Intro

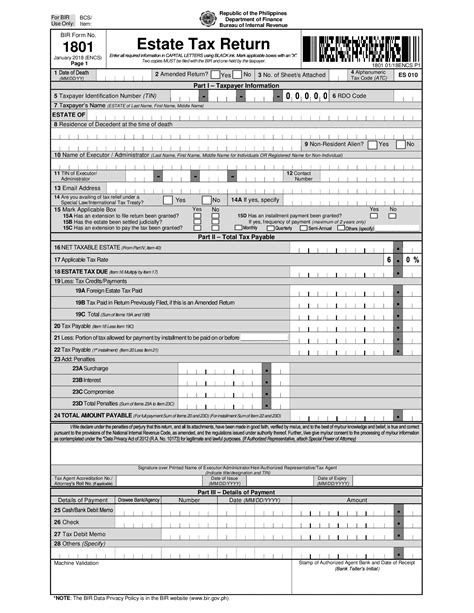

Completing the NC Form D-410, also known as the "North Carolina Inheritance Tax Return," is a crucial step in the process of settling an estate in North Carolina. This form is used to report the inheritance tax owed by the estate and to calculate the amount of tax due. In this article, we will guide you through the process of downloading and completing the NC Form D-410 in 5 easy steps.

Understanding the Importance of NC Form D-410

Before we dive into the steps, it's essential to understand the importance of the NC Form D-410. This form is required by the North Carolina Department of Revenue to report the inheritance tax owed by the estate. The form is used to calculate the amount of tax due, which is typically paid by the estate before distributing the assets to the beneficiaries.

Why is the NC Form D-410 necessary?

The NC Form D-410 is necessary because it helps the state of North Carolina to collect the inheritance tax owed by the estate. The form provides the necessary information to calculate the amount of tax due, which is based on the value of the estate's assets. By completing the form accurately, you can ensure that the estate is in compliance with the state's tax laws and avoid any potential penalties.

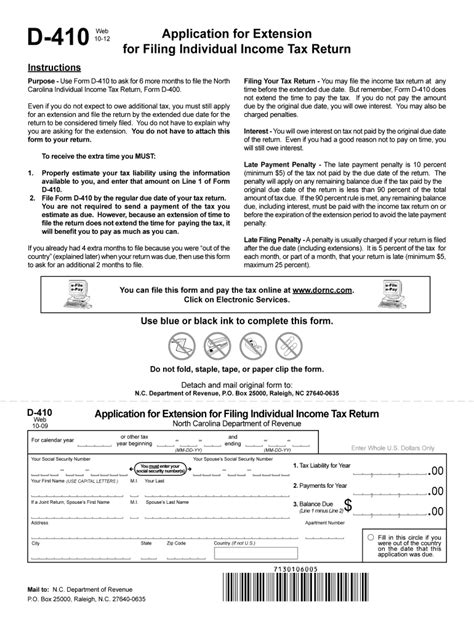

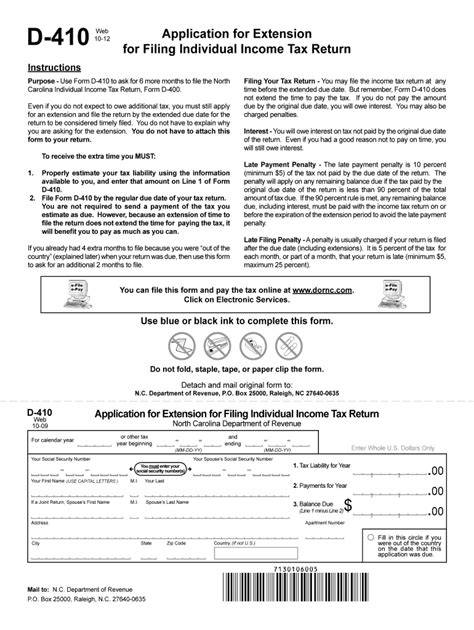

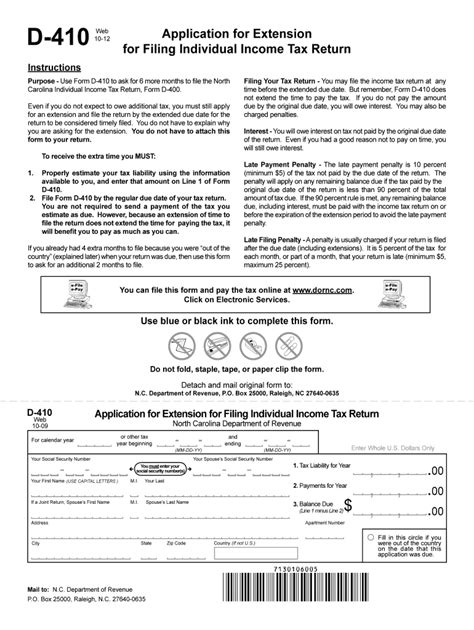

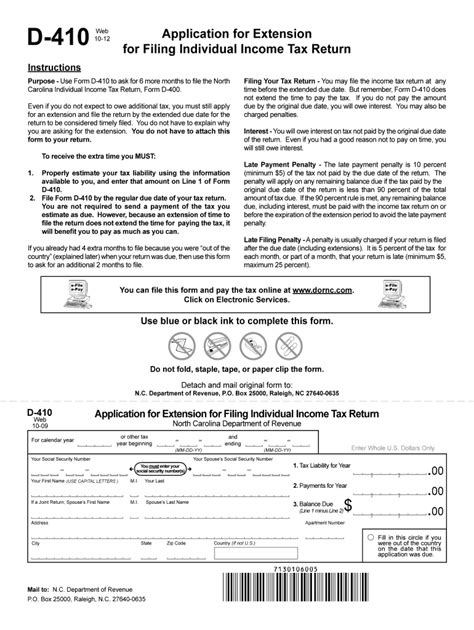

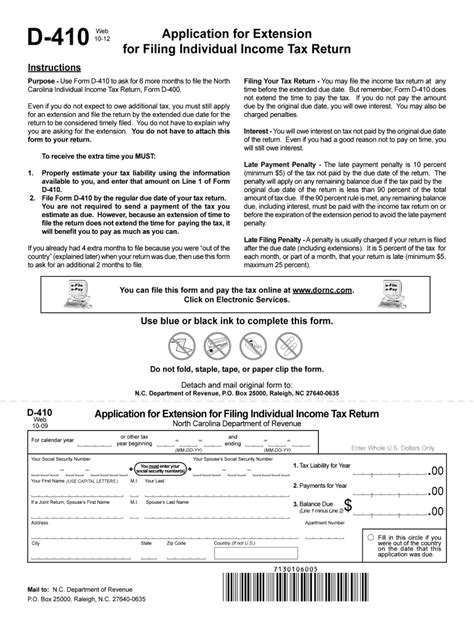

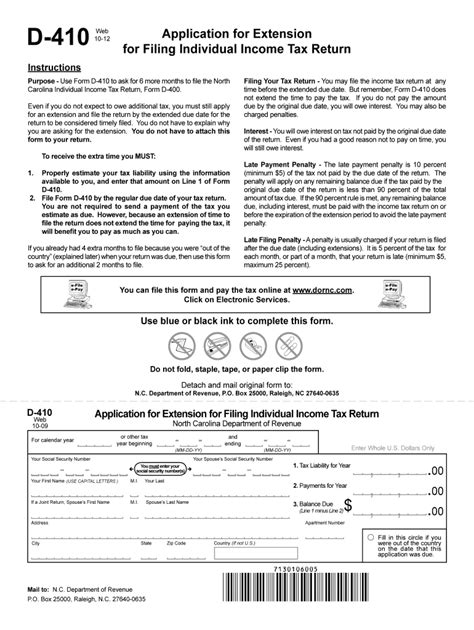

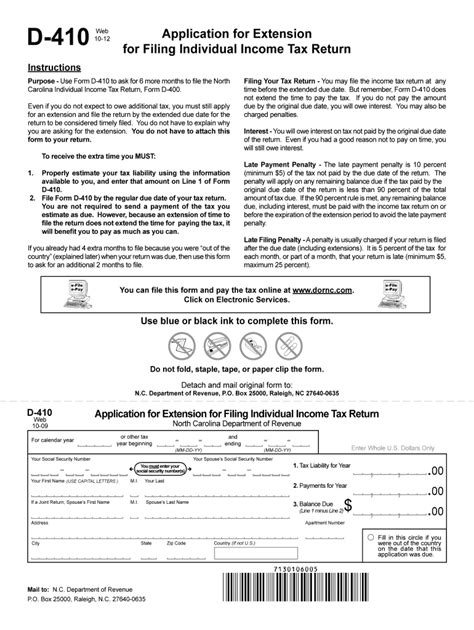

Step 1: Download the NC Form D-410

To start the process, you need to download the NC Form D-410 from the North Carolina Department of Revenue's website. You can search for the form on the website or click on the "Forms" tab to find it. Once you've found the form, click on the "Download" button to save it to your computer.

Tips for downloading the form:

- Make sure you download the latest version of the form to ensure you have the most up-to-date information.

- Save the form to a location on your computer where you can easily access it.

- If you're having trouble finding the form, you can contact the North Carolina Department of Revenue for assistance.

Step 2: Gather the Necessary Information

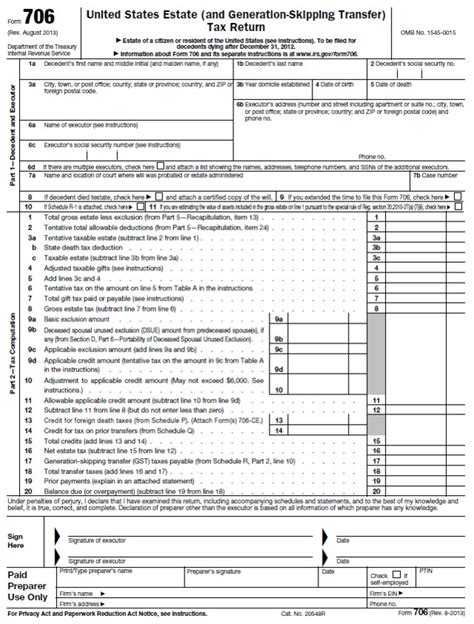

Before you start completing the form, you need to gather the necessary information. This includes:

- The name and address of the decedent

- The name and address of the executor or personal representative

- The date of death

- The value of the estate's assets

- The names and addresses of the beneficiaries

Tips for gathering information:

- Make sure you have all the necessary information before starting to complete the form.

- Use the decedent's tax returns and other financial documents to determine the value of the estate's assets.

- If you're unsure about any of the information, consult with an attorney or tax professional.

Step 3: Complete the Form

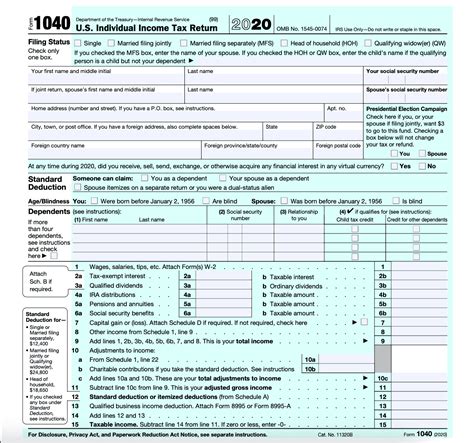

Now that you have the necessary information, you can start completing the form. The NC Form D-410 is divided into several sections, including:

- Section 1: Decedent's Information

- Section 2: Executor's Information

- Section 3: Estate's Assets

- Section 4: Beneficiaries' Information

- Section 5: Tax Calculation

Tips for completing the form:

- Make sure you complete all the required sections.

- Use the instructions provided with the form to guide you.

- If you're unsure about any of the questions, consult with an attorney or tax professional.

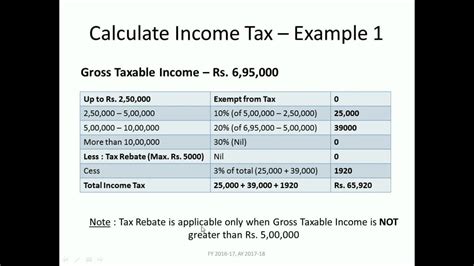

Step 4: Calculate the Tax Due

Once you've completed the form, you need to calculate the tax due. The tax is calculated based on the value of the estate's assets and the number of beneficiaries. You can use the tax tables provided with the form to determine the amount of tax due.

Tips for calculating the tax due:

- Make sure you use the correct tax tables.

- Double-check your calculations to ensure accuracy.

- If you're unsure about any of the calculations, consult with an attorney or tax professional.

Step 5: File the Form

Finally, you need to file the completed form with the North Carolina Department of Revenue. You can file the form electronically or by mail. Make sure you keep a copy of the form for your records.

Tips for filing the form:

- Make sure you file the form on time to avoid any potential penalties.

- Use the correct mailing address or electronic filing system.

- Keep a copy of the form for your records.

NC Form D-410 Image Gallery

By following these 5 easy steps, you can download and complete the NC Form D-410 with ease. Remember to gather all the necessary information, complete the form accurately, and file it on time to avoid any potential penalties. If you're unsure about any part of the process, consult with an attorney or tax professional for guidance.