Intro

Learn how to dispute errors on your credit report with a free 609 letter template. Discover the power of Section 609 of the Fair Credit Reporting Act and how to use it to remove negative marks. Get expert tips on crafting a effective credit dispute letter and improve your credit score with our downloadable template.

Maintaining good credit is crucial for securing loans, credit cards, and other financial opportunities. Unfortunately, errors on credit reports can negatively impact credit scores. The good news is that you can dispute these errors with the credit reporting agencies (CRAs). One effective way to do this is by using a 609 letter template for credit dispute.

The Fair Credit Reporting Act (FCRA) requires CRAs to investigate disputes and correct errors within 30 days. A 609 letter is a formal request to dispute an error on your credit report, and it can be an essential tool in maintaining your credit health.

Why Credit Disputes Matter

Credit disputes are essential for several reasons:

- Errors on credit reports can lower your credit score, making it harder to secure loans or credit cards.

- Credit disputes can help you remove negative marks, such as late payments or collections, from your credit report.

- Disputing errors on your credit report can improve your credit utilization ratio, which can positively impact your credit score.

How to Write a 609 Letter

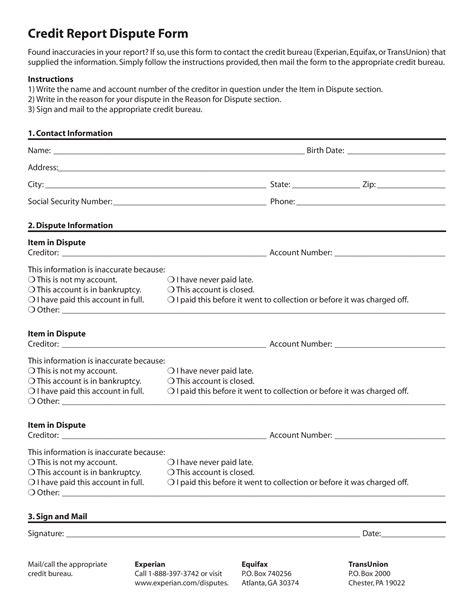

A 609 letter is a formal request to dispute an error on your credit report. Here's a step-by-step guide on how to write a 609 letter:

- Get a copy of your credit report: Obtain a copy of your credit report from the three major CRAs: Equifax, Experian, and TransUnion.

- Identify the error: Review your credit report and identify the error you want to dispute.

- Gather supporting documents: Collect any supporting documents, such as receipts, invoices, or court documents, that prove the error.

- Use a 609 letter template: Use a 609 letter template as a guide to write your dispute letter.

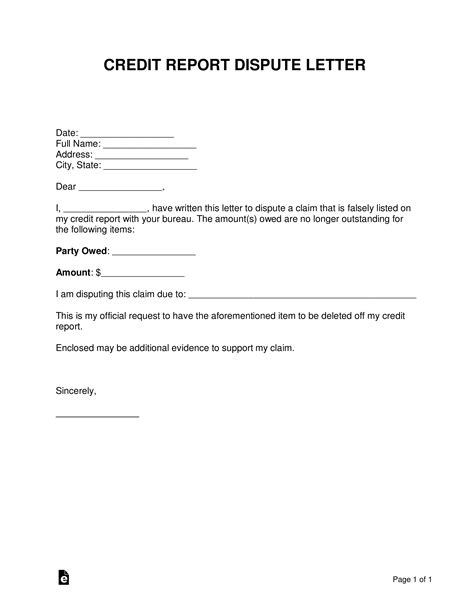

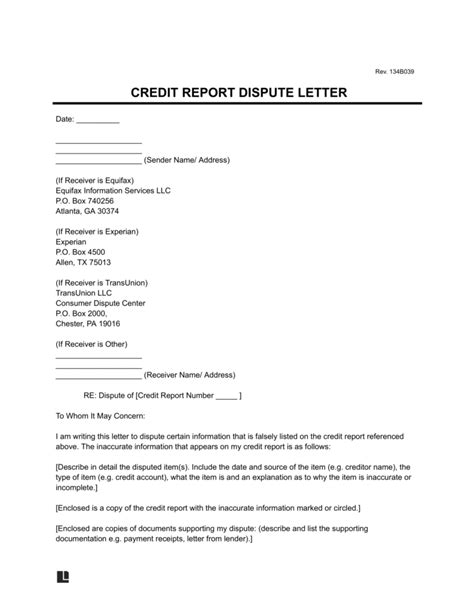

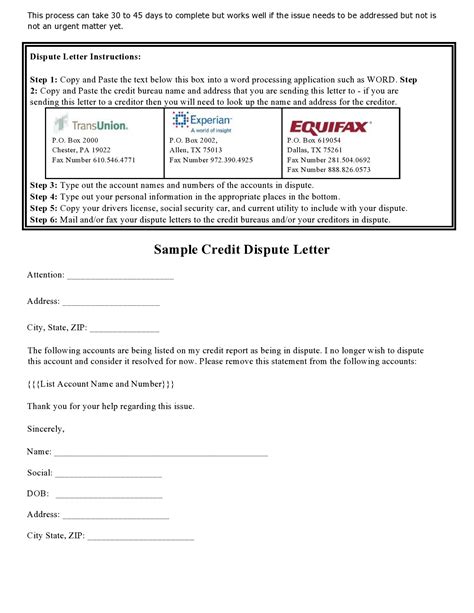

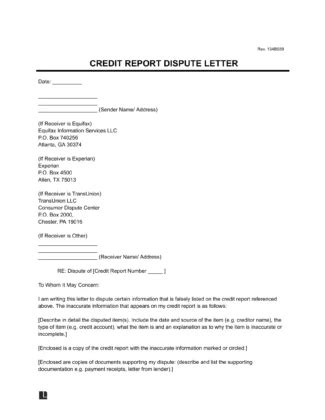

609 Letter Template for Credit Dispute

Here's a sample 609 letter template for credit dispute:

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Date]

[Credit Reporting Agency's Name] [Credit Reporting Agency's Address] [City, State, ZIP]

Dear [Credit Reporting Agency's Representative],

Re: Dispute of Error on Credit Report

I am writing to dispute an error on my credit report, which was provided to me on [Date]. The error is [ specify the error, e.g., "a late payment marked on my account with [Creditor's Name]"].

After reviewing my credit report, I found that [ specify the error and provide supporting documents]. I request that you investigate this dispute and correct the error on my credit report.

Please find attached the following supporting documents:

- [List the supporting documents, e.g., "receipts, invoices, court documents"]

I would appreciate it if you could investigate this dispute and correct the error on my credit report within 30 days, as required by the Fair Credit Reporting Act.

Please update my credit report to reflect the corrected information. I also request a copy of my updated credit report.

Thank you for your prompt attention to this matter. If you require any additional information, please do not hesitate to contact me.

Sincerely,

[Your Signature] [Your Name]

Tips for Writing a 609 Letter

Here are some tips for writing a 609 letter:

- Be clear and concise in your dispute letter.

- Provide supporting documents to prove the error.

- Keep a copy of your dispute letter and supporting documents.

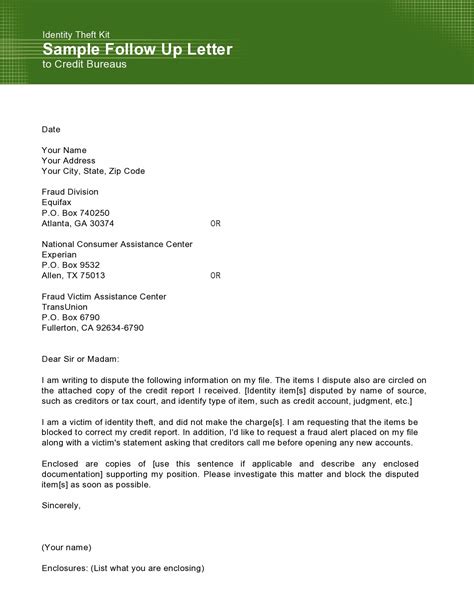

- Send your dispute letter via certified mail with a return receipt requested.

- Follow up with the credit reporting agency if you don't receive a response within 30 days.

What to Expect After Sending a 609 Letter

After sending a 609 letter, you can expect the following:

- The credit reporting agency will investigate your dispute and correct the error on your credit report within 30 days.

- You will receive a copy of your updated credit report.

- If the credit reporting agency finds that the error is valid, they will remove the error from your credit report.

Additional Resources

Here are some additional resources to help you with credit disputes:

- Federal Trade Commission (FTC): www.ftc.gov

- Credit Reporting Agency's websites: www.equifax.com, www.experian.com, www.transunion.com

Gallery of Credit Dispute Templates

Credit Dispute Templates

Frequently Asked Questions

Here are some frequently asked questions about 609 letters and credit disputes:

- What is a 609 letter? A 609 letter is a formal request to dispute an error on your credit report.

- How do I write a 609 letter? Use a 609 letter template as a guide to write your dispute letter.

- What documents do I need to support my dispute? Provide supporting documents, such as receipts, invoices, or court documents, to prove the error.

- How long does it take to resolve a credit dispute? The credit reporting agency must investigate and correct the error within 30 days.

Conclusion

A 609 letter is a powerful tool for disputing errors on your credit report. By using a 609 letter template and providing supporting documents, you can effectively dispute errors and improve your credit score. Remember to follow up with the credit reporting agency if you don't receive a response within 30 days. With persistence and the right tools, you can maintain good credit health and achieve your financial goals.

Actionable Steps

Here are some actionable steps you can take to dispute errors on your credit report:

- Obtain a copy of your credit report from the three major credit reporting agencies.

- Identify the error on your credit report.

- Gather supporting documents to prove the error.

- Use a 609 letter template to write your dispute letter.

- Send your dispute letter via certified mail with a return receipt requested.

- Follow up with the credit reporting agency if you don't receive a response within 30 days.

Share Your Thoughts

Have you ever disputed an error on your credit report? Share your experience in the comments below.