5 Essential Tips For A Promissory Note In Kentucky Summary

Secure your financial agreements with a legally binding promissory note in Kentucky. Learn the 5 essential tips to create an enforceable note, including drafting, signing, and recording requirements. Understand the importance of interest rates, payment terms, and default clauses to protect your investments. Get informed and avoid costly mistakes.

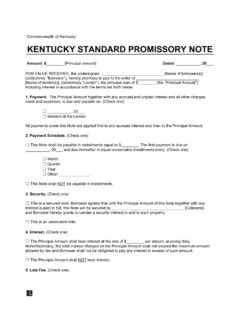

When it comes to borrowing or lending money in Kentucky, a promissory note is a crucial document that outlines the terms of the loan. A promissory note is a written agreement between two parties, where one party (the borrower) promises to repay a certain amount of money to the other party (the lender) with interest. In this article, we will provide you with 5 essential tips for a promissory note in Kentucky.

A promissory note is a binding contract that can have serious consequences if not followed properly. As a borrower or lender in Kentucky, it's essential to understand the importance of a promissory note and how to create one that protects your interests. Here are 5 essential tips to consider:

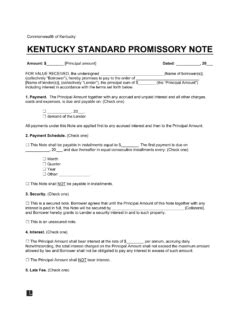

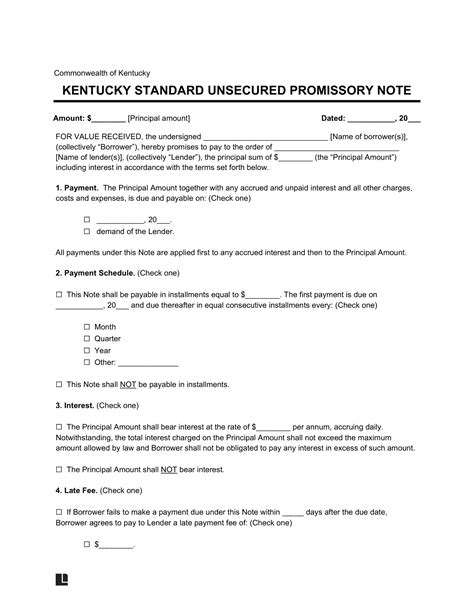

Tip 1: Define the Terms of the Loan Clearly

A promissory note should clearly outline the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any fees associated with the loan. It's essential to define these terms clearly to avoid any misunderstandings or disputes in the future.

For example, the promissory note should specify the principal amount borrowed, the interest rate, and the repayment schedule, including the frequency of payments and the due date. It's also essential to specify any fees associated with the loan, such as late payment fees or origination fees.

Example of a Clear Loan Term

"The borrower agrees to repay the principal amount of $10,000 plus interest at a rate of 6% per annum. The borrower will make monthly payments of $500 for a period of 24 months, with the first payment due on January 1st and subsequent payments due on the 1st day of each month thereafter."

Tip 2: Identify the Parties Involved

A promissory note should clearly identify the parties involved in the loan, including the borrower and the lender. It's essential to include the names, addresses, and contact information of both parties to avoid any confusion or disputes.

For example, the promissory note should include the borrower's name, address, and contact information, as well as the lender's name, address, and contact information.

Example of Identifying Parties Involved

"Borrower: John Doe, 123 Main Street, Lexington, KY 40502 Lender: ABC Bank, 456 Elm Street, Louisville, KY 40202"

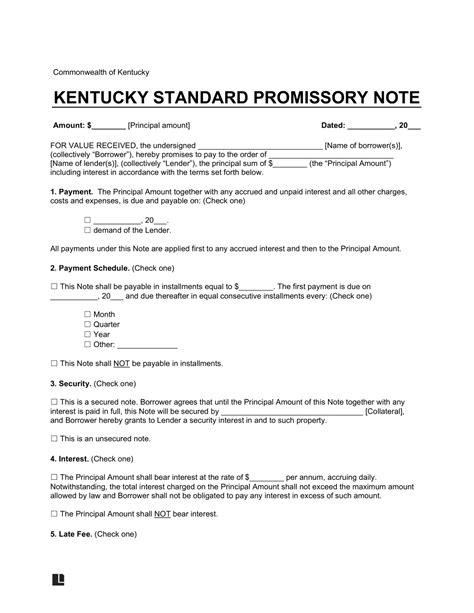

Tip 3: Specify the Collateral (If Any)

If the loan is secured by collateral, such as a house or a car, the promissory note should clearly specify the collateral and the terms of the security agreement.

For example, the promissory note should specify the type of collateral, its value, and the terms of the security agreement, including the borrower's obligations to maintain the collateral and the lender's rights to foreclose on the collateral in the event of default.

Example of Specifying Collateral

"The borrower grants to the lender a security interest in the real property located at 123 Main Street, Lexington, KY 40502, as collateral for the loan. The borrower agrees to maintain the property in good condition and to pay all taxes and insurance premiums associated with the property."

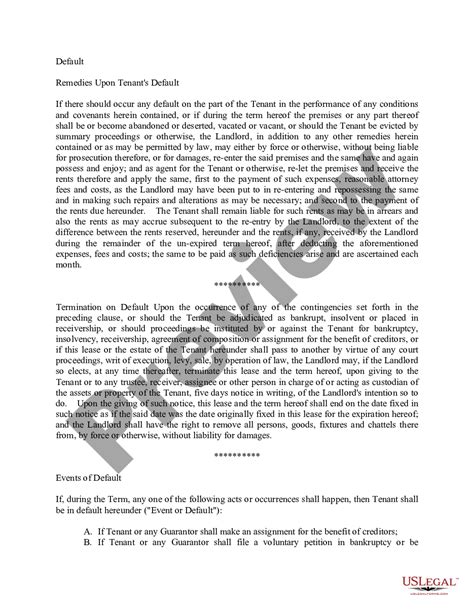

Tip 4: Include a Default Clause

A promissory note should include a default clause that outlines the consequences of default, including the lender's rights to accelerate the loan, foreclose on the collateral, and collect late payment fees.

For example, the promissory note should specify the events that constitute default, such as failure to make payments or failure to maintain the collateral. It should also specify the lender's rights and remedies in the event of default, including the right to accelerate the loan, foreclose on the collateral, and collect late payment fees.

Example of a Default Clause

"Default: The borrower shall be in default under this note if the borrower fails to make any payment when due or fails to maintain the collateral in good condition. Upon default, the lender may accelerate the loan, foreclose on the collateral, and collect late payment fees in the amount of $50 per month."

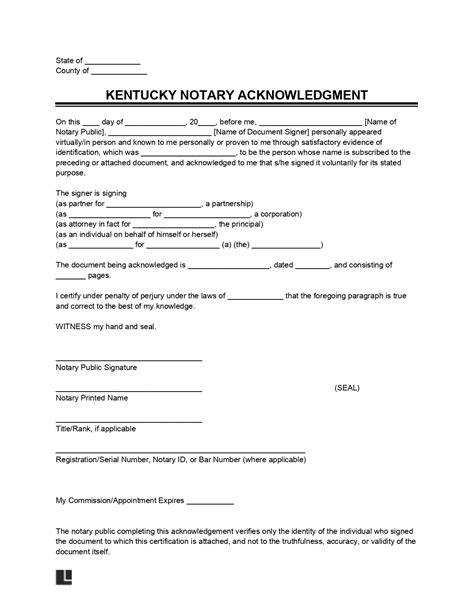

Tip 5: Have the Note Signed and Notarized

Finally, it's essential to have the promissory note signed and notarized by both parties to make it a binding contract.

The borrower and the lender should sign the promissory note in the presence of a notary public, who should verify their identities and witness their signatures.

Example of a Signed and Notarized Promissory Note

"IN WITNESS WHEREOF, the borrower and the lender have executed this promissory note as of the date first above written.

Borrower's Signature: _____________________________ Lender's Signature: _____________________________ Notary Public: _____________________________"

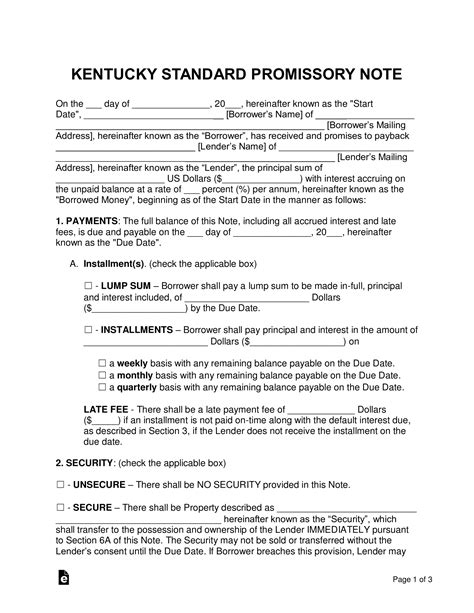

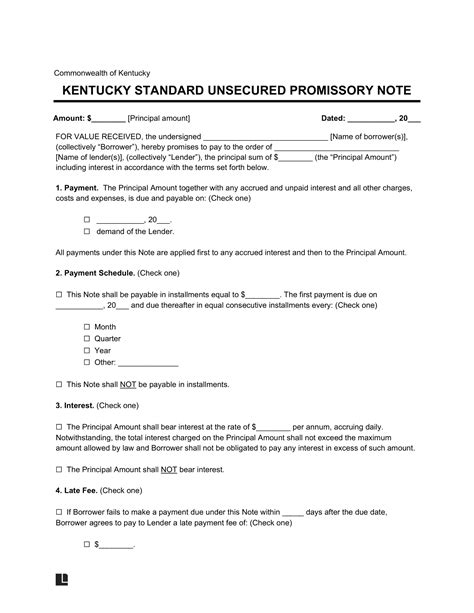

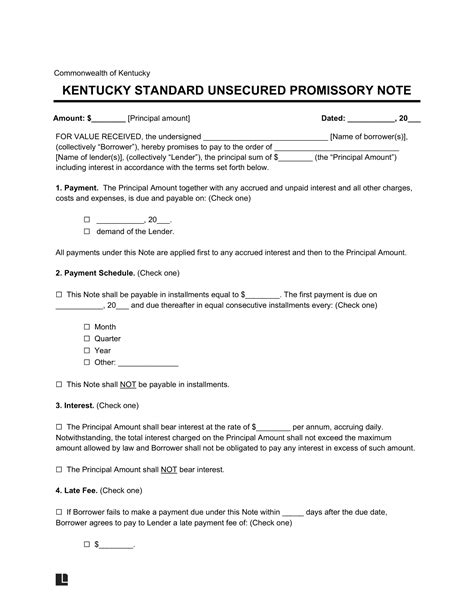

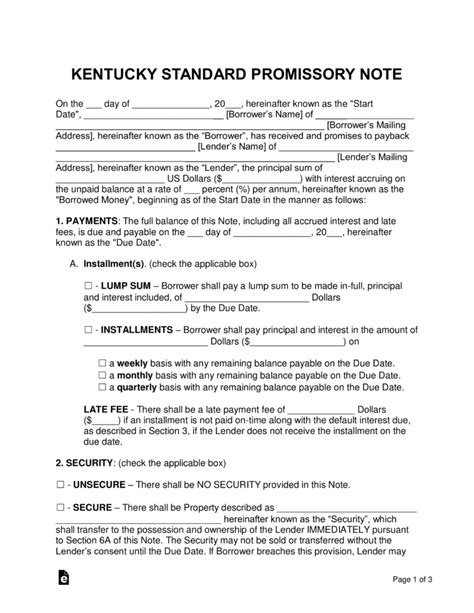

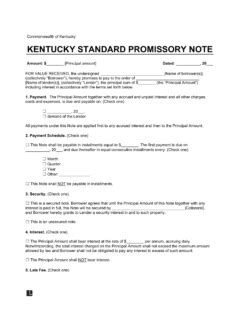

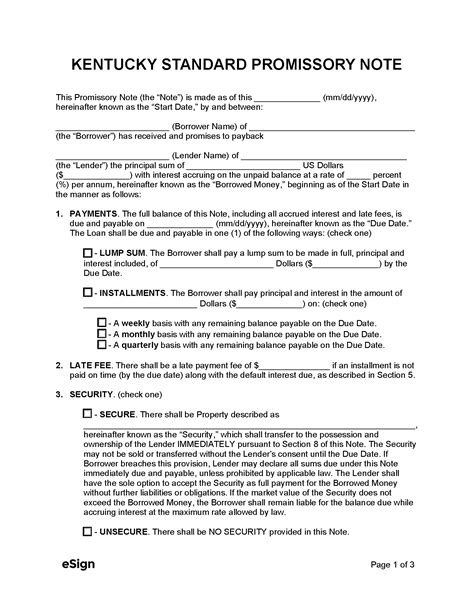

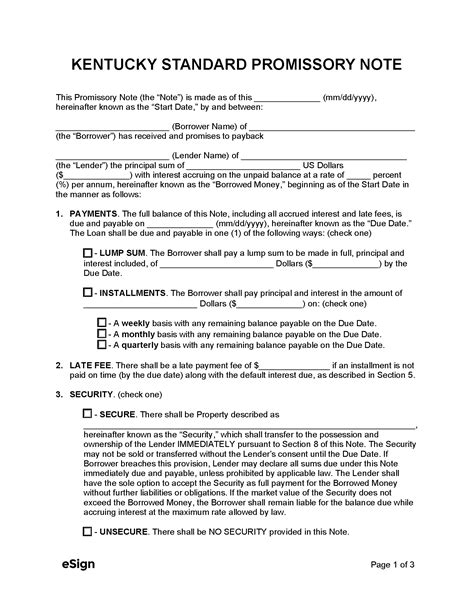

Gallery of Kentucky Promissory Note Templates

Kentucky Promissory Note Templates Image Gallery

By following these 5 essential tips, you can create a promissory note that protects your interests and ensures a smooth loan transaction in Kentucky. Remember to define the terms of the loan clearly, identify the parties involved, specify the collateral (if any), include a default clause, and have the note signed and notarized.