Intro

Unlock the value of your lease payments with our expert guide. Learn the 5 ways to calculate lease payments present value, including net present value, internal rate of return, and more. Discover how to accurately assess lease options, consider time value of money, and make informed decisions with these essential lease calculation methods.

The present value of lease payments is a crucial concept in finance and accounting, particularly when it comes to lease agreements. Calculating the present value of lease payments can help individuals and businesses understand the true cost of a lease and make informed decisions. In this article, we will explore five ways to calculate the present value of lease payments, along with practical examples and explanations.

Understanding Present Value of Lease Payments

The present value of lease payments refers to the current worth of a series of future lease payments. It takes into account the time value of money, which is the idea that a dollar received today is worth more than a dollar received in the future. Calculating the present value of lease payments helps individuals and businesses determine the total cost of a lease and compare different lease options.

Why is Present Value of Lease Payments Important?

Calculating the present value of lease payments is essential for several reasons:

- It helps individuals and businesses understand the true cost of a lease

- It allows for comparison of different lease options

- It enables individuals and businesses to make informed decisions about leasing

- It is a requirement for financial reporting and accounting purposes

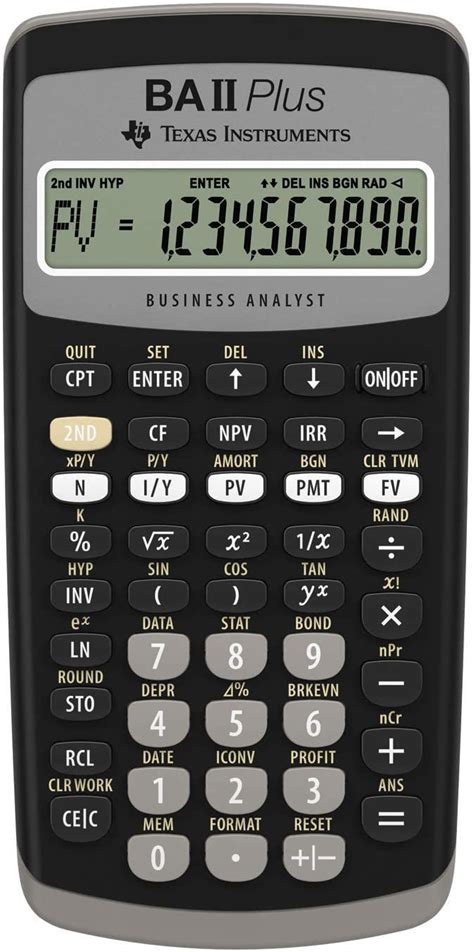

Method 1: Using a Financial Calculator

One way to calculate the present value of lease payments is by using a financial calculator. A financial calculator can quickly and easily calculate the present value of a series of lease payments.

To use a financial calculator, you will need to know the following information:

- The monthly lease payment

- The number of payments

- The interest rate

Once you have this information, you can plug it into the calculator and get the present value of the lease payments.

Example:

Suppose you are leasing a car for $500 per month for 36 months, and the interest rate is 6%. Using a financial calculator, you can calculate the present value of the lease payments as follows:

- Monthly lease payment: $500

- Number of payments: 36

- Interest rate: 6%

The present value of the lease payments would be approximately $14,491.41.

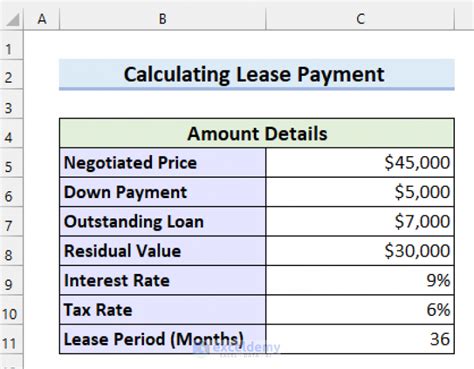

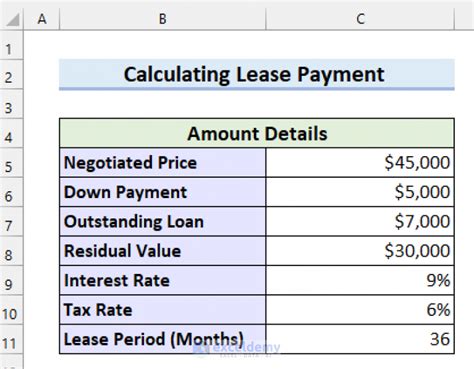

Method 2: Using a Spreadsheet

Another way to calculate the present value of lease payments is by using a spreadsheet program such as Microsoft Excel. A spreadsheet can be used to create a formula that calculates the present value of a series of lease payments.

To use a spreadsheet, you will need to know the following information:

- The monthly lease payment

- The number of payments

- The interest rate

Once you have this information, you can create a formula that calculates the present value of the lease payments.

Example:

Suppose you are leasing a car for $500 per month for 36 months, and the interest rate is 6%. Using a spreadsheet, you can calculate the present value of the lease payments as follows:

- Monthly lease payment: $500

- Number of payments: 36

- Interest rate: 6%

The present value of the lease payments would be approximately $14,491.41.

Method 3: Using a Lease Payment Calculator

A lease payment calculator is an online tool that can be used to calculate the present value of lease payments. A lease payment calculator can be found on various websites and can be used to calculate the present value of a series of lease payments.

To use a lease payment calculator, you will need to know the following information:

- The monthly lease payment

- The number of payments

- The interest rate

Once you have this information, you can plug it into the calculator and get the present value of the lease payments.

Example:

Suppose you are leasing a car for $500 per month for 36 months, and the interest rate is 6%. Using a lease payment calculator, you can calculate the present value of the lease payments as follows:

- Monthly lease payment: $500

- Number of payments: 36

- Interest rate: 6%

The present value of the lease payments would be approximately $14,491.41.

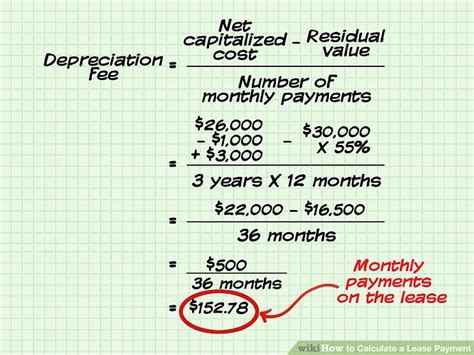

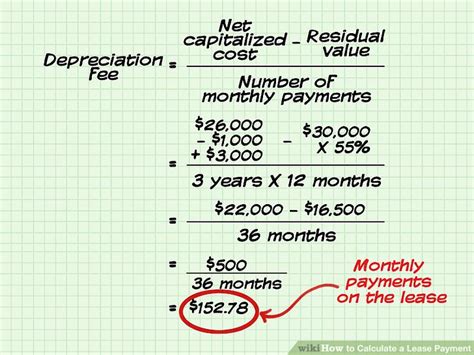

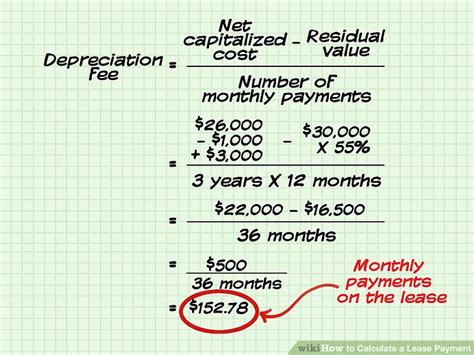

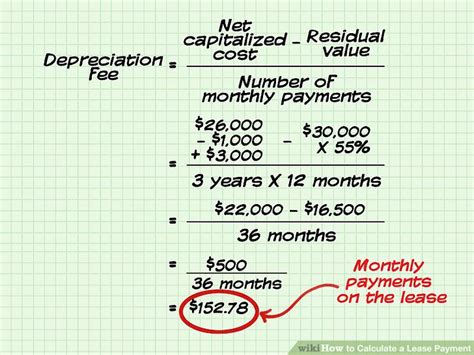

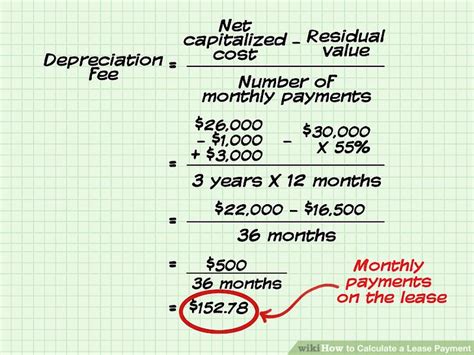

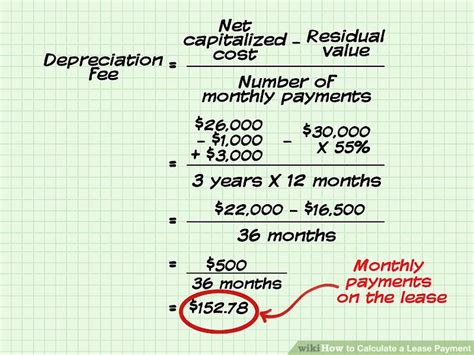

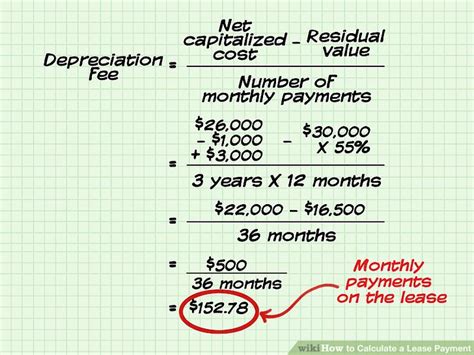

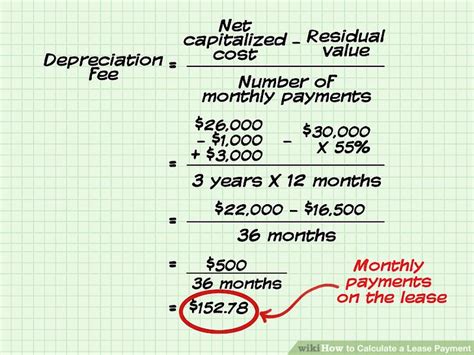

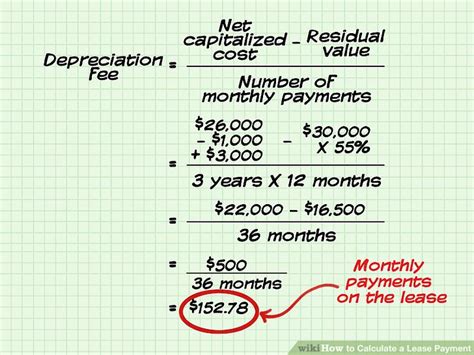

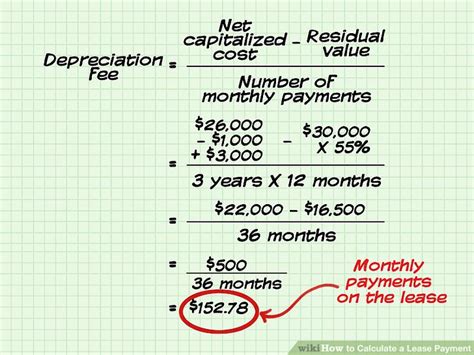

Method 4: Using a Formula

A formula can be used to calculate the present value of lease payments. The formula is as follows:

PV = PMT x [(1 - (1 + r)^(-n)) / r]

Where:

- PV = present value

- PMT = monthly lease payment

- r = interest rate

- n = number of payments

To use the formula, you will need to know the following information:

- The monthly lease payment

- The number of payments

- The interest rate

Once you have this information, you can plug it into the formula and get the present value of the lease payments.

Example:

Suppose you are leasing a car for $500 per month for 36 months, and the interest rate is 6%. Using the formula, you can calculate the present value of the lease payments as follows:

- Monthly lease payment: $500

- Number of payments: 36

- Interest rate: 6%

The present value of the lease payments would be approximately $14,491.41.

Method 5: Using a Financial Software

Financial software such as LeaseQuery or Nakisa can be used to calculate the present value of lease payments. Financial software can be used to create a lease amortization schedule that shows the present value of the lease payments.

To use financial software, you will need to know the following information:

- The monthly lease payment

- The number of payments

- The interest rate

Once you have this information, you can create a lease amortization schedule that shows the present value of the lease payments.

Example:

Suppose you are leasing a car for $500 per month for 36 months, and the interest rate is 6%. Using financial software, you can create a lease amortization schedule that shows the present value of the lease payments as follows:

- Monthly lease payment: $500

- Number of payments: 36

- Interest rate: 6%

The present value of the lease payments would be approximately $14,491.41.

Gallery of Lease Payment Calculations

Lease Payment Calculations Image Gallery

In conclusion, calculating the present value of lease payments is an essential task that can help individuals and businesses understand the true cost of a lease. There are several methods that can be used to calculate the present value of lease payments, including using a financial calculator, spreadsheet, lease payment calculator, formula, and financial software. Each method has its own advantages and disadvantages, and the choice of method depends on the specific needs and requirements of the individual or business.