Intro

Securely lend or borrow money in Connecticut with a reliable promissory note template. Easily create a binding agreement outlining loan terms, interest rates, and repayment schedules. Ensure compliance with state laws and protect your interests with this customizable and enforceable document, perfect for personal or business loans.

Understanding the Importance of a Connecticut Promissory Note Template

In the state of Connecticut, when a borrower receives a loan from a lender, it's essential to have a written agreement that outlines the terms of the loan. This is where a promissory note comes in. A promissory note is a legally binding document that contains the borrower's promise to repay the loan, along with the terms of the loan, such as the interest rate, repayment schedule, and amount borrowed.

Having a Connecticut promissory note template can provide a simple and secure solution for both lenders and borrowers. It helps to ensure that all parties are on the same page and understand their obligations, reducing the risk of misunderstandings and potential disputes.

The Benefits of Using a Promissory Note Template

Using a promissory note template can provide several benefits, including:

- Clarifies the terms of the loan: A promissory note template helps to ensure that all parties understand the terms of the loan, including the interest rate, repayment schedule, and amount borrowed.

- Provides a record of the loan: A promissory note template provides a written record of the loan, which can be useful in case of disputes or if the borrower defaults on the loan.

- Protects the lender: A promissory note template helps to protect the lender by outlining the borrower's obligations and providing a clear understanding of the loan terms.

- Reduces the risk of misunderstandings: Using a promissory note template can help to reduce the risk of misunderstandings by providing a clear and concise document that outlines the terms of the loan.

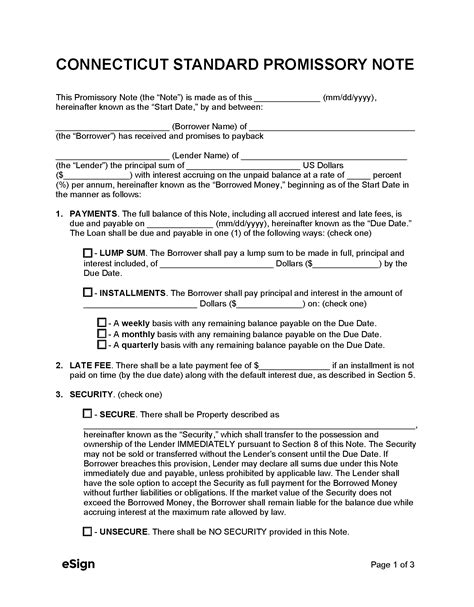

Key Components of a Connecticut Promissory Note Template

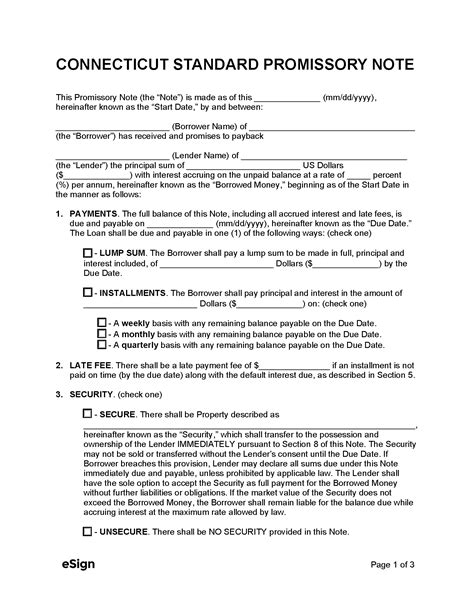

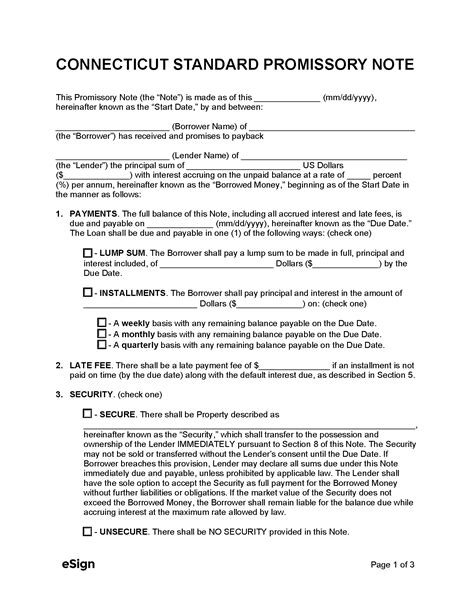

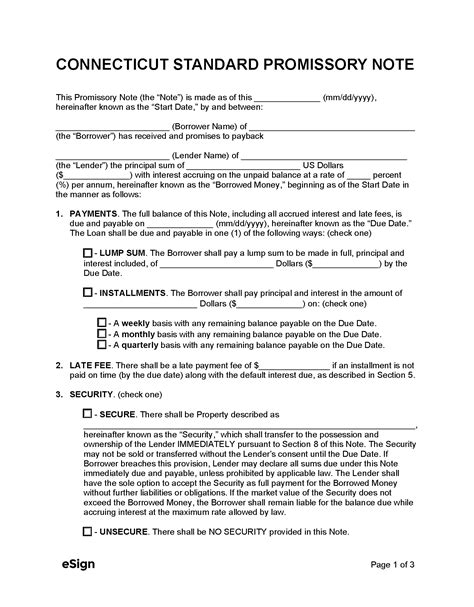

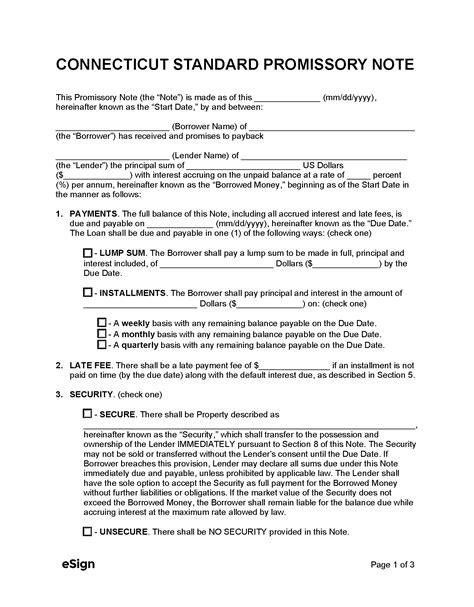

A Connecticut promissory note template typically includes the following key components:

- Names and addresses of the parties involved: The template should include the names and addresses of the borrower and lender.

- Loan amount and interest rate: The template should outline the amount borrowed and the interest rate applicable to the loan.

- Repayment schedule: The template should include a repayment schedule that outlines when and how much the borrower is required to pay.

- Default provisions: The template should include provisions that outline what happens if the borrower defaults on the loan.

- Security provisions: The template should include provisions that outline any security or collateral provided by the borrower.

Step-by-Step Guide to Completing a Connecticut Promissory Note Template

Completing a Connecticut promissory note template is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Download a template: Start by downloading a Connecticut promissory note template from a reputable source.

- Fill in the borrower's information: Fill in the borrower's name and address, as well as any other relevant contact information.

- Fill in the lender's information: Fill in the lender's name and address, as well as any other relevant contact information.

- Outline the loan terms: Outline the loan terms, including the amount borrowed, interest rate, and repayment schedule.

- Include default provisions: Include provisions that outline what happens if the borrower defaults on the loan.

- Include security provisions: Include provisions that outline any security or collateral provided by the borrower.

- Sign the document: Once the template is complete, sign the document and have the borrower sign it as well.

Using a Connecticut Promissory Note Template for Specific Situations

A Connecticut promissory note template can be used for a variety of specific situations, including:

- Personal loans: A promissory note template can be used for personal loans between friends or family members.

- Business loans: A promissory note template can be used for business loans between a lender and a borrower.

- Real estate loans: A promissory note template can be used for real estate loans, such as mortgages or home equity loans.

- Student loans: A promissory note template can be used for student loans, such as federal student loans or private student loans.

Best Practices for Using a Connecticut Promissory Note Template

Here are some best practices for using a Connecticut promissory note template:

- Use a reputable source: Use a reputable source to download a promissory note template.

- Read the template carefully: Read the template carefully before signing it.

- Seek legal advice: Seek legal advice if you're unsure about any aspect of the template.

- Keep a record of the loan: Keep a record of the loan, including the promissory note template and any repayment schedules.

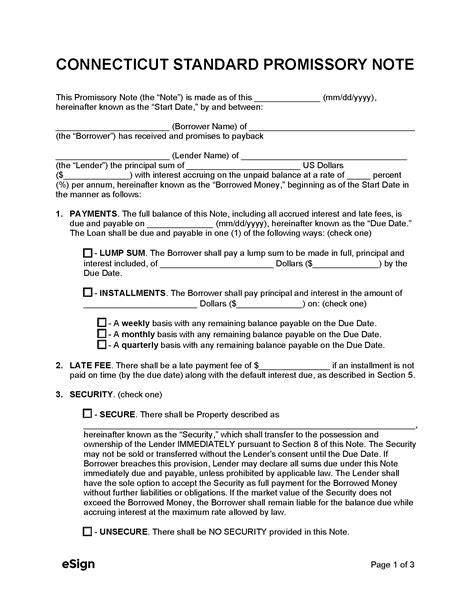

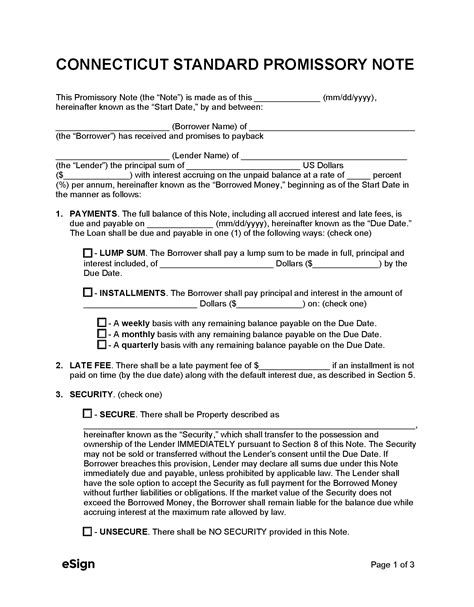

Gallery of Connecticut Promissory Note Templates

Connecticut Promissory Note Template Image Gallery

Conclusion

A Connecticut promissory note template can provide a simple and secure solution for both lenders and borrowers. It helps to ensure that all parties are on the same page and understand their obligations, reducing the risk of misunderstandings and potential disputes. By using a reputable source to download a promissory note template, reading the template carefully, seeking legal advice, and keeping a record of the loan, you can ensure that your loan is secure and successful.

We hope this article has provided you with a comprehensive understanding of Connecticut promissory note templates. If you have any further questions or need assistance with a promissory note template, please don't hesitate to reach out.