Prepaid expenses are a common occurrence in many businesses, and tracking them accurately is essential for financial reporting and decision-making. Excel can be a powerful tool for tracking prepaid expenses, and in this article, we will explore five ways to do so.

Accurate tracking of prepaid expenses is crucial for businesses to ensure that they are properly accounted for and matched against the corresponding revenue or expenses. Prepaid expenses can include items such as rent, insurance, and subscriptions, which are paid in advance but expensed over a period of time. By using Excel to track prepaid expenses, businesses can streamline their accounting processes, reduce errors, and gain valuable insights into their financial performance.

Using Excel to track prepaid expenses can also help businesses to improve their budgeting and forecasting capabilities. By accurately tracking prepaid expenses, businesses can better anticipate future expenses and make informed decisions about resource allocation.

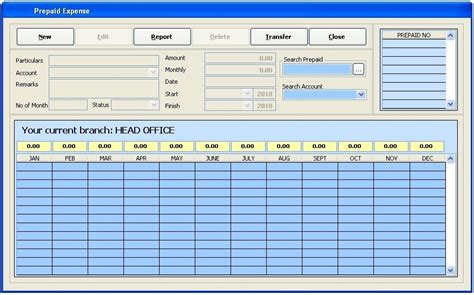

Method 1: Using a Simple Prepaid Expense Template

One of the simplest ways to track prepaid expenses in Excel is to use a pre-designed template. A prepaid expense template can be created to track the date of payment, the amount paid, the expense account, and the date range over which the expense will be amortized.

For example, let's say a business pays an annual insurance premium of $12,000 on January 1st, which will be expensed over the next 12 months. Using a prepaid expense template, the business can record the payment as follows:

| Date | Amount | Expense Account | Amortization Period |

|---|---|---|---|

| 01/01/2023 | $12,000 | Insurance | 01/01/2023 - 12/31/2023 |

By using a prepaid expense template, businesses can quickly and easily track their prepaid expenses and ensure that they are properly accounted for.

How to Create a Prepaid Expense Template in Excel

Creating a prepaid expense template in Excel is a straightforward process. Here are the steps:

- Open a new Excel spreadsheet and create a table with the following columns: Date, Amount, Expense Account, and Amortization Period.

- Enter the prepaid expense details into the table, including the date of payment, the amount paid, the expense account, and the date range over which the expense will be amortized.

- Format the table to make it easy to read and understand.

- Save the template for future use.

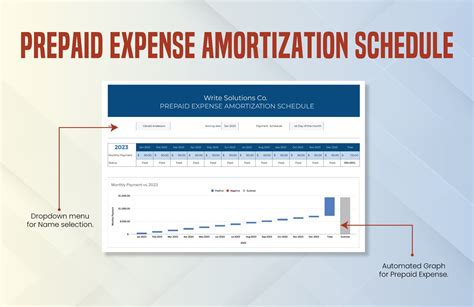

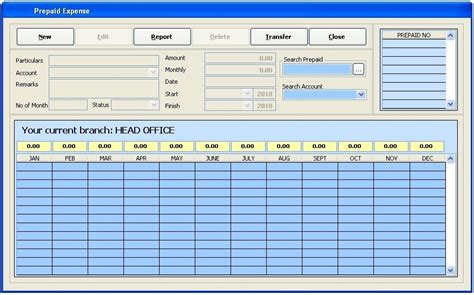

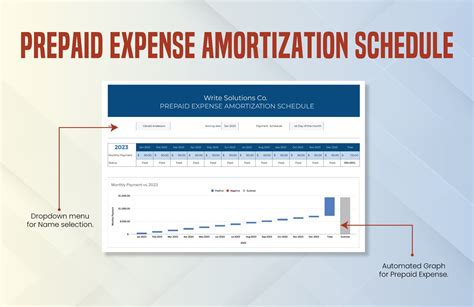

Method 2: Using a Prepaid Expense Amortization Schedule

Another way to track prepaid expenses in Excel is to use a prepaid expense amortization schedule. A prepaid expense amortization schedule is a table that shows the monthly amortization of a prepaid expense over a specified period.

For example, let's say a business pays an annual software subscription fee of $6,000 on January 1st, which will be expensed over the next 12 months. Using a prepaid expense amortization schedule, the business can track the monthly amortization of the expense as follows:

| Month | Amortization Amount |

|---|---|

| January | $500 |

| February | $500 |

| March | $500 |

| ... | ... |

By using a prepaid expense amortization schedule, businesses can easily track the monthly amortization of their prepaid expenses and ensure that they are properly accounted for.

How to Create a Prepaid Expense Amortization Schedule in Excel

Creating a prepaid expense amortization schedule in Excel is a simple process. Here are the steps:

- Open a new Excel spreadsheet and create a table with the following columns: Month and Amortization Amount.

- Enter the prepaid expense details into the table, including the monthly amortization amount.

- Format the table to make it easy to read and understand.

- Save the schedule for future use.

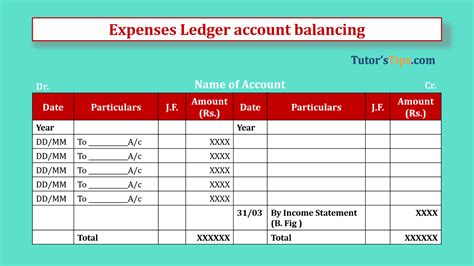

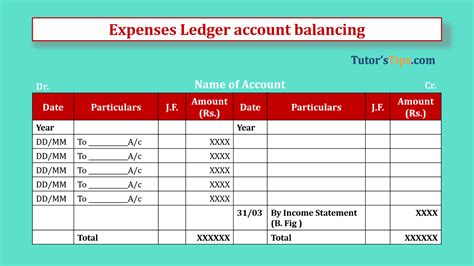

Method 3: Using a Prepaid Expense Ledger

A prepaid expense ledger is a comprehensive tracking system that allows businesses to record and track all prepaid expenses in one place. A prepaid expense ledger can be created in Excel to track the date of payment, the amount paid, the expense account, and the date range over which the expense will be amortized.

For example, let's say a business pays an annual rent payment of $24,000 on January 1st, which will be expensed over the next 12 months. Using a prepaid expense ledger, the business can record the payment as follows:

| Date | Amount | Expense Account | Amortization Period |

|---|---|---|---|

| 01/01/2023 | $24,000 | Rent | 01/01/2023 - 12/31/2023 |

By using a prepaid expense ledger, businesses can easily track all their prepaid expenses in one place and ensure that they are properly accounted for.

How to Create a Prepaid Expense Ledger in Excel

Creating a prepaid expense ledger in Excel is a straightforward process. Here are the steps:

- Open a new Excel spreadsheet and create a table with the following columns: Date, Amount, Expense Account, and Amortization Period.

- Enter the prepaid expense details into the table, including the date of payment, the amount paid, the expense account, and the date range over which the expense will be amortized.

- Format the table to make it easy to read and understand.

- Save the ledger for future use.

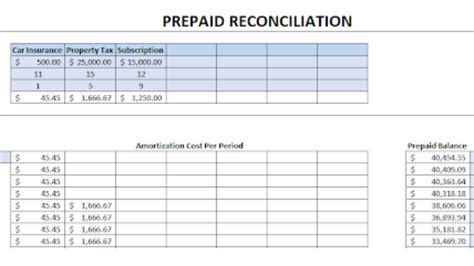

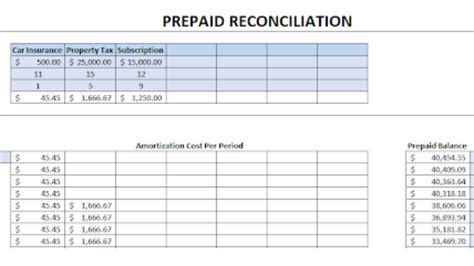

Method 4: Using a Prepaid Expense Reconciliation Template

A prepaid expense reconciliation template is a useful tool for businesses to reconcile their prepaid expenses with their general ledger accounts. A prepaid expense reconciliation template can be created in Excel to track the prepaid expenses, the corresponding general ledger accounts, and the reconciliation differences.

For example, let's say a business pays an annual insurance premium of $12,000 on January 1st, which will be expensed over the next 12 months. Using a prepaid expense reconciliation template, the business can reconcile the prepaid expense with the corresponding general ledger account as follows:

| Prepaid Expense | General Ledger Account | Reconciliation Difference |

|---|---|---|

| Insurance | Insurance Expense | $0 |

By using a prepaid expense reconciliation template, businesses can easily reconcile their prepaid expenses with their general ledger accounts and ensure that they are properly accounted for.

How to Create a Prepaid Expense Reconciliation Template in Excel

Creating a prepaid expense reconciliation template in Excel is a simple process. Here are the steps:

- Open a new Excel spreadsheet and create a table with the following columns: Prepaid Expense, General Ledger Account, and Reconciliation Difference.

- Enter the prepaid expense details into the table, including the prepaid expense account, the corresponding general ledger account, and the reconciliation difference.

- Format the table to make it easy to read and understand.

- Save the template for future use.

Method 5: Using a Prepaid Expense Dashboard

A prepaid expense dashboard is a visual tool that allows businesses to track and analyze their prepaid expenses in real-time. A prepaid expense dashboard can be created in Excel to track the prepaid expenses, the corresponding general ledger accounts, and the reconciliation differences.

For example, let's say a business pays an annual software subscription fee of $6,000 on January 1st, which will be expensed over the next 12 months. Using a prepaid expense dashboard, the business can track the prepaid expense as follows:

| Prepaid Expense | General Ledger Account | Reconciliation Difference |

|---|---|---|

| Software Subscription | Software Expense | $0 |

By using a prepaid expense dashboard, businesses can easily track and analyze their prepaid expenses in real-time and make informed decisions about resource allocation.

How to Create a Prepaid Expense Dashboard in Excel

Creating a prepaid expense dashboard in Excel is a simple process. Here are the steps:

- Open a new Excel spreadsheet and create a table with the following columns: Prepaid Expense, General Ledger Account, and Reconciliation Difference.

- Enter the prepaid expense details into the table, including the prepaid expense account, the corresponding general ledger account, and the reconciliation difference.

- Use Excel's built-in dashboard tools to create a visual dashboard that displays the prepaid expenses in real-time.

- Format the dashboard to make it easy to read and understand.

- Save the dashboard for future use.

Prepaid Expense Image Gallery

By using one of these five methods, businesses can accurately track their prepaid expenses and ensure that they are properly accounted for. Whether you choose to use a simple prepaid expense template, a prepaid expense amortization schedule, a prepaid expense ledger, a prepaid expense reconciliation template, or a prepaid expense dashboard, Excel can help you streamline your accounting processes and make informed decisions about resource allocation.

We hope this article has been helpful in explaining the different ways to track prepaid expenses in Excel. If you have any questions or need further assistance, please don't hesitate to ask.