Intro

Improve your credit score with a 609 letter template. Learn 7 effective ways to use this powerful tool to dispute errors, remove negative marks, and restore your financial health. Discover how to write a 609 letter, what to include, and how to optimize it for maximum impact, including credit repair, credit reporting, and dispute resolution.

Having a good credit score is essential for getting approved for loans, credit cards, and other forms of credit. However, errors on your credit report can negatively impact your credit score, making it harder to get approved for credit. One way to dispute errors on your credit report is by using a 609 letter template. In this article, we will explore 7 ways to use a 609 letter template to improve your credit score.

What is a 609 Letter Template?

A 609 letter template is a type of dispute letter that you can use to challenge errors on your credit report. The letter is based on Section 609 of the Fair Credit Reporting Act (FCRA), which requires credit reporting agencies to verify the accuracy of the information on your credit report.

7 Ways to Use a 609 Letter Template

1. Dispute Inaccurate Information

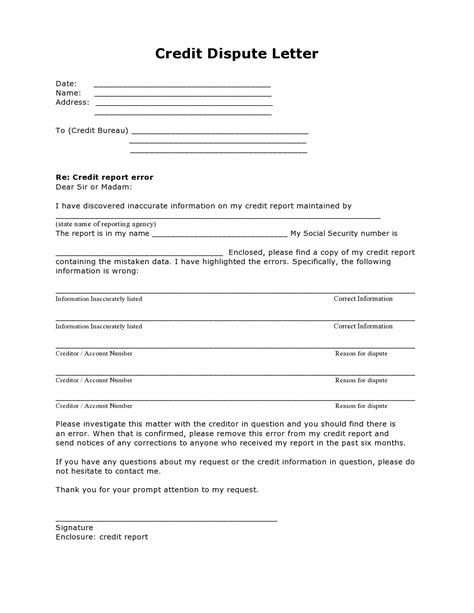

One of the most common ways to use a 609 letter template is to dispute inaccurate information on your credit report. If you notice errors on your report, such as incorrect addresses, dates of birth, or Social Security numbers, you can use a 609 letter to dispute the information.

For example, if your credit report shows an incorrect address, you can use a 609 letter to dispute the information and request that it be corrected.

- Sample 609 letter template: "Dear [Credit Reporting Agency], I am writing to dispute the inaccurate information on my credit report. The address listed on my report is incorrect. My correct address is [insert correct address]. Please verify the accuracy of the information on my report and correct any errors. Sincerely, [Your Name]"

2. Remove Late Payments

Late payments can significantly lower your credit score. If you have late payments on your credit report that are incorrect, you can use a 609 letter to dispute them.

For example, if you made a payment on time, but the creditor reported it as late, you can use a 609 letter to dispute the information.

- Sample 609 letter template: "Dear [Credit Reporting Agency], I am writing to dispute the late payment on my credit report. I made the payment on time, but it was reported as late. Please verify the accuracy of the information on my report and correct any errors. Sincerely, [Your Name]"

3. Dispute Collections

Collections can also negatively impact your credit score. If you have collections on your credit report that are incorrect, you can use a 609 letter to dispute them.

For example, if a creditor reported a collection that you do not owe, you can use a 609 letter to dispute the information.

- Sample 609 letter template: "Dear [Credit Reporting Agency], I am writing to dispute the collection on my credit report. I do not owe the debt and it was reported in error. Please verify the accuracy of the information on my report and correct any errors. Sincerely, [Your Name]"

4. Remove Public Records

Public records, such as bankruptcies and foreclosures, can significantly lower your credit score. If you have public records on your credit report that are incorrect, you can use a 609 letter to dispute them.

For example, if you filed for bankruptcy, but it was discharged, you can use a 609 letter to dispute the information.

- Sample 609 letter template: "Dear [Credit Reporting Agency], I am writing to dispute the public record on my credit report. I filed for bankruptcy, but it was discharged. Please verify the accuracy of the information on my report and correct any errors. Sincerely, [Your Name]"

5. Dispute Credit Inquiries

Credit inquiries can also negatively impact your credit score. If you have credit inquiries on your credit report that are incorrect, you can use a 609 letter to dispute them.

For example, if you did not apply for credit, but there is an inquiry on your report, you can use a 609 letter to dispute the information.

- Sample 609 letter template: "Dear [Credit Reporting Agency], I am writing to dispute the credit inquiry on my credit report. I did not apply for credit and the inquiry was reported in error. Please verify the accuracy of the information on my report and correct any errors. Sincerely, [Your Name]"

6. Remove Old Accounts

Old accounts can remain on your credit report for up to 7 years. If you have old accounts on your credit report that are incorrect, you can use a 609 letter to dispute them.

For example, if you paid off an old debt, but it is still reporting on your credit report, you can use a 609 letter to dispute the information.

- Sample 609 letter template: "Dear [Credit Reporting Agency], I am writing to dispute the old account on my credit report. I paid off the debt and it should be removed from my report. Please verify the accuracy of the information on my report and correct any errors. Sincerely, [Your Name]"

7. Dispute Credit Reporting Agency Errors

Credit reporting agencies are not perfect and can make errors. If you notice errors on your credit report, such as incorrect credit scores or credit limits, you can use a 609 letter to dispute them.

For example, if your credit report shows an incorrect credit score, you can use a 609 letter to dispute the information.

- Sample 609 letter template: "Dear [Credit Reporting Agency], I am writing to dispute the error on my credit report. My credit score is incorrect and I request that it be corrected. Please verify the accuracy of the information on my report and correct any errors. Sincerely, [Your Name]"

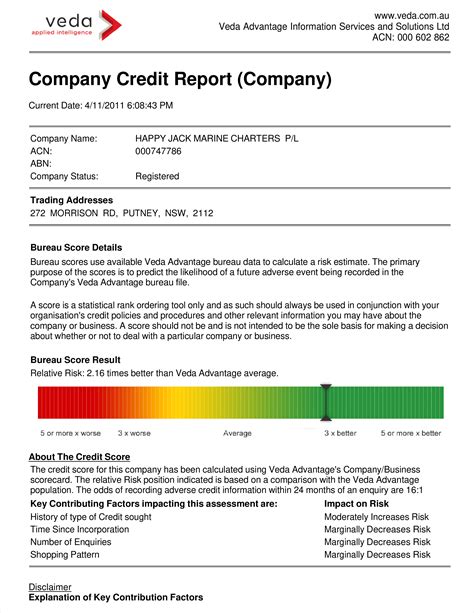

Gallery of Credit Report Images

Credit Report Image Gallery

By using a 609 letter template, you can dispute errors on your credit report and improve your credit score. Remember to always keep a copy of your dispute letter and follow up with the credit reporting agency to ensure that the errors are corrected.

If you have any questions or need help with disputing errors on your credit report, please comment below. Share this article with others who may be struggling with credit report errors.