Intro

Kickstart your savings journey with the 52 Week Money Saving Challenge Printable! This innovative plan helps you save over $1,300 in a year through manageable weekly deposits. Boost your financial discipline and achieve your goals with this step-by-step guide, featuring weekly savings charts and trackers.

Saving money can be a daunting task, especially when you're trying to make a significant impact on your financial situation. However, with a clear plan and a bit of motivation, you can achieve your financial goals. One effective way to save money is by following a structured challenge, like the 52-week money saving challenge. In this article, we'll explore the benefits of this challenge, how it works, and provide you with a printable template to get started.

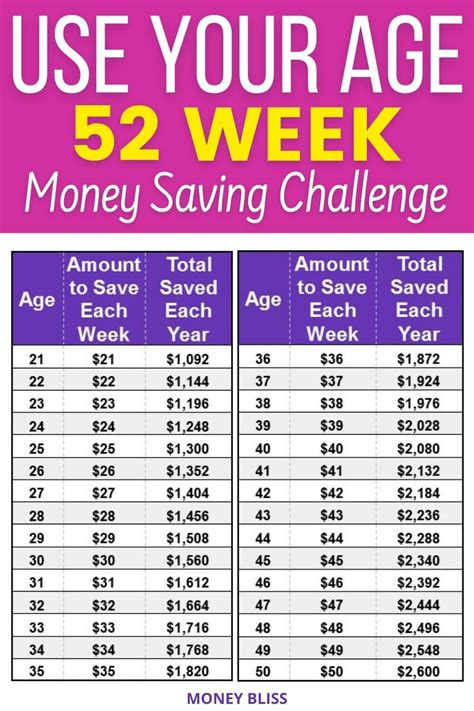

The 52-week money saving challenge is a simple yet effective way to save money by setting aside a specific amount each week for a year. The challenge starts with saving an amount equal to the number of the week. For example, in week 1, you'll save $1, in week 2, you'll save $2, and so on. By the end of the 52 weeks, you'll have saved over $1,378.

This challenge is an excellent way to develop a savings habit, and it's flexible enough to accommodate any income level. You can adjust the amount you save each week based on your financial situation. The key is to make saving a priority and to be consistent.

Benefits of the 52-Week Money Saving Challenge

The 52-week money saving challenge offers several benefits that can help you achieve your financial goals. Some of the advantages of this challenge include:

- Develops a savings habit: By saving a specific amount each week, you'll develop a habit of setting aside money regularly.

- Increases savings: Over the course of the challenge, you'll save a significant amount of money that can be used for emergencies, large purchases, or long-term investments.

- Improves financial discipline: The challenge requires you to be consistent and disciplined in your savings, which can help you make better financial decisions.

- Enhances financial awareness: By tracking your savings, you'll become more aware of your spending habits and can identify areas where you can cut back.

How to Get Started with the 52-Week Money Saving Challenge

Getting started with the 52-week money saving challenge is easy. Here's a step-by-step guide to help you begin:

- Determine your savings goal: Decide why you want to save money and what you want to achieve with the challenge. This will help you stay motivated throughout the process.

- Choose a savings account: Open a separate savings account specifically for the challenge. This will help you keep your savings separate from your everyday spending money.

- Set up automatic transfers: Set up automatic transfers from your checking account to your savings account. This way, you'll ensure that you save the required amount each week without having to think about it.

- Track your progress: Use a printable template or a mobile app to track your progress. This will help you stay motivated and see how far you've come.

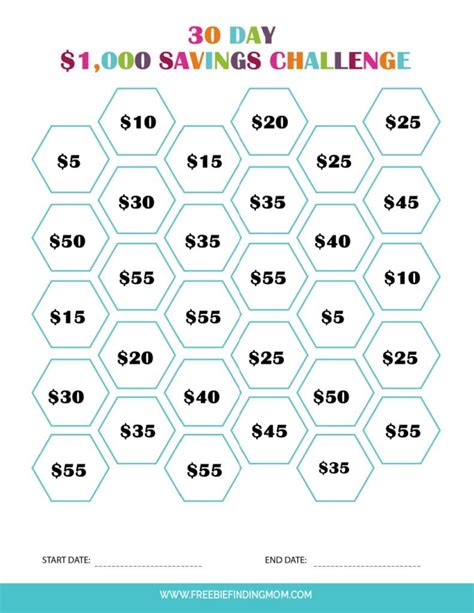

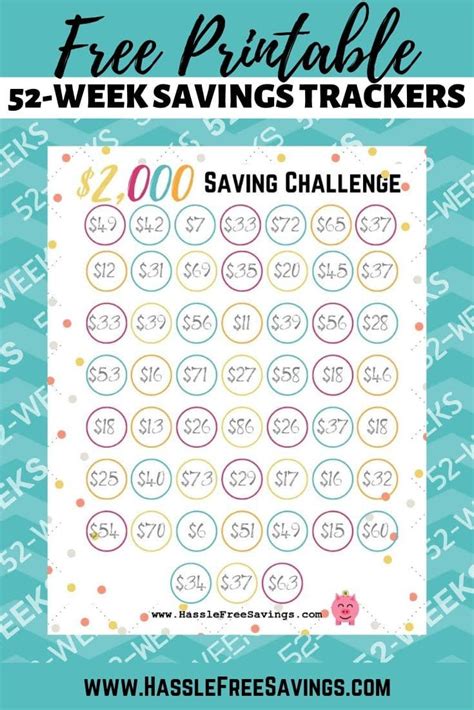

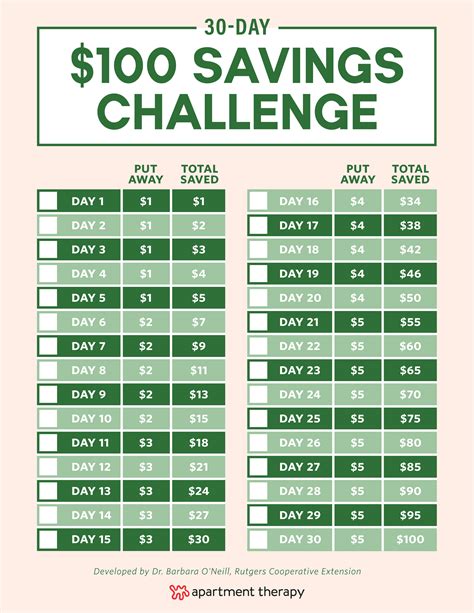

52-Week Money Saving Challenge Printable Template

To help you get started with the challenge, we've created a printable template that you can use to track your progress. The template includes:

- Week number: The number of the week, from 1 to 52.

- Savings amount: The amount you need to save each week, based on the week number.

- Total savings: The total amount you've saved so far.

- Notes: A section where you can note any challenges you faced, successes you achieved, or tips for staying motivated.

You can download the printable template and start using it today.

Tips for Staying Motivated

Staying motivated is crucial to completing the 52-week money saving challenge. Here are some tips to help you stay on track:

- Make it a habit: Try to save at the same time every week, so it becomes a habit.

- Track your progress: Use a printable template or a mobile app to track your progress. This will help you see how far you've come and stay motivated.

- Reward yourself: Set small rewards for yourself when you reach certain milestones. This will help you stay motivated and give you something to look forward to.

- Get support: Share your goals with a friend or family member and ask them to hold you accountable. This will help you stay motivated and provide an added level of support.

Common Challenges and Solutions

While the 52-week money saving challenge is a great way to save money, you may face some challenges along the way. Here are some common challenges and solutions:

- Irregular income: If you have an irregular income, it may be challenging to save a fixed amount each week. Solution: Try to save a percentage of your income instead of a fixed amount.

- Expenses: If you have high expenses, it may be challenging to save money. Solution: Try to reduce your expenses by cutting back on non-essential spending.

- Lack of motivation: If you're struggling to stay motivated, try to remind yourself why you started the challenge in the first place. Solution: Reward yourself when you reach certain milestones, and get support from friends and family.

Conclusion

The 52-week money saving challenge is a great way to save money and develop a savings habit. By following the challenge, you'll be able to save over $1,378 in just one year. Remember to stay motivated, track your progress, and reward yourself when you reach certain milestones. With the right mindset and support, you can achieve your financial goals and start building a secure financial future.

52 Week Money Saving Challenge Image Gallery

We hope this article has provided you with the information and motivation you need to start the 52-week money saving challenge. Remember to stay consistent, track your progress, and reward yourself when you reach certain milestones. Good luck!