Are you tired of living paycheck to paycheck? Do you dream of having a stress-free financial life? Having a solid budget in place is the key to achieving financial stability. With a biweekly pay budget template, you can take control of your finances and start building a more secure future.

In today's economy, it's easy to get caught up in the cycle of overspending and debt. But with the right tools and a little bit of planning, you can break free from financial stress and start living the life you want. A biweekly pay budget template is a simple yet effective way to manage your finances and achieve your financial goals.

The Benefits of a Biweekly Pay Budget Template

A biweekly pay budget template offers several benefits, including:

- Reduced financial stress: By creating a budget that works for you, you'll feel more in control of your finances and less stressed about money.

- Improved financial stability: A biweekly pay budget template helps you prioritize your spending and make smart financial decisions.

- Increased savings: With a budget in place, you'll be able to save more money and achieve your long-term financial goals.

How to Create a Biweekly Pay Budget Template

Creating a biweekly pay budget template is easier than you think. Here's a step-by-step guide to get you started:

Step 1: Identify Your Income

Start by calculating how much you earn every two weeks. Include all sources of income, such as your salary, investments, and any side hustles.

Step 2: Track Your Expenses

Next, track your expenses for two weeks to get an idea of where your money is going. Write down every single transaction, no matter how small.

Step 3: Categorize Your Expenses

Categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies). Be honest with yourself – do you really need that daily latte?

Step 4: Set Financial Goals

Determine what you want to achieve with your budget. Do you want to pay off debt? Save for a down payment on a house? Build an emergency fund?

Step 5: Create a Budget Plan

Using the 50/30/20 rule, allocate 50% of your income towards needs, 30% towards wants, and 20% towards saving and debt repayment.

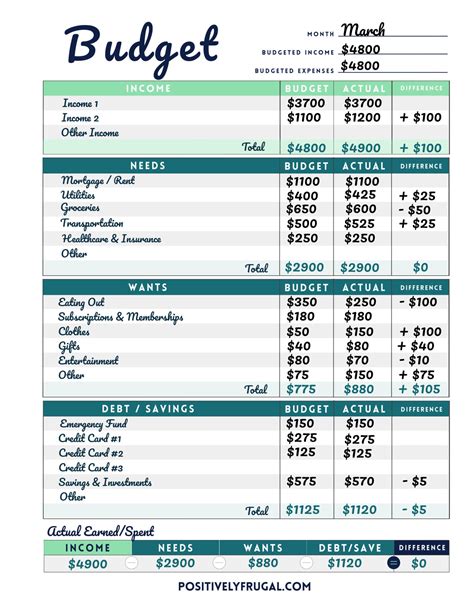

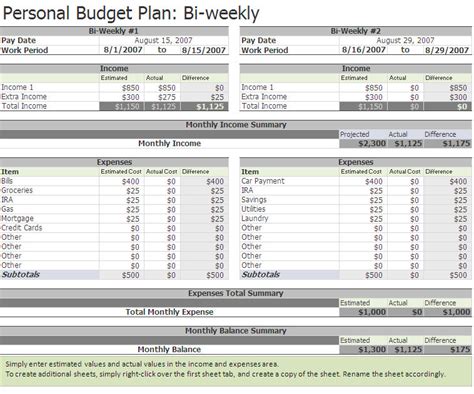

Biweekly Pay Budget Template Example

Here's an example of what a biweekly pay budget template might look like:

| Category | Biweekly Amount | Monthly Amount |

|---|---|---|

| Housing | $1,000 | $2,000 |

| Food | $500 | $1,000 |

| Utilities | $150 | $300 |

| Transportation | $200 | $400 |

| Entertainment | $200 | $400 |

| Savings | $500 | $1,000 |

| Debt Repayment | $500 | $1,000 |

Tips for Using a Biweekly Pay Budget Template

Here are some tips to keep in mind when using a biweekly pay budget template:

- Be flexible: Life is unpredictable, and your budget should be too. Don't be too hard on yourself if you need to make adjustments.

- Automate your savings: Set up automatic transfers to your savings and investment accounts to make saving easier and less prone to being neglected.

- Review and adjust regularly: Regularly review your budget to ensure you're on track to meet your financial goals. Adjust as needed.

Common Mistakes to Avoid When Using a Biweekly Pay Budget Template

Here are some common mistakes to avoid when using a biweekly pay budget template:

- Not accounting for irregular expenses: Make sure to include expenses that don't come up regularly, such as car maintenance or property taxes.

- Not prioritizing needs over wants: Be honest with yourself about what you need versus what you want.

- Not reviewing and adjusting regularly: Regularly review your budget to ensure you're on track to meet your financial goals.

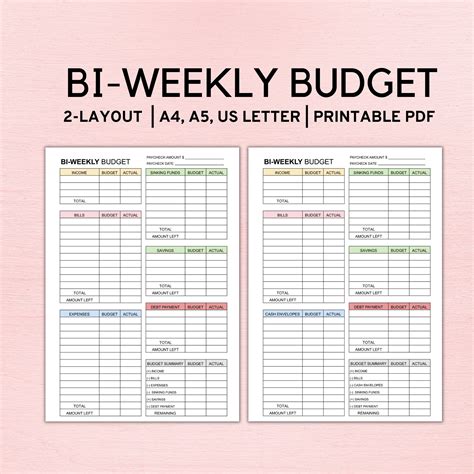

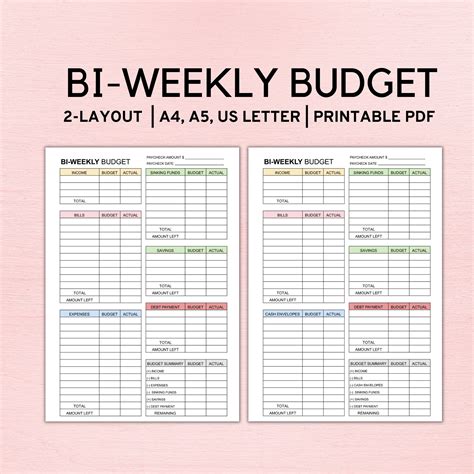

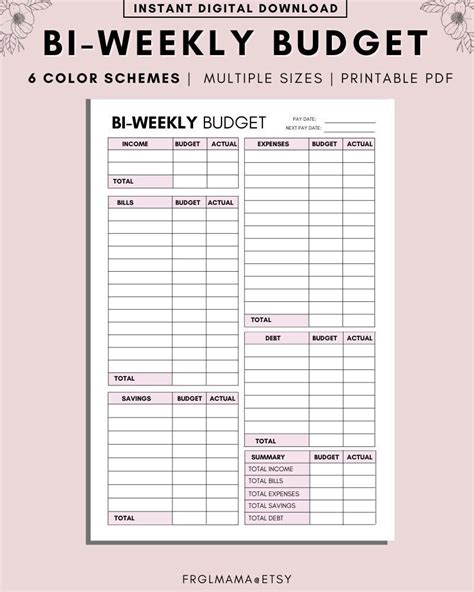

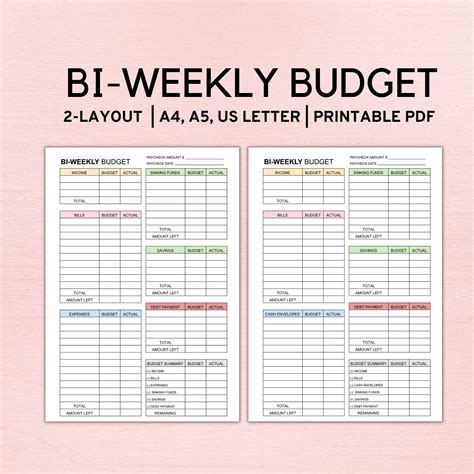

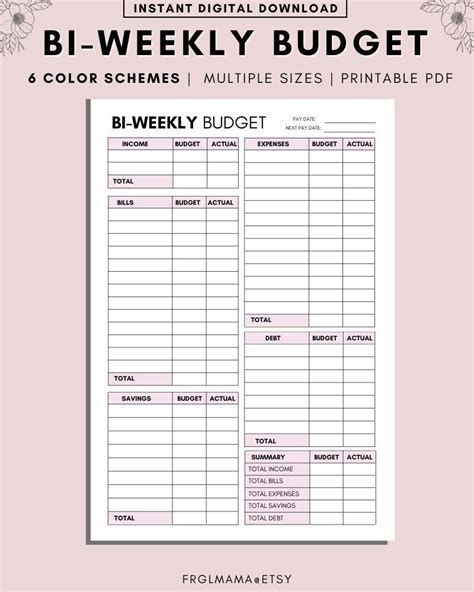

Biweekly Budget Template Gallery

Conclusion

Creating a biweekly pay budget template is a simple yet effective way to manage your finances and achieve financial stability. By following the steps outlined in this article, you can create a budget that works for you and helps you achieve your financial goals. Remember to be flexible, automate your savings, and review and adjust your budget regularly.

Now it's your turn! Take control of your finances today by creating a biweekly pay budget template. Share your experiences and tips in the comments below.