Pro Forma Financial Projections Template For Business Success Summary

Boost business success with a pro forma financial projections template. Accurately forecast income statements, balance sheets, and cash flow statements to inform strategic decisions. This comprehensive guide provides a downloadable template and expert tips for creating realistic financial projections, including revenue forecasting, expense management, and break-even analysis.

A pro forma financial projections template is a crucial tool for businesses to forecast their financial performance and make informed decisions. In this article, we will explore the importance of pro forma financial projections, its components, and how to create a template for business success.

Importance of Pro Forma Financial Projections

Pro forma financial projections are essential for businesses to anticipate future financial performance and make strategic decisions. By creating a comprehensive template, businesses can:

- Forecast revenue and expenses

- Identify potential financial risks and opportunities

- Develop a realistic business plan

- Make informed decisions about investments and funding

- Evaluate the feasibility of new projects or ventures

Components of Pro Forma Financial Projections

A typical pro forma financial projections template includes the following components:

- Income Statement: This statement outlines projected revenues, cost of goods sold, gross profit, operating expenses, and net income.

- Balance Sheet: This statement presents projected assets, liabilities, and equity.

- Cash Flow Statement: This statement shows projected inflows and outflows of cash and cash equivalents.

Creating a Pro Forma Financial Projections Template

To create a pro forma financial projections template, follow these steps:

- Determine the Projection Period: Decide on the length of the projection period, typically 3-5 years.

- Gather Historical Data: Collect historical financial data to use as a basis for projections.

- Estimate Revenue: Forecast revenue based on market trends, sales projections, and pricing strategies.

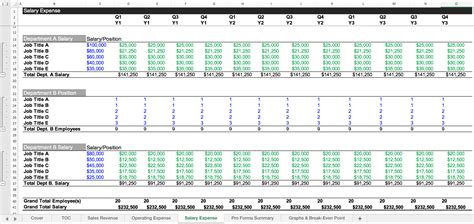

- Estimate Expenses: Project expenses, including cost of goods sold, operating expenses, and capital expenditures.

- Create Assumptions: Make assumptions about future market conditions, interest rates, and other factors that may impact financial performance.

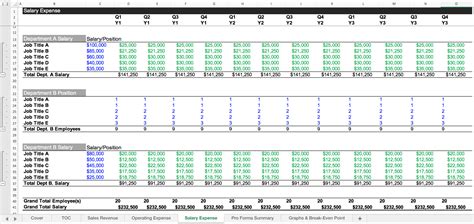

- Develop a Template: Create a template using a spreadsheet software, such as Excel, to organize and calculate projections.

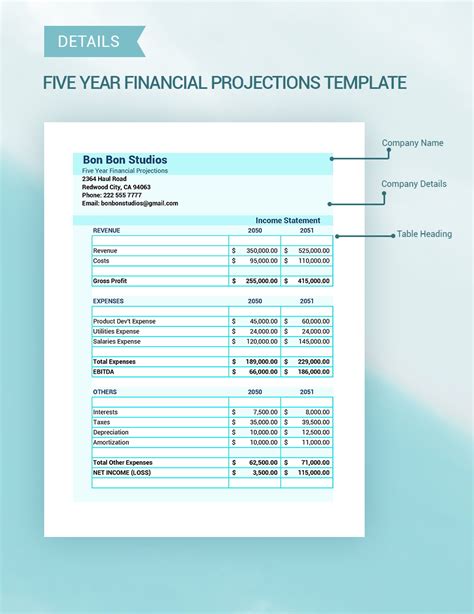

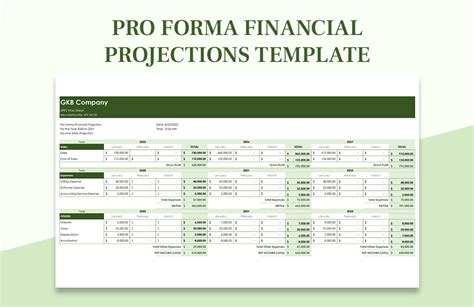

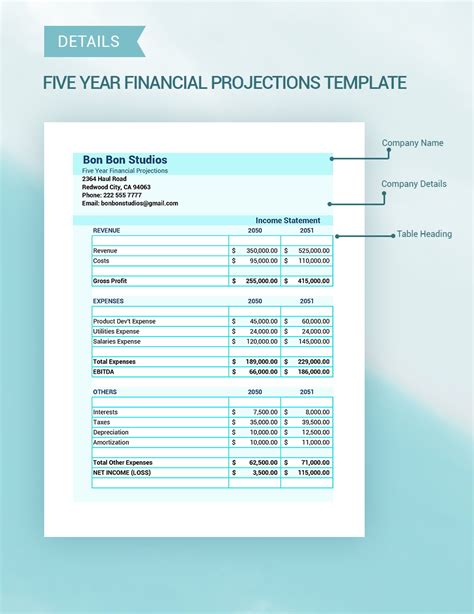

Example of a Pro Forma Financial Projections Template

Here is an example of a pro forma financial projections template:

Income Statement

| Year | Revenue | Cost of Goods Sold | Gross Profit | Operating Expenses | Net Income |

|---|---|---|---|---|---|

| 2023 | $100,000 | $60,000 | $40,000 | $20,000 | $20,000 |

| 2024 | $120,000 | $72,000 | $48,000 | $24,000 | $24,000 |

| 2025 | $150,000 | $90,000 | $60,000 | $30,000 | $30,000 |

Balance Sheet

| Year | Assets | Liabilities | Equity |

|---|---|---|---|

| 2023 | $200,000 | $100,000 | $100,000 |

| 2024 | $250,000 | $125,000 | $125,000 |

| 2025 | $300,000 | $150,000 | $150,000 |

Cash Flow Statement

| Year | Cash Inflows | Cash Outflows | Net Change in Cash |

|---|---|---|---|

| 2023 | $50,000 | $30,000 | $20,000 |

| 2024 | $60,000 | $36,000 | $24,000 |

| 2025 | $75,000 | $45,000 | $30,000 |

Benefits of Using a Pro Forma Financial Projections Template

Using a pro forma financial projections template offers several benefits, including:

- Improved Financial Planning: By creating a comprehensive template, businesses can better anticipate future financial performance and make informed decisions.

- Increased Accuracy: A template helps reduce errors and improves accuracy by organizing and calculating projections in a systematic way.

- Enhanced Credibility: A well-structured template can enhance credibility with investors, lenders, and other stakeholders.

Tips for Creating an Effective Pro Forma Financial Projections Template

- Use Historical Data: Use historical financial data to create a basis for projections.

- Make Realistic Assumptions: Make assumptions about future market conditions, interest rates, and other factors that may impact financial performance.

- Regularly Review and Update: Regularly review and update the template to reflect changes in market conditions and business performance.

Common Mistakes to Avoid When Creating a Pro Forma Financial Projections Template

- Overestimating Revenue: Avoid overestimating revenue by making unrealistic assumptions about future market conditions.

- Underestimating Expenses: Avoid underestimating expenses by failing to account for all costs associated with running a business.

- Ignoring Assumptions: Avoid ignoring assumptions by failing to make assumptions about future market conditions, interest rates, and other factors that may impact financial performance.

Conclusion

Creating a pro forma financial projections template is a crucial step in anticipating future financial performance and making informed decisions. By following the steps outlined in this article, businesses can create a comprehensive template that helps improve financial planning, increase accuracy, and enhance credibility. Remember to use historical data, make realistic assumptions, and regularly review and update the template to reflect changes in market conditions and business performance.

Gallery of Pro Forma Financial Projections Templates

Pro Forma Financial Projections Templates

We hope this article has provided you with a comprehensive guide to creating a pro forma financial projections template. By following the steps outlined in this article, you can create a template that helps improve financial planning, increase accuracy, and enhance credibility.