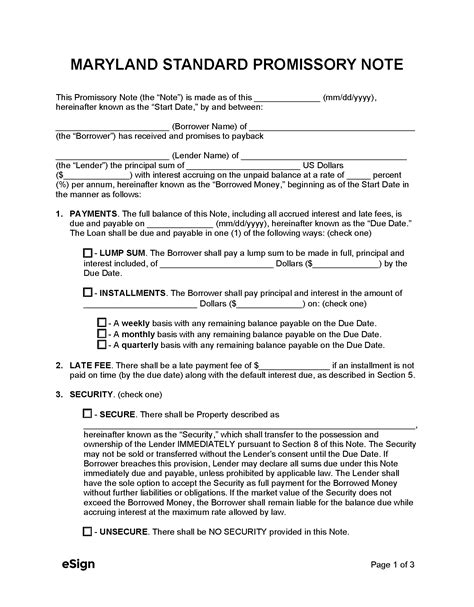

Maryland Promissory Note Template And Agreement Sample Summary

Create a legally binding agreement with our free Maryland Promissory Note Template. Download a sample template to outline loan terms, payment schedules, and interest rates. Ensure a smooth lending process with our comprehensive template, covering loan agreements, payment plans, and debt repayment in Maryland.

A promissory note is a written agreement that outlines the terms of a loan between two parties. It is a legally binding document that serves as a promise to repay the loan amount, along with any interest or fees, within a specified timeframe. In Maryland, a promissory note template can be used to create a personalized agreement that meets the state's laws and regulations.

Why Use a Maryland Promissory Note Template?

Using a promissory note template in Maryland provides several benefits, including:

- Convenience: A pre-designed template saves time and effort in creating a personalized agreement from scratch.

- Compliance: A template ensures that the agreement meets Maryland's laws and regulations, reducing the risk of errors or disputes.

- Clarity: A well-structured template helps to clearly outline the terms and conditions of the loan, avoiding misunderstandings or miscommunications.

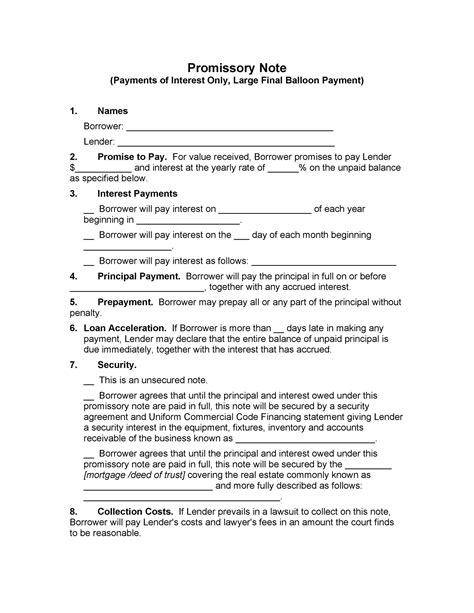

What to Include in a Maryland Promissory Note Template

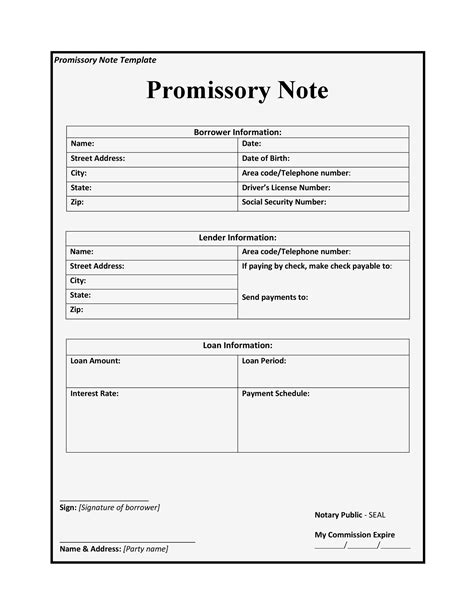

A comprehensive Maryland promissory note template should include the following essential elements:

- Parties Involved: The names and addresses of the borrower (also known as the "maker") and the lender (also known as the "payee").

- Loan Amount: The total amount borrowed, including any interest or fees.

- Interest Rate: The annual interest rate applied to the loan amount.

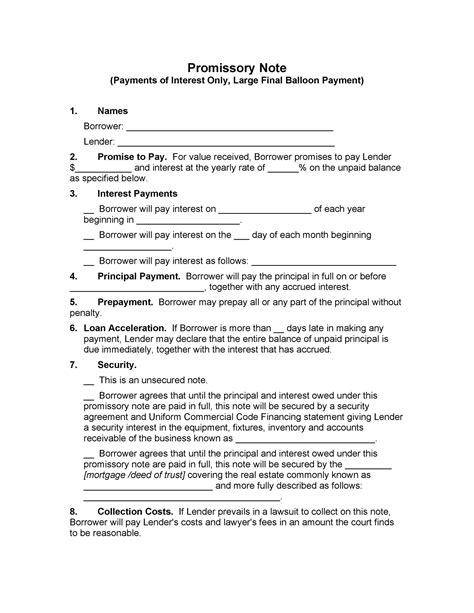

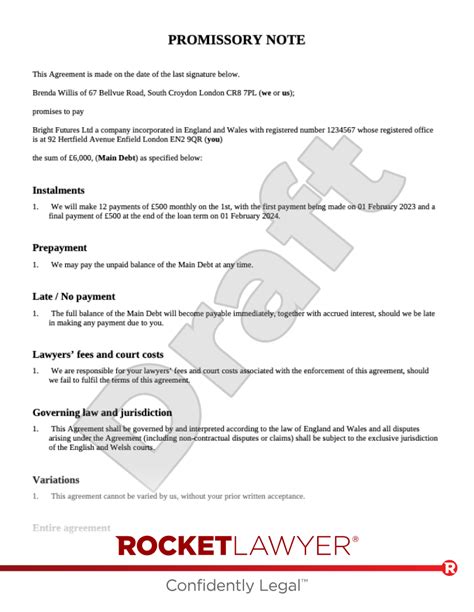

- Repayment Terms: The repayment schedule, including the due date, payment amount, and frequency (e.g., monthly, quarterly).

- Payment Methods: The accepted payment methods, such as check, bank transfer, or online payment.

- Default Provisions: The consequences of defaulting on the loan, including late fees, penalties, and acceleration of the loan.

- Security: Any collateral or security provided to secure the loan.

- Governing Law: A statement indicating that the agreement is governed by Maryland law.

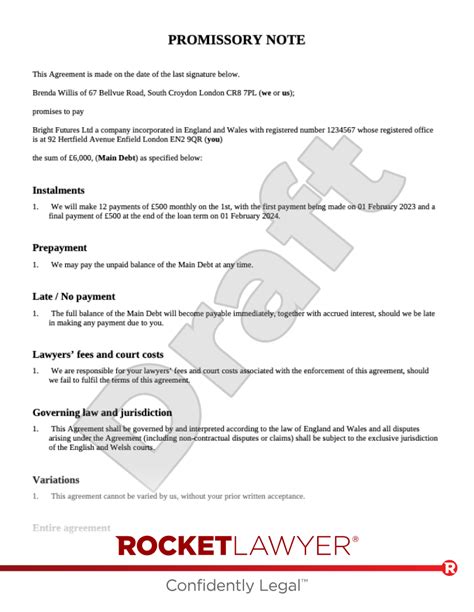

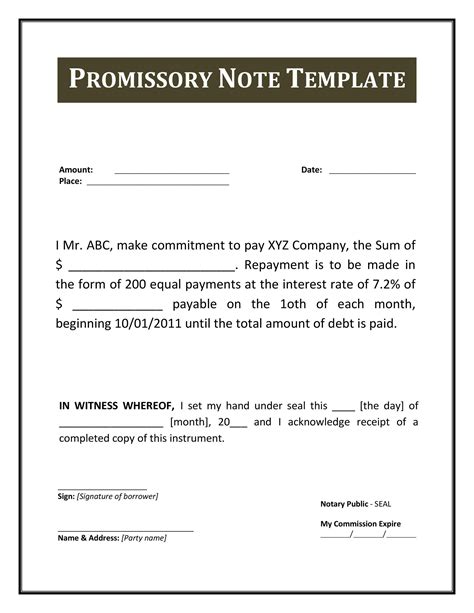

Sample Maryland Promissory Note Template

Below is a sample Maryland promissory note template:

[Insert Date]

[Insert Borrower's Name] [Insert Borrower's Address]

[Insert Lender's Name] [Insert Lender's Address]

PROMISSORY NOTE

In consideration of the loan made by [Lender's Name] (the "Lender") to [Borrower's Name] (the "Borrower"), the Borrower agrees to repay the loan amount of $[Insert Loan Amount] (the "Loan Amount") together with interest at the rate of [Insert Interest Rate]% per annum.

REPAYMENT TERMS

The Borrower shall repay the Loan Amount in [Insert Number] installments, each due on the [Insert Due Date] of each [Insert Frequency] month/quarter, commencing on [Insert Start Date]. Each payment shall be in the amount of $[Insert Payment Amount].

DEFAULT PROVISIONS

In the event of default, the Borrower shall pay a late fee of $[Insert Late Fee] and shall be liable for all costs and expenses incurred by the Lender in collecting the debt.

SECURITY

The Borrower shall provide [Insert Security] as collateral to secure the loan.

GOVERNING LAW

This agreement shall be governed by and construed in accordance with the laws of the State of Maryland.

ACKNOWLEDGMENT

The Borrower acknowledges that they have read and understood the terms and conditions of this agreement and agrees to be bound by them.

SIGNATURE

Signature of Borrower: _____________________________

Date: _____________________________________________

Signature of Lender: _____________________________

Date: _____________________________________________

Note: This is just a sample template, and you should consult with an attorney to ensure that the agreement meets Maryland's laws and regulations.

Frequently Asked Questions

- What is a promissory note? A promissory note is a written agreement that outlines the terms of a loan between two parties.

- What is the purpose of a promissory note? The purpose of a promissory note is to provide a written record of the loan agreement, including the loan amount, interest rate, repayment terms, and any security provided.

- What should I include in a Maryland promissory note template? A comprehensive Maryland promissory note template should include the parties involved, loan amount, interest rate, repayment terms, payment methods, default provisions, security, and governing law.

- Can I use a promissory note template for personal loans? Yes, a promissory note template can be used for personal loans between individuals, but it's recommended to consult with an attorney to ensure that the agreement meets Maryland's laws and regulations.

Gallery of Maryland Promissory Note Templates

Maryland Promissory Note Templates

We hope this article has provided you with a comprehensive understanding of Maryland promissory note templates and agreements. If you have any further questions or need assistance with creating a personalized template, feel free to comment below or share your thoughts.