Intro

Create a legally binding agreement with our free printable promissory note template and comprehensive guide. Learn how to draft a promissory note, understand the key elements, and discover the benefits of using a promissory note for personal or business loans. Download and customize our template to secure your loan with ease.

A promissory note is a written agreement where one party, known as the borrower or maker, promises to pay a certain amount of money to another party, known as the lender or payee. This document is often used in various financial transactions, including personal loans, business loans, and real estate transactions. In this article, we will provide a free printable promissory note template and guide to help you create a legally binding document.

Importance of a Promissory Note

A promissory note is a crucial document in any lending transaction, as it outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment terms, and any security or collateral. This document provides a clear understanding of the agreement between the borrower and lender, reducing the risk of disputes or misunderstandings.

Having a well-drafted promissory note can also provide protection for both parties. For lenders, it ensures that they have a written record of the loan agreement, which can be used as evidence in case of default. For borrowers, it provides a clear understanding of their obligations and can help prevent unexpected surprises or penalties.

Types of Promissory Notes

There are several types of promissory notes, including:

- Secured Promissory Note: This type of note is secured by collateral, such as property or assets.

- Unsecured Promissory Note: This type of note is not secured by collateral and relies on the borrower's creditworthiness.

- Demand Promissory Note: This type of note requires the borrower to repay the loan on demand by the lender.

- Installment Promissory Note: This type of note requires the borrower to make regular installment payments to repay the loan.

Components of a Promissory Note

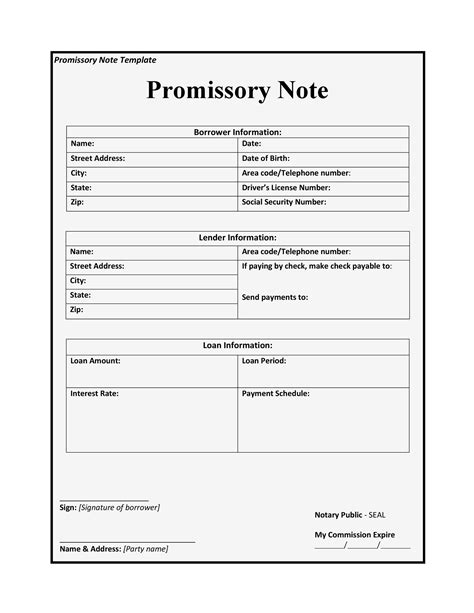

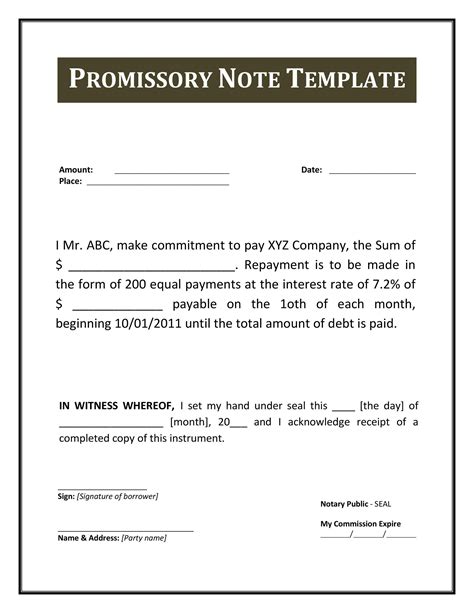

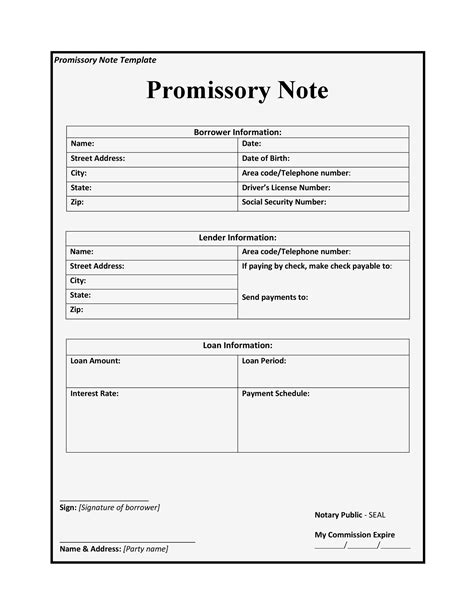

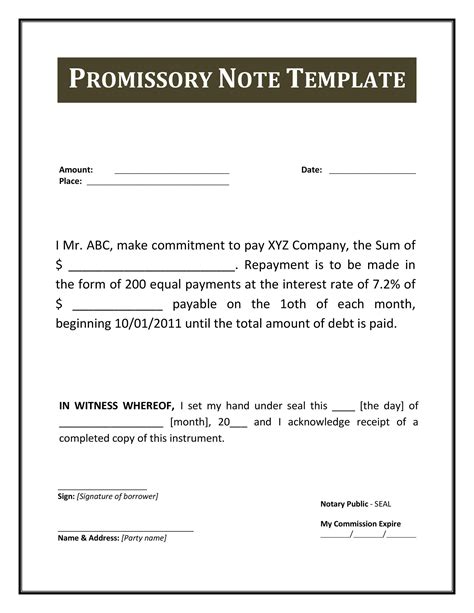

A typical promissory note should include the following components:

- Names and Addresses: The names and addresses of the borrower and lender should be included.

- Loan Amount: The amount borrowed should be clearly stated.

- Interest Rate: The interest rate and how it is calculated should be specified.

- Repayment Terms: The repayment terms, including the payment schedule and amount, should be outlined.

- Security or Collateral: If the note is secured, the collateral or security should be described.

- Default Provisions: The consequences of default, including late fees and penalties, should be specified.

- Governing Law: The laws of which state or jurisdiction will govern the agreement should be stated.

Free Printable Promissory Note Template

Here is a free printable promissory note template that you can use:

[PROMISSORY NOTE]

This Promissory Note ("Note") is made and entered into on [DATE] ("Effective Date") by and between [LENDER'S NAME] ("Lender") with an address at [LENDER'S ADDRESS] and [BORROWER'S NAME] ("Borrower") with an address at [BORROWER'S ADDRESS].

LOAN TERMS

- Loan Amount: $[LOAN AMOUNT]

- Interest Rate: [INTEREST RATE]%

- Repayment Terms: The Borrower shall repay the Loan Amount in [NUMBER] installments of $[INSTALLMENT AMOUNT] each, commencing on [FIRST PAYMENT DATE] and continuing on [SUBSEQUENT PAYMENT DATES] until the Loan Amount is paid in full.

- Security or Collateral: [DESCRIPTION OF COLLATERAL OR SECURITY, IF ANY]

DEFAULT PROVISIONS

- Late Fees: If any payment is not made on or before the due date, a late fee of [LATE FEE AMOUNT] shall be added to the unpaid balance.

- Penalties: If the Borrower fails to make any payment when due, the Lender may, at its option, declare the entire Loan Amount immediately due and payable.

GOVERNING LAW

- This Note shall be governed by and construed in accordance with the laws of the [STATE/JURISDICTION].

ACKNOWLEDGMENT

- By signing below, the parties acknowledge that they have read, understand, and agree to be bound by the terms and conditions of this Note.

SIGNATURES

- Lender's Signature: _____________________________

- Borrower's Signature: _____________________________

How to Use the Promissory Note Template

To use the promissory note template, follow these steps:

- Download the template and fill in the required information, including the names and addresses of the borrower and lender, loan amount, interest rate, repayment terms, and security or collateral.

- Review the template carefully to ensure that it meets your specific needs and complies with applicable laws and regulations.

- Sign the template in the presence of a notary public, if required by your state or jurisdiction.

- Keep a copy of the signed promissory note for your records.

Gallery of Promissory Note Templates

Promissory Note Template Image Gallery

Conclusion

A promissory note is a vital document in any lending transaction, providing a clear understanding of the agreement between the borrower and lender. By using a free printable promissory note template, you can create a legally binding document that protects both parties and ensures a smooth transaction. Remember to review the template carefully and sign it in the presence of a notary public, if required by your state or jurisdiction.

We hope this article has provided valuable information and resources to help you create a promissory note that meets your specific needs. If you have any questions or need further assistance, please don't hesitate to ask.

Don't forget to share this article with others who may benefit from it, and leave a comment below if you have any feedback or suggestions.