Intro

Master creating a prepaid expense schedule in Excel with these 5 easy-to-follow methods. Learn how to efficiently manage prepaid assets, calculate amortization, and automate journal entries. Boost your accounting skills with step-by-step tutorials and examples, covering prepaid expense tracking, accruals, and more.

Managing prepaid expenses is a crucial aspect of financial management for businesses. Prepaid expenses are payments made for goods or services that will be received in the future. A prepaid expense schedule helps you keep track of these expenses and ensure that they are properly accounted for in your financial statements. In this article, we will explore five ways to create a prepaid expense schedule in Excel.

Understanding Prepaid Expenses

Before we dive into creating a prepaid expense schedule, it's essential to understand what prepaid expenses are and how they work. Prepaid expenses are payments made for goods or services that will be received in the future. These expenses are typically recorded as assets on the balance sheet until they are used or expired.

For example, if a company pays $12,000 for a year's worth of insurance premiums in advance, the payment would be recorded as a prepaid expense. Each month, the company would recognize $1,000 of the prepaid expense as an actual expense on the income statement.

Method 1: Using a Simple Table

The first method to create a prepaid expense schedule in Excel is by using a simple table. This method is suitable for small businesses with few prepaid expenses.

- Create a table with the following columns: Date, Description, Amount, and Remaining Balance.

- Enter the date, description, and amount of each prepaid expense.

- Calculate the remaining balance by subtracting the actual expenses from the prepaid amount.

- Use formulas to calculate the actual expenses and remaining balance for each period.

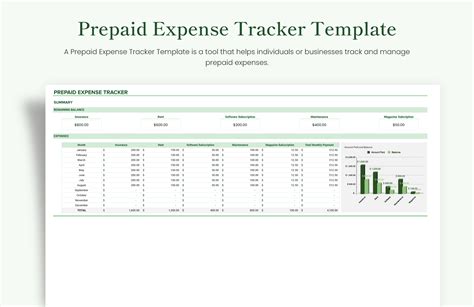

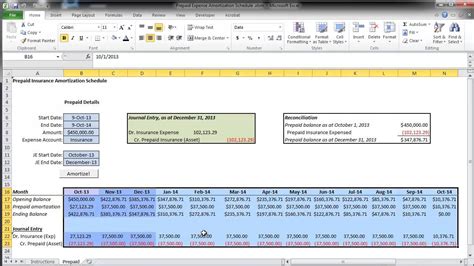

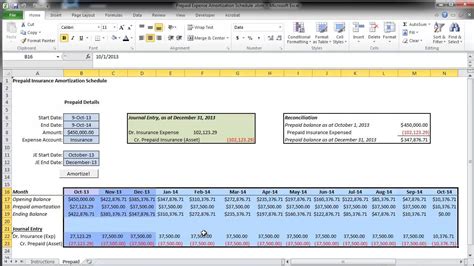

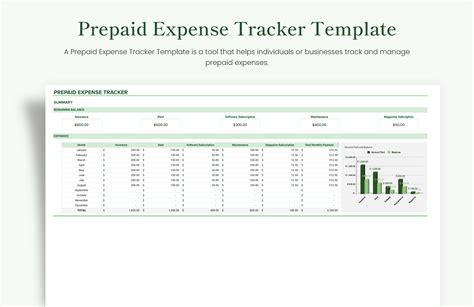

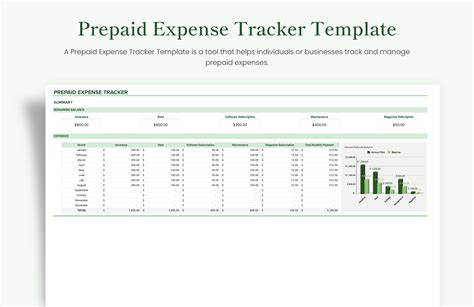

Method 2: Using a Prepaid Expense Template

The second method is to use a prepaid expense template. This method is suitable for businesses with multiple prepaid expenses.

- Download a prepaid expense template from the internet or create your own template.

- Enter the prepaid expenses into the template, including the date, description, and amount.

- The template will automatically calculate the actual expenses and remaining balance for each period.

Method 3: Using a Pivot Table

The third method is to use a pivot table to create a prepaid expense schedule. This method is suitable for businesses with large amounts of data.

- Create a table with the prepaid expenses, including the date, description, and amount.

- Create a pivot table to summarize the data by date and description.

- Use the pivot table to calculate the actual expenses and remaining balance for each period.

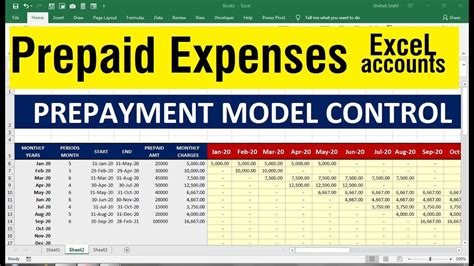

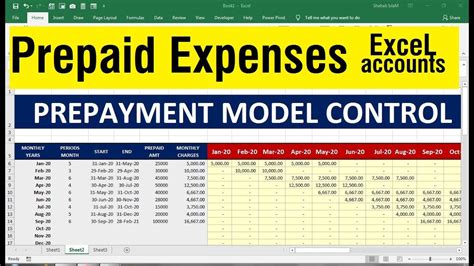

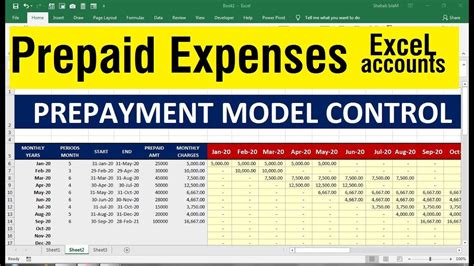

Method 4: Using a Macro

The fourth method is to use a macro to create a prepaid expense schedule. This method is suitable for businesses with complex prepaid expense calculations.

- Create a macro that calculates the actual expenses and remaining balance for each period.

- Use the macro to update the prepaid expense schedule regularly.

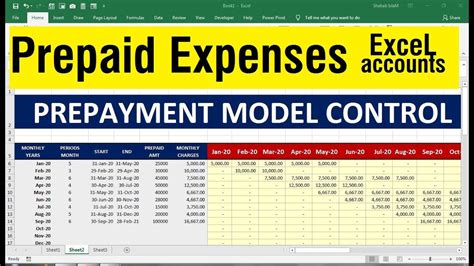

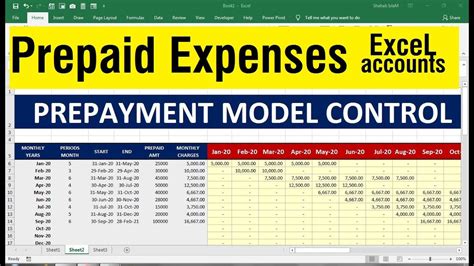

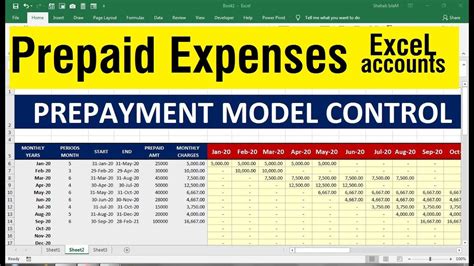

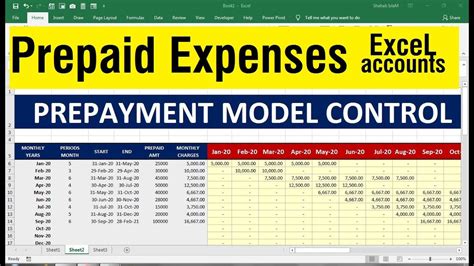

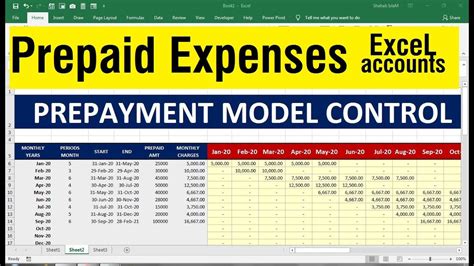

Method 5: Using a Dashboard

The fifth method is to use a dashboard to create a prepaid expense schedule. This method is suitable for businesses with multiple prepaid expenses and complex calculations.

- Create a dashboard that includes charts and tables to summarize the prepaid expenses.

- Use the dashboard to calculate the actual expenses and remaining balance for each period.

Gallery of Prepaid Expense Schedules in Excel

Prepaid Expense Schedule Examples

In conclusion, creating a prepaid expense schedule in Excel can be done in various ways, depending on the complexity of the calculations and the size of the business. By using one of the methods outlined above, businesses can effectively manage their prepaid expenses and ensure accurate financial reporting.

We hope this article has been informative and helpful in creating a prepaid expense schedule in Excel. If you have any questions or need further assistance, please don't hesitate to comment below.