Intro

Create a secure loan agreement in Alabama with our free promissory note template. This comprehensive guide provides a customizable template, outlining key terms and conditions, to protect lenders and borrowers. Learn how to draft a legally binding Alabama promissory note, covering repayment terms, interest rates, and collateral requirements.

In the state of Alabama, when two parties enter into a loan agreement, it's essential to have a written contract that outlines the terms of the loan. A promissory note is a legally binding document that sets forth the borrower's promise to repay the loan to the lender. This article will guide you through the key elements of an Alabama promissory note template, ensuring a secure loan for both parties.

Understanding Alabama Promissory Note Laws

Alabama follows the Uniform Commercial Code (UCC), which governs promissory notes and other commercial transactions. The Alabama Code, specifically Title 7, Chapter 3, Article 3, sets forth the requirements for promissory notes. To ensure compliance with state laws, it's crucial to include specific language and terms in the promissory note template.

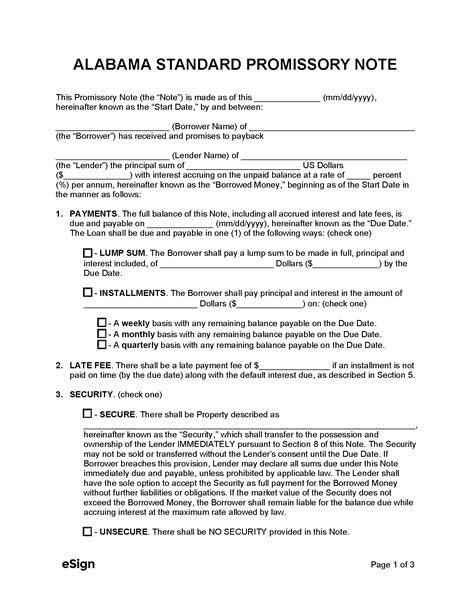

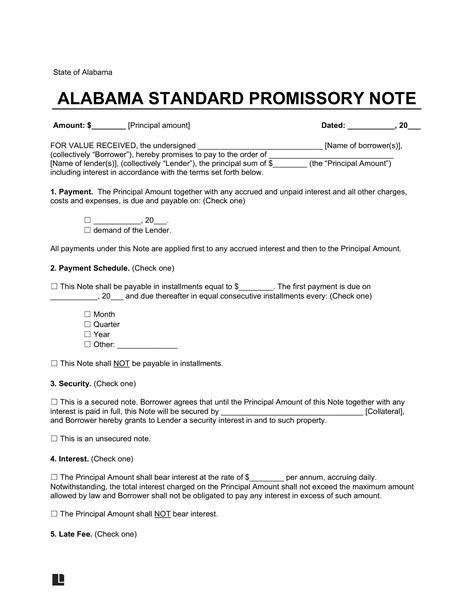

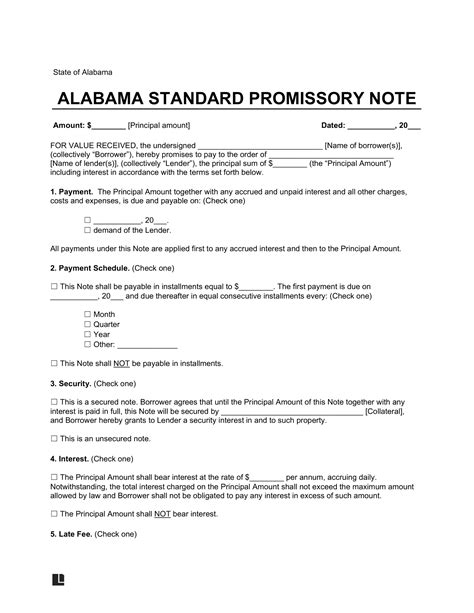

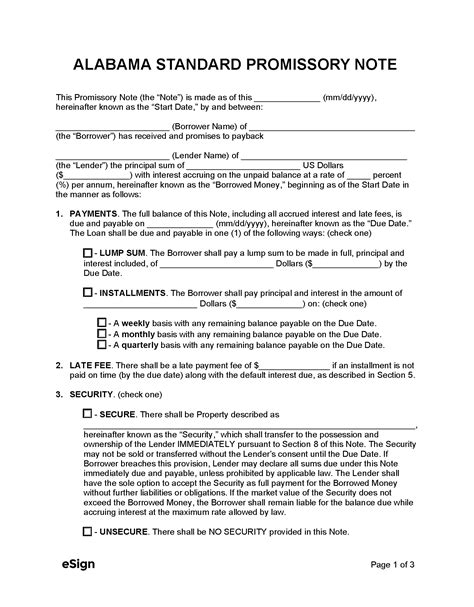

Key Elements of an Alabama Promissory Note Template

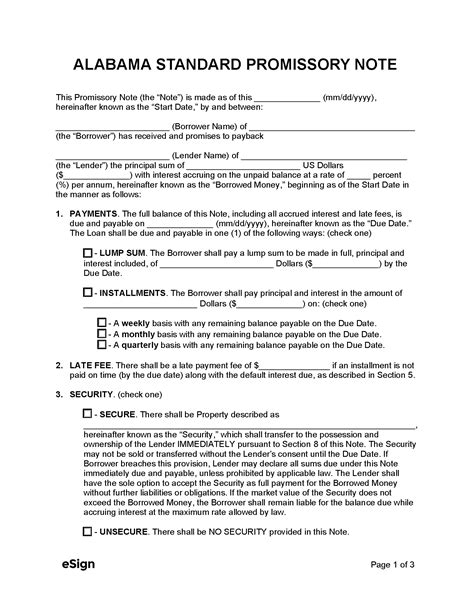

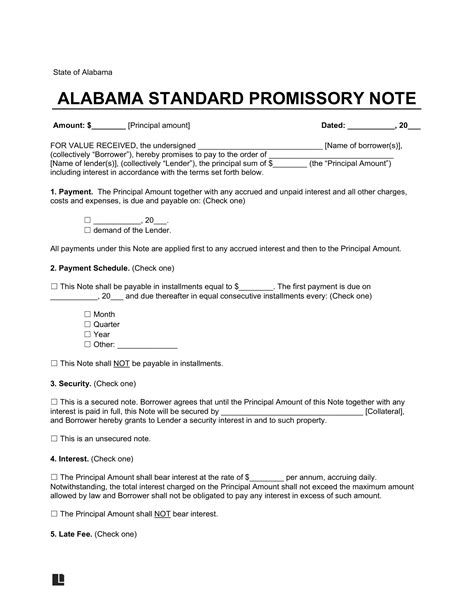

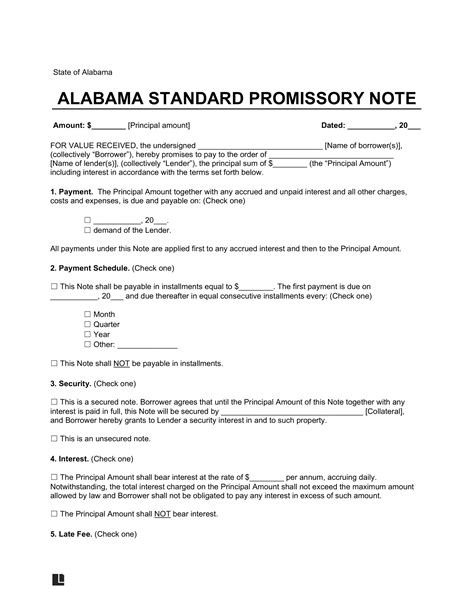

A standard Alabama promissory note template should include the following essential elements:

- Parties' Information: The names and addresses of the borrower (maker) and lender (payee).

- Loan Amount: The principal amount borrowed, which should be a specific, agreed-upon amount.

- Interest Rate: The interest rate charged on the loan, which may be fixed or variable.

- Repayment Terms: The repayment schedule, including the payment amount, frequency (e.g., monthly), and due date.

- Collateral: A description of any collateral or security interest pledged to secure the loan.

- Default and Late Payment Provisions: Terms outlining the consequences of default or late payment, including any additional fees or charges.

- Governing Law: A statement specifying that Alabama law governs the promissory note.

- Signatures: The signatures of both the borrower and lender, which makes the agreement binding.

Additional Clauses to Consider

When creating an Alabama promissory note template, you may want to include additional clauses to protect the interests of both parties. Some examples include:

- Prepayment Clause: Allows the borrower to make prepayments or pay off the loan early without penalty.

- Acceleration Clause: Permits the lender to accelerate the repayment schedule if the borrower defaults.

- Warranty Clause: Requires the borrower to provide warranties or guarantees regarding the collateral or loan purpose.

Benefits of Using an Alabama Promissory Note Template

Using an Alabama promissory note template offers several benefits for both lenders and borrowers:

- Clarity and Transparency: A clear, written agreement helps prevent misunderstandings and ensures both parties understand their obligations.

- Enforceability: A promissory note template helps establish a legally binding contract, making it easier to enforce in case of disputes.

- Compliance: Using a template that meets Alabama state laws and regulations helps ensure compliance and avoids potential issues.

Best Practices for Creating an Alabama Promissory Note Template

When creating an Alabama promissory note template, keep the following best practices in mind:

- Seek Professional Advice: Consult with an attorney or financial expert to ensure the template meets your specific needs and complies with Alabama laws.

- Customize the Template: Tailor the template to fit your specific loan agreement, including the loan amount, interest rate, and repayment terms.

- Review and Revise: Carefully review the template before signing, and make any necessary revisions to ensure it accurately reflects the agreement.

Gallery of Alabama Promissory Note Templates and Related Images

Alabama Promissory Note Template Gallery

Final Thoughts on Alabama Promissory Note Templates

In conclusion, using an Alabama promissory note template is essential for secure loans. By including the necessary elements and clauses, both lenders and borrowers can ensure a clear, enforceable, and compliant agreement. Remember to seek professional advice, customize the template, and review it carefully before signing.