Intro

Learn how to create a 501c3 donation receipt template with our expert guide. Discover 5 essential ways to craft a compliant and effective receipt, including formatting, required elements, and acknowledgment statements. Boost donor trust and simplify tax deductions with a well-designed receipt, and stay IRS-compliant with ease.

Creating a 501c3 donation receipt template is an essential step for non-profit organizations to acknowledge and appreciate their donors' contributions. A well-designed receipt not only shows gratitude but also provides essential documentation for tax purposes. In this article, we will explore five ways to create a 501c3 donation receipt template that is both professional and effective.

Donation receipts are a crucial aspect of non-profit accounting and donor relations. They serve as proof of a donor's contribution, which can be used for tax deduction purposes. A receipt also provides an opportunity for non-profits to express their appreciation for the donor's support. By creating a 501c3 donation receipt template, non-profits can streamline their donation acknowledgement process and ensure compliance with IRS regulations.

Understanding the IRS Requirements

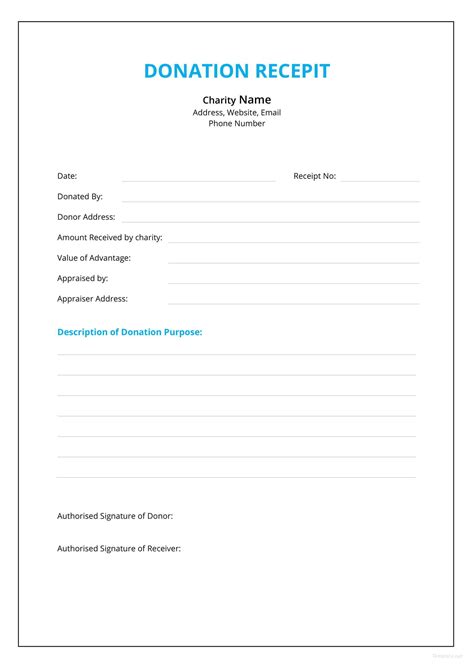

Before creating a 501c3 donation receipt template, it's essential to understand the IRS requirements for donation receipts. According to the IRS, a donation receipt must include the following information:

- The name and address of the donor

- The date and amount of the donation

- A description of the donation (e.g., cash, goods, or services)

- A statement indicating whether any goods or services were provided in exchange for the donation

- The name and address of the non-profit organization

5 Ways to Create a 501c3 Donation Receipt Template

Here are five ways to create a 501c3 donation receipt template that meets the IRS requirements:

1. Use a Word Processing Software

You can create a donation receipt template using a word processing software like Microsoft Word or Google Docs. Create a new document and add the required fields, such as the donor's name and address, date, and amount of the donation. You can also add a logo and a statement of appreciation.

2. Utilize Online Templates

There are many online templates available that can help you create a 501c3 donation receipt template. Websites like Canva, Template.net, and Vertex42 offer a range of templates that are specifically designed for non-profit organizations. You can customize these templates to fit your organization's brand and needs.

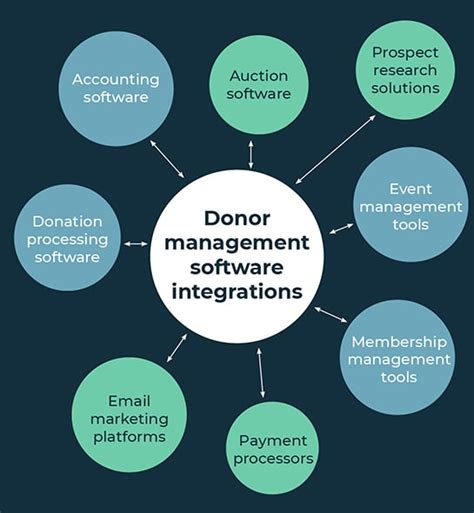

3. Leverage Donor Management Software

Donor management software like DonorPerfect, Network for Good, and Qgiv often include built-in receipt templates that meet the IRS requirements. These templates can be customized to fit your organization's brand and can be easily sent to donors via email or mail.

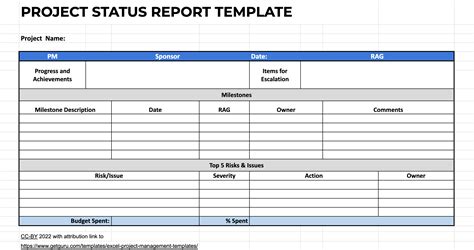

4. Create a Spreadsheet Template

You can create a donation receipt template using a spreadsheet software like Microsoft Excel or Google Sheets. Create a new spreadsheet and add columns for the required fields, such as the donor's name and address, date, and amount of the donation. You can then use formulas to automatically populate the fields.

5. Use a Non-Profit Accounting Software

Non-profit accounting software like QuickBooks, Xero, and Aplos often include built-in receipt templates that meet the IRS requirements. These templates can be customized to fit your organization's brand and can be easily sent to donors via email or mail.

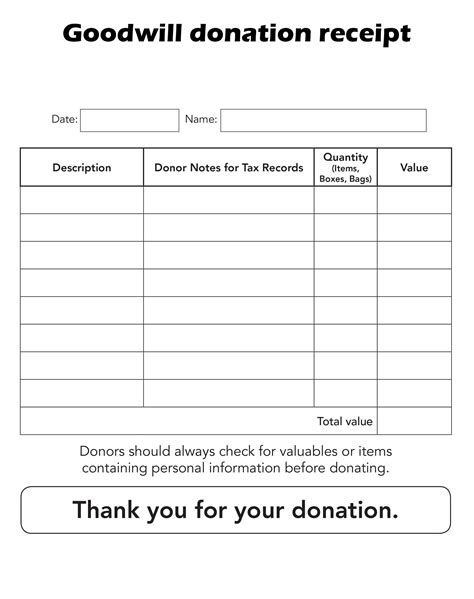

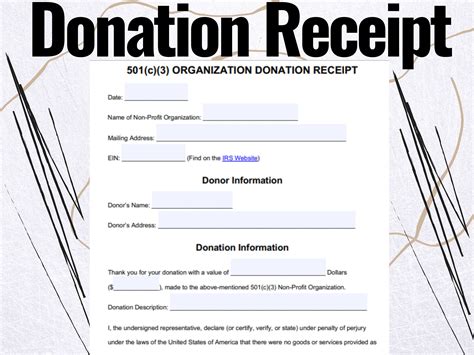

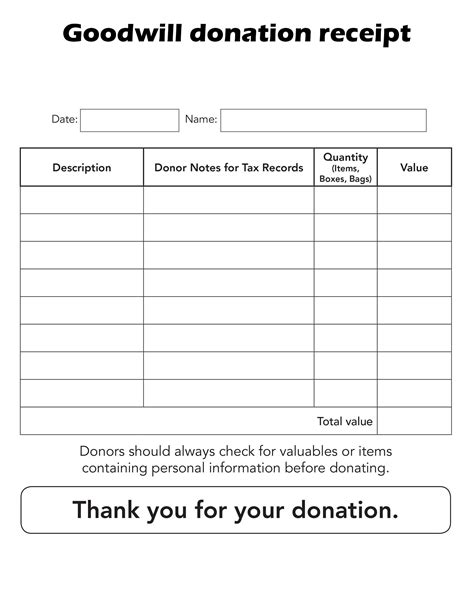

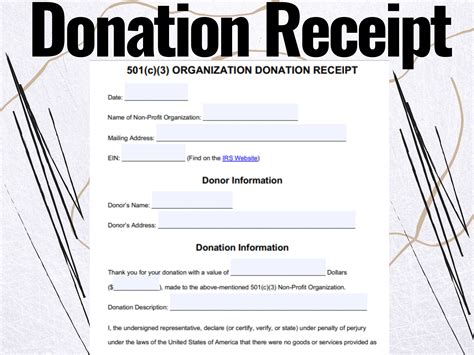

Gallery of Donation Receipt Templates

Donation Receipt Template Examples

Conclusion

Creating a 501c3 donation receipt template is an essential step for non-profit organizations to acknowledge and appreciate their donors' contributions. By understanding the IRS requirements and using one of the five methods outlined above, non-profits can create a professional and effective donation receipt template. Remember to customize the template to fit your organization's brand and needs, and to include the required fields to ensure compliance with IRS regulations.

We hope this article has provided you with the necessary information to create a 501c3 donation receipt template that meets your organization's needs. If you have any further questions or would like to share your experiences, please leave a comment below.