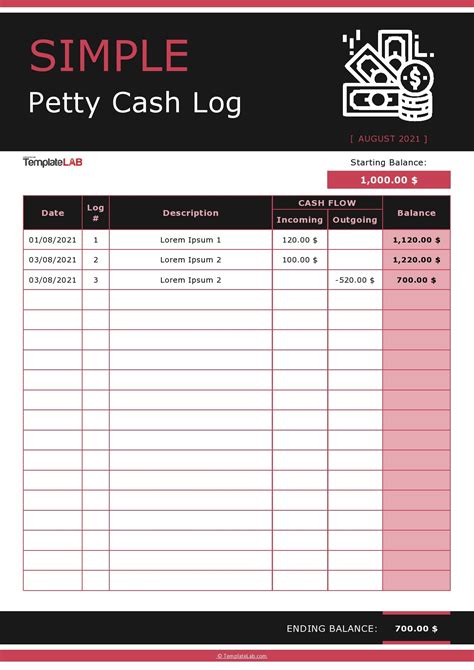

Streamline small expense management with a Petty Cash Template Excel. Track daily transactions, reconcile accounts, and maintain transparency with our free downloadable template. Say goodbye to lost receipts and hello to financial clarity. Perfect for small businesses, entrepreneurs, and individuals, our template helps you stay on top of petty cash management with ease.

Effective management of small expenses is crucial for the financial health of any business. Petty cash, a small amount of money set aside for minor expenses, can help streamline day-to-day transactions. However, keeping track of petty cash transactions can be tedious and prone to errors. This is where a petty cash template in Excel comes in handy.

A petty cash template in Excel is a simple and efficient way to manage small expenses, ensuring that your business stays organized and on top of its finances. In this article, we will discuss the importance of petty cash management, the benefits of using a petty cash template in Excel, and provide a step-by-step guide on how to create and use a petty cash template.

Importance of Petty Cash Management

Petty cash management is essential for any business, regardless of its size or nature. Here are some reasons why:

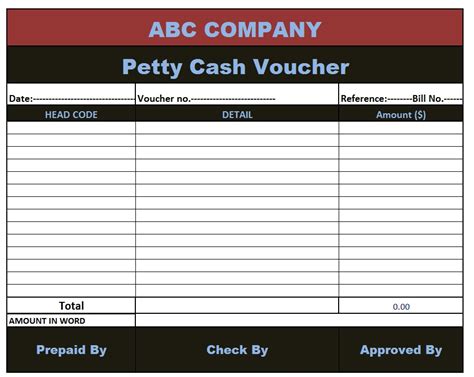

- Prevents Misuse of Funds: Petty cash management ensures that the money set aside for minor expenses is used for legitimate purposes only.

- Streamlines Financial Transactions: Petty cash management simplifies day-to-day transactions, reducing the need for complex accounting procedures.

- Reduces Errors: Petty cash management minimizes the risk of errors, ensuring that financial records are accurate and up-to-date.

- Enhances Transparency: Petty cash management promotes transparency, making it easier to track expenses and identify areas for cost reduction.

Benefits of Using a Petty Cash Template in Excel

Using a petty cash template in Excel offers several benefits, including:

- Easy to Use: A petty cash template in Excel is simple to use, even for those without extensive accounting knowledge.

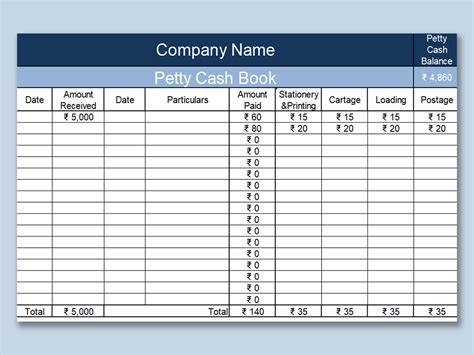

- Customizable: A petty cash template in Excel can be customized to meet the specific needs of your business.

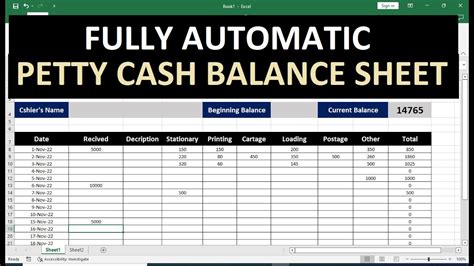

- Automated Calculations: A petty cash template in Excel automates calculations, reducing the risk of errors and saving time.

- Real-time Tracking: A petty cash template in Excel enables real-time tracking of expenses, making it easier to identify areas for cost reduction.

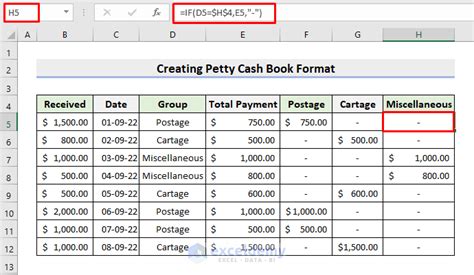

Creating a Petty Cash Template in Excel

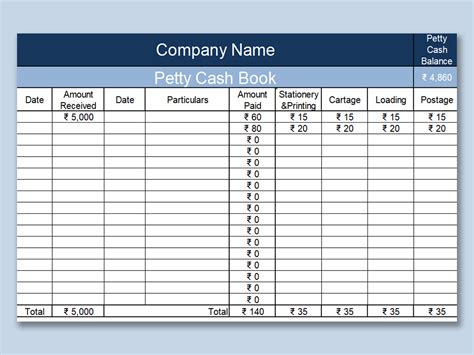

Creating a petty cash template in Excel is a straightforward process. Here's a step-by-step guide:

- Open Excel: Open a new Excel spreadsheet and give it a name, such as "Petty Cash Template."

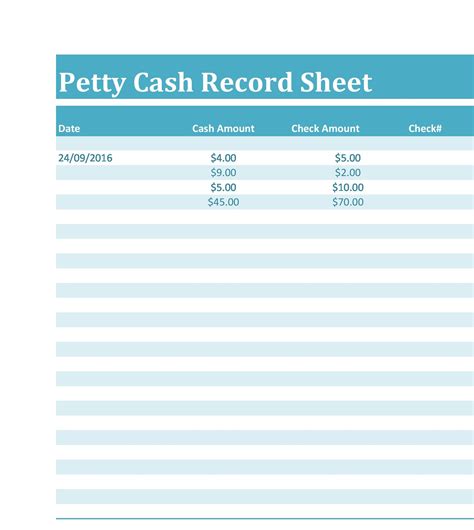

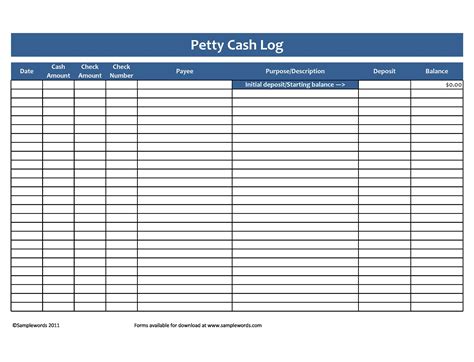

- Set up the Template: Set up the template by creating columns for date, description, amount, and balance.

- Format the Template: Format the template by adjusting the column widths and adding borders.

- Add Formulas: Add formulas to automate calculations, such as the balance column.

- Save the Template: Save the template as an Excel file, such as "Petty Cash Template.xlsx."

Using a Petty Cash Template in Excel

Using a petty cash template in Excel is easy. Here's a step-by-step guide:

- Open the Template: Open the petty cash template in Excel.

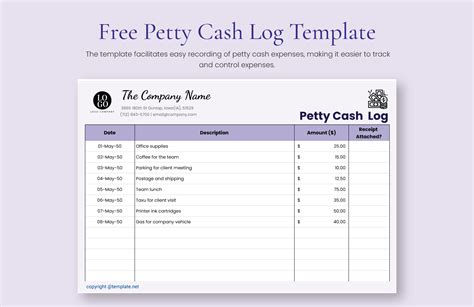

- Enter Transactions: Enter transactions, including date, description, and amount.

- Update the Balance: Update the balance column to reflect the new transactions.

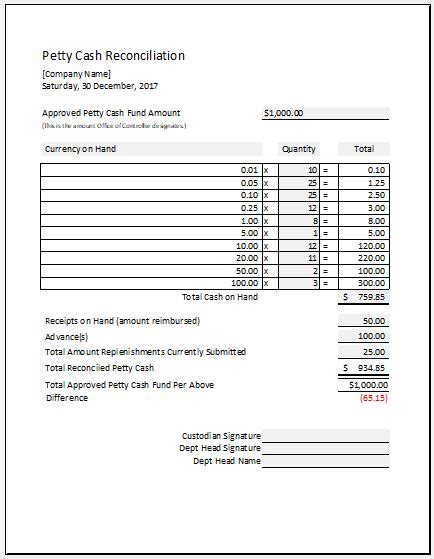

- Review and Reconcile: Review and reconcile the petty cash account regularly to ensure accuracy and identify areas for cost reduction.

Petty Cash Template Excel Gallery

By following these steps and using a petty cash template in Excel, you can effectively manage small expenses, streamline financial transactions, and enhance transparency in your business.