Intro

Real estate investing can be a lucrative venture, but it requires a solid understanding of the underlying math formulas that drive the industry. Whether you're a seasoned investor or just starting out, having a grasp of these essential formulas can help you make informed decisions and maximize your returns. In this article, we'll explore the top 10 real estate math formulas you need to know, along with examples and explanations to help you master them.

Understanding the Importance of Real Estate Math

Real estate math is the foundation of successful investing. It allows you to analyze properties, assess risk, and make informed decisions about your investments. By understanding these essential formulas, you'll be able to:

- Evaluate potential investment opportunities

- Calculate returns on investment (ROI)

- Determine cash flow and profitability

- Assess risk and make informed decisions

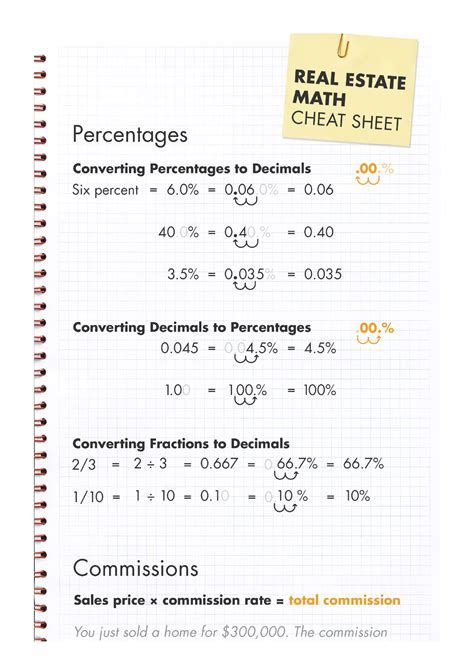

1. Gross Yield Formula

The gross yield formula is used to calculate the annual return on investment (ROI) based on the property's annual rental income.

Gross Yield = (Annual Rental Income / Property Value) x 100

Example: If a property has an annual rental income of $20,000 and a property value of $200,000, the gross yield would be:

Gross Yield = ($20,000 / $200,000) x 100 = 10%

Why is Gross Yield Important?

Gross yield is a key metric in real estate investing, as it allows you to compare the potential returns of different investment opportunities. A higher gross yield generally indicates a more attractive investment.

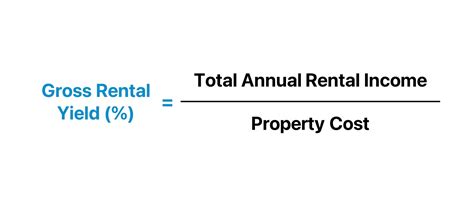

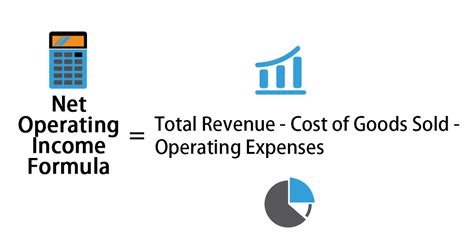

2. Net Operating Income (NOI) Formula

The NOI formula is used to calculate the annual net operating income of a property.

NOI = Gross Income - Operating Expenses

Example: If a property has a gross income of $100,000 and operating expenses of $40,000, the NOI would be:

NOI = $100,000 - $40,000 = $60,000

Why is NOI Important?

NOI is a critical metric in real estate investing, as it allows you to evaluate the potential cash flow of a property.

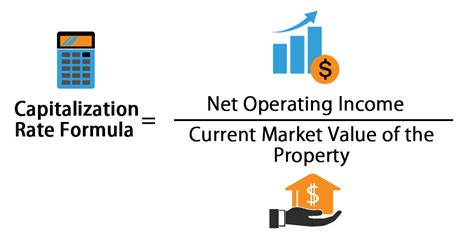

3. Capitalization Rate (Cap Rate) Formula

The cap rate formula is used to calculate the rate of return on a property based on its NOI and property value.

Cap Rate = NOI / Property Value

Example: If a property has an NOI of $60,000 and a property value of $1,000,000, the cap rate would be:

Cap Rate = $60,000 / $1,000,000 = 6%

Why is Cap Rate Important?

Cap rate is a key metric in real estate investing, as it allows you to compare the potential returns of different investment opportunities. A higher cap rate generally indicates a more attractive investment.

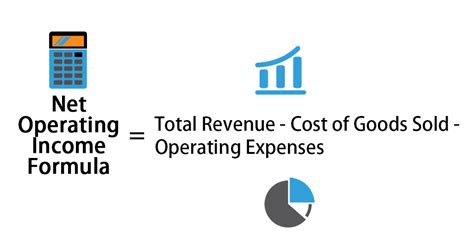

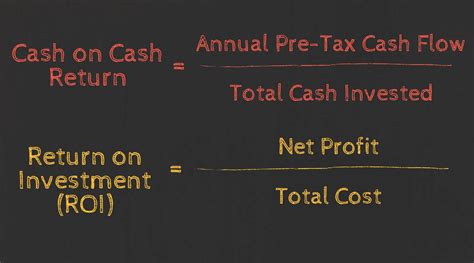

4. Cash-on-Cash Return Formula

The cash-on-cash return formula is used to calculate the annual return on investment (ROI) based on the property's annual cash flow.

Cash-on-Cash Return = (Annual Cash Flow / Total Cash Invested) x 100

Example: If a property has an annual cash flow of $20,000 and a total cash investment of $100,000, the cash-on-cash return would be:

Cash-on-Cash Return = ($20,000 / $100,000) x 100 = 20%

Why is Cash-on-Cash Return Important?

Cash-on-cash return is a key metric in real estate investing, as it allows you to evaluate the potential returns of a property based on your actual cash investment.

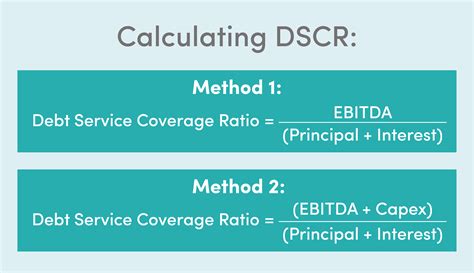

5. Debt Service Coverage Ratio (DSCR) Formula

The DSCR formula is used to calculate the ratio of a property's NOI to its annual debt service.

DSCR = NOI / Annual Debt Service

Example: If a property has an NOI of $60,000 and an annual debt service of $40,000, the DSCR would be:

DSCR = $60,000 / $40,000 = 1.5

Why is DSCR Important?

DSCR is a critical metric in real estate investing, as it allows you to evaluate the potential risk of a property based on its debt obligations.

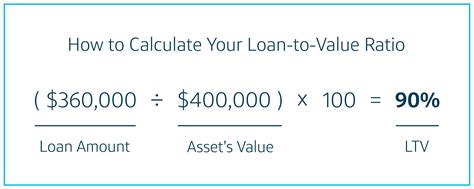

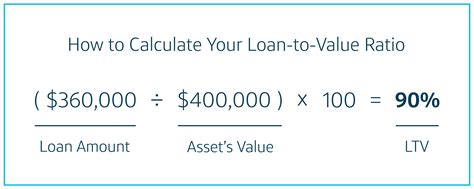

6. Loan-to-Value (LTV) Ratio Formula

The LTV ratio formula is used to calculate the ratio of a property's loan amount to its property value.

LTV Ratio = Loan Amount / Property Value

Example: If a property has a loan amount of $800,000 and a property value of $1,000,000, the LTV ratio would be:

LTV Ratio = $800,000 / $1,000,000 = 80%

Why is LTV Ratio Important?

LTV ratio is a key metric in real estate investing, as it allows you to evaluate the potential risk of a property based on its loan obligations.

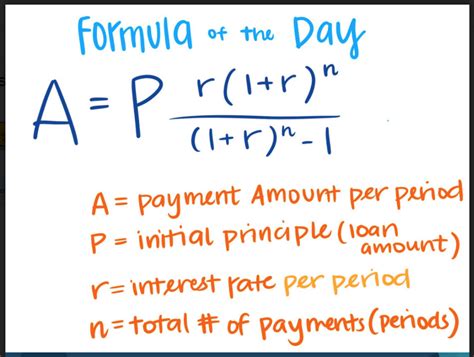

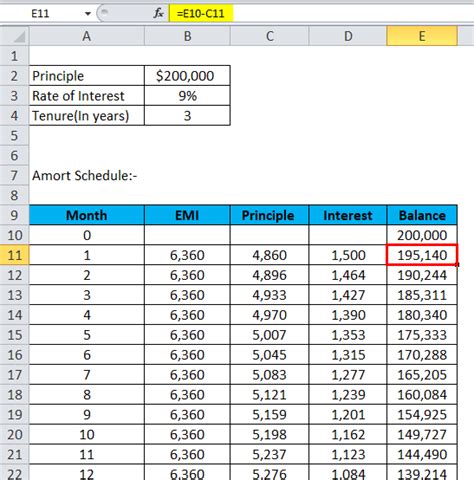

7. Amortization Formula

The amortization formula is used to calculate the monthly loan payment based on the loan amount, interest rate, and loan term.

Monthly Loan Payment = (Loan Amount x Interest Rate) / (1 - (1 + Interest Rate)^(-Loan Term))

Example: If a property has a loan amount of $800,000, an interest rate of 5%, and a loan term of 30 years, the monthly loan payment would be:

Monthly Loan Payment = ($800,000 x 5%) / (1 - (1 + 5%)^(-30)) = $4,382.81

Why is Amortization Important?

Amortization is a critical concept in real estate investing, as it allows you to evaluate the potential cash flow of a property based on its loan obligations.

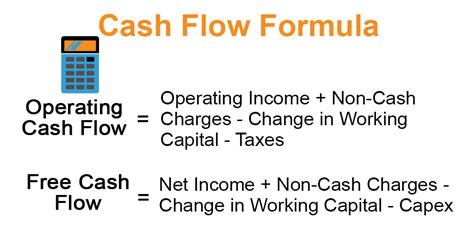

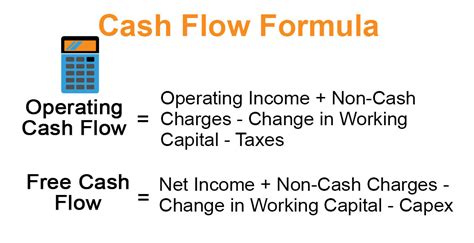

8. Cash Flow Formula

The cash flow formula is used to calculate the annual cash flow of a property.

Cash Flow = NOI - Annual Debt Service

Example: If a property has an NOI of $60,000 and an annual debt service of $40,000, the cash flow would be:

Cash Flow = $60,000 - $40,000 = $20,000

Why is Cash Flow Important?

Cash flow is a key metric in real estate investing, as it allows you to evaluate the potential returns of a property based on its actual cash flow.

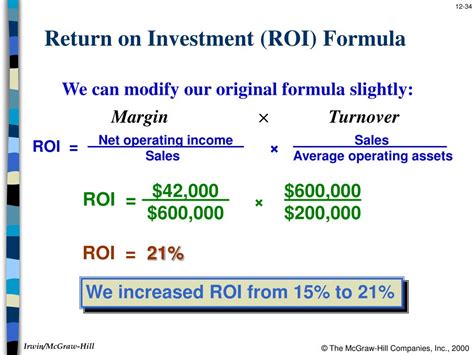

9. Return on Investment (ROI) Formula

The ROI formula is used to calculate the annual return on investment (ROI) based on the property's annual cash flow.

ROI = (Annual Cash Flow / Total Cash Invested) x 100

Example: If a property has an annual cash flow of $20,000 and a total cash investment of $100,000, the ROI would be:

ROI = ($20,000 / $100,000) x 100 = 20%

Why is ROI Important?

ROI is a key metric in real estate investing, as it allows you to evaluate the potential returns of a property based on your actual cash investment.

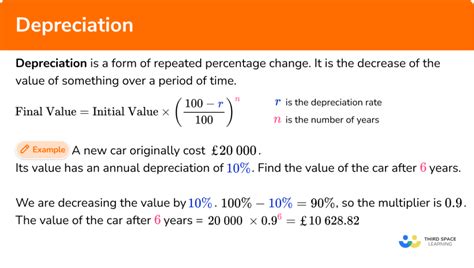

10. Appreciation Formula

The appreciation formula is used to calculate the annual appreciation of a property.

Appreciation = (Current Property Value - Original Property Value) / Original Property Value

Example: If a property has a current property value of $1,200,000 and an original property value of $1,000,000, the appreciation would be:

Appreciation = ($1,200,000 - $1,000,000) / $1,000,000 = 20%

Why is Appreciation Important?

Appreciation is a key metric in real estate investing, as it allows you to evaluate the potential long-term returns of a property.

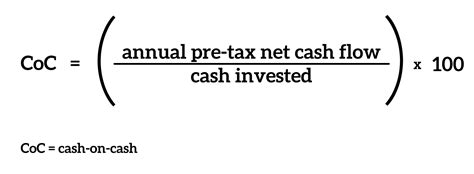

Real Estate Math Formulas Image Gallery

By mastering these 10 essential real estate math formulas, you'll be able to evaluate potential investment opportunities, calculate returns on investment, and make informed decisions about your investments. Remember to use these formulas in conjunction with each other to get a comprehensive understanding of a property's potential.

Don't forget to share this article with your friends and colleagues who are interested in real estate investing. If you have any questions or comments, please leave them in the section below.