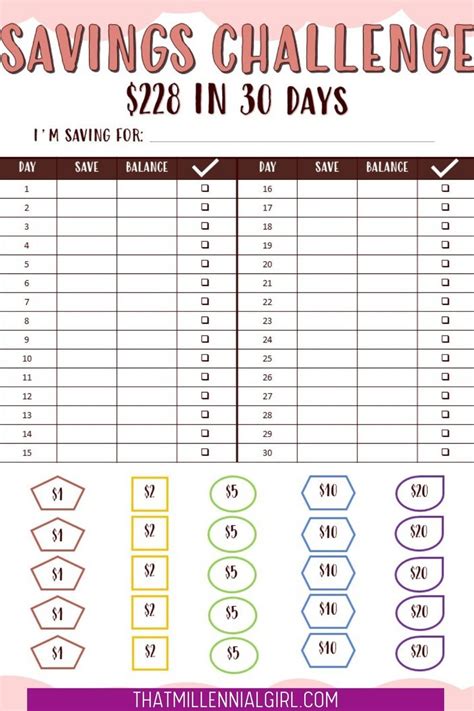

Taking control of your finances and working towards a debt-free life can be a daunting task, but with a solid plan and commitment, it's achievable. One effective way to get started is by using a 52-week printable savings challenge. This challenge is designed to help you save a significant amount of money over the course of a year, and by following it, you'll be well on your way to reducing debt and building a stronger financial future.

The 52-week savings challenge is simple: each week, you'll save an amount equal to the number of the week. For example, in week one, you'll save $1, in week two, you'll save $2, and so on. By the end of the 52 weeks, you'll have saved over $1,300. This may not seem like a lot, but it's a great starting point, and the discipline and habits you develop during this challenge will serve you well in your financial journey.

Benefits of the 52-Week Savings Challenge

The 52-week savings challenge offers numerous benefits that can help you achieve your financial goals. Some of the most significant advantages include:

- Developing a savings habit: By committing to saving a certain amount each week, you'll develop a habit that will serve you well throughout your life.

- Reducing debt: The money you save during this challenge can be used to pay off debt, reducing the amount of interest you owe and freeing up more money in your budget for savings and investments.

- Building an emergency fund: The 52-week savings challenge can help you build a cushion of savings that will protect you from unexpected expenses and financial setbacks.

- Increasing financial discipline: This challenge requires discipline and commitment, skills that will benefit you in all areas of your financial life.

How to Make the Most of the 52-Week Savings Challenge

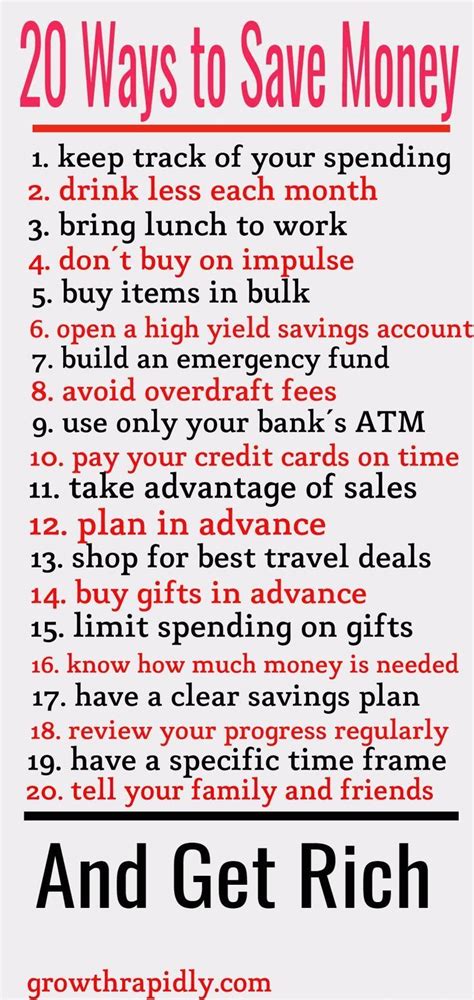

To get the most out of the 52-week savings challenge, follow these tips:

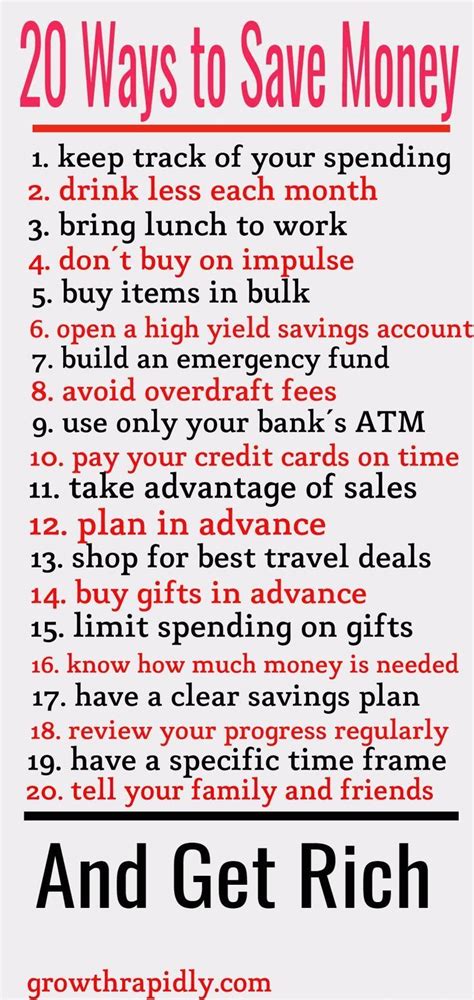

- Start small: Don't try to save too much too soon. Start with a manageable amount and gradually increase it as you become more comfortable with the challenge.

- Make it automatic: Set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

- Track your progress: Keep track of your progress throughout the challenge. Seeing how far you've come can be a great motivator.

- Stay consistent: Consistency is key when it comes to saving. Try to save at the same time each week to make it a habit.

Overcoming Obstacles and Staying Motivated

Despite your best intentions, you may encounter obstacles during the 52-week savings challenge. Here are some tips for overcoming common challenges and staying motivated:

- Don't be too hard on yourself: If you miss a week or two, don't get discouraged. Simply get back on track as soon as possible.

- Find a savings buddy: Having someone to hold you accountable and share the experience with can make the challenge more enjoyable and help you stay motivated.

- Reward yourself: Consider rewarding yourself at certain milestones during the challenge. This can help motivate you to stay on track.

Additional Tips for Success

In addition to the tips mentioned earlier, here are a few more strategies that can help you succeed in the 52-week savings challenge:

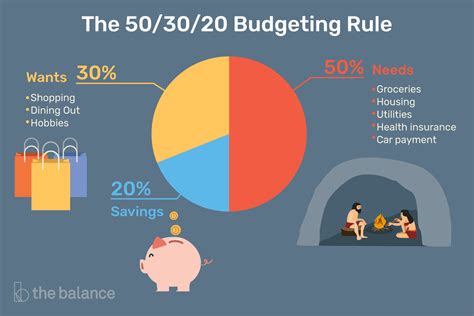

- Use the 50/30/20 rule: Allocate 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

- Avoid impulse purchases: Be mindful of your spending habits and avoid making impulse purchases, especially on big-ticket items.

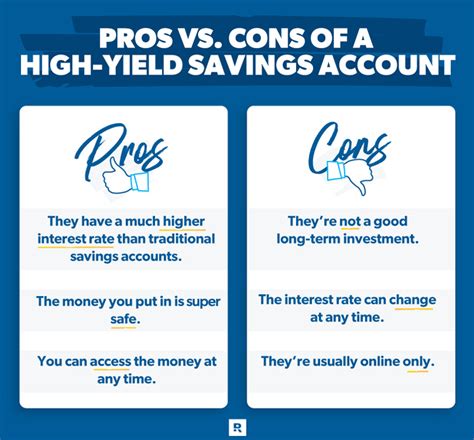

- Consider a savings account with a high-yield interest rate: Opening a savings account with a high-yield interest rate can help your money grow faster over time.

Printable Savings Challenge Templates

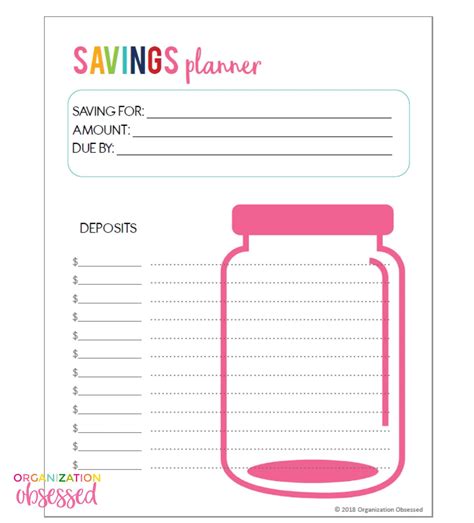

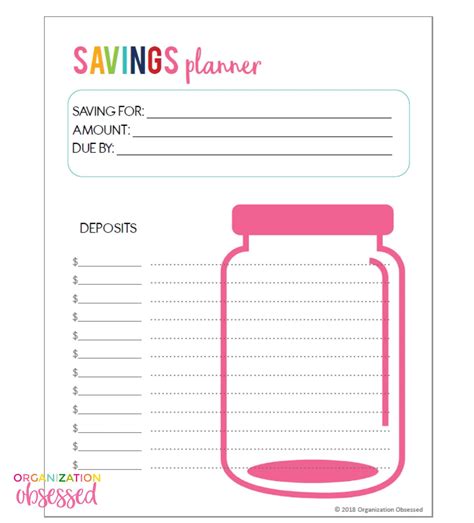

To make the 52-week savings challenge easier to follow, you can use a printable template. Here are a few options:

- Weekly savings tracker: A weekly savings tracker can help you keep track of your progress and stay motivated.

- Monthly savings calendar: A monthly savings calendar can provide a bigger picture view of your progress and help you plan for the upcoming month.

- Savings challenge chart: A savings challenge chart can help you visualize your progress and see how far you've come.

Conclusion

The 52-week savings challenge is a fun and effective way to develop a savings habit, reduce debt, and build a stronger financial future. By following the tips and strategies outlined in this article, you can make the most of this challenge and achieve your financial goals. Remember to stay consistent, overcome obstacles, and reward yourself along the way.

52-Week Savings Challenge Image Gallery