Intro

Unlock the power of present value lump sum calculations with our easy-to-use formula guide. Discover how to determine the current worth of future sums using the present value lump sum formula, and explore concepts like time value of money, discount rates, and compounding. Simplify your financial calculations today!

The present value lump sum formula is a fundamental concept in finance that helps individuals and businesses determine the current value of a future sum of money. Understanding this formula is crucial for making informed decisions about investments, loans, and other financial transactions.

The present value lump sum formula is often denoted as PV, and it represents the amount of money that an individual or business needs to invest today in order to receive a specific amount of money in the future. This formula takes into account the time value of money, which is the idea that a dollar received today is worth more than a dollar received in the future.

The present value lump sum formula is widely used in various fields, including finance, accounting, and economics. It is a key concept in calculating the present value of a future cash flow, which is essential for determining the feasibility of a project or investment.

In this article, we will delve into the details of the present value lump sum formula, including its components, calculation methods, and practical applications. We will also provide examples and illustrations to help you understand this concept better.

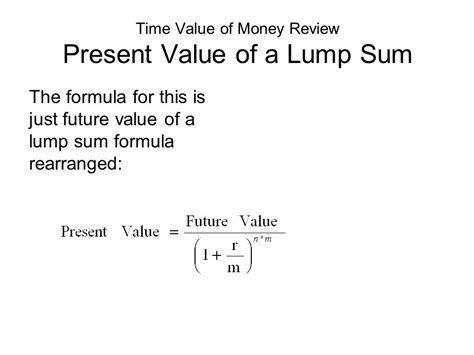

Understanding the Present Value Lump Sum Formula

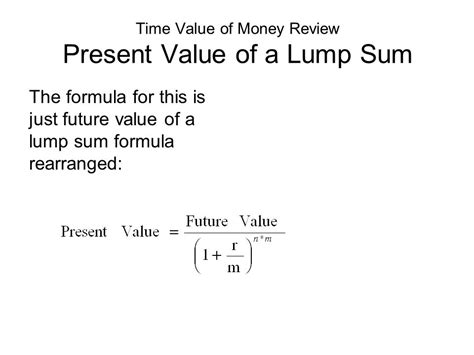

The present value lump sum formula is calculated using the following components:

- Future Value (FV): This is the amount of money that is expected to be received in the future.

- Interest Rate (r): This is the rate at which the money is expected to grow over time.

- Time (n): This is the number of years or periods that the money is expected to grow.

- Present Value (PV): This is the amount of money that needs to be invested today in order to receive the future value.

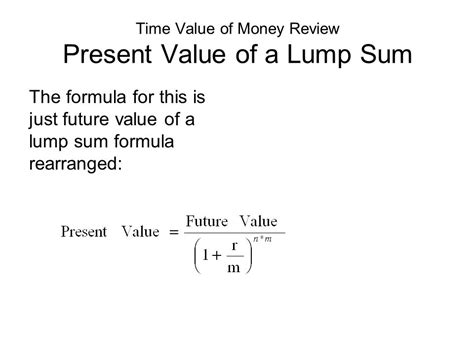

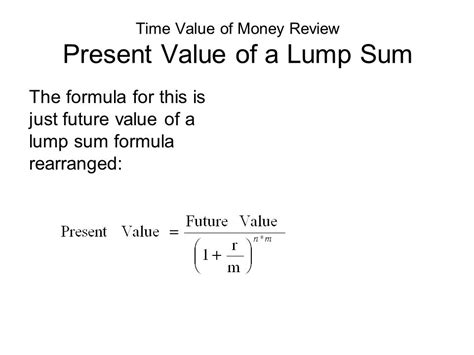

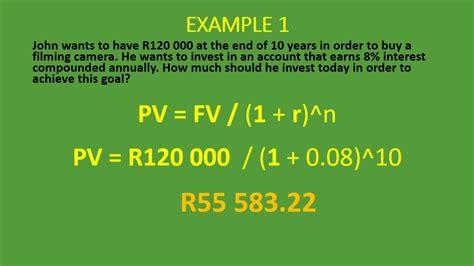

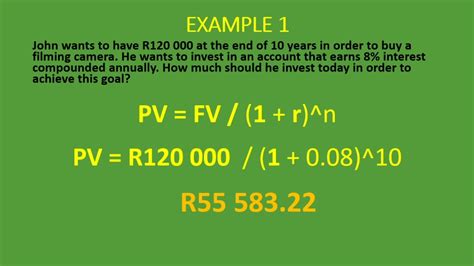

The formula for calculating the present value lump sum is as follows:

PV = FV / (1 + r)^n

Components of the Present Value Lump Sum Formula

In order to calculate the present value lump sum, you need to understand the components of the formula. Here's a breakdown of each component:

- Future Value (FV): This is the amount of money that is expected to be received in the future. For example, if you expect to receive $10,000 in 5 years, the future value is $10,000.

- Interest Rate (r): This is the rate at which the money is expected to grow over time. For example, if the interest rate is 5%, the interest rate is 0.05.

- Time (n): This is the number of years or periods that the money is expected to grow. For example, if the money is expected to grow over 5 years, the time is 5.

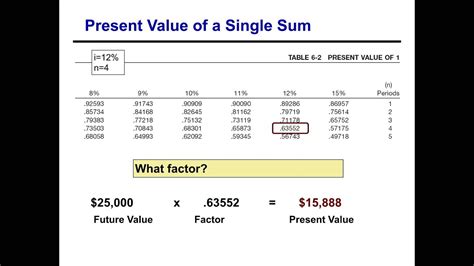

Calculating the Present Value Lump Sum

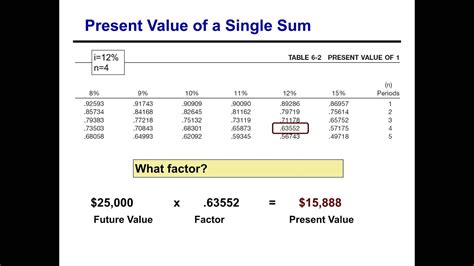

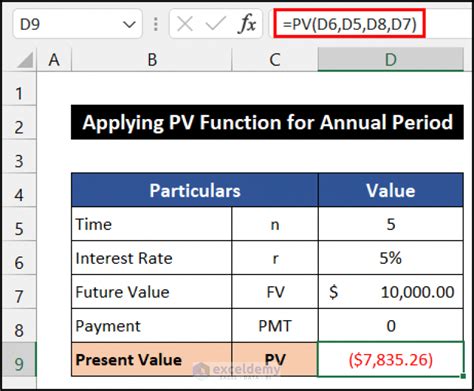

Now that we have understood the components of the present value lump sum formula, let's calculate the present value using an example.

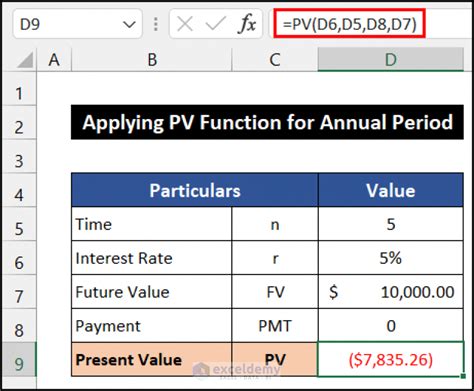

Suppose you expect to receive $10,000 in 5 years, and the interest rate is 5%. What is the present value of this future sum?

Using the formula, we get:

PV = $10,000 / (1 + 0.05)^5 PV = $10,000 / 1.2762815625 PV = $7,835.26

Therefore, the present value of the future sum is $7,835.26.

Practical Applications of the Present Value Lump Sum Formula

The present value lump sum formula has numerous practical applications in finance, accounting, and economics. Here are a few examples:

- Calculating the present value of a future investment: Suppose you are considering investing in a project that is expected to generate $10,000 in 5 years. Using the present value lump sum formula, you can calculate the present value of this future investment and determine whether it is worth investing in.

- Determining the feasibility of a project: The present value lump sum formula can be used to determine the feasibility of a project by calculating the present value of the expected future cash flows.

- Evaluating the cost of a loan: The present value lump sum formula can be used to evaluate the cost of a loan by calculating the present value of the future interest payments.

Gallery of Present Value Lump Sum Formula Illustrations

Present Value Lump Sum Formula Image Gallery

We hope this article has helped you understand the present value lump sum formula and its practical applications. Remember to use this formula to make informed decisions about investments, loans, and other financial transactions. Share your thoughts and comments below!