Intro

Discover how 9/11 impacted payment amounts in lasting ways. Learn how the terrorist attacks influenced online payment security, increased demand for contactless transactions, and reshaped global finance regulations. Explore the five significant changes that have affected payment amounts, from enhanced authentication to rising transaction fees, and their enduring impact on the financial landscape.

The 9/11 attacks on the World Trade Center in 2001 had a profound impact on various aspects of American life, including the way people think about and manage their finances. In the aftermath of the tragedy, there were significant changes in payment amounts, influenced by shifting consumer behavior, advances in technology, and regulatory responses. Here, we will explore five ways in which 9/11 changed payment amounts.

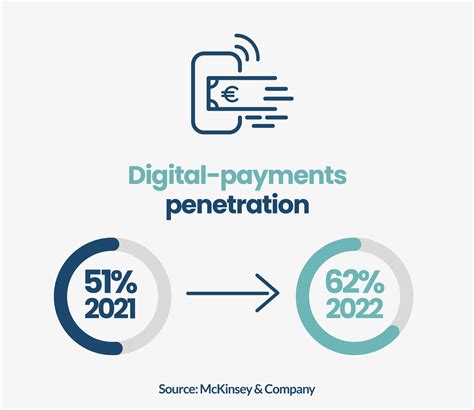

Increased Demand for Digital Payments

The 9/11 attacks accelerated the shift towards digital payments, as people became increasingly concerned about the safety and security of physical transactions. With the rise of online banking and digital payment platforms, consumers began to favor contactless transactions, reducing the need for cash and checks. This shift has had a lasting impact on payment amounts, with digital transactions becoming the norm in many industries.

As a result, payment amounts have become more convenient, faster, and more secure. Digital payment platforms like PayPal, Venmo, and Zelle have simplified the process of sending and receiving money, making it easier for individuals and businesses to manage their finances. This trend has continued to grow, with the COVID-19 pandemic further accelerating the adoption of digital payments.

Rise of Contactless Payments

Contactless payments, which allow users to make transactions without physically touching a payment terminal, have become increasingly popular since 9/11. This trend has been driven by advances in technology, including the introduction of contactless credit cards, mobile payments, and wearables.

Contactless payments have transformed the way people make transactions, reducing the need for cash and increasing the speed of transactions. With contactless payments, consumers can simply tap their card or device on a payment terminal to complete a transaction, making it faster and more convenient.

Growing Importance of Online Security

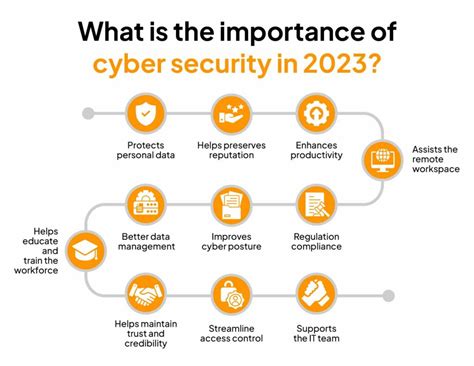

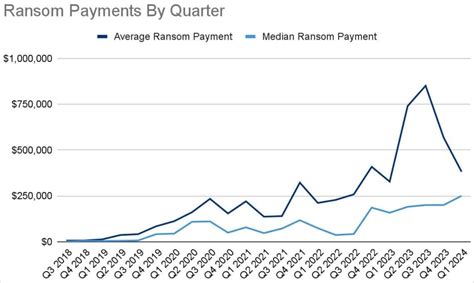

The 9/11 attacks highlighted the importance of online security, as concerns about identity theft and financial fraud grew. In response, payment platforms and financial institutions have implemented robust security measures to protect consumers' sensitive information.

These measures include encryption, two-factor authentication, and advanced threat detection systems. As a result, payment amounts have become more secure, reducing the risk of financial losses due to cybercrime.

Increased Use of Biometric Authentication

Biometric authentication, which uses unique physical characteristics like fingerprints, facial recognition, or voice recognition to verify identities, has become more prevalent since 9/11. This technology has been integrated into various payment platforms, including mobile devices and wearables.

Biometric authentication provides an additional layer of security, making it more difficult for hackers to access sensitive information. As a result, payment amounts have become more secure, reducing the risk of financial losses due to identity theft.

Shift Towards Alternative Forms of Currency

The 9/11 attacks led to a shift towards alternative forms of currency, including cryptocurrencies like Bitcoin and Ethereum. These digital currencies have gained popularity, offering a decentralized and secure way to make transactions.

Cryptocurrencies have transformed the way people think about money, providing an alternative to traditional fiat currencies. While still a relatively new phenomenon, cryptocurrencies have the potential to disrupt the financial industry, changing the way payment amounts are processed and secured.

Increased Focus on Financial Inclusion

The 9/11 attacks highlighted the importance of financial inclusion, as many people were left without access to basic financial services. In response, there has been an increased focus on providing financial services to underserved communities.

Mobile payment platforms and digital wallets have expanded access to financial services, enabling people to send and receive money, make transactions, and access credit. As a result, payment amounts have become more inclusive, providing opportunities for people to participate in the formal economy.

Impact on Consumer Behavior

The 9/11 attacks had a profound impact on consumer behavior, leading to changes in spending habits and financial decision-making. Consumers became more cautious, prioritizing security and convenience when making transactions.

As a result, payment amounts have become more mindful, with consumers taking a more thoughtful approach to their financial decisions. This trend has continued, with the COVID-19 pandemic further accelerating changes in consumer behavior.

Increased Use of Budgeting Tools

Budgeting tools, which help consumers track and manage their expenses, have become more popular since 9/11. These tools provide a clear picture of spending habits, enabling consumers to make informed financial decisions.

With the rise of digital payment platforms and mobile banking apps, consumers have access to a range of budgeting tools, making it easier to manage their finances. As a result, payment amounts have become more intentional, reducing the risk of financial stress and promoting financial well-being.

Payment Amounts Image Gallery

In conclusion, the 9/11 attacks had a profound impact on payment amounts, driving changes in consumer behavior, technological innovation, and regulatory responses. As we continue to navigate the complexities of the digital economy, it's essential to stay informed about the trends and innovations shaping the way we make transactions. Share your thoughts on how 9/11 changed payment amounts, and how you think the future of payments will unfold.