5 Essential Promissory Note Templates For Minnesota Summary

Securely draft and manage loans in Minnesota with our 5 essential promissory note templates. Learn how to create legally binding agreements with these customizable templates, covering personal, real estate, and business loans. Ensure compliance with Minnesota laws and regulations, including usury rates and statute of limitations.

As a business owner or individual in Minnesota, you may need to use promissory notes to formalize loans or financial agreements. A promissory note is a written promise to pay a debt, and it can be used in a variety of situations, including business loans, personal loans, and real estate transactions. In this article, we'll discuss five essential promissory note templates for Minnesota and provide guidance on how to use them.

Minnesota's laws and regulations regarding promissory notes are governed by the Minnesota Uniform Commercial Code (UCC) and the Minnesota Statutes. It's essential to comply with these laws when creating and using promissory notes in the state.

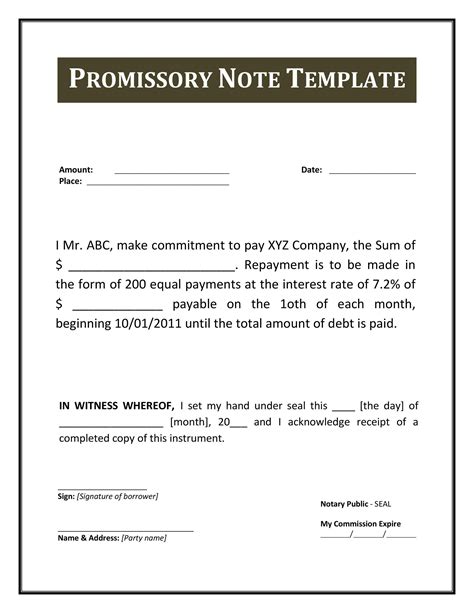

What is a Promissory Note?

A promissory note is a written agreement between two parties, where one party (the borrower) promises to pay a certain amount of money to the other party (the lender). The note typically includes the amount borrowed, the interest rate, the repayment terms, and the due date.

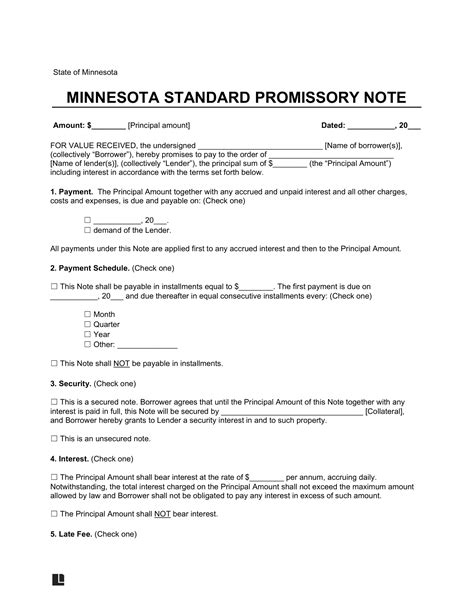

5 Essential Promissory Note Templates for Minnesota

Here are five essential promissory note templates for Minnesota, each with its unique characteristics and uses:

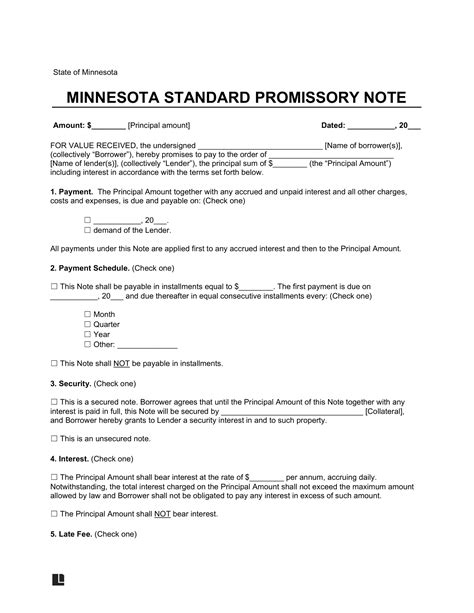

1. Personal Loan Promissory Note

This template is used for personal loans between individuals, such as friends or family members. It's essential to use a promissory note for personal loans to avoid misunderstandings and ensure that both parties are clear on the terms of the loan.

Key Elements of a Personal Loan Promissory Note:

- Borrower's name and address

- Lender's name and address

- Loan amount

- Interest rate (if applicable)

- Repayment terms (e.g., monthly payments)

- Due date

Example of a Personal Loan Promissory Note:

"On [date], I, [Borrower's Name], promise to pay [Lender's Name] the sum of $ [Loan Amount] with interest at the rate of [Interest Rate]% per annum. The loan shall be repaid in [Number] monthly installments of $ [Monthly Payment] each, commencing on [First Payment Date] and continuing until [Due Date]."

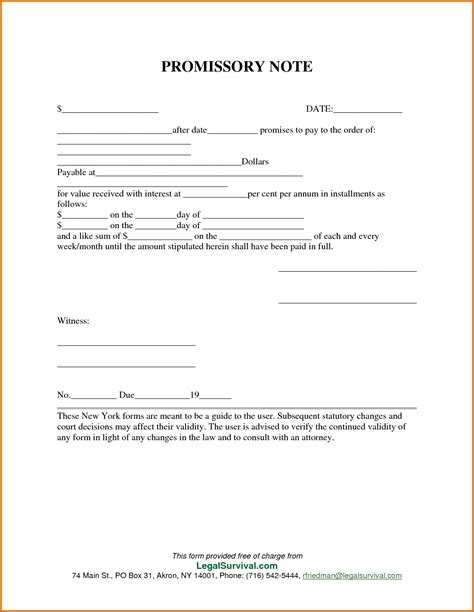

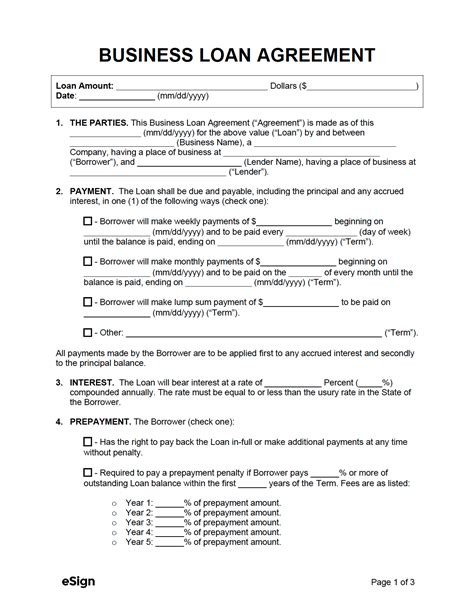

2. Business Loan Promissory Note

This template is used for business loans between a lender and a borrower, such as a company or partnership. A business loan promissory note is essential for formalizing the loan agreement and ensuring that both parties understand the terms of the loan.

Key Elements of a Business Loan Promissory Note:

- Borrower's business name and address

- Lender's name and address

- Loan amount

- Interest rate (if applicable)

- Repayment terms (e.g., monthly payments)

- Due date

- Collateral (if applicable)

Example of a Business Loan Promissory Note:

"On [date], [Borrower's Business Name], a [State] corporation, promises to pay [Lender's Name] the sum of $ [Loan Amount] with interest at the rate of [Interest Rate]% per annum. The loan shall be repaid in [Number] monthly installments of $ [Monthly Payment] each, commencing on [First Payment Date] and continuing until [Due Date]. The borrower shall provide [Collateral] as security for the loan."

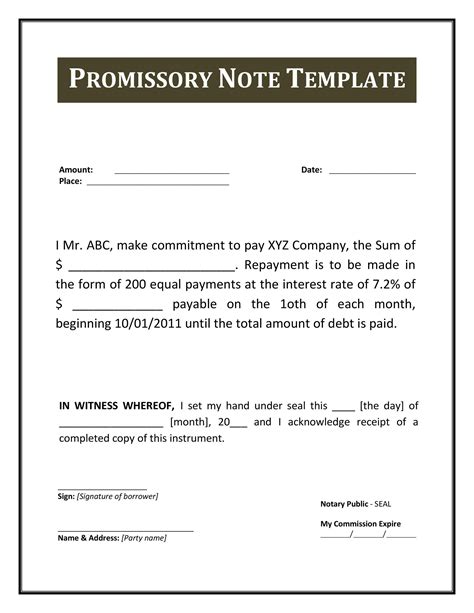

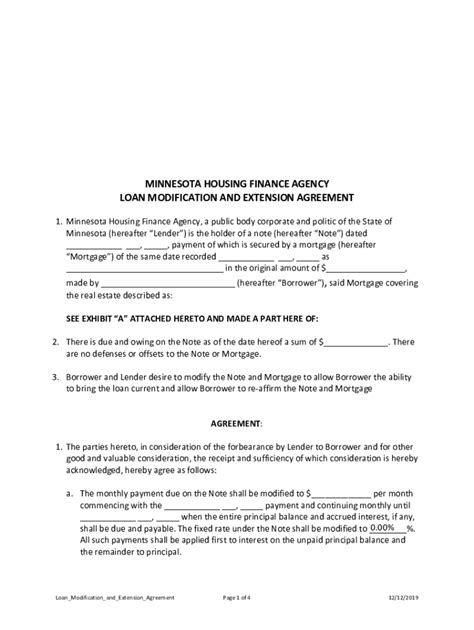

3. Real Estate Promissory Note

This template is used for real estate transactions, such as mortgages or deeds of trust. A real estate promissory note is essential for formalizing the loan agreement and ensuring that both parties understand the terms of the loan.

Key Elements of a Real Estate Promissory Note:

- Borrower's name and address

- Lender's name and address

- Property description (e.g., address, parcel number)

- Loan amount

- Interest rate (if applicable)

- Repayment terms (e.g., monthly payments)

- Due date

- Collateral (e.g., property)

Example of a Real Estate Promissory Note:

"On [date], I, [Borrower's Name], promise to pay [Lender's Name] the sum of $ [Loan Amount] with interest at the rate of [Interest Rate]% per annum. The loan shall be repaid in [Number] monthly installments of $ [Monthly Payment] each, commencing on [First Payment Date] and continuing until [Due Date]. The borrower shall provide [Property Description] as collateral for the loan."

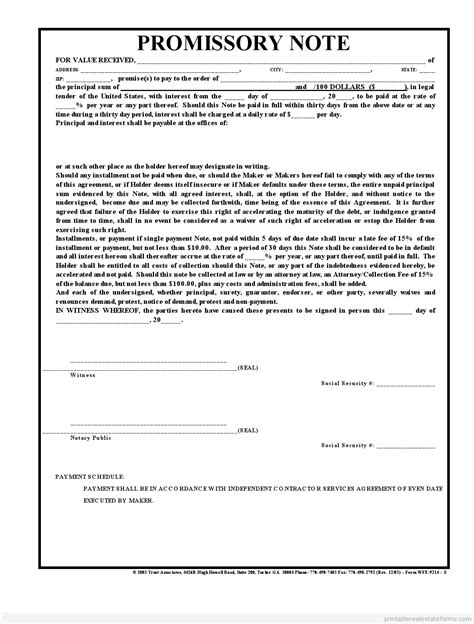

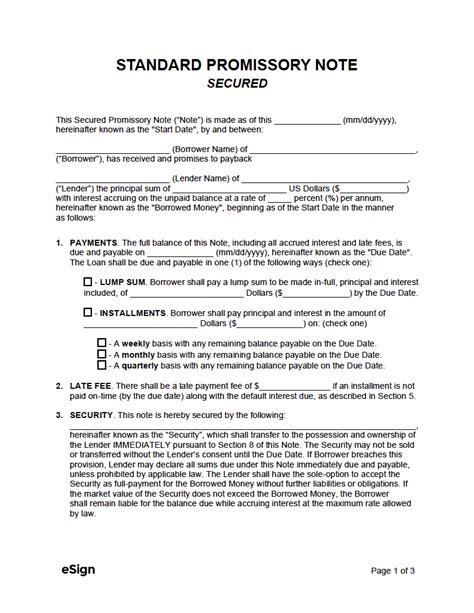

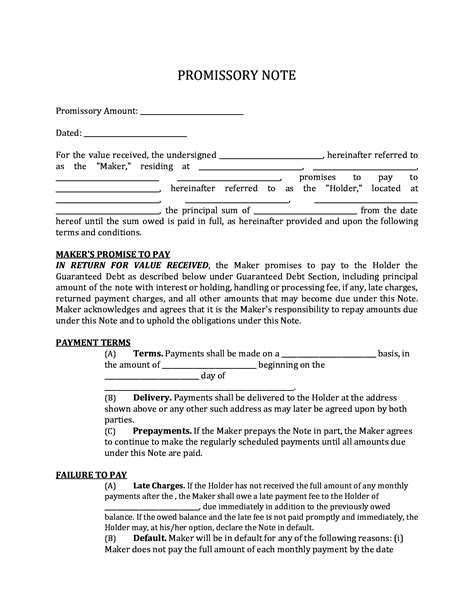

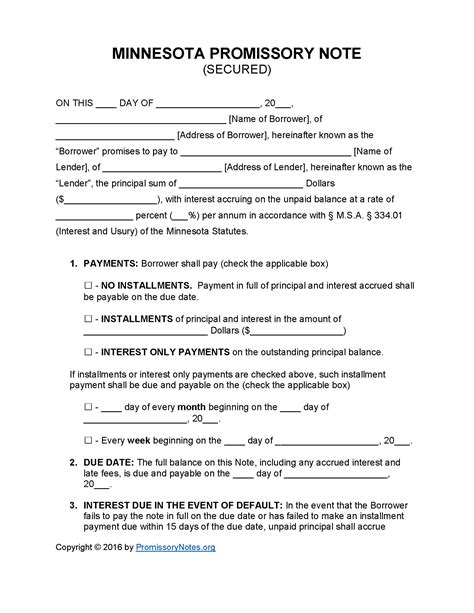

4. Secured Promissory Note

This template is used for loans that are secured by collateral, such as a car or equipment. A secured promissory note is essential for formalizing the loan agreement and ensuring that both parties understand the terms of the loan.

Key Elements of a Secured Promissory Note:

- Borrower's name and address

- Lender's name and address

- Loan amount

- Interest rate (if applicable)

- Repayment terms (e.g., monthly payments)

- Due date

- Collateral description

Example of a Secured Promissory Note:

"On [date], I, [Borrower's Name], promise to pay [Lender's Name] the sum of $ [Loan Amount] with interest at the rate of [Interest Rate]% per annum. The loan shall be repaid in [Number] monthly installments of $ [Monthly Payment] each, commencing on [First Payment Date] and continuing until [Due Date]. The borrower shall provide [Collateral Description] as collateral for the loan."

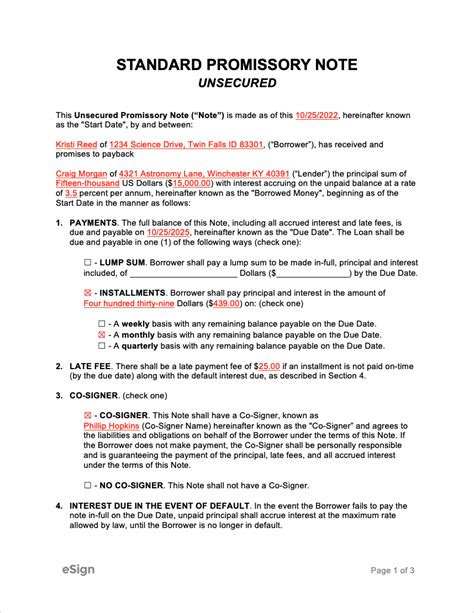

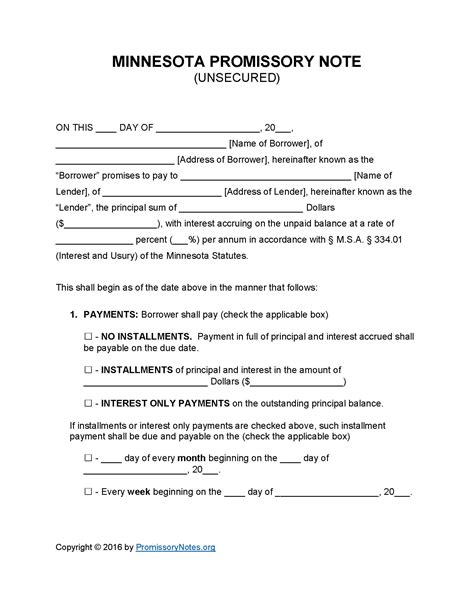

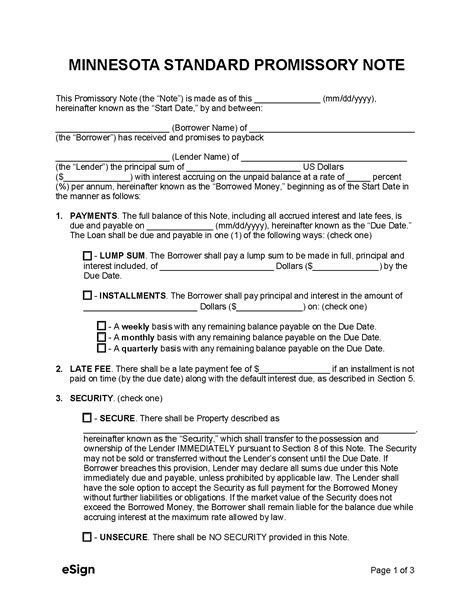

5. Unsecured Promissory Note

This template is used for loans that are not secured by collateral. An unsecured promissory note is essential for formalizing the loan agreement and ensuring that both parties understand the terms of the loan.

Key Elements of an Unsecured Promissory Note:

- Borrower's name and address

- Lender's name and address

- Loan amount

- Interest rate (if applicable)

- Repayment terms (e.g., monthly payments)

- Due date

Example of an Unsecured Promissory Note:

"On [date], I, [Borrower's Name], promise to pay [Lender's Name] the sum of $ [Loan Amount] with interest at the rate of [Interest Rate]% per annum. The loan shall be repaid in [Number] monthly installments of $ [Monthly Payment] each, commencing on [First Payment Date] and continuing until [Due Date]."

Gallery of Minnesota Promissory Note Templates

Minnesota Promissory Note Templates

We hope this article has provided you with essential information about promissory notes in Minnesota. Remember to always use a promissory note template that complies with Minnesota's laws and regulations. If you have any questions or need further assistance, please don't hesitate to ask.