Intro

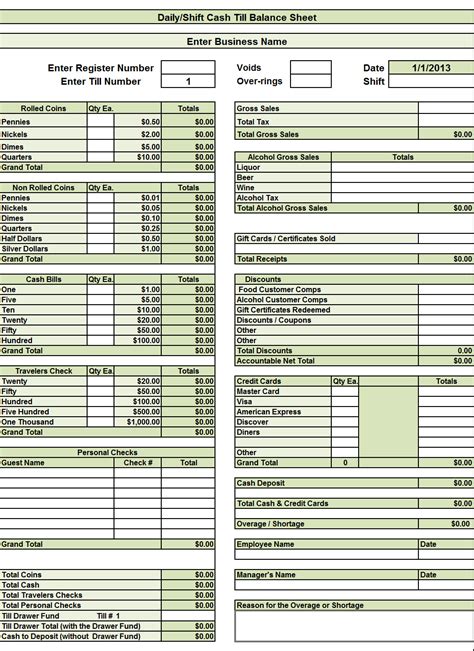

As a retail business owner or manager, you understand the importance of maintaining accurate financial records, particularly when it comes to balancing your till. A shift sheet is a valuable tool that helps you keep track of cash transactions, credit card sales, and other forms of payment. In this article, we'll explore five ways to balance your till with a shift sheet, ensuring that your financial records are accurate and up-to-date.

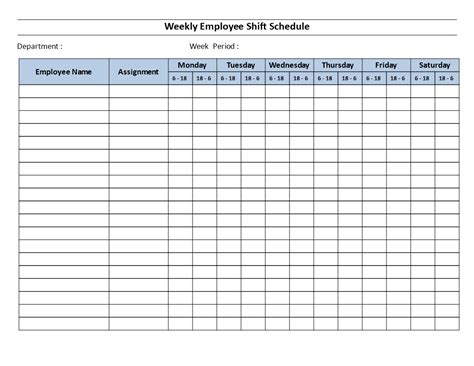

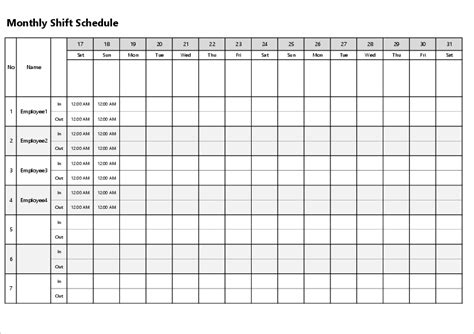

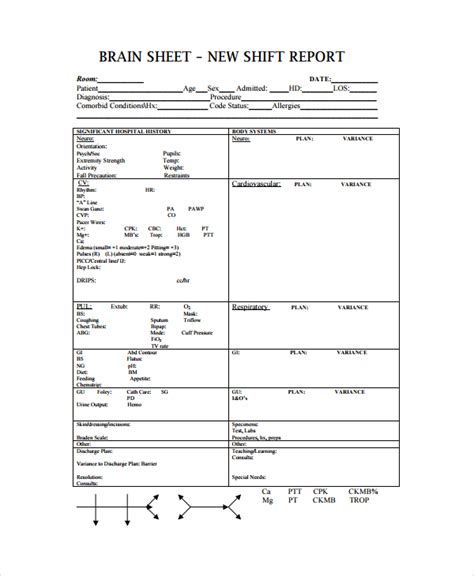

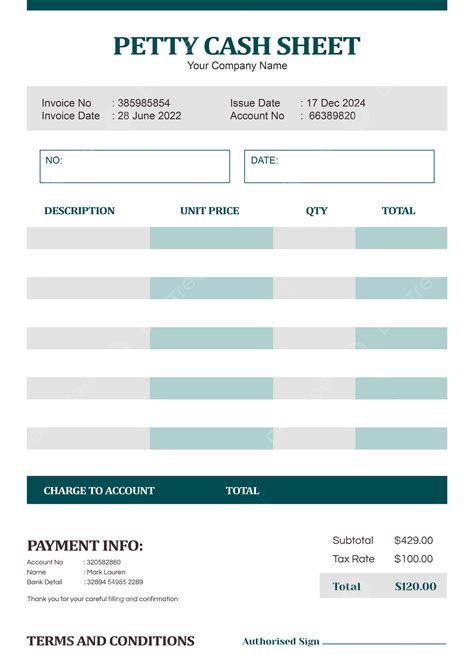

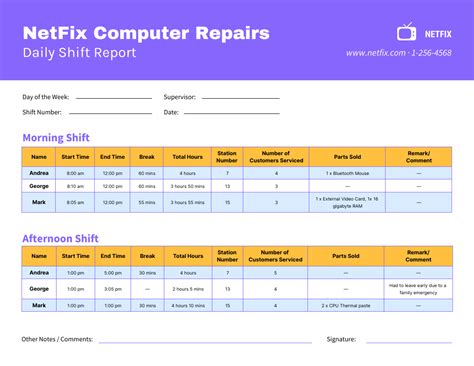

What is a Shift Sheet?

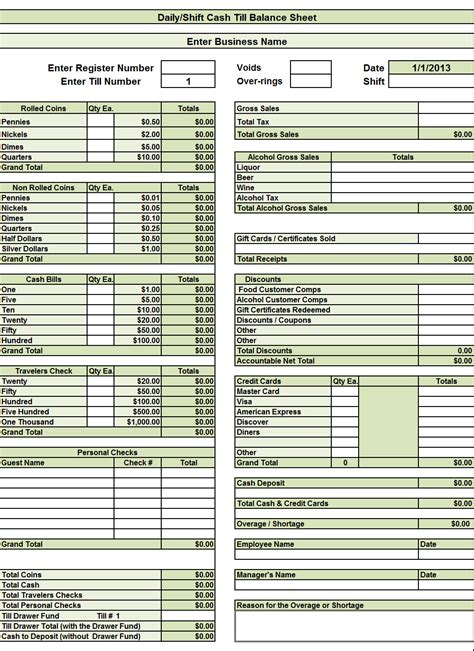

A shift sheet, also known as a cash handling sheet or till balance sheet, is a document used to record and reconcile cash transactions during a specific shift or period. It's typically used by retail businesses, restaurants, and other organizations that handle cash transactions. The shift sheet helps to ensure that all cash transactions are accounted for, reducing the risk of errors, discrepancies, and potential theft.

Why is Balancing Your Till Important?

Balancing your till is crucial for maintaining accurate financial records, ensuring that your business is running smoothly, and preventing potential financial losses. Here are some reasons why balancing your till is important:

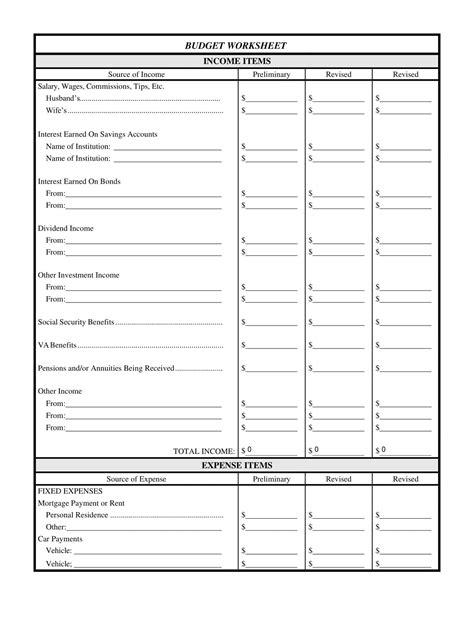

- Accuracy: Balancing your till ensures that your financial records are accurate, which is essential for making informed business decisions.

- Preventing Discrepancies: Regularly balancing your till helps to identify and resolve discrepancies, reducing the risk of errors and potential theft.

- Cash Flow Management: Balancing your till helps you to manage your cash flow effectively, ensuring that you have sufficient funds to meet your business needs.

- Compliance: Balancing your till is essential for complying with accounting and tax regulations.

5 Ways to Balance Your Till with a Shift Sheet

Now that we've discussed the importance of balancing your till, let's explore five ways to do so with a shift sheet:

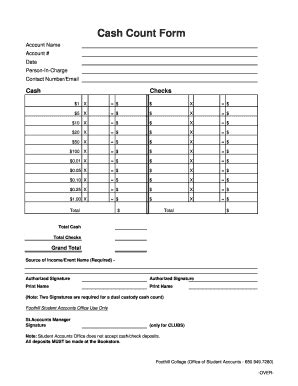

1. Count and Record Cash at the Start of the Shift

Begin by counting and recording the cash in the till at the start of the shift. This includes all denominations of bills and coins. Record the total amount of cash in the till on the shift sheet. This will provide a baseline for reconciling cash transactions throughout the shift.

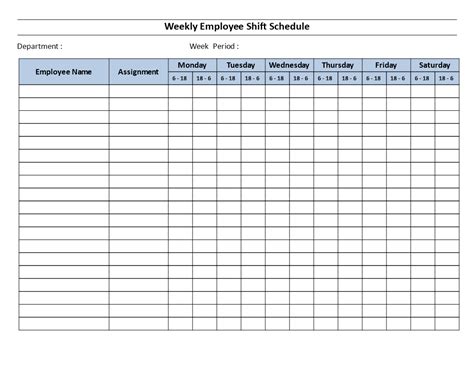

2. Record All Cash Transactions Throughout the Shift

Throughout the shift, record all cash transactions on the shift sheet, including sales, refunds, and voids. Make sure to include the date, time, and amount of each transaction. This will help you to track all cash transactions and identify any discrepancies.

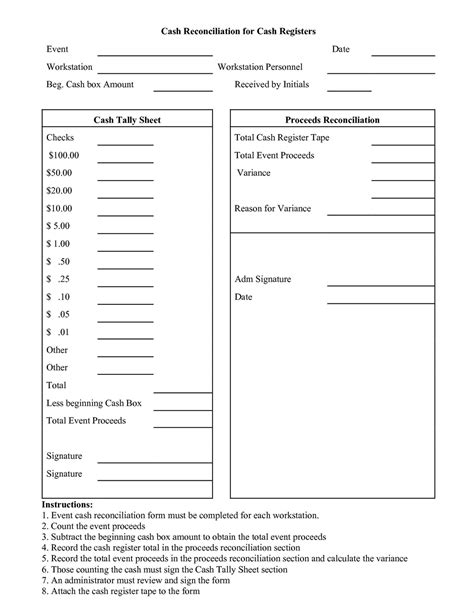

3. Reconcile Cash Transactions at the End of the Shift

At the end of the shift, reconcile the cash transactions recorded on the shift sheet with the actual cash in the till. Count the cash in the till and compare it to the total amount recorded on the shift sheet. Identify any discrepancies and investigate the cause.

4. Investigate Discrepancies and Make Adjustments

If you identify any discrepancies during the reconciliation process, investigate the cause and make adjustments as necessary. This may involve re-counting cash, reviewing security footage, or speaking with employees.

5. Review and Verify the Shift Sheet

Finally, review and verify the shift sheet to ensure that it's accurate and complete. Check for any errors or omissions and make sure that all cash transactions are accounted for.

Shift Sheet Templates and Examples

By following these five steps and using a shift sheet, you can ensure that your till is balanced accurately and efficiently. Remember to count and record cash at the start of the shift, record all cash transactions throughout the shift, reconcile cash transactions at the end of the shift, investigate discrepancies and make adjustments, and review and verify the shift sheet.

Conclusion

Balancing your till with a shift sheet is a crucial task that helps to maintain accurate financial records, prevent discrepancies, and ensure that your business is running smoothly. By following the five steps outlined in this article, you can ensure that your till is balanced accurately and efficiently. Remember to use a shift sheet template or example to help you get started.